The 2 billion related transactions were not disclosed!This listed company was punished

Author:Dahe Cai Cube Time:2022.09.06

The result of another "HNA" listed company "boots landed"!

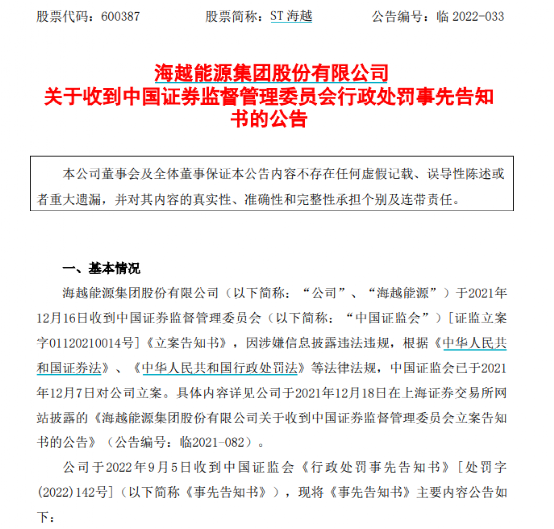

On the evening of September 5, ST Hai Yue announced that he received the "Administrative Penalty Prior to Administrative Penalties" on the same day. Because the non -associated connection transactions were not disclosed in 2020, the total scale reached 1.983 billion yuan. The ST sea was intended to be given a warning and fined 1 million yuan. Yuan.

In December 2021, a series of listed companies such as HNA Holdings, HNA Basic, Supply and Marketing Collection, HNA Investment, a subsidiary of HNA Group, issued an announcement one after another, and was investigated by the Securities Regulatory Commission for suspected information disclosure. Recently, the punishment results of related companies have been released one after another.

The affiliated transaction of 1.983 billion yuan was not disclosed

In December 2021, Haiyue Energy issued an announcement saying that the company was investigated by the CSRC for investigation due to illegal information disclosure of information disclosure. After nine months, the survey surface surfaced.

As a member of the HNA Group, the specific letter of Haiyue Energy's dedication to the non -operating affiliated transaction for non -operating affiliated transactions in accordance with regulations is naturally related to the HNA Group.

According to the survey, there are three companies that conduct non -operating affiliated transactions with Haiyue Energy. All three companies are controlled by HNA Group and constitute a relationship with Haiyue Energy.

From February to May 2020, Haiyue Energy provided a total of 1.983 billion yuan to Hainan Chengmu, Hainan Sciences, and Hainan Xiyue, accounting for 63.19%of the net assets recorded in Haiyue Energy in the 2020s. For these non -operating affiliated transactions over 60 % of net assets, Haiyue Energy has not disclosed in time. In the semi -annual report of 2020, Haiyue Energy was filled in "Whether the controlling shareholder and its related parties' non -operating occupation funds" was filled in "No".

In addition, supervision also pointed out that Qiu Guoliang, then chairman and general manager, Zhou Yong, then director and chief financial officer, then director Xing Xihong, then director Wang Kan, signed the "2020 Annual Report" Haiyue Energy's non -operating affiliated transactions are responsible for the above -mentioned illegal acts. Among them, Qiu Guoliang is directly responsible for the supervisors. Zhou Yong, Xing Xihong, and Wang Kan are other direct responsible persons, and they must bear the corresponding responsibilities.

Based on this, the CSRC intends to give a warning to Haiyue Energy and impose a fine of 700,000 yuan. fine.

ST Haiyue said that the company's current production and operation is normal, and administrative penalties will not have a significant impact on production and operation; it has rectified the above matters. , Timely and fairly fulfilling the obligation of information disclosure.

Due to the "band hats" due to funds occupation

It is precisely due to the problem of shareholders 'shareholders' funds in Haiyue Energy that it has been suffering from risk warnings since May 2021.

At the end of April 2021, Haiyue Energy reported in the 2020 annual report that "since 2020, the company's former major shareholders Tongchuan Haiyue Development Co., Ltd., the current major shareholders Tongchuan Huixin Energy Co., Ltd. and related parties have large non -operability Occupying the company's funds, 1.45 billion yuan has not yet been recovered, accounting for 45.89%of the company's recent audited net assets. "

Due to this defect, the China Reception Certified Public Accountants issued a negative opinion of Haiyue Energy's "Internal Control Audit Report 2020". From May 6, 2021, Haiyue Energy was implemented with other risk warnings, and the stock abbreviation was changed to "ST Haiyue".

After the problem of funds occupation was exposed, the submission letter was sent to the sub -handling letter as soon as possible to ask Haiyue Energy for rectification. During the same period, Tongchuan Energy, the controlling shareholder of Haiyue Energy, promised to repay the funds occupying 1.453 billion yuan in cash backfilling by cash backfilling, and undertake the issue of funds left by listed companies.

In December 2021, ST Sea issued an announcement saying that Tongchuan Energy had repaid non -operating funds to occupy 1.073 billion yuan through cash. At this point, the shareholders and its non -operating funds occupied by non -operating funds have been paid off.

In the semi -annual report of 2022, ST Hyatt said that the occupation of related parties' funds has been settled. However, due to the ongoing investigation, the company's shares have not yet applied for other risk warnings. After the investigation is completed, the application for revocation of other risk warnings shall be submitted in accordance with the requirements of relevant laws and regulations. Investors are requested to pay attention to investment risks.

The results of the penalty are released one after another

In December 2021, a series of listed companies such as HNA Holdings, HNA Basic, Supply and Marketing Collection, HNA Investment, a subsidiary of HNA Group, issued an announcement by the suspected information disclosure of the law and violations of laws and regulations.

On the evening of September 1, ST HNA announced that it received the "Administrative Penalty Decision" by the Securities Regulatory Commission. Because of the failure to disclose non -operating affiliated transactions and association guarantees, as well as regular reports of major omissions, HNA Holdings was warned and fined 2 million yuan; the relevant responsible person involved in the case would warn and a fine of 200,000 to 300,000 yuan. Essence

The penalty decision shows that HNA Holdings lacks independence in the management and control of financial funds. Its funds with related related parties and the signing of foreign guarantee contracts are completed under the organization and control of the HNA Group. As a result, HNA Holdings did not disclose non -operating affiliated transactions and association guarantees in accordance with regulations. Specifically, from 2018 to 2020, 2,849 non -operating affiliated transactions such as HNA Holdings and HNA Group, including HNA Hall, had a total amount of 165.215 billion yuan, including funds for 138.457 billion yuan. In addition, from 2018 to 2020, HNA Holdings had not disclosed 197 association guarantees in a timely manner, with a total amount of 39.573 billion yuan, forming a major omissions.

The next day, the Shanghai Stock Exchange publicly condemned the relevant responsible persons of ST HNA and 11, and supervised and warned 14 relevant responsible persons.

The ST foundation received an advance notification of administrative penalties on August 24, which also involved the issue of non -operating affiliated transactions and related guarantee disclosure. The CSRC plans to give a warning to the foundation of HNA and impose a fine of 2 million yuan.

Similarly, the ST collection was intended to be warned by the CSRC and a fine of 1.5 million yuan, and the responsible persons were fined 150,000 to 1 million yuan. ST Haitou was placed to be warned and fined 1.5 million yuan, and the responsible persons fined 200,000 yuan to 800,000 yuan.

Several administrative punishment decisions/advance notifications pointed out that the HNA Group's three-story management structure of the "HNA Group-Institute/Industrial Group-Single Company" was managed. The financial integration, vertical, and three -layer control and management are implemented financially; cash flow integration management is implemented in funding, and funds are uniformly allocated by HNA Group.

Therefore, the listed company involved in the case lacks independence in the management and control of financial funds. The guarantee matters of related related parties, etc., are completed under the organization and control of the HNA Group. question.

In April this year, HNA Group announced that its risk disposal related work was successfully completed. Trust trust trusts in HNA Group's bankruptcy reorganization have been established in accordance with the law, and 321 substantial merger reorganization plans such as HNA Group have been implemented and the court rules have been confirmed.

Responsible editor: Tao Jiyan | Review: Li Zhen | Director: Wan Junwei

- END -

Essays in Shandong: Priority support for major projects that have been introduced in the starting area and other eligible projects

Increase the coordination and support of the relevant projects and establish a gre...

Silaid will close 1,300 Chinese stores. How can the clothing industry survive the "cold winter"?

The industry will usher in a shuffleAt 00:00 on June 1st, more than a dozen people...