Oriental Red Asset Management Ji Wenjing: "Solid Harvest+" product investment needs to use combined management ideas

Author:Capital state Time:2022.09.06

Since 2022, the A -share market has shocked, the industry sector has rotated rapidly, and the difficulty of excess returns has increased.

As an asset allocation method, "solidarity+" can better balance security and benefits by controlling the risk of controlling risks, which has attracted the attention of investors.

Recently, Ji Wenjing, who has been cultivating in the field of solidarity investment and research for 15 years, has ushered in a new journey in his investment career -the general manager of the Fixed Investment Department of the Public Revenue Investment Department of Lingxin Oriental Red Assets Management.

On the basis of doing a good job of fund product investment management, she continues to improve the system of fixed income investment and "solidaries+" products, forming a relatively comprehensive logical framework, and better adapting to different macro environments and market changes.

Deeply cultivated in the field of solidaries in the field of solidaries and research

Public information shows that Ji Wenjing is a senior veteran in the field of solid income, rich investment experience, and the experience experience runs through the securities firm's solidarity transaction, the securities firm's self -employment, and the public offering fund. Essence

After graduating from a master's degree in 2007, Ji Wenjing entered the Fixed Invenial Department of the Brokerage to engage in bond transactions. At that time, the development of the bond market was still in the initial stage. The solid income dealer of the brokerage company assumed the function of investment and transactions, and it would also involve the research and issuance of bonds, and its capabilities have been comprehensively developed.

After that, Ji Wenjing served as the general manager of the bond investment and trading department of the brokerage firms. In 2014, he joined Dongfang Red Asset Management and moved to the public fund.

Before the net value of bank wealth management, ordinary investors have little demand for "solidaries+" funds and less understanding. However, with in recent years, the rigid redemption of bank wealth management products has become disintegrated, and the "solid income+" fund has attracted more and more attention from investors.

Ji Wenjing said that with the changes in market and regulatory policies, non -standard assets that support the high yield of bank financial management have gradually disappeared, and investors have begun to pay attention to the "solid income+" fund, and the tolerance of the income and fluctuations is also mutually mutual. During the matching process.

Emphasize the combination management ideas that focus on cost -effective assets

Thanks to years of continuous cultivation, Ji Wenjing summarized a system of "solidarity+" product investment research system. Ji Wenjing said that the management of "solidaries+" product management requires combined management ideas, which not only emphasizes the risk adjustment income of the combination, but also emphasizes the advantages of better use of each type of asset.

Different from some "solidaries+" funds in the market, unlike the solid income team and the equity team, the "solid income+" fund managed by Dongfang Red Assets Management is separately managed by the solid harvest team. Assets such as convertible bonds are responsible for management by the fund manager of the solid income team. The fund manager considers the investment operation of various types of assets from the perspective of large -scale asset allocation, and considers the cost -effectiveness of various types of assets in different market environments.

Under the systematic asset allocation framework, Ji Wenjing summarized the "three -board ax" of "solidarity+" product management: first, first understand the product and investor risk preferences to determine the target volatility of the combination; second, from large assets From the perspective of configuration, analyze the macro environment, and use the risk exposure valuation system to compare the price of various types of assets, focusing on cost -effective assets; third, in various types of asset categories, formulate investment strategies Personal vouchers to choose and track.

So how to implement and refine the combination management ideas, and better use the "solid income+" strategy?

The Oriental Red Solid Harvest Team will fully communicate the ideas of macro and large -scale asset allocation and give full play to synergy. At the same time, through the use of quantitative models, tracking data, prices, etc., it predicts macro indicators such as economic growth and credit cycles. On the one hand, it is given suggestions for the allocation of large categories of assets, and on the other hand, the configuration scheme under different goals is also constructed, so as to better track the combination fluctuations and work hard to give investors a better experience.

In terms of investment strategy, Ji Wenjing said that he will consider the market environment and adjust it, but this adjustment is more medium -length, rather than frequent adjustment of short -term transaction emotions. She believes that many short -term factors in investment do not need to pay too much attention. At the level of the entire combination, many things need to be done before, track the entire combination of the entire equity exposure, and pay attention to the income after risk adjustment.

Risk reminder: The content published in this article is for reference only, and should not be rely on as prediction, research, propaganda materials or investment suggestions. The content of this article may contain certain forward -looking statements, and the forward -looking statement is uncertain. Market risk, the investment need to be cautious. Fund investment needs to be cautious. Please read the fund's "Fund Contract", "Recruitment Manual", "Fund Products Information Outline" and other documents and related announcements. Investors are requested to pay attention to relevant regulations on appropriate management, do a good job of risk assessment in advance, and purchase products that match risks according to their own risk tolerance.

- END -

Is WeChat and live broadcasts reliable?Avoid the easiest way to "kill piglets"

According to media reports, there are some funds in the A -share market for killin...

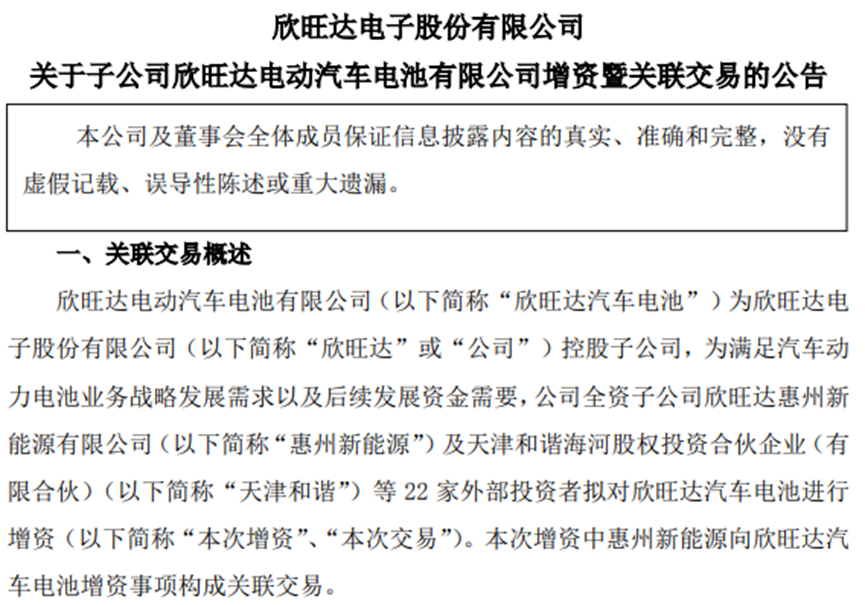

The two brothers in Guangdong have a unicorn, Xinwangda valued 30 billion

The largest RMB financing this year was born.The investment community was informed...