Focus on the development of the "loan" dynamic industry chain for the development of the business entity

Author:China Agricultural Credit News Time:2022.09.06

Focus on the development of the "loan" dynamic industry chain for the development of the business entity

Yang Xiao

In order to continue to implement the party committees and governments at all levels and the provincial and municipal federations on the series of policies for helping enterprises, the Shanxi Yuncheng Rural Commercial Bank of China has paid an eye on the financing problem of operating entities in its jurisdiction, innovated the rural financial product service system, expanded the scope of the application of mortgage loans, and actively active Exploring breeding lives as a new measure as mortgage financing products has effectively promoted the continuous development of the breeding industry in the jurisdiction.

As the saying goes, "Family wealth is very consistent, and the hair is not counted." No mortgage is the "boss" of farmers' financing. Chen Xinxin, the head of a cow breeding Co., Ltd. at Zhangxiang Dongdi Zhangcun, was worried about this problem some time ago.

Chen Xinxin has been raising cattle for more than 17 years. It has more than 600 cows and is worth nearly 10 million yuan. Not only is the bull raising technology mature and experienced, but also drives many poor households around the surrounding poverty -stricken households to get rid of poverty through the breeding industry. With the continuous expansion of the scale of the farm, the demand for funds is increasing, and it is suffering from the mortgage that cannot be financed. Chen Xinxin often sits in his own farm to "look at the cattle and sigh."

The arrival of the Credit Center of Yuncheng Rural Commercial Bank and the staff of Xi Zhang branch made Chen Xinxin frown to stretch. According to the actual situation of Chen Xinxin, the customer manager of the Credit Center investigated the post to the customer manager introduced him in detail the information, service scope, interest rate period and other information of the "living loan", carefully explained the re -loan policy of the people who could enjoy, and helped customers contact the asset evaluation company. , Insurance companies, epidemic prevention departments and other relevant units to help customers go through relevant procedures. In just three days, Xi Zhang Sub -branch quickly issued a mortgage loan of "living dairy cows" for the company.

Yuncheng Rural Commercial Bank actively explores modern rural financial service methods, relying on the "bank insurance shares" cooperation model and mutual trust coordination supervision mechanism of "biological biological mortgage+provincial agricultural burden+cow breeding insurance+banking" to give play to the Real Estate of the People's Bank of China Credit Center The role of the unified financing registration and publicity system, which clearly incorporates live assets into the mortgage registration variety, and fully solves "the bank is not dared to put money, and the breeding households cannot loans". There is a new path of financing households.

Taking the opportunity of the promotion of the new model of the "living dairy cow" mortgage loan, the Yuncheng Rural Commercial Bank will focus on the core of various types of breeding chain companies, communicate with the townships and village party committees of the districts. Funding demand, providing technical support and discounted loans in all aspects, opening up the upper, middle and lower reaches of the entire breeding market, the size of the breeding market, and at the same time implement the duties of "rural revitalization and host banks", effectively introduce various financial resources, innovate finance Products and models, build a financial service chain of the entire agricultural industry chain, promote high -quality and efficient agriculture, rural areas, livable and industrial, farmers' wealth, and contribute to farmers and commercial forces to compose a chapter in the new era of rural rejuvenation.

- END -

This loan principal can be repaid!The application strategy is here →

In order to help the family's economic difficulties to relieve employment pressure...

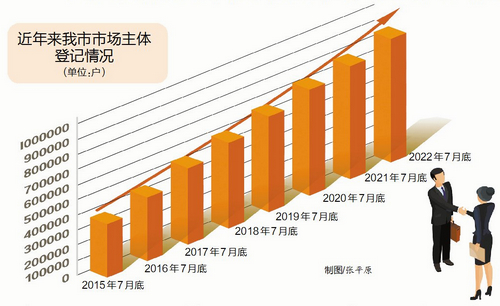

Optimize the business environment!The main body of Xiamen market exceeds 800,000 households

The main body of the market is an important force for economic and social developm...