CBRC: Be wary of misleading behaviors of sales

Author:Yangtze Cloud Time:2022.09.06

The CBRC issued a risk prompt on September 6. In order to improve sales performance, some insurance sales staff recently provided consumers with information that did not match or misunderstand people to buy insurance products. Routine marketing, induction of consumption, and forced sales have infringed on consumers' legitimate rights and interests.

According to reports, there are three performances of insurance sales personnel misleading:

The first is to conceal and confuse product information to mislead consumers. For example, to publicize the sales insurance products in the name of other financial products such as bank wealth management products, bank deposits, and securities investment funds; ratio of the dividend rate, settlement interest rate of insurance products, and other financial products such as bank deposit interest rates, national debt interest rates and other financial products Simple comparison rates can easily cause claims disputes or surrender disputes.

The second is to hide the misleading consumers. Individual sales staff misleads consumers blindly insured high insurance products on the grounds of discount discounts, company regulations, and underwriting policies. There are also some web pages and APP operation pages to bundle and sell them by default, compulsory checking, etc., and forced consumers to purchase unnecessary products or services.

The third is to exaggerate the insurance liability or commitment to ensure that the income is misleading consumers. For example, to verbally promise to the insurer, "everything can be compensated", intentionally solved the scope of the guarantee; when the sales of new products such as dividend insurance, investment connection insurance, universal insurance and other personal insurance, there are only emphasis on "high yields" without displaying unfavorable information and commitment to commitment, commitment to commitment, promise, and commitment. Ensure false publicity such as income.

The person in charge of the relevant departments of the CBRC said that consumers must confirm the content of the insurance contract when purchasing insurance products, pay attention to protecting personal information security, do not trust the "agency surrender" and "agency rights protection", and beware of the risk of misleading sales.

"Return to Hubei · Travel"

Hubei Travel Service Platform

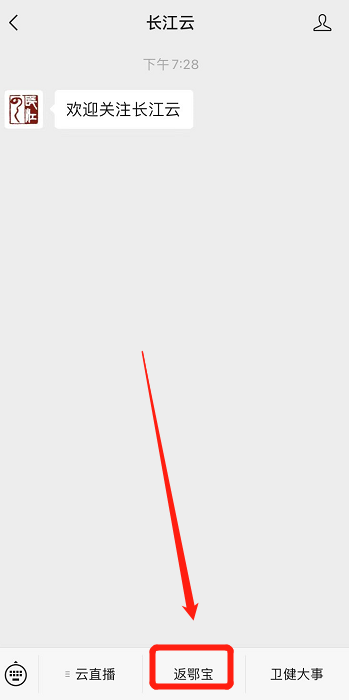

How to use "Return to Ebao"

Click the card below

Follow the official WeChat of "Changjiang Cloud"

Click on the menu bar "Return to Ebao"

Enter the service platform

Departure, destination risk, travel policy

Query

- END -

Zhongshang Association: In the first half of the year, listed companies achieved net profit of 3.25 trillion, an increase of 3.19% year -on -year

Zhongxin Jingwei, August 31st. On the 31st, the China Listed Companies Association released data showing that in the first half of the year, net profit achieved a net profit of 3.25 trillion yuan, an

Sichuan Provincial Advanced Hydropower Equipment Innovation Unite of Xihua University officially awarded licenses

On August 27, the 2022 World Clean Energy Equipment Conference opened in Deyang. At the Conference Industrial Investment Promotion and Policy Report Conference, Luo Qiang, deputy governor of Sichuan P