V viewing financial report | The performance trailer is inaccurate, Hemo Technology and the chairman have been notified to criticize

Author:Zhongxin Jingwei Time:2022.09.06

Zhongxin Jingwei, September 6th. Hymo Technology (Group) Co., Ltd. (hereinafter referred to as Heimo Technology) announced on the evening of the 6th that due The chairman and chief financial officer of Mo Technology and Company were criticized by the Shenzhen Stock Exchange.

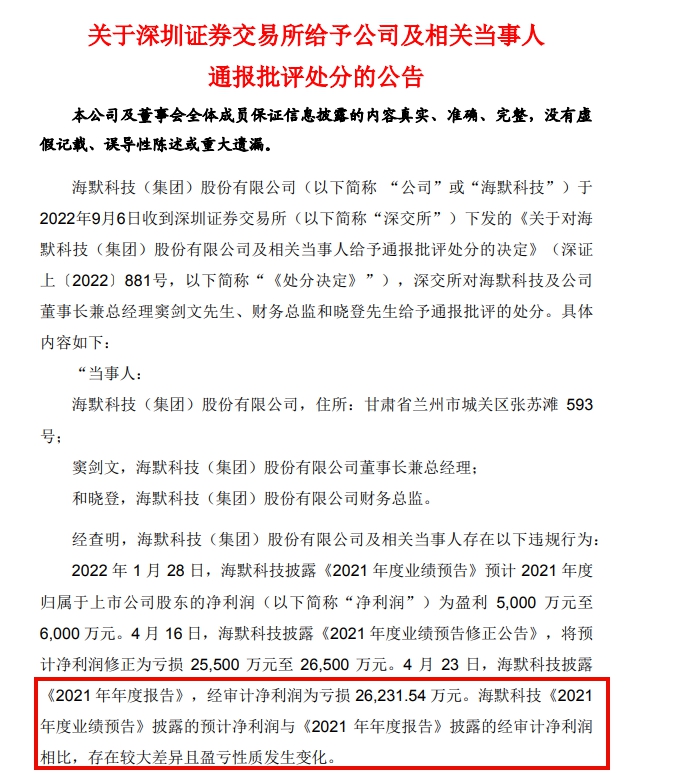

The announcement stated that on September 6, 2022, the "Decision on the Critical Criticism of Heimer Technology (Group) Co., Ltd. and related parties" issued by the Shenzhen Stock Exchange (Decision on the Critical Criticism "(Shenzhen Certificate above [2022] No. 881, below "Decision of Set"), the Shenzhen Stock Exchange Mr. Dou Jianwen, Chairman and General Manager of Heimo Technology and the company, and Mr. Dou Jianwen, the chief financial officer and Mr. Xiaodeng gave a notification criticism.

Source: Science and Technology Announcement Screenshot

Specifically, on January 28, 2022, Hemo Technology disclosed that the "2021 Annual Performance Trailer" is expected to have a net profit attributable to shareholders of listed companies in 2021 to a profit of 50 million yuan to 60 million yuan. On April 16, Hemo Technology disclosed the "Amendment to the 2021 Annual Performance Trailer", which will be expected to amend the net profit to a loss of 255 million yuan to 265 million yuan. On April 23, Haimer Technology disclosed the "Annual Report of 2021", and the audited net profit was a loss of 262.3154 million yuan. The estimated net profit disclosed by Hemo Technology's "2021 Annual Performance Trailer" is compared with the audited net profit disclosed by the 2021 Annual Report, and there is a large difference in the nature of the profit and loss.

The Shenzhen Stock Exchange pointed out that the above -mentioned behavior of Heimo Technology violated Article 1.4, 5.1.1, Article 6.2.1, and Article 6.2.5 of the Shenzhen Stock Exchange's behavior of the Shenzhen Stock Exchange (revised in December 2020) " Regulation. Dou Jianwen, chairman and general manager of Heimo Technology, chief financial officer, and Xiao Deng failed to fulfill their duties and fulfill their diligence and diligence. Article 5.1.2 provisions have important responsibilities for the above behavior of Hemo Technology.

According to relevant regulations, the Shenzhen Stock Exchange makes the following decision:

1. A punishment for criticism of Heimo Technology (Group) Co., Ltd.;

2. Dou Jianwen, chief and general manager of Hemimer Technology (Group) Co., Ltd., chief financial officer and chief financial officer, and Xiaodeng give not reporting criticism.

For the above -mentioned violations of Hemo Technology (Group) Co., Ltd. and related parties, and the punishment given by the Shenzhen Stock Exchange will be recorded in the integrity file of listed companies and disclose it to the society.

Heimo Technology said that the company and the relevant responsible person attach great importance to the problems involved in the "Disition Decision". Laws and regulations, ensure the company's standardized operation, the company's directors, supervisors, and senior managers ensure their diligence, timely, authentic, complete, and accurately fulfilling the information disclosure obligations of listed companies, safeguarding the rights and interests of the company and small and medium shareholders, and eliminating the above matters.

According to the company's official website information, Haimer Technology (Group) Co., Ltd. is a multinational technology, products and services that are committed to increasing production, production optimization and oil and gas collection management for oil and gas fields, and providing a multinational multinational transformation of oil and gas fields and related industries. enterprise. The company was founded in 1994, and in 2000, it was changed to a joint -stock company as a whole, and in May 2010, it was listed on the Shenzhen Stock Exchange GEM.

According to the 2022 semi -annual report, Haimo Technology achieved approximately 155 million yuan in the first half of 2022, a year -on -year decrease of 17.33%; the main business profit was about 55.3824 million yuan, a decrease of 20.12%from the same period last year; The loss of net profit was about 41.6316 million yuan, and the loss expanded by 50.82%compared with the same period last year.

In this regard, Heimo Technology explained that due to the characteristics of its industry, the company's main business income has obvious seasonal characteristics. In the first half of the year, the confirmation of sales revenue was mainly concentrated in the second half of the year, especially the fourth quarter. The main reasons for the decrease in the company's operating income and net profit compared with the same period of the previous year: Reporting period, Shanghai Qinghe Machinery Co., Ltd., an important subsidiary of the company, is for nearly three months due to the suspension of production and control in Shanghai and its surrounding areas. The continuous impact of the interruption of the supply chain did not gradually return to normal production and operation until the end of June. Therefore, the mid -term performance of Qinghe machinery in the subsidiary did not reach expectations.

In the secondary market, as of the closing on the 6th, Hymo Technology Newspaper 5.30 yuan/share, a decrease of 1.12%on the day. According to the same flowers of the same flower, the stock price of Hemie Technology fell by 8.46%in 2022, and the company's total market value is 2.039 billion yuan. (Zhongxin Jingwei APP)

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

Minqin "Guawazi" has something to say!

Golden Autumn August, Xiangpiao SifangWelcome friends to my homeHello everyone! I ...

Kaizhou 28,000 acres of wood incense harvest is expected, and the estimated output value will reach 30 million yuan!

Quanxiu Village, Guannan Township is called China Mu Xiang First VillageRight now ...