Shenzhen and Hong Kong jointly announced the "policy pack" to the public for the first time, focusing on this field

Author:Southern Magazine Time:2022.09.06

The Qianhai Cooperation Zone has continuously improved quality and efficiency in the financial industry, especially the high -level construction of Qianhai Shenzhen -Hong Kong International Financial City. At present, it has signed 200 financial institutions, and Hong Kong -funded foreign -funded institutions account for 30 %.

"Southern" magazine all media reporter 丨 Gentle

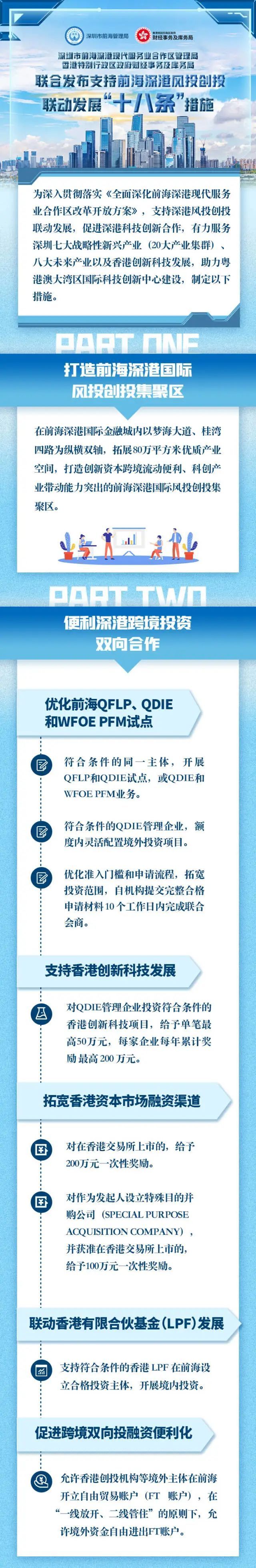

On September 2nd, the "Eighteenth Measures of the Financial Affairs and Treasury Bureau of the Hong Kong Special Administrative Region Government of Shenzhen Qianhai Shenzhen and Hong Kong Modern Service Industry Cooperation Zone on the Shenzhen Special Administrative Region Government of Shenzhen "Eighteenth" measures) were officially released in Shenzhen and Hong Kong.

The "eighteen" measures are the specific actions to implement the "Reform and Opening and Opening Plan for the Comprehensive Deepening of the Qianhai Shenzhen -Hong Kong Modern Service Industry Cooperation Zone", which is of great significance to deepen the pragmatic and innovative cooperation in the financial field of Shenzhen and Hong Kong. This will also further promote the development of Shenzhen -Hong Kong wind investment and innovation, effectively serve Shenzhen -Hong Kong scientific and technological innovation cooperation, and help the construction of the International Science and Technology Innovation Center of the Guangdong -Hong Kong -Macao Greater Bay Area.

The "eighteen" measures proposed that in Qianhai Shenzhen -Hong Kong International Financial City (Qianhai Guiwan, Qianwan District), Dream Sea Avenue and Guiwan Four Roads were used as the two axes to coordinate the high -quality industrial carriers on both sides to expand 80 80 10,000 square meters of high -quality industrial space, creating Qianhai Shenzhen -Hong Kong International Venture Capital Capital Area, which has innovative capital cross -border flowing convenience, and has outstanding capacity of science and technology industry.

In addition, the "eighteen" measures have introduced a number of specific measures to "facilitate Shenzhen -Hong Kong cross -border investment two -way cooperation", "support for large -scale agglomeration development" and "build a good ecological environment of Shenzhen -Hong Kong linkage". For example, support Hong Kong's innovation and technology development. Encourage Qianhai QDIE management enterprises to invest in Hong Kong Innovation Technology, and invest in Hong Kong Science Park or Hong Kong Digital Port enterprises, have been selected as participating in the Hong Kong Science Park or Hong Kong Digital Port Cultivation Project, as well as the funding of the Hong Kong Special Administrative Region Government Innovation and Science and Technology Fund Funding Project According to the actual investment of 2%and a single maximum of 500,000 yuan, each company has a total of 2 million yuan per year.

Shenzhen and Hong Kong for the first time released measures in the form of joint announcements

The "18" measures are based on in -depth research and widely investigating the pain points of the pain points reflected by the private equity industry in Shenzhen and Hong Kong. Administration) and the Hong Kong Special Administrative Region Government Financial Affairs and Treasury Bureau (hereinafter referred to as the Hong Kong Treasury Bureau) jointly studied and launched a pragmatic and powerful measure to support the development of Shenzhen -Hong Kong Wind Investment and Investment.

It is worth noting that the "eighteen" measures are the first time in Shenzhen and Hong Kong to adopt a joint announcement of "policy packages", which is not only an innovation of cooperation mechanisms, but also exploring a new road for Qianhai to deepen Shenzhen -Hong Kong cooperation. At the same time, the two sides have established a normal communication and cooperation mechanism to promote the connection and mechanism docking of the Shenzhen -Hong Kong financial sector, and promote the interconnection of larger, wider areas, and deeper in the Shenzhen -Hong Kong financial market, and serve the high -quality development of the real economy.

Qianhai Stone (taken on July 15, 2021). Photo by Xinhua News Agency reporter Mao Siqian

In fact, since the release of the reform and opening up of the Qianhai Cooperation Zone in the "Reform and Opening Area of the Qianhai Shenzhen -Hong Kong Modern Service Industry Cooperation Zone" on September 6 last year, Qianhai Cooperation Zone has continuously improved quality and efficiency in the financial industry. In particular, the high -level construction of the former sea and Shenzhen -Hong Kong International Financial City has been signed in 200 financial institutions. Hong Kong -funded foreign -funded institutions account for 30 %. The institution is out of the sea.

Convenient for both Shenzhen -Hong Kong cross -border investment two -way cooperation

The Hong Kong financial industry has proposed many times that it hopes to broaden the channels for cooperation in Shenzhen -Hong Kong Private Equity Fund. The Shenzhen Qianhai Administration and the Hong Kong Treasury Bureau actively responded to the industry's demands, promoting the Hong Kong Limited Partnership Fund (LPF) and the pilot rules of the Qianqian overseas investment equity investment enterprise (QFLP) pilot rules and mechanisms to support Qianhai Wind Investment Investment Investment Institution Link Hong Kong LPF develops overseas business, while optimizing the pilot work of Qianhai QFLP, launching pragmatic measures such as optimizing the entry threshold, broadening investment scope, and flexible allocation projects, and clarifying that the self -institution submits a complete qualified application materials to complete the federal merchants within 10 working days.

In particular, the "eighteen" measures proposed to broaden the financing channels of Hong Kong's capital market. Support Qianhaifeng Investment Investment Investment Agency to broaden financing channels, and give 2 million yuan award award to the Hong Kong Stock Exchange. For the Special Purpose Acquisition Company as a sponsorship of Qianhai Wind Investment Investment Agency and its wholly -owned subsidiaries in Hong Kong, it is approved to be listed on the Hong Kong Stock Exchange, and the Qianhai Wind Investment Investment Agency is 1 million yuan to the Hong Kong Stock Exchange. Reward at one time. For Qianhai's high -quality infrastructure projects listed on the Hong Kong Stock Exchange through REITs, it will give the project's equity 1 million yuan award reward.

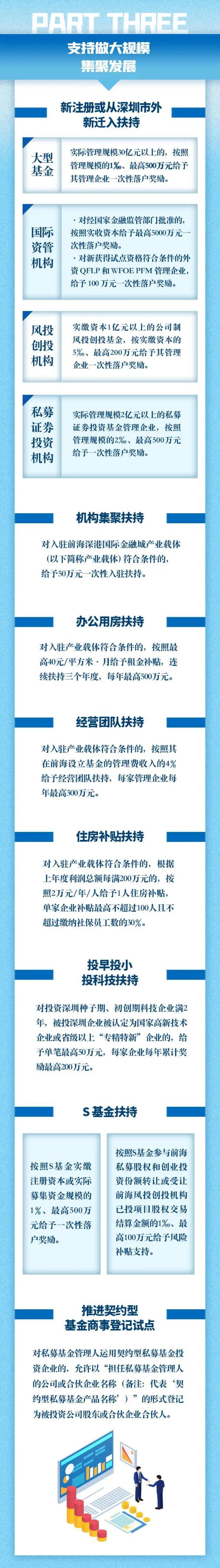

The maximum reward can exceed 50 million yuan

This time, the "eighteen" measures at the same time support the venture capital venture capital institutions from the aspects of settlement awards, rent subsidies, gathering support, operating teams, and early investment technology. Or the relevant policies of Baoan District, the total reward can exceed 50 million yuan.

In terms of vigorously attracting international asset management institutions, support the settlement of well -known overseas venture capital venture capital institutions, international asset management institutions, and Hong Kong family offices. Give a reward of up to 50 million yuan at one time according to the income capital. For newly obtained pilot qualifications, foreign QFLP and WFOE PFM management companies, which are eligible, will give 1 million yuan award rewards at one time. Shenzhen Qianhai Shenzhen -Hong Kong Modern Service Industry Cooperation Zone. Photo by Zhu Hongbo, a reporter from Nanfang Daily

In particular, the "eighteen" measures encouraged early investment in small investment technology. For Qianhaifeng Investment Investment Investment Investment Investment Investment Investment Investment Period and Chuangchuang Technology Enterprise for 2 years, and have been invested in Shenzhen enterprises as national high -tech enterprises or "specialized new" enterprises above the provincial level, their management enterprises are invested in accordance with investment. The amount of the amount and a single maximum of 500,000 yuan are rewarded, and each company has a total of 2 million yuan per year.

In addition, in terms of talent rewards, the operating team support is given to the operating team according to 4%of the management fee income of the establishment of a fund in Qianhai.

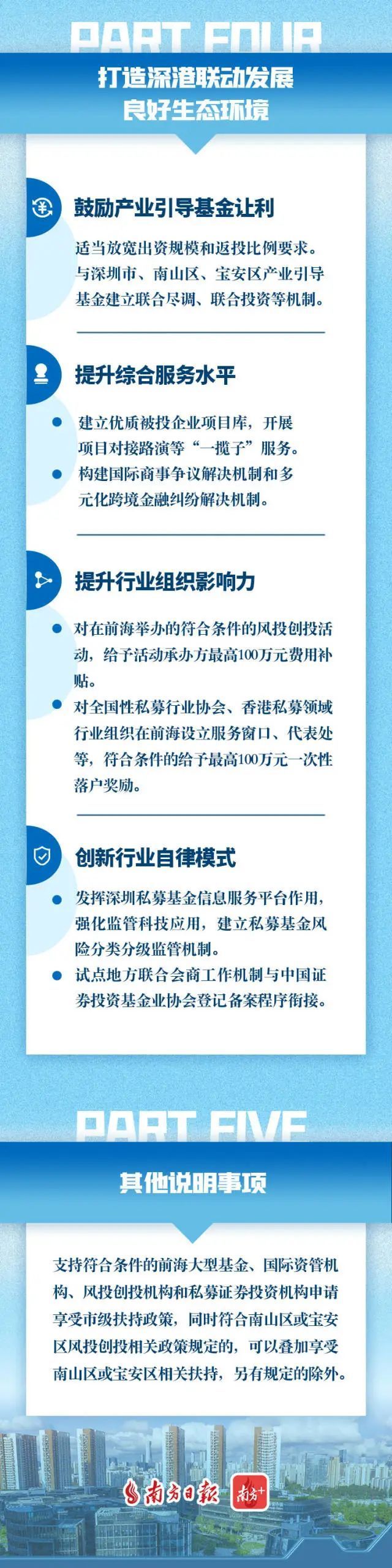

Create a good environment for Shenzhen -Hong Kong Local Liner Development

"Building a good ecological environment in Shenzhen and Hong Kong" is one of the most important contents of this "eighteen" measures.

The "eighteen" measures proposed to encourage industrial guidance funds to make benefits. Optimize the Qianhai Industry Guidance Fund incentive mechanism. On the basis of compliance in accordance with laws, the investment amount of investment in Shenzhen enterprises is calculated in accordance with a certain coefficient, and the amount of capital contribution and the proportion of return on investment should be appropriately relaxed. Support the Qianhai Industry Guidance Fund with Shenzhen, Nanshan District, Baoan District Industry Guidance Fund to establish joint adjustments, joint investment and other mechanisms, and coordinate improving the efficiency of government industry guidance funds.

The "eighteen" measures also propose to improve the level of comprehensive service. Unite Nanshan District and Baoan District established a high -quality investment enterprise project library, supported the improvement of the function of Qianhai Shenzhen -Hong Kong Fund, established a high -quality venture capital venture capital institution library, and carried out "a small" service such as road shows. Strengthen the security of talent housing, increase the protection of investors, and build an international commercial dispute resolution mechanism and a diversified cross -border financial dispute resolution mechanism. Support eligible accounting, taxation, law and other Hong Kong professionals in Hong Kong to facilitate cross -border practice in Qianhai. Study and explore the tax environment that is conducive to the development of Shenzhen -Hong Kong wind investment.

It is reported that the rewards and support funds involved in the "eighteen measures" measures and support funds are implemented in accordance with the "Interim Measures for the Management of the Special Fund Management Zone of Shenzhen Qianhai Shenzhen -Hong Kong Modern Service Industry Cooperation Zone" and its application guidelines. It is implemented since September 2, 2022, with a validity period of three years.

In particular, it supports eligible Qianhai Fund, international asset management institutions, venture capital venture capital institutions and private equity securities investment institutions to apply to enjoy municipal support policies, and municipal policies can be superimposed with Qianhai policies. At the same time, if it complies with the relevant policies of Nanshan District or Baoan District Venture Capital Venture Capital, it can be superimposed to enjoy the relevant support of Nanshan District or Baoan District, except for other regulations.

Responsible for this article 丨 Guo Fang

- END -

Harbor Xiong opened 10,000 tons of giant ships in Quanzhou Port

Quanzhou Evening News · Quanzhou Tong Client August 23 (Quanzhou Evening News rep...

Tencent was reduced by major shareholders?The stock price evaporated 170 billion yuan. What happened to Tencent?

In the Chinese Internet market, Tencent is undoubtedly one of the most concerned c...