Agricultural distribution of Hubei Branch for full 6 billion yuan in funds to support the acquisition of summer grain

Author:China Economic Times Rural Fin Time:2022.06.20

Agricultural distribution of Hubei Branch for full 6 billion yuan in funds to support the acquisition of summer grain

Agricultural distribution of Hubei Branch actively improved its positions, serving the country's food security as the primary political task, prepared 6 billion yuan in credit funds in advance, and fully supported the acquisition of summer grain. During the summer harvest this year, the bank had accumulated 53 companies to buy in the market. The cumulative loan was invested by 1.5 billion yuan, an increase of 900 million yuan year -on -year, and supporting enterprises to acquire 1.07 billion kg of food.

"Early" planning to do loans fast. In mid -April, the bank began to deploy the acquisition of summer grain. The leaders of the division of the branch led the team to Xiangyang, Jingzhou, Suizhou, Xiaogan and other places in Xiangyang in the Xialiang main production area to conduct field investigations, and visited the grain and oil acquisition enterprises in various places. Hold a survey of bank -enterprise video connection, and visited food -related functional departments many times to comprehensively predict the acquisition of the market situation, and reasonably estimate the demand for funds. Formulate the "timetable" and "roadmap", timely decompose the target of summer collection loans, guide the dynamic tasks of various lines in the jurisdiction, complete customer rating credit before the new grain listing, and ensure "money and other grains". As of now, the approved by 53 companies has been identified to achieve full coverage of 13 prefectures.

"New" mode solve problems. The bank vigorously promoted the food acquisition loan credit guarantee fund business, and the fund size increased from 112 million yuan in 2021 to 175 million yuan in 2022. Since 2021, the bank has issued a total of 283 million yuan to 28 customers, and supports the acquisition of 210 million kilograms of food. In order to increase the use of credit guarantee funds, since this year, 30 county branches in the province have established credit insurance funds, an increase of 11 county branches from the beginning of the year. The bank actively marketing grain enterprises, market -oriented collection and storage enterprises, extending downstream customer chains such as processing and warehousing, expanding the grain industry chain and supply chain customers, and effectively solving the problem of "financing difficulties and guarantee" of grain companies.

The "excellent" service traffic point. The bank established the summer grain acquisition team, formulated a "one enterprise, one policy" service plan, involved in the counseling in advance, designed the loan plan design, opened up the blocking points of the acquisition, supported the company to lock the food source early, and the local planting households and farmers cooperatives were supported by the company. Establish a solid purchase and sales relationship, and effectively protect farmers' "food and money." At the same time, keeping the "7 × 24" hours of electronic payment channels such as online banking and bank -enterprise direct couplet, and do a good job in the demand for funds during the epidemic prevention and control and holidays in advance to ensure that the supply of funds is continuously gear. (Tang Fangyu Chen Ling)

Responsible editor: Zhang Wei Guo Jinhui

- END -

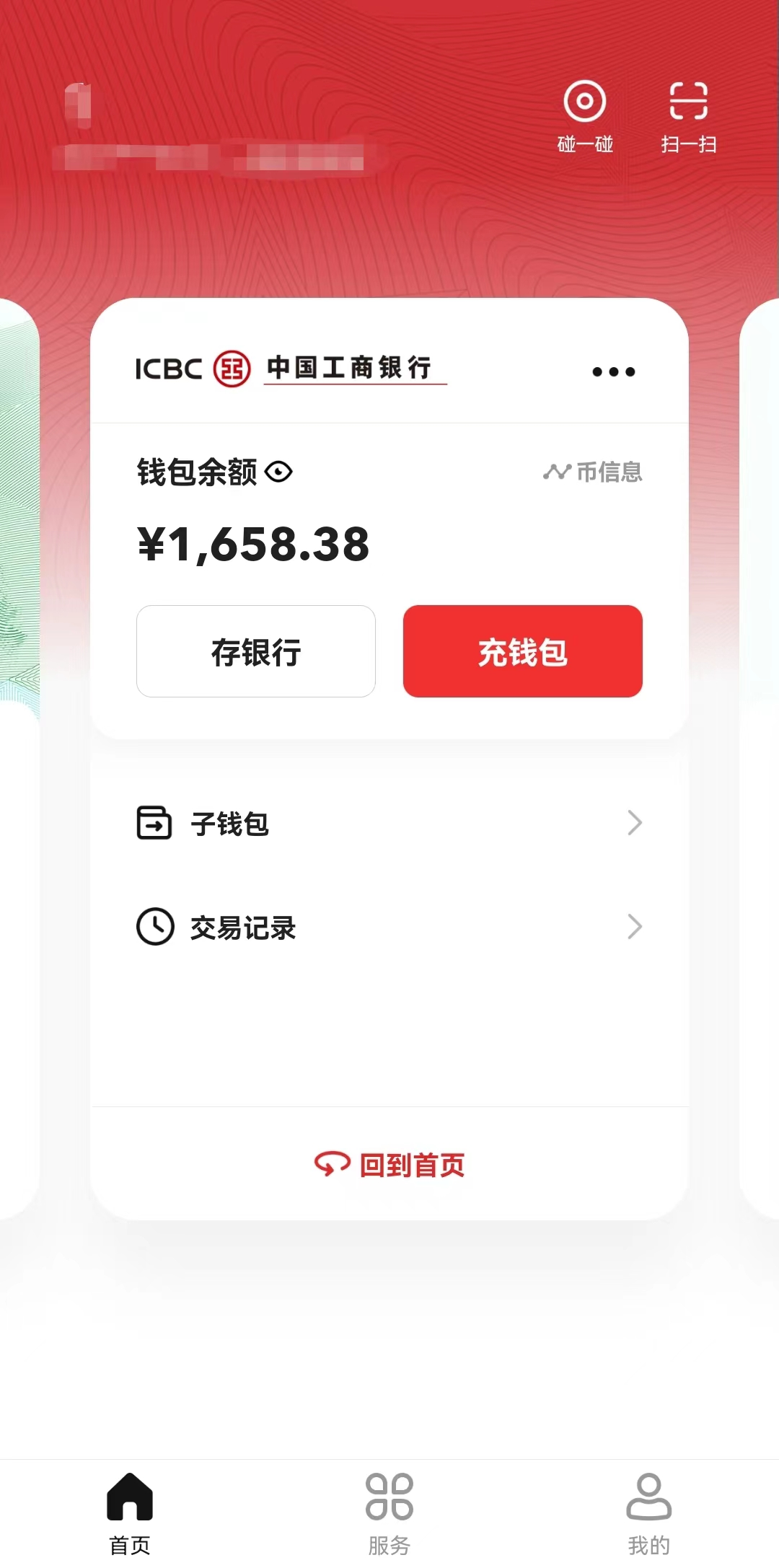

The first stroke of Hebei Province!Digital RMB public health related subsidy funds are successfully issued in Xiong'an!

Recently, the province's first digital RMB national basic public health service pr...

Ordos, Inner Mongolia: Reluing measures to re -ignite their confidence

Xinhua News Agency, Hohhot, June 17th. Question: Inner Mongolia Ordos: Reluing measures to re -ignite their confidenceXinhua News Agency reporters Zhang Lina, Li Xin, Zhu WenzheRecently, the governme