Even Salesforce is like this, is there still hope for the SaaS track?

Author:Loud Time:2022.09.05

Author | Chen Wenqi

The "SaaS originator", which is regarded by many SaaS companies as the target of the benchmark and the industry ceiling, is encountering unprecedented challenges.

Recently, Salesforce released the second quarter of fiscal year (as of July 31) in fiscal year. Although revenue and earnings per share were expected to be super Wall Street this year, Salesforce's stock price fell 7%during the extension of the transaction on that day. Since this year, Salesforce's stock price has fallen 37%.

In the financial report, many data show a dangerous signal:

FY2023Q2, its revenue rose slightly, and its net profit plummeted: Salesforceq's quarterly revenue was US $ 7.72 billion, an increase of 22%year -on -year, and its net profit was 68 million US dollars, a decrease of 87%compared with US $ 535 million in the same period last year. The second time the annual revenue is expected to be lowered: currently Salesforce is expected to reach US $ 30.9 billion to $ 31 billion (including a negative foreign exchange effect of $ 800 million), and the income per share is US $ 4.71 to $ 4.73. The fiscal season is expected to be US $ 31.7 billion to US $ 31.8 billion, with a profit of $ 4.74 to $ 4.76 per share. Its FY23Q3 is expected to increase by 14%to $ 7.8 billion. According to the S & P Global Market Intelligence data, this will be the fiscal season with the lowest revenue growth rate in the company's history. In addition, Salesforce announced its first stock repurchase plan, with a scale of 10 billion US dollars. During the financial report, the company said that the repurchase plan expressed the company's confidence in business prospects, but obviously, this is more like giving shareholders to shareholders’s shareholders' people. One explanation.

The growth rate of Salesforce's revenue has slowed, the level of profit is not good, and the secondary market has performed poorly. The strategic target of this CRM giant and countless SaaS companies seems to be difficult to reverse the downturn in the short term.

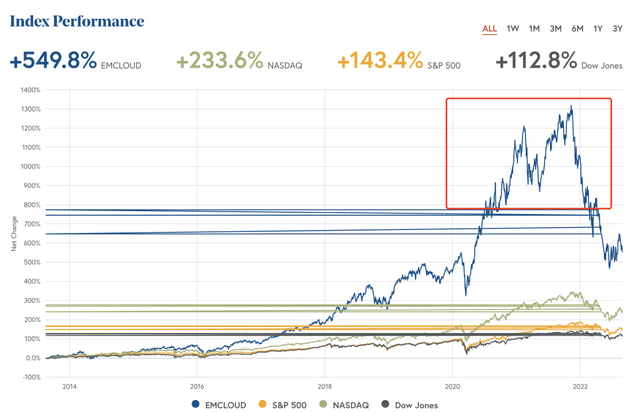

Not only Salesforce, the SaaS industry saw various IPOs and rising valuations last year. This year, it is a collective streamlined. The EMCloud INDEX index of Bessemer in the United States (important indicators in the cloud and SaaS industry) has lost the vigorously running market this year. Turking down, the valuation multiple of the relevant company's valuation has been greatly retracted. For example Falling below the issue price.

What fluctuation factors behind the fast steering, what inspiration can this be given to domestic SaaS companies?

EMCloud Index Index History Performance Source: BESSEMER Official Website

Salesforce does not increase the income?

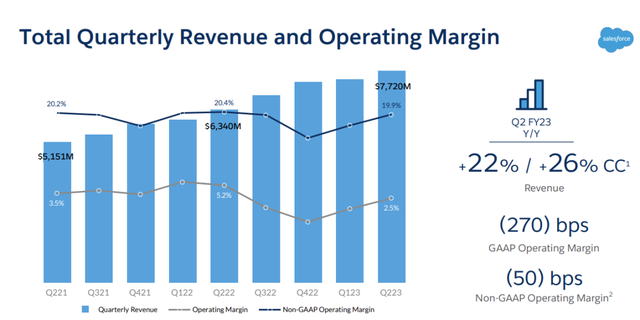

From the perspective of quarterly revenue and revenue growth, the basic market of Salesforce is still stable, maintaining a growth rate of more than 20%on the huge base, and the total revenue of Q2 has reached US $ 7.720 billion.

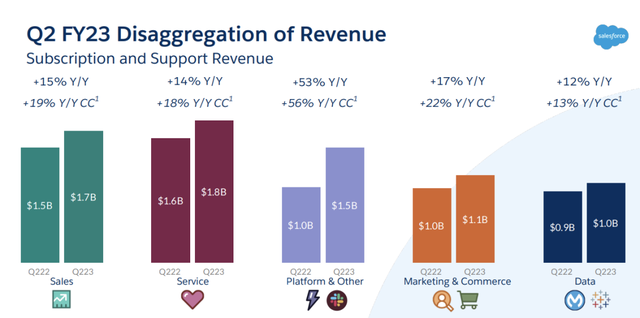

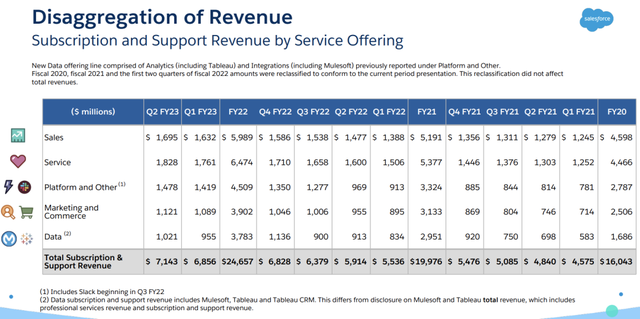

Disassembling business, Salesforce revenue sources are divided into two parts, subscriptions and support services, professional services and other businesses. Among them, the former was a large revenue. The FY23Q2 revenue was US $ 7.143 billion, an increase of 21%compared with the US $ 5.914 billion in the same period last year, and the proportion of the total revenue was 93%.

This part of business is divided into five sections: Sales, Service, Platform & Others, Marketing & Commerce, and data analysis (data). Among them, SalesForce's office association platform SLACK was merged into the platform and application sector, which achieved a year -on -year growth of 53%this quarter.

Divide Salesforce Revenue Source of Source: Company Financial Report

The growth of Salesforce in terms of business basic and revenue is obvious to all, and it is even more worrying that it has unstable profitability.

During the fiscal season, Salesforce's gross profit was US $ 5.593 billion, accounting for 72%of the total revenue, 75%in the same period last year, and the gross profit level has been at a high level. However, Q2's operating profit was US $ 193 million, and the operating profit margin under GAAP was only 2.5%, a decrease of 2.7 percentage points from the same period last year. The operating profit margin under NON-GAAP was 19.9%.

Salesforce business profit margin Trend Map Source: Company Financial Report

Exposing Salesforce's "non -profit" is not that Salesforce does not make money, but it has invested profits into frequent external acquisitions.

Salesforce started from CRM and gradually constructed a comprehensive layout of the PaaS/SaaS ecosystem. Acquisition/mergers and acquisitions were an important means. Several large acquisitions were MUOLESOFT, Tableau, and $ 15.7 billion data analysis platform, and $ 15.7 billion. 22.7 billion US dollars of Slack.

The purpose of the acquisition is to develop in the future, and the "card position" faces competition, but at the same time, it will inevitably bring pressure on financial and organizational integration.

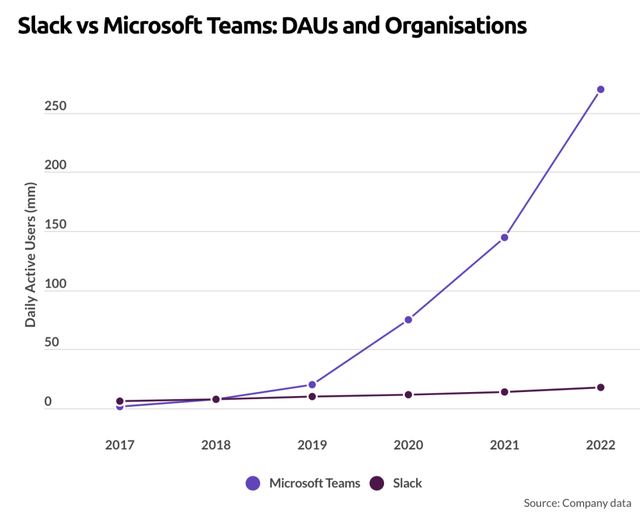

Even if its ecological layout is increasingly complete, Salesforce cannot ignore the threat of the opponent. On the one hand, it is an old opponent, such as Microsoft, and the TOB gene is deep. It has accumulated a large number of customers through the layout of products such as Office365, Skype, Azure Cloud. From the strategy of driving PaaS/SaaS business from IaaS, the specific business policy, similar collaborative tool Teams The synergy effect with Office365 greatly increased its users and quickly surpassed Slack.

Slack and Microsoft Teams DAU comparison map Source: Business of Apps

On the other hand, a group of SaaS companies deeply cultivated in the vertical field, such as Adobe with obvious advantages in creative and marketing directions, Shopify, which has e -commerce resources, etc. The industry depth will compete with it.

From the perspective of the industry, the SaaS track entered the "de -bubble" stage. The US secondary market's preference for SaaS's preferences and crossing cycles have continued to rise. Factors have grown rapidly, but with factors such as monetary policy adjustment, corporate layoffs, budget reduction, geopolitics, etc., this year has shown a decline. Salesforce is just one of the epitome.

The dawn of Chinese disciples?

The concept of SaaS is starting late in China, and the development stage and model are different from the US market. This is discussed in many analysis articles. At the same time, the industry is also very vulnerable to the influence of the US market fluctuations.

Since the beginning of this year, there have been many negative industries such as the cold and the decline in the company's performance. The first -level market has gone through the "big year" in 2021, and rationality is returning. In addition, the state of losses in the first half of the financial report of SaaS, such as Youzan and Weimeng, is worrying.

In early August, the news of the retreat of Salesforce China came, and some sounds began to "sing" SaaS's development in the Chinese market, while some voices were optimistic that "this is the dawn of Chinese manufacturers." In fact, if you look closely, Salesforce's adjustment of the Chinese region is not a major event for itself. Its Chinese business and other Chinese manufacturers' services are not a simple alternative relationship.

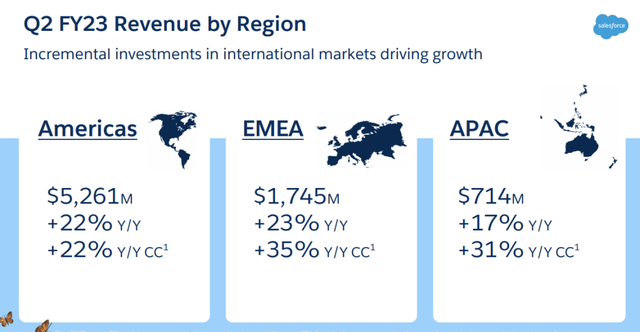

According to several media reports and Salesforce itself, the company has indeed adjusted the entire sales team in China and closed the Hong Kong office responsible for China's operation. However, in the Asia -Pacific region, the focus of Salesforce business. According to its latest financial reports, Salesforce's revenue of the Americas, Europe, and Asia -Pacific business revenue was US $ 5.261 billion, US $ 1.745 billion, and US $ 714 million, respectively. The Asian region only accounts for less than 10%of the total revenue, and the growth rate is not prominent, and the sense of existence is weak.

Salesforce fy23q2 revenue is divided by the region. Source: Company Financial Report

In addition, according to TechCrunch, Salesforce said: "Because of cooperation with Ali, the company is optimizing the business structure to better serve the Greater China, and will also open a new position while layoffs." Alibaba Cloud will be the general agent as the general agent The Chinese market that undertakes Salesforce has also been retained in the Singapore office.

From this point of view, getting out of Chinese business is more like a strategic abandonment. There is indeed a factor of "not accepting soil and water" behind it. In 2003, Salesforce entered the Chinese market and started its business. Hong Kong's work was established in 2006. However, in this booming market for more than ten years, Salesforce did not realize Breakthrough.

Objectively speaking, the size and penetration rate of China's SaaS market is far less than mature in Europe and the United States. According to iResearch data, the size of the Chinese enterprise SaaS market is expected to reach 99.1 billion yuan in 2022, of which the CRM market size is only 15.6 billion yuan (this number is even far less than that of Salesforce's fiscal season), compared with 2020 growth 16.5%.

This is also one of the reasons why Chinese CRM products are as good as hairy, but they can't run out of the unicorn. In the actual business promotion, the company's paid willingness is low, the value evaluation of CRM is inaccurate, the use threshold is high, and the market price war is different, so that the penetration rate has always been low. Chinese SaaS companies have unique problems to be resolved. Salesforce can only be the target of scriptures, copying the photo and copying.

However, it cannot be denied that, due to the demand for cost reduction and efficiency, the trend of enterprises on clouds and digitalization will not change for a long time. The economic environment or the limitation of the company's own development stage is more short -term challenges.

China's SaaS industry is still a stage for flowers and heroes. Traditional software manufacturers such as UFIDA, Kingdee, Jinshan office, and Internet giants that expand cloud computing services such as Ali, Tencent, bytes, independent SaaS manufacturers such as Zan, Inspiries, Micro League, etc., the steps are getting bigger and bigger.

Looking further, more segmented, vertical, and more professional has become an unstoppable trend.In addition to the general SaaS, there are small air outlets in product direction and specific industries. For example, cross -border e -commerce SaaS, as more and more brands and sellers go out to sea, more infrastructure builders and service providers are needed.In the past two years, the large -scale investment and financing incidents in the first -level market have been frequent. Store secrets, Jiga, and Malaysia have become Hot Deal. There are many new products.The downturn of the SaaS industry and the leader Salesforce is expected to last for a period of time, which is clearly visible to analysts and the company's guidance.The market for hot and cold markets is inevitable, but pessimism will not continue. SaaS, which has product power and strategic vision, will continue to grow steadily in this long -term track.

- END -

Hanting Hotel was fined for hygiene!User security is threatened, and the parent company Huazhu expands slowly

Produced: the front line of entrepreneurshipAccording to Sina Finance, recently, a...

Social Comment: The "hidden power" of the Chinese economy is breaking out

If you look at the recent foreign media reports on the Chinese economy, it is like...