The fund manager walked into the pig farm, and it was on fire!Real fund investigations are optimistic about the four directions

Author:Daily Economic News Time:2022.09.04

In the generation of Z, Brother Z is the most realistic.

This weekend, Brother Z in Chengdu just wants to go out and look at the outside world, even if it is going to the suburbs and rural areas to see pig farms, it is very good.

On this weekend, a news was on fire. Zhang Shengxian, the fund manager of the Fuguo Fund, went out to investigate. The object of the investigation was the pig farm.

According to reports, the investigation of pig farms shared by Zhang Shengxian, the fund manager of the Fuguo Agricultural theme ETF connection fund, has experienced fire. This article "I'm going to investigate!" How many times do you take to take a shower when you enter a pig farm? The post on the financial discussion area was on the hot search list. The topic generated 42,000 views, and nearly 1,000 people participated in the discussion.

Don't think that investigating pig farms is a very simple matter. On the first day when Zhang Shengxian went to investigate, he didn't see pigs at all. According to his description, to enter the pig farm, the process is very cumbersome, and the first day is disinfected. And first need to be tested and bathing in the "outer ring" of the pig farm. When bathing, you need to rinse first, then apply special powder on your body. After setting up for five minutes, then rinse, then in the "Central" and "Inner Inner" and "Inner Inner" of the pig farm. The operation of the region repeatedly bath.

Photo source: Fund Manager Zhang Shengxian research network post

To be honest, if it wasn't born in the countryside, many people would not know what the pig farm was like. Brother Z went to the countryside when he was a kid. The pigpen in the impression was dirty and smelly, and the pigs were eating water. Of course, I have seen all kinds of reports now, and I know that the pig farm is already getting more and more advanced. It's right.

Brother Z is interested in the news, not just because the fund manager entered the pig farm to investigate, it was fun. What really feels interesting is that more and more fund managers are now paying attention to agriculture and pork plates.

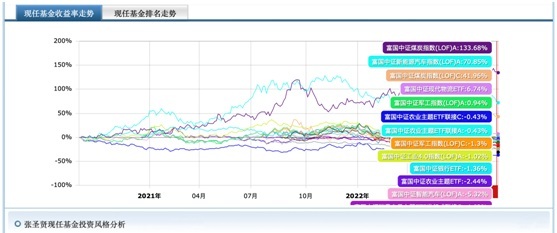

In fact, Zhang Shengxian, the fund manager of the rich country, is not a fund manager of an active fund. He currently manages index funds in many industries such as new energy, sports, industry, consumer electronics, military industry, chips, and agricultural theme ETFs are considered performance. A medium product.

Zhang Shengxian's ETF of the Fortune Agricultural theme managed by the country has a scale of 2.099 billion yuan. Since this year, it has lost about 4%. He has lost about 4%. He has won about 4%. He has won about 4%. He has warehouses. As a index fund manager covering multiple industries, Zhang Shengxian investigated pork concept stocks at this time, which also shows that he attaches great importance to this industry.

Talking about the reason for the investigation of the pig farm on the spot, Zhang Shengxian said that on the one hand, he had previously shared his views on the agricultural sector. In the CSI agricultural index, the proportion of component stocks in the breeding sector accounts for nearly 60 %, and in the breeding, pork stocks occupy the big head, which is self -evident on the index. "Field survey may understand the status quo of the industry better."

Since the beginning of this year, another fund manager who has achieved good performance and has achieved good performance is Jin Zicai of Caitong Fund.

Among the funds he managed, the best performance was the Fortune Duo strategy, Fuxin, and mixed, and obtained 10%of this year. The product disclosed in the interim report that there are as many as 8 pork stocks in the top ten heavy stocks, and the other two are the Jinjiang Hotel and the first travel hotel.

In addition to the top ten heavy warehouse stocks, the central report disclosed that the fund also held Southern Airlines and Air China of aviation stocks; the tourist sector Songcheng Performing Arts, Tianmu Lake;

Next, let's talk about the research expert in the fund manager.

Zhong Shuai, the fund manager of the Huaxia industry, is definitely a survey expert in the industry. According to reports, Zhong Shuai surveyed more than 100 times a year, and the frequency of survey was high. Personal habits are to do some transactions and handling some things in the company every Monday, basically from Tuesday, go to various places to investigate. Zhong Shuai said that in fact, many excellent and diligent fund managers in the industry do this.

Since the first half of this year, the A -share market, especially the growth stocks, has fluctuated greatly. What does Zhong Shuai think of the future market?

Zhong Shuai said that the investment of growth stocks or the entire equity investment is very sensitive to changes in liquidity. The recent market has become very irritable, rising and falling, and fluctuations may be formed by various factors. It has something to do with the rapid spread of information brought by the mobile Internet, the flatness of information dissemination, and the switching of the size of the entire market. As one of the participants in the market, in fact, we are not qualified to evaluate the right or bad or bad. We can only adapt to it as much as possible after observing it.

Zhong Shuai said that he insisted on looking at the value of the company as much as possible, buying some underestimated companies for a long time. It is more effective than some technical means.

Which plates and directions are optimistic in the second half of the year? Zhong Shuai said that the first is still new energy. He believes that investment in new energy industry is a very important investment in our era. This direction mainly includes two major sectors, one is the new energy electric vehicle industry chain; the second is clean energy, such as photovoltaic power generation. Photovoltaic is one of the few industries with core industries and comparative advantages worldwide. Behind this is the adjustment of the entire economic structure. The proportion of traditional economies such as real estate and infrastructure has declined, and the advancement of photovoltaic technology and the continued decrease in power generation costs. The development of the overall photovoltaic power plant has actually received the urgent attention of future capital, and the growth of the photovoltaic industry chain is very sustainable.

The second direction is the high -end manufacturing industry. Last year, with the sharp rise in raw materials, the impact of epidemic conditions, and electricity limit, the performance of many manufacturing companies was greatly suppressed. A group of companies with good texture and long -term growth logic will usher in recovery. These companies may be distributed in TMT, high -end equipment manufacturing, military industry, and new energy -related industrial chains, and we need to diligently dig. Third, state -owned enterprise reform. This year is the year of the "Three -Year Action Plan for State -owned Enterprise Reform". We believe that outstanding state -owned enterprises with strong industrial competitiveness and their own marketization mechanisms and incentive mechanisms will stand out in the capital market.

Fourth, the growth industry with reversal in the predicament. Pharmaceutical and media such as the growth section with more valuation adjustments in the past few years may have the opportunity to reverse difficulties in the second half of the year. Especially in the pharmaceutical industry, because of the influence of collecting policies in recent years, the valuation of the entire industry has been adjusted violently. Among them, there are a group of good innovative drug companies. Essence These companies have relatively high -speed sustainable growth, and their valuations are relatively high.

Finally, take a look at the performance of the product of the Huaxia industry managed by Zhong Shuai.

The prosperity of the Huaxia industry has lost 9%this year, but has achieved 100%positive income (ranking first) in the past two years, and 194.75%of the net income in the past 3 years (ranked 10th), ranking very high. In the past year, with the significant increase in the size of the product and the significant fluctuations in the new energy sector, its performance has also fallen. In the middle of last year, the product had only 700 million yuan in scale, and this year has exceeded 11 billion.

Finally, look at the stock layout of the Huaxia industry. As of the end of the second quarter, the fund holds Shengxin Lithium, Junda, Delsay Battery, Hangjin Technology, Yongxin Materials, etc., all of which are companies in the new energy industry chain. In addition, the fund also holds individual stocks such as chemical industry, vaccine.

Daily Economic News

- END -

Without the permission of the fire rescue agency to operate without permission, Uniqlo's shop was fined 70,000

Radar Finance | Editor Wu Yanrui | Deep SeaRecently, Xunwa (China) Trading Co., Lt...

Hua'an Fund will push the new work of the "列" series, Hua An Yueyue Debt is issued

Under the shock market, secondary debt -based debts with both offensive and defensive advantages are generally favored by the market. The second -level debt base only adds a maximum of 20%of the stock