Haitong Strategy: At present, the adjustment has reached the later period, and the growth hope continues to dominate, focusing on the new energy and digital economy

Author:Broker China Time:2022.09.04

Source: Stock Market Xunye ID: xunyugen

Core conclusion: ① 7/5 has been adjusted from market concerns from the fundamentals of the market, referring to history, and the early increase of 0.5-0.7, the transaction volume has shrunk by half, and the current adjustment has reached the later stage. ② The low point of the market is the bottom of the reversal. The fundamental leading indicators confirm the upward trend of the mid -term. The re -rising turns or the stable growth measures such as the preservation building are implemented. ③ The style is difficult to switch for the time being, and the growth hope continues to dominate, focusing on the new energy and digital economy.

Progress and transfer of adjustment

Since July 5, the largest decline in the Shanghai Composite Index has reached 8%, the CSI 300 fell 12%, and the GEM index fell 13%. In many reports such as 20220717 ", from July to August, it was a cold-style adjustment, that is, after the first wave of rising, the core was the fundamentals that could not keep up with the fundamentals. Which step is the current adjustment of Chunhan? What is the opportunity for the market again in the future? This article analyzes this.

1.7/5 The progress of market adjustment: Later

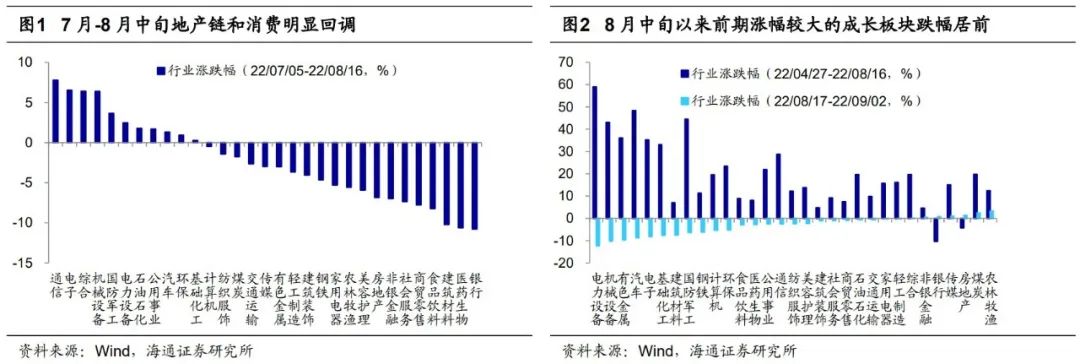

The market continued since 7/5 of the market in August. Since August, the market trend has been shocking as a whole. The major Broad -based indexes of A shares have obviously recovered after reaching a phased high on August 17. So far (as of 2022/09/02, the same below) Shanghai Composite Index, the maximum decline of 3.7%, and a 3.7%decline. CSI 300 fell 5.2%, 10,000 A full A fell 5.9%, the GEM index fell 10.2%, and the CSI 1,000 fell 9.2%. In fact, from the perspective of the index level, the first wave of the market from the bottom of the 4/27 has been on the 7/5 phase, and the recent decline in the index is actually the continuation of the adjustment of the 7/5 market high. However, the market adjustment since the beginning of July and mid-August has different structural structure: because the market recovery starting in early July began with concerns about real estate and epidemic, so the real estate chain and consumption declined, 7/5-8/1616 During the period, the bank fell 10.8%, the medicine fell 10.6%, the building materials fell 10.2%, and the food and beverages fell by 8.2%; the industries that had fallen among the top declines since mid -August are the largest growth sections in the early stage. , Machinery and equipment fell 10.2%, cars fell 8.7%, and electronically fell 8.2%.

Compared with history, from the perspective of exponential vomiting and transactional atrophy, this round of adjustment has reached the later period. For the nature of this adjustment, we analyzed in many reports such as "Rest and Wait Waiting Basic-201220710", "Adjustment Nature: Infalling Spring Cold -20220717", etc., and other reports have been analyzed. Two retreats. So how to judge the progress of this adjustment? With reference to history, the first wave of rising markets after the bear market after the bottom of the bear market has gone, and the market will often make a profit. In the process The average retracement of about 13%and the increase in the rise of about 0.5-0.7 in the early stage. At present, the adjustment since 7/5 has lasted for 59 days, of which the Shanghai Composite Index has fallen by 8%(0.48 of the early increase in the early stage), the CSI 300 declined 12%(0.68 in the early stage of vomiting), 7%(0.34 of the early increase in the early stage), the GEM finger fell 13%(0.50 of the early increase in the early stage). In addition, during the historical profit, the average contracted volume of the entire A transaction was 62%(52%smooth on the 5th). See Table 1 for details. As of 22/09/02, the total transaction volume of A was reduced by 44%compared with the previous high, and the 5 -day smooth caliber was reduced by 27%. Therefore, from the perspective of the comprehensive index vomiting and the atrophy of transaction volume, the adjustment of the cold spring of this round has reached the later period.

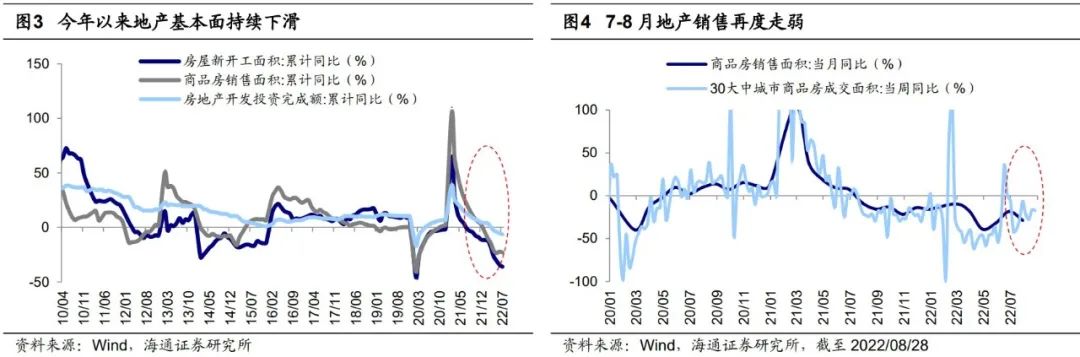

2. Re -rising turns: the measures to keep the property landed

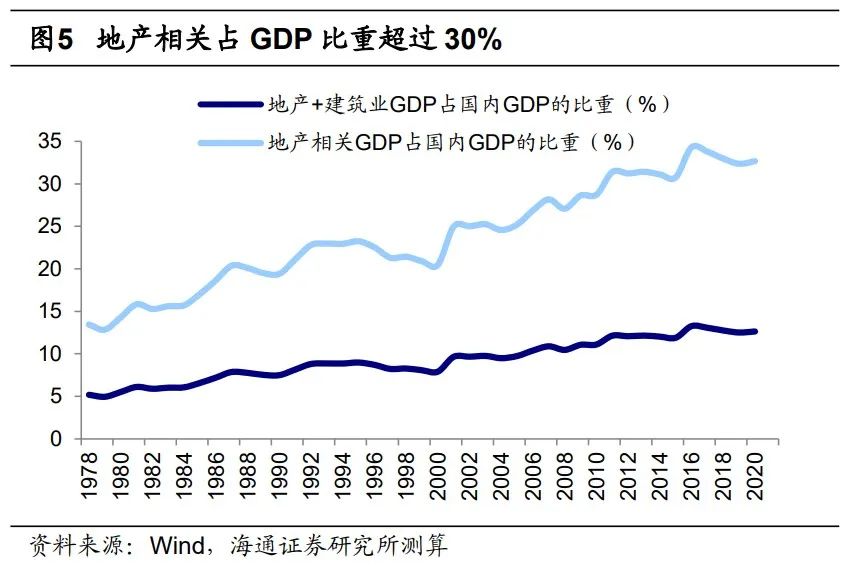

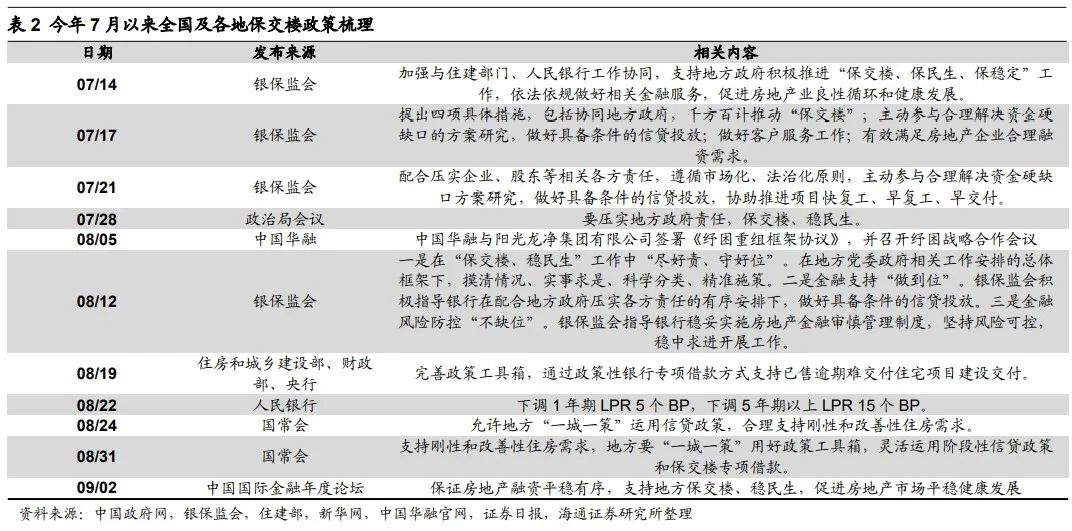

The main reason for the adjustment since the 7/5 is that the market is worried about the fundamentals, and real estate is the key. What conditions do we need to rebound to reverse? -20220504, "Comparison of history, this time it may be a shallow V base -20220605" and other reports, etc. In many reports, it has been emphasized that in combination with the investment clock and beef and bear cycle, the market low on April 27 is 3-4 years old once every 3-4 years old. At the bottom, three of the five fundamental leadership indicators have been picked up, and the other two are gradually stabilizing, showing that the long -term reversal of the market has been established in the long -term reversal of the market. However, in history, the first wave of the market rises at the bottom will often make a profit. The core reason is that the fundamentals are not solid enough. For this time, real estate is one of the important factors for the twists and turns of economic recovery in this round. From the perspective of the medium and long term, the fundamental downward trend of the current real estate industry is obvious. In July of this year, the cumulative investment in real estate investment has fallen to -6.4%year-on-year, the newly started area has fallen to -36.1%year-on-year, and the construction area has fallen to -3.7 year-on-year to -3.7 %, The completion area has fallen to -23.3%year-on-year, and the accumulated area of land purchase has fallen to -48.1%year-on-year. According to high -frequency data, real estate sales data has rebounded in June this year, but since mid -July, the suspension of loans has led to weakening the willingness to buy a house. Real estate sales data has fallen significantly again. Weekly declined from -17.3%of 06/26 to -17.3%of 08/28, so the market's concerns about the spread of real estate risks again heated up again. We are worried about the market? -20220731 has been analyzed that the real estate chain is still the pillar industry of my country's economy. Real estate and related industries account for nearly 1/3 in my country's economy. At the same time, real estate accounts for nearly 60 % of my country's residents' assets. Big assets than the largest. Therefore, the importance of real estate and related industries in my country's economy is still very prominent. If real estate continues to weaken, the economic fundamentals will be difficult to stabilize. The opportunity of the market again is the implementation of the stable growth policies such as the preservation and traffic building. Therefore, in the future, the market's rising probability requires a significant rise in economic fundamentals. The key is to stabilize growth and the implementation of the policy of maintaining the policy. At present, in order to stabilize the economic market, on August 24th, the National Association has deployed a policy measure of a policy of stabilizing the economy to consolidate the basis of economic recovery and development; The efficiency of a policy of stabilizing the economy, the continuation policy rules should be out in early September, focusing on expanding effective demand and consolidating the foundation of economic recovery. In addition, in order to stabilize the market expectations and the emotions of home buyers, the implementation of the policy of maintaining the policy is still the focus. Xinhuanet reported on August 19 that relevant departments such as the Ministry of Housing and Urban -Rural Development, the Ministry of Finance, and the People's Bank of China have recently issued measures to improve the policy toolbox, and support the construction of residential projects for overdue difficulty in the residential project through policy banks. 8 On the 31st, the State Conference proposed that supporting rigid and improving housing needs, local "one city, one policy" should be used to make good use of policy tool boxes, and flexibly use phased credit policies and special borrowings for insurance. Looking at it later, with the effectiveness of the preservation of houses and the implementation of the stable growth policy, the stability of economic fundamentals is expected to catalyze the market to start a new round of rise again.

3. Style is temporarily difficult to switch

The necessary conditions for style switching are already available. Last week's "Style is temporarily difficult to switch-201220828", we resumed two style switching at the end of 14 and 14 years. It was found that the necessary condition for the value sector at the time was that the early value of the value was largely lost, valuation and fund holding positions were at a low level. Essence At present, these conditions have also been available, for example, for the valuation angle, as of 2022/9/2 the National Certificate Growth Index PE (TTM, the same below) is 20.5 times, which has been divided in 13 years, and the national certificate value index PE It is only 7.1 times, and it has been divided since 13 years. The national certificate value PE/Stock Exchange growth PE also continues to decline. It is currently 25%of the division in 13 years. The stock market value accounted for 20.6%, which was significantly over 7.4 percentage points relative to the CSI 300 index, while bank+real estate accounted for only 5%, which was relatively low in the CSI 300 index of 8.3 percentage points.

However, there are insufficient conditions, lack of short -term catalytic and long -term logic, and premature time. From the perspective of long logic, the space of the real estate industry is not the same as before. In 18-121, my country's real estate sales area was stable in 1.7-18 billion square meters. In 2021, the average population of my country's population was 38.8 years. To maturity. In the short term, the growth rate of the 22Q2 National Certificate Growth Plate is 10%in a single quarter, and the value of the national certificate is 3%. Policies such as stimulating economy are still there. In the absence of strong policies, it is difficult for investors to judge value stocks. From the perspective of the game, the game at the end of the year due to the assessment of public offerings often occur from November to December, and it is currently too early.

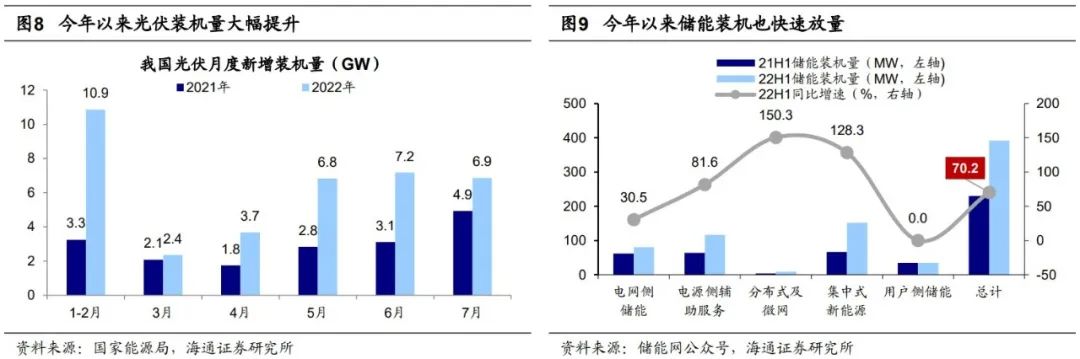

The growth style is expected to continue, and the opportunity to grow up in the market is that the profit will increase again. In the context of the current epidemic and the downlook of real estate fundamentals and dragging down the traditional economy, we believe that from the perspective of the comparison of the growth value style, the trend of growth in the future may still continue, and the large and small plates inside the growth are strong or weak or weak, but we are weak or weak, but we are weak and weak. It depends on profit growth. What factors do we look at the relatively strong and weak growth plate? -20220814 has analyzed that the small market value style in the recent growth stocks is dominant, mainly because the overall profit growth of the growth sector has slowed down, the growth valuation of small disk growth is better. , Large market value growth stocks may be better. At the industry level, continue to be optimistic about the growth of high prosperity, such as new energy and digital economy. In terms of specific industries, the high prosperity of new energy -related industries will support the industry's performance. In late April this year, we have repeatedly emphasized the growth of high prosperity represented by new energy combined with the fundamentals and market dimensions. From January to July this year, the new photovoltaic installation machine maintained a high growth rate, an increase of 110%compared with the same period last year. The National Energy Administration is expected to increase the grid-connected grid by 96%year-on-year in 22 years; the new type of energy storage has also ushered in rapid development. The total amount of electrochemical energy storage machines increased by 70%compared with the same period last year. GGII predicted that the shipments of China's energy storage lithium batteries in 2025 were close to 390GWh, and the 5 -year compound growth rate exceeded 60%. In terms of new energy vehicles, according to the forecast of the Federation of Federation, the retail sales of new energy vehicles in August will reach 52 million units, an increase of 108.3%year -on -year, and a 7.0%month -on -month increase. It is expected that the sales of new energy vehicles will reach 6.5 million vehicles throughout the year this year, which is expected to support support. The industry has further performed.

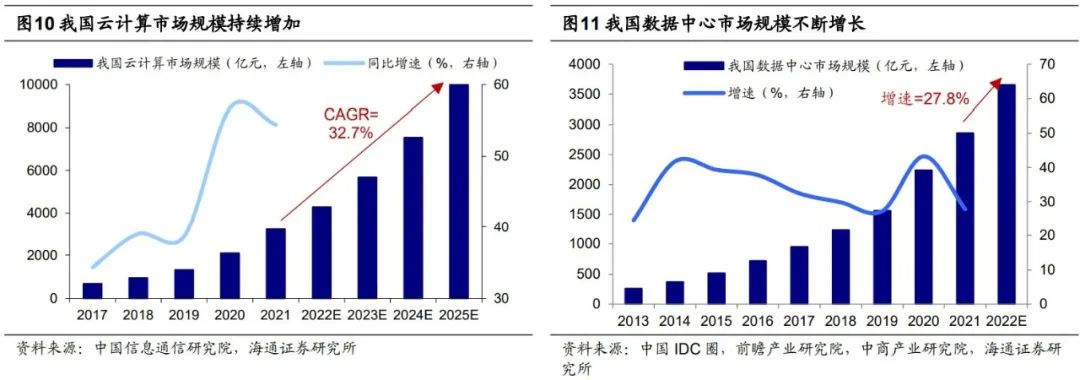

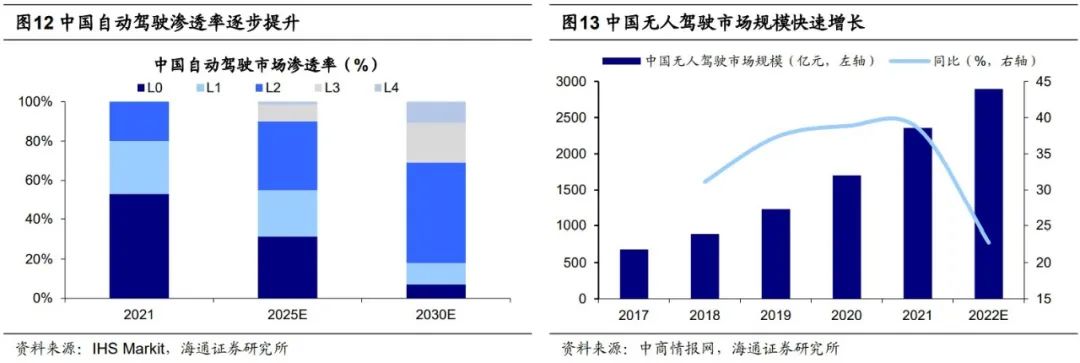

In addition to landscape storage and electric vehicles, you can also pay attention to the digital economy -related fields during growth. The current development of the digital economy is a national strategy, and policy support has been increasing. Among them, digital infrastructure is the foundation of the development of the digital economy. Infrastructure investment such as cloud computing and data centers is constantly increasing. The China Institute of Xinong is expected to have a compound growth rate of the cloud computing market in my country in 21-25. 32.7%will be as high as 32.7%. In addition, the Internet platform is entering the track of healthy development. On July 28, the Central Political Bureau meeting of the Central Political Bureau "implemented normalized supervision and launched a number of" green light 'investment cases "in the platform economy requirements. We believe that the digital economy is expected to become one of the" green lights "of the Internet. China's Internet companies have a high share in the cloud service market, and in order to promote the development of the Industrial Internet. China Business Intelligence Network is expected to reach 1.1 trillion in my country's industrial Internet industry in 2022. In addition, China's Internet company's autonomous driving technology leads the leading development of the industrial chain upstream and downstream. In the future, the penetration rate of autonomous driving in China is expected to increase rapidly. China Business Intelligence Network is expected to reach 289.4 billion yuan in 2022.

Risk reminder: The deterioration of domestic epidemic affects the domestic economy; hard landing in the US economy affects the global economy.

Responsible editor: Yang Yucheng

School pair: Zhao Yan

- END -

Can the coal rebound after two days and then rebound? Can it last?

On September 1st, the broader market opened down and fell down. The three major indexes hit a new low, and the GEM index fell for 7 consecutive days. On the plate, the coal sector has strengthened aga

The 2nd RCEP Expo Preparation is basically ready

The second RCEP area (Shandong) Imported Commodity Expo (hereinafter referred to a...