Chinese old -fashioned five -Fangzhai landed on A shares, but the real controllers of the 80s were foreign citizenship?

Author:Refer to the business Time:2022.09.06

"The first share of Zongzi" came, and Wufangzhai successfully landed on A shares, becoming a veritable "King of Dang".

A -share dumplings first share

In the peak season of moon cake sales, Wufangzhai successfully grabbed the hot search of moon cakes. On the morning of August 31st, the "No. 1 Shao" at the helm of Wen Shang Li Jianping officially landed on the main board of the Shanghai Stock Exchange. On the first day of listing, the company's market value reached 4.979 billion yuan.

Wufangzhai is a Chinese old name with a century -old history.

In the 1920s, Zhang Jinquan, a businessman in Zhejiang Lanxi, picked up the name "Wufangzhai Zongzi" in the old town of Jiaxing and gradually launched the name of Wufangzhai. In 1999, the Jiaxing service area on the Shanghai -Hangzhou Expressway introduced local specialties in order to fill the format of the service area with a single service area, and Wufangzhai became one of the earliest local brands to settle in. Soon, Wufangzhai expanded its popularity with the service area and increased sales.

The company experienced two restructuring, and then the Lord from Li Jianping, from Ruian, Wenzhou, will develop and grow. In 2007, the profit area obtained from Wufangzhai reached more than 9 million yuan. In 2010, Wufang Tao's Shanghai Headquarters was established, and the national strategic map was further improved.

Public data shows that in 2021, Wufangzhai sold a total of 448 million rice dumplings.

It is reported that the company is mainly engaged in food research and development, production, and sales dominated by glutinous rice food. At present, it is mainly dominated by rice dumplings. , Cooperative operation, franchise, distribution, etc. have established 478 stores.

From 2018 to 2021, Wufangzhai's revenue was 2.423 billion yuan, 2.507 billion yuan, 2.421 billion yuan, and 2.892 billion yuan; net profit was 95.448 million yuan, 164 million yuan, 142 million yuan, and 194 million yuan. By 2022, Wufangzhai's performance was affected by the epidemic.

From January to June this year, Wufangzhai's revenue was 1.809 billion yuan, a year-on-year decrease of 15.32%; net profit was 242 million yuan, a year-on-year decrease of 20.78%.

Dangzi products have significant seasonal characteristics, and their market demand and production have obvious periodicity. The importance of the second quarter performance is self -evident to Wufangzhai. Therefore, the performance in the first half of 2022 was affected by the epidemic.

Dangzi dependence does not heal for a long time

Although sitting on the title of the first share of Zongzi, Wufangzhai's disadvantages are also a lot.

Opening its prospectus, the overall revenue of Wufangzhai in 2021 was 2.892 billion yuan, a year -on -year increase of 19.48%, and the net profit attributable to the mother was 194 million, a year -on -year increase of 36.48%.

Among them, the revenue of the Zongzi series of products was 2.07 billion yuan, accounting for 73.06%, the income of the moon cake series products was 219 million, accounting for 8%, the revenue of the meal series of products was 252 million, accounting for 9.17%, the egg products, pastries and other product revenue were 268 million, and 268 million. It accounts for 9.76%.

(Screenshot of Wufangzhai Prospectus)

The most obvious disadvantage of the product side, the most obvious disadvantage of Wufangzhai is: excessive dependence on the dumplings on the product structure.

According to Chinese food statistics, in 2019, the domestic rice dumplings market size is only 7.3 billion yuan. Even if Wufangzhai achieves the extreme in the vertical field, it is an indisputable leader in the industry. However, in the rice industry with less than 10 billion yuan, the profit margin is limited after all.

At this time, Wufangzhai needs to create a "second growth curve" to provide investors with room for full imagination.

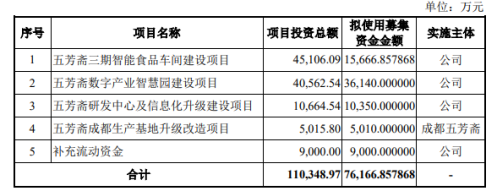

Regarding the purpose of listing funds, Wufangzhai said that in addition to fist products, the brand's products also have moon cakes, pastries and other baking products. Its public listing funds will be used to continuously improve the level of technology innovation and new product development capabilities, and further expand the production capacity of the company's baked foods and quick -frozen foods.

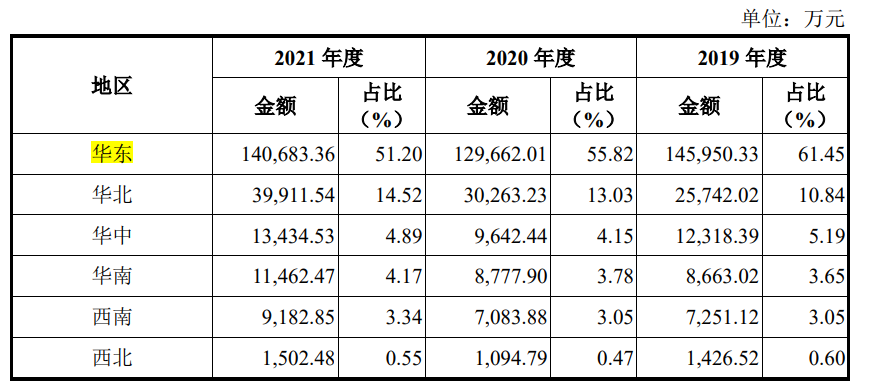

From the perspective of the channel, the annual revenue of the past three years comes from the East China market. In 2021, the region's revenue was 1.407 billion yuan, accounting for 51.2%. The sales channels are also too concentrated. The eggs are in a basket, and the basket is difficult to guarantee.

Wufangzhai urgently needs to change more than just a single problem with the product. The single problem of the sales area also needs to be resolved.

Then the sales expenses were as high as 783 million, the company's profitability was directly lowered, and the revenue and profits declined this year. The reasons can also be seen.

Under the pressure of single, diversified failure, production capacity and even operation control, is Wufangzhai's imagination?

The actual controller's son has become a foreign richest man

Wufangzhai's listing has created a number of billionaires in the Li family. Although it is the first batch of "Chinese old -fashioned" enterprises in the country, the production method of rice dumplings is derived from the traditional craftsmanship of a century -old inheritance, but the actual controller has become a foreign rich.

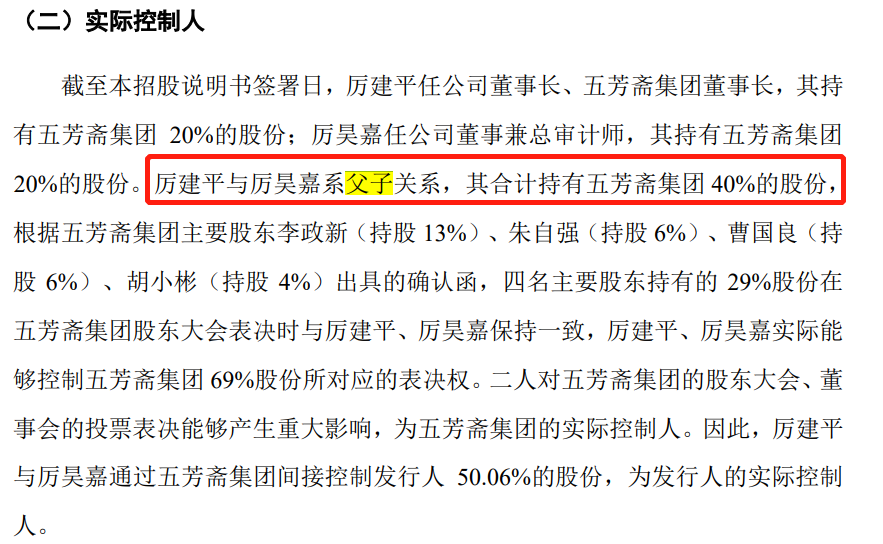

The prospectus shows that Li Jianping is chairman of Wufangzhai. After the listing, Li Jianping and his son Li Haojia indirectly controlled the issuer's 37.55%of the shares through Wufangzhai Group.

Among them, Li Jianping is a Hong Kong nationality in China and has no foreign permanent residency; Li Haojia is a French nationality and has the permanent residence right of Singapore.

It is also worth mentioning that Wufangzhai has frequently received complaints in terms of food safety. Some consumers report that Wufangzhai has mildew and even eat cockroaches. The corresponding data behind it is that the number of days of inventory has reached 72 days, and it is not unusual for consumers to buy expired products.

Isn't this a moldy rice dumplings that make money for foreigners?

Judging from the factors such as the current performance and food safety risks of Wufangzhai, the newly listed Wufangzhai can be told how long the story can be told, which remains to be verified by the market.Reference materials:

Xiaoying female tribe "Fangzhai's listing continuous daily limit: products and markets are treated alone," Chinese old name "achieves foreign" rich people "?"

Financial Rui Eye "Flooding Four days after listing:" Old name "Wufangzhai is constantly, and the real controllers of the post -80s are foreign nationality."

- END -

Zhongqingbao was exposed to the game version number transaction: the asking price of 400,000 yuan, but it cannot guarantee the normal use of the version number, or is suspected of violating the law

On July 12, the website of the National Press and Publication Agency announced the...

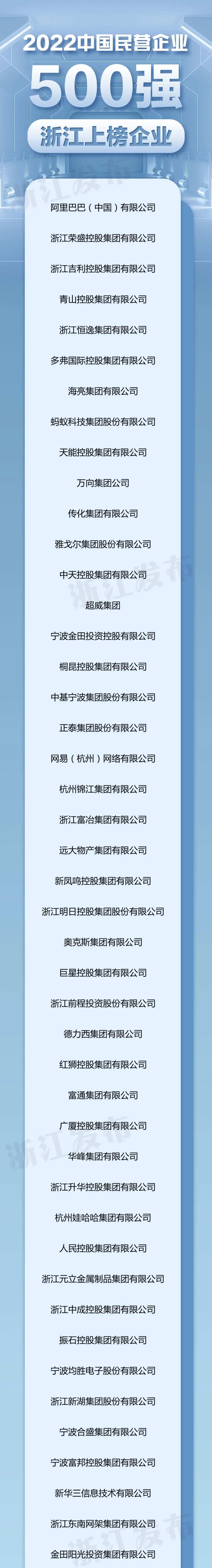

Just announced!107 in Zhejiang on the list, ranking first in the country

notSource: Zhejiang PublishedThe copyright belongs to the original author, if ther...