Shangtang-W-collar 3.54%, a large premium in the Hang Seng Technology Index ETF (159742)

Author:Capital state Time:2022.09.05

In the morning, the Hang Seng Technology Index ETF (159742) fell 2.17%. The transaction on the session had a sharp premium. In the past 5 days, the funds continued to inflow, and the turnover exceeded 25 million.Among the ingredients stocks, Shangtang-W led 3.54%, SMIC, Jinshan Software, Zhongan Online followed up; Bilibili-SW, Ruisheng Technology, Weilai-SW and other leading declines.

Everbright Securities believes that Shangtang-W is the industry's leading computer vision software supplier. It establishes the first AI infrastructure Sensecore, which can largely produce a high-performance artificial intelligence model.The "improvement effect" of model production, empowering multiple vertical tracks, is expected to gradually expand the emerging business model to achieve commercialization acceleration, and has a certain first -mover advantage and high -industry barriers.The company maintains a leading position in the computer vision AI. At the same time, the commercial monetization space and potential are huge. It has a certain scarcity and premium space for the target, and maintains the "increase" rating.

- END -

China, Japan and South Korea International Enterprise Development Exchange Conference (Yancheng) and Yancheng High -speed Rail New City Project 4th Investment Promotion Conference was successfully held

On August 30, 2022, the China -Japan -Korea International Enterprise Development E...

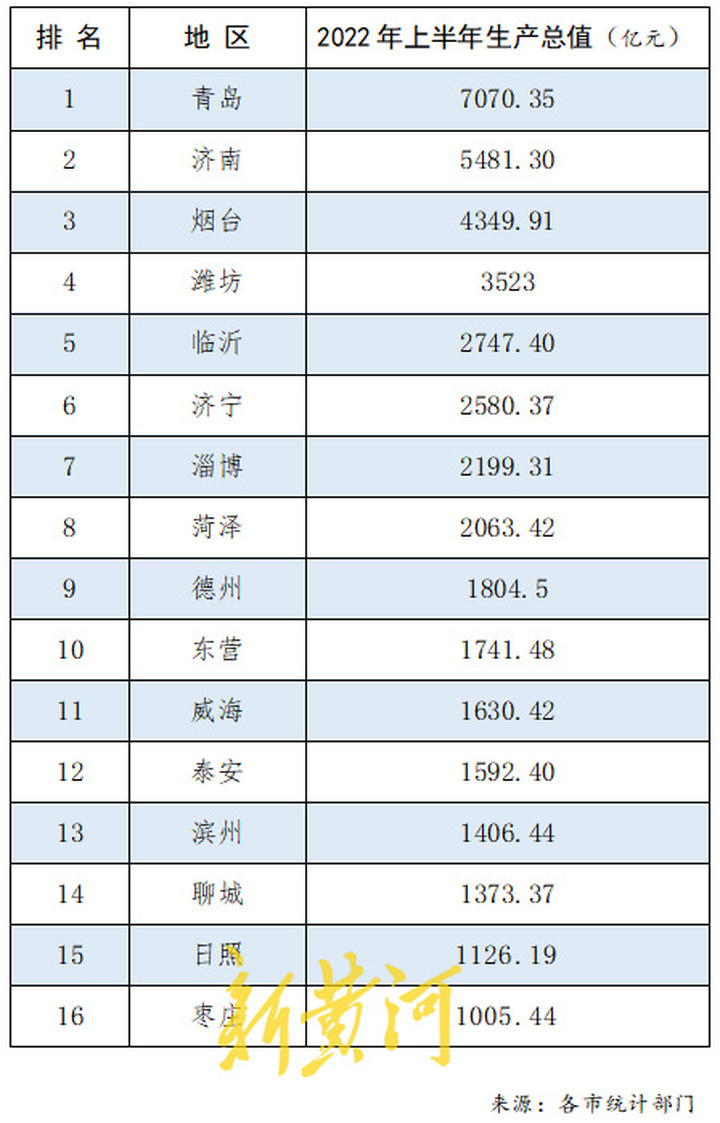

In the first half of the year, the GDP ranking of 16 cities in Shandong is here

As of July 30, the economic operation data of the 16th city of Shandong Province w...