Shaanxi listed company semi -annual examination: Who is the king of profit?

Author:Daily Economic News Time:2022.09.06

As of August 31, 72 A -share listed companies in Shaanxi ended in 2022.

According to Fanxiang Finance, in the first half of this year, 72 A -share companies in Shaanxi achieved revenue of 360.732 billion yuan, an increase of 14.9%year -on -year; the total net profit was 43.403 billion yuan, a year -on -year increase of 50.3%.

Through this transcript, it can be seen that in the first half of 2022, Shaanxi A -share listed companies played the leading role of high -quality enterprises. Most of them achieved revenue and profits, reflecting strong toughness and vitality. So, Fanxiang Finance also takes a look at the profit king of the Shaanxi stock "mid -term entrance examination."

Who is the profit king?

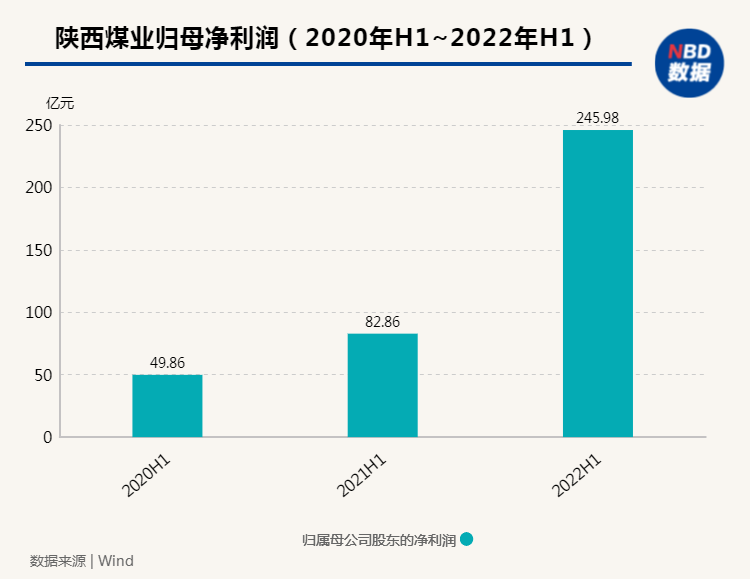

Shaanxi Coal Industry is still the king of profitability of Shaanxi stocks.

From the perspective of the semi -annual report data, Shaanxi Coal Industry achieved operating income of 83.69 billion yuan, an increase of 14.86%year -on -year; net profit at home was 24.598 billion yuan, an increase of 196.6%year -on -year.

Picture source: Fanxiang Finance System

Specifically, the dual growth of Shaanxi Coal Industry's revenue economy has benefited from the continuous high prosperity cycle of the coal industry. The coal prices running at high levels not only make the efficiency of Shaanxi coal industry continue to rise, but also perform well in the capital market. As of the close of September 5, Shaanxi Coal Industry reported 24.53/share, with a total market value of 237.818 billion yuan, ranking second in the market value of Shaanxi stocks.

As an energy enterprise, Shaanxi Coal Industry has made efforts in scientific research in recent years. The semi -annual report shows that Shaanxi Coal Industry has invested 119 million yuan in science and technology research and development in the first half of the year, an increase of 522.63%year -on -year. As of now, the company has a total of 2 national scientific research platforms and 10 provincial and ministerial scientific research platforms.

It is worth noting that the total net profit of 72 companies in Shaanxi stocks in the first half of the year was 43.403 billion yuan, and the Shaanxi Coal Industry's family contributed 56.67%.

Picture source: Fanxiang Finance System

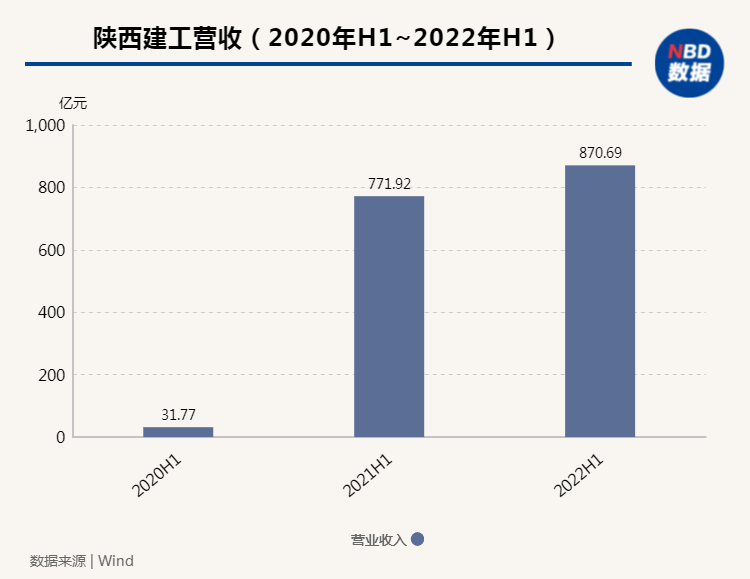

In addition, the revenue of Shaanxi Construction Engineering in the first half of the year also attracted the attention of Fanxiang Finance. During the reporting period, Shaanxi Construction Industry achieved operating income of 87.069 billion yuan, an increase of 6.60%over the same period last year. It is the company with the highest revenue in Shaanxi. 2007.49 billion yuan, a year -on -year increase of 21.35%.

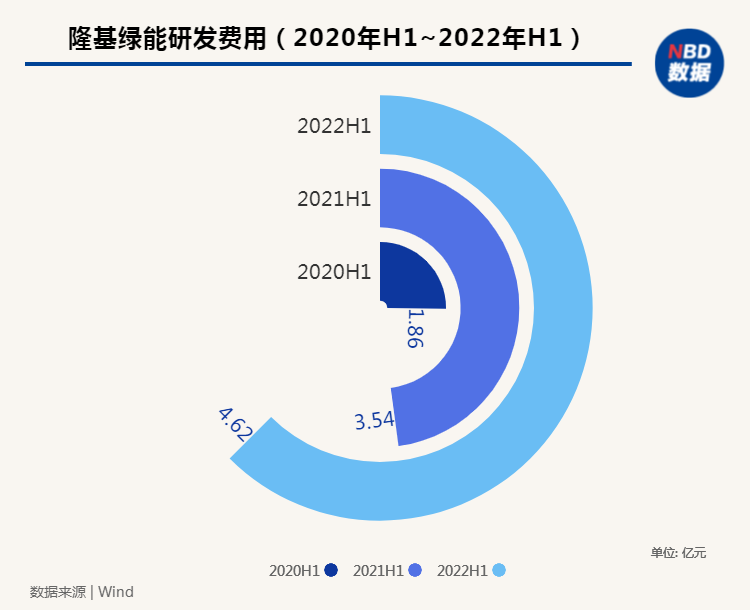

If the Shaanxi Coal Industry is the king of profit, Shaanxi's construction industry is the "king of revenue", then from the operating performance and shareholder return, Long Ji Green Energy is undoubtedly the "king of value".

During the reporting period, Longji Green Energy achieved operating income of 50.417 billion yuan, an increase of 43.64%year -on -year; the net profit attributable to shareholders of listed companies was 6.481 billion yuan, an increase of 29.79%year -on -year. Its profitability is also constantly strengthening.

Fanxiang Finance has noticed that Longji Green Energy's performance growth is mainly the investment in R & D. In the first half of 2022, Longji Green Energy's R & D investment reached 3.670 billion yuan, accounting for 7.28%of operating income; as of the first half of the year, Longji Green had obtained 1,808 authorized patents.

Picture source: Fanxiang Finance System

From the perspective of long -term performance, the above three companies have focused on the main business, focusing on various advantageous resources on the main business and related industrial chains, and constantly excelment the main business.

Among them, Shaanxi Coal Industry and Shaanxi Construction Institute of Industry and the influence of the company's volume have absolute industry advantages, which is also the key point of its high -speed growth; Longji Green Energy focuses on technological innovation. The world record of breaking the next -generation photovoltaic battery conversion efficiency 10 times is a typical internal technology -driven enterprise.

Nearly 60 % of enterprises have increased performance

Except for companies with outstanding profitability, the quality of listed companies in Shaanxi as a whole is good. In the first half of the year, a total of 42 companies in Shaanxi listed companies maintained their performance growth, accounting for 58%of all companies.

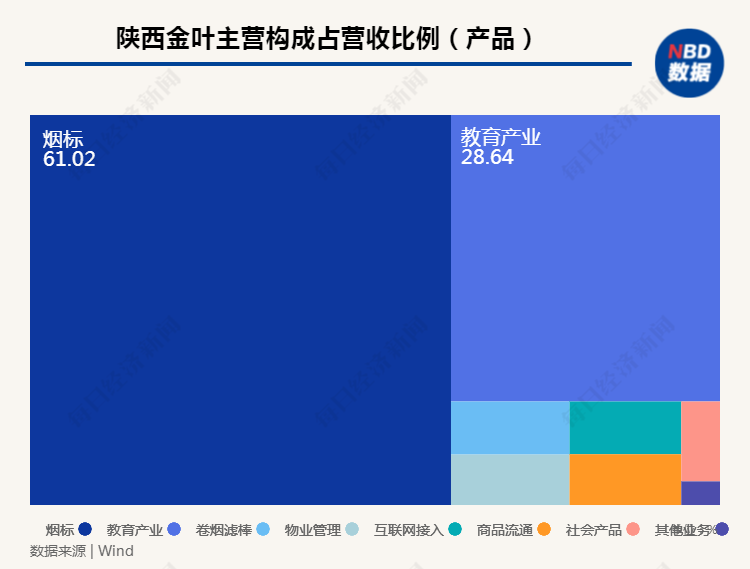

尤为表现惊喜的是,陕西金叶报告期内营业收入6.23亿元,同比增长9.65%;归属于上市公司股东的净利润0.44亿元,同比增长199.23%;基本每股收益0.0578元/股,同比Growing 199.48%.

Fanxiang Finance noticed that in the first half of 2022, the growth of the revenue of the Jinye education industry in Shaanxi has exceeded the tobacco supporting industry, which has made a great contribution to the overall revenue. Its educational industry operation subject is Xi'an Mingde Institute of Technology, which currently accounts for 28.6%of the total revenue of Shaanxi Golden Leaf.

Picture source: Fanxiang Finance System

From the perspective of extended time, state -owned enterprises such as Shaanxi Drum Power and Tiandi Source have also performed steadily, and their performance has achieved steadily. The semi -annual report shows that the Shaanxi Drum Power achieved operating income of 5.880 billion yuan in the first half of the year, an increase of 8.07%year -on -year, and a net profit of 572 million yuan, an increase of 11.68%year -on -year;

Tiandi Source achieved operating income of 3.1 billion yuan in the first half of the year, an increase of 10.8%year -on -year. In the future, with the successive delivery of major projects, the revenue of Tiandi Source will continue to grow.

It is worth noting that the fascinating*ST Bikang in the first half of the year also achieved profitability. During the reporting period, Yan'an Bikang achieved operating income of 3.993 billion yuan, an increase of 15.76%year -on -year; the net profit of the mother was 324 million yuan, an increase of 6.65%year -on -year, and both revenue remained increased.

But even so, the big changes of Yan'an Bikang's performance trailer last year are still vivid. The major shareholders of violations of listed companies' funds, illegal guarantees, and financial fraud have continued. Essence

On August 31, the Shaanxi Securities Regulatory Bureau issued an advance notice of administrative penalties on*ST Bikang. The notice shows that*ST Bikang was late for annual report and was warned by 1 million fines. The main responsible person chairman Han Wenxiong and the financial director Fang Xi were fined 300,000. Decrease in the number of losses

Some companies remain profitable. Naturally, the company performs poorly. In the first half of 2022, a total of 13 Shaanxi stocks suffered losses, accounting for 18%of the total number of enterprises. But overall, Shaanxi's loss -making companies have narrowed a lot compared to a few years ago.

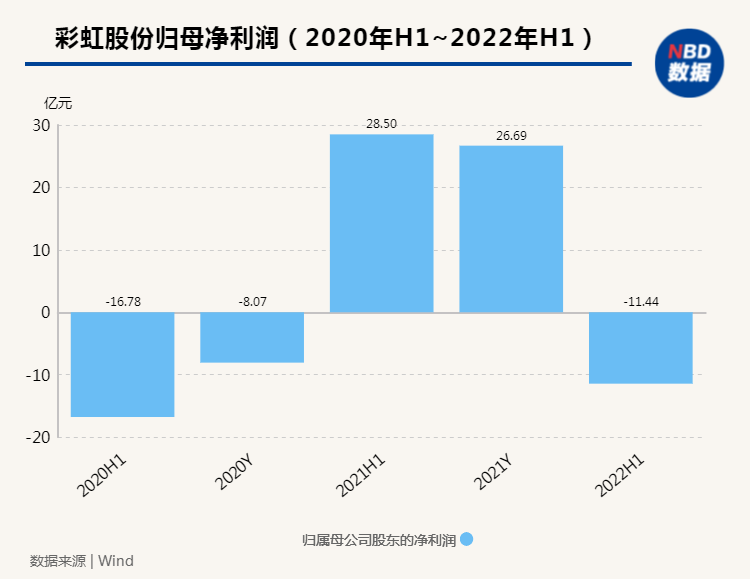

After sorting out Fanxiang Finance, it was found that Rainbow shares became the king of losses in Shaanxi stocks in the first half of the year. The semi -annual report shows that the Rainbow shares achieved a revenue of 4.478 billion yuan in the first half of the year, a year -on -year decrease of 49.81%; the net profit loss attributable to shareholders of listed companies was 1.144 billion yuan, which was a year -on -year loss.

Specifically, in 2021, Rainbow shares have just achieved a profit of turning losses and handed over the best transcript since the listing; but in fact, in the fourth quarter of 2021, Rainbow shares have developed a loss. In the fourth quarter, the deduction of the fourth quarter Non-net profit is -925 million yuan.

Picture source: Fanxiang Finance System

In addition, Qujiang Cultural Tourism, as an operator of the cultural tourism industry, was seriously affected by the epidemic. The semi -annual report shows that in the first half of 2022, Qujiang Cultural Tourism realized operating income of 449 million yuan, a year -on -year decrease of 28.87%, and a net loss was 85.1359 million yuan.

According to Fanxiang Finance, at the moment when the tourism business is under pressure, Qujiang Cultural Tourism has expanded the source of income from digital collections to expand the source of income and excavate the IP value of the scenic spot. However, Qujiang Cultural Travel previously stated that the revenue of digital collections accounted for less than 1%of the company's annual revenue.

Although international medicine loses losses, the loss has narrowed significantly. Data show that in the first half of the year, international medicine realized operating income of 1.068 billion yuan, a decrease of 18.24%over the same period last year; the net profit attributable to shareholders of listed companies was -596 million yuan, a year-on-year decrease of 65.53%.

Different from companies with poor profitability, Fanxiang Finance noticed that international medicine losses mainly originated from Xi'an High -tech Hospital and Xi'an International Medical Center Hospital for three months on the company's operations in the first quarter. After the resumption of the two hospitals, the operation of international medicine has risen steadily. Specifically, the operating income of the first quarter of international medicine was 305 million yuan, and the operating income in the second quarter was 763 million yuan, an increase of 150.16%month -on -month;

From the perspective of the overall losses, Shaanxi stock market tourism, catering and other sectors have been greatly affected by the epidemic situation, and the performance of related companies has been greatly impacted, and losses are inevitable; some companies are affected by industry cycles, business market activities, operations and other operations. Both are restricted and therefore encountered a greater impact.

Excellent science and technology enterprise performance

From the perspective of the sub -sector, Shaanxi listed companies have shown strong development resilience and vitality in the field of scientific and technological innovation, and the overall performance tends to be stable. Judging from the more than 10 scientific and technological enterprises in the inventory of Fanxiang Finance, only Platinum Line's performance losses.

For example, Huaqin Technology achieved operating income of 270 million yuan in the first half of 2022, an increase of 37.29%year -on -year, and net profit was 124 million yuan, an increase of 39.59%year -on -year, and its revenue and net profit increased by more than 30%.

In the first half of 2022, the western superconducting development was fierce, achieving operating income of 2.084 billion yuan, an increase of 65.95%year -on -year, and a net profit of 552 million yuan, an increase of 76.27%year -on -year.

It is worth noting that Western superconducting is also a technology -driven enterprise. During the reporting period, the Western Super Guide R & D investment was 122 million yuan, an increase of 34.7%year -on -year. In the first half of the year, Western Super Guide applied for 24 national patents, and 26 new authorized patents and software copyrights were newly obtained.

Photo source: Photo Network-400961767

In addition, the performance of Kang Tuo Medical and the just -launched Yitian world is also prominent.

The semi -annual report shows that Kang Tuo Medical achieved operating income of 115 million yuan in the first half of the year, an increase of 20.50%year -on -year, of which the main business revenue was 110 million yuan, an increase of 19.02%year -on -year, and the net profit attributable to shareholders of listed companies was 39 million yuan, an increase of 12.71 year -on -year increased by 12.71 %; Easy Dianxia achieved operating income of 1.314 billion yuan in the first half of the year; net profit attributable to shareholders of listed companies was 178 million yuan, an increase of 42.12%year -on -year.

As a metal 3D printed leading enterprise, Polyte's performance is relatively average. The semi -annual report shows that in the first half of 2022, Polyte's operating income was 277 million yuan, an increase of 92.83%year -on -year; net profit attributable to shareholders of listed companies was 38.961 million yuan, and the loss decreased by 50.59%year -on -year.

It is worth noting that Polyte is mainly for aviation and aerospace manufacturing. Due to the characteristics of the customer industry and its own industrial cycle, the next half of the year is delivered. On the same day, Polyt also released a fixed increase plan. The total amount of fundraising was not more than 3.109 billion yuan, and it was invested in large -scale intelligent production base projects and supplementary funds for metal additive manufacturing.

In addition, in the first half of this year, in addition to the rapid growth of the number of listed companies in Shaanxi, the clearing of ST Baode also showed the further improvement of the capital market to listed companies. As one of the "power sources" of China's economic growth, only listed companies can better play the "barometer" function of the capital market only by continuously improving the quality of listed companies.

Daily Economic News

- END -

A laboratory officially unveiled

On July 1, China Aerospace Science and Technology issued an announcement: a labora...

Picture Story | Solo Time Under the Epidemium

China Economic Weekly reporter Xiao Yan | Beijing Photography ReportThe epidemic c...