Nanjing Bank "Thunderstorm Oolong"

Author:First financial Time:2022.09.04

04.09.2022

Number of this text: 933, the reading time is about 1.5 minutes.

Introduction: Commercial banks represent the clearing business of village and township banks. They are only used as funds clearing channels and do not bear the risk of funds.

Author | First Finance Zhou Erin

On September 2nd, Nanjing Bank fell into a storm again due to the village bank incident. In the middle of the night on the 2nd, the First Financial reporter learned from the insiders of the Bank of Nanjing that in the early morning of September 3, the presidents of the sub -branch will verbally convey the relevant situation to the staff.

The reporter learned that the specific content includes the recent announcement of the Henan Banking Insurance Regulatory Bureau and the Henan Provincial Local Financial Supervision Bureau that according to the mating work arrangement, from 9 am on August 30, 2022, Cai Huimin Village Bank, Huanghuai Village Bank, and Kaifeng New Oriental Village Bank Outside Business Customer Institute of Bentian Single Institutions Single Merchants of 400,000 to 500,000 yuan (inclusive) began to pay, less than 400,000 yuan (inclusive) below 400,000 yuan (inclusive) Continue to pay. For more than 500,000 yuan, pay for 500,000 yuan, and the reservations of partial equity are not paid. Some of the storage households had objections to this, so they came to the Binjiang Technology Sub -branch under the jurisdiction of the Hangzhou Branch of Nanjing Bank on the early morning of the 2nd, and organized to take pictures and upload social media in a organized manner. The public security staff also arrived in the early morning of the same day and persuaded some personnel to leave. Bank of Nanjing has issued an announcement saying that the liquidation of commercial banks agency village and township banks is based on the "Guiding Opinions of the People's Bank of China on improving the payment service environment in rural areas" and the "Measures for the Agency of Payment and Settlement Business". business. During the proxy clearing process, as a commercial bank of the agency clearing bank, it is responsible for the receiving and receiving funds of the receiving and instructions of the liquidation instructions. It only has a liquidation relationship with the agent and the People's Bank of China.

In August this year, Nanjing Bank was in a storm due to the liquidation business of the relevant village and town banks. On September 2, the deposit incident of village banks was fermented again. There is a social platform news that "Nanjing Bank Zhejiang Branch" thunderstorm, "the bank has closed the door, and the storage households can't get money anymore." According to the online photos, there are people gathered outside the square at the gate of the building logo marked by the Bank of China.

A person familiar with the matter told the First Financial Reporter that in terms of the village bank incident, there were about 3,000 single -person mergers exceeding 500,000 yuan. According to the reporter's understanding, the gathering staff on the 2nd are mainly personnel in Jiangsu, Zhejiang and Shanghai, and most of them from Shaoxing. The online information mentioned that the incident was the Zhejiang Branch of Bank of Nanjing. In fact, Nanjing Bank did not set up the Zhejiang Branch. The branch established by the bank was officially named Hangzhou Branch.

In addition, on the 2nd, there were rumors on the 2nd that Nanjing Bank mines and could not withdraw money. People inside Nanjing also told reporters that this is not true, and everything is normal at present. It also emphasized that commercial banks represent village and towns' liquidation business, only as funds liquidation channels, and do not bear the risk of funds.

- END -

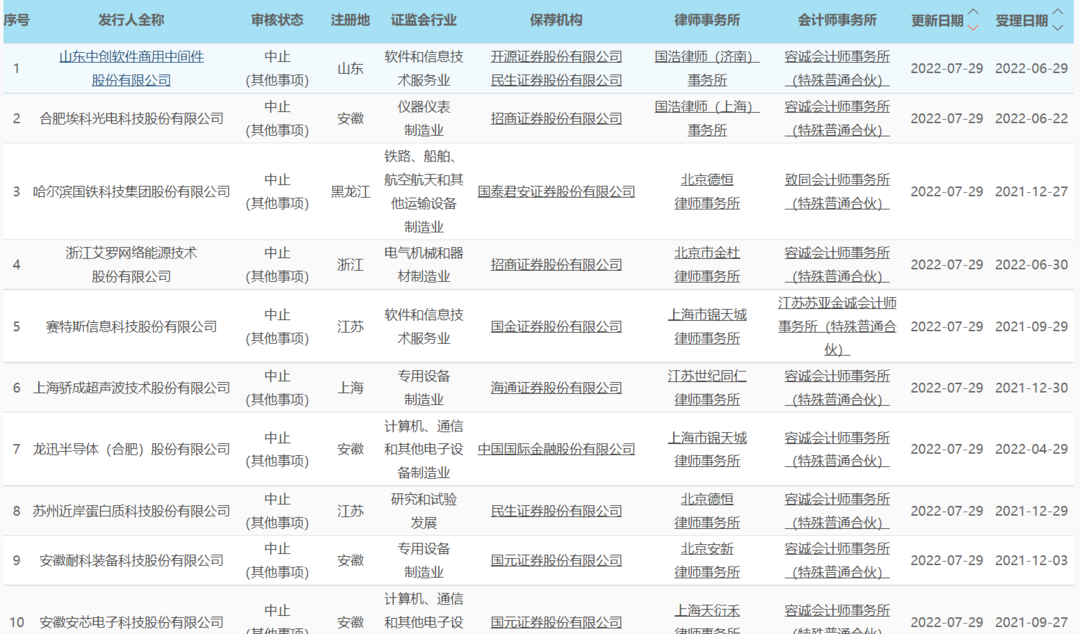

The intermediary agency was dragged down by the IPO of more than a hundred companies during the investigation

Cover Journalist Xiong YingyingThe IPO market is now withdrawn, but this time is t...

The hidden dangers of the risk of frequent misconducts of the agricultural and commercial banks are frequent.

Recently, another news has frequently swiped the screen -Shenyang Rural Commercial Bank undertakes the Liaoyang Agricultural Commercial Bank and the Town Bank of Etzihe Village. Related to a hot news