Rare collective shots!Directors and executives of 100 billion white horse stocks announced: increase their holdings

Author:China Fund News Time:2022.09.06

China Fund reporter Nan Shen

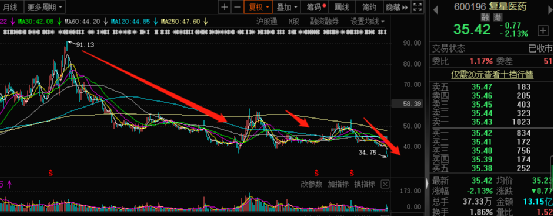

On September 3, the China Fund reported that Guo Guangchang's Fosun High Technology suddenly threw a large -scale reduction plan for Fosun Pharmaceuticals exceeding 50%. See. After a weekend, Fosun Pharmaceuticals fell on September 5th, and it fell 2.13%on September 6. The market value evaporated by 12.8 billion in two days.

On the evening of September 6, Fosun Pharmaceutical Management could not sit still. It was also a rare throwing plan to increase its holdings. 18 directors and executives collectively shot. Stocks), if the latest A -share stock price is expected to cost less than 16 million yuan.

However, many shareholders believe that this additional holding plan is a spear. The lower limit of the minimum holding of a single executive is only 10,000 shares. Some shareholders believe that the company's management practices are more of a posture and recognition of the current company value.

Management rare collective shots

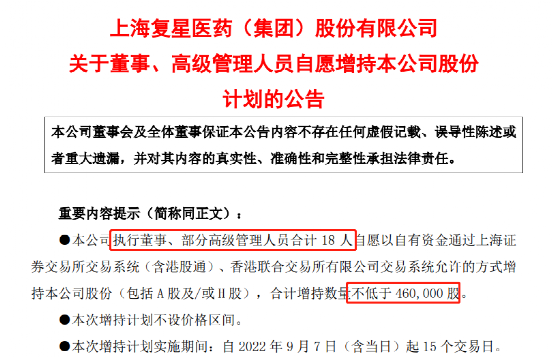

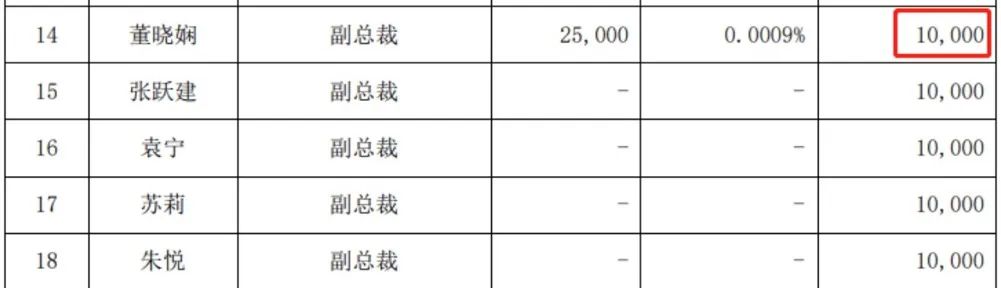

According to the announcement, Fosun Pharmaceutical Executive Director and some senior managers were voluntarily increased their holdings of the company's shares in a total of 18 people voluntarily through their own funds through their own funds through the Shanghai Stock Exchange trading system (including Hong Kong Stock Connect) and the transaction system of Hong Kong United Exchange Co., Ltd. ( Including A shares and/or H shares), the total number of holdings increases not less than 460,000 shares.

There is no price range in this holding plan, and the implementation period of the increase plan is 15 trading days from September 7, 2022 (including the day). The company said that the purpose of 18 directors and executives to increase its holdings was "based on confidence in the future development prospects of the company and the recognition of internal value." The company also reminded that during the implementation of this holding plan, there may be risks such as changes in the situation of the capital market and the progress of increasing holdings of holdings than expected.

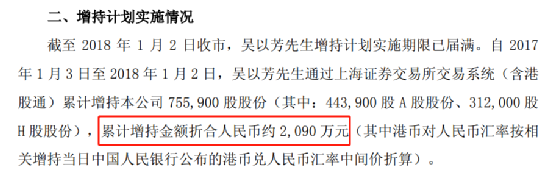

Like the company's controlling shareholder Fosun Hi -Tech Rarely Raising Large Large -Holding Plan, the increase in holdings of this executive is equally rare, especially the management of management. The company's last executive's holdings occurred from January 2017 to January 2018. At that time, only the executive director, president, and CEO Wu Yifang took a shot and increased its holdings of 756,000 shares and cost 20.9 million yuan.

Netizen: There is not much to increase the holdings of a single holder

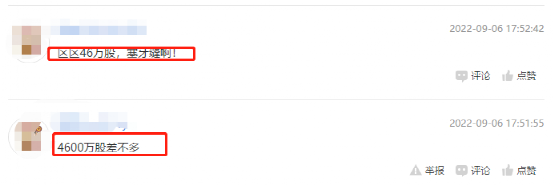

However, this rare collective operation has been spit out by many shareholders. The main reason is that the number of holdings of 460,000 shares is compared with the number of reducing holdings of the controlling shareholder of 808 million shares.

"This is a sesame seed, not even sesame seeds" "460,000 shares, plugging teeth", "a single one is not as much as I bought" ... And some netizens said, "How do you feel more like such a neat shares, it feels more like "The task" "This is a siege for the boss" "I want to run away, full of routines" ... Fosun Pharmaceutical Interim Report shows that as of June 30, 2022, the number of shareholders of the company was 306,200.

From the perspective of the specific arrangements of the holdings, the 18 directors and executives have increased their holdings of not less than 50,000 shares, including Wu Yifang, executive director, chairman, Wang Kexin, executive director, joint chairman, and executive director and vice chairman. Guan Xiaohui. On September 6, the price of the A -share collection price was not less than 1.77 million yuan. Wu Yifang's annual salary of 2021 was 10.98 million yuan, and the increase in holding holdings would cost about 16.13%of the annual salary.

In addition, two people including Executive Director and CEO Wende planned to increase their holdings of not less than 40,000 shares. The executive president Mei Yiping and other two people planned to increase their holdings not less than 30,000 shares. The increase in holdings of not less than 20,000 shares, while 5 people including the vice president Dong Xiaoxian intend to increase the holdings of not less than 10,000 shares.

It is not difficult to find that the number of directors and executives of the company is basically arranged according to the rank sequence, that is, 50,000 shares of the executive directors, 40,000 CEO sequences, 30,000 executive sequences, 20,000 senior vice president sequences 20,000 Stocks, 10,000 deputy presidents.

10 institutions such as Gao Yi float 16%

Some investors suffer

Earlier, the China Fund reported that the "Fosun" at the helm of the big guy Guo Guangchang has continued to sell assets this year. After reducing the equity of listed companies such as Hainan Mining, Zhongshan Public, Taihe Technology, Tsingtao Beer, Jinhui Wine, in September On the evening of the 2nd, the "Big Knife" finally cut to Fosun's flagship company Fosun Pharmaceutical.

The reporter checked Fosun Pharmaceutical's past announcement and found that in addition to the proportion of equity brought about by reasons such as increasing issuance and equity incentives, this is the listed on the Shanghai Stock Exchange on August 7, 1998 (formerly known as "Fosun Industry," Fosun Industrial ") For the first time, it has been taken the initiative to reduce its holdings by the controlling shareholder. In the past year, Fosun Pharmaceutical's largest decline has exceeded 50%. The low -level reduction of major shareholders has also formed a huge contrast with its frequent increase in its historical low.

In this context, the A shares of Fosun Pharmaceutical on September 5 encountered a limit in the Disciplinary A shares. On September 6, another 2%fell by 2%. The two -day decline was about 12%, and the market value increased by about 12.8 billion.

After such a plunge, the rapid decline caused a lot of investors to lose heavy losses. On the day of September 5th, investors were exposed to the snowball on the day of the snowball. "I regret that I trust in a company too. The company, I never dreamed that I would have today. "

In addition to retail investors, many well -known institutions are also injured.On July 28, Fosun Pharmaceuticals had just completed a round of fixed increase, issued 107 million A shares, the issuance price was 42 yuan/share, and the total amount of funds raised was 4.484 billion yuan.This time, the fixed increase has attracted a lot of luxury institutions to participate. Among them, the "Gao Yi neighboring Mountain No. 1 Fund" of the private equity leader Feng Liu, who was born in the grassroots, took 47.62 million shares, cost 2 billion yuan, and others such as the other, such as the other, such asCaitong Fund, UBSAG, CITIC Securities, Huatai Securities, J.P.MORGANSECURITIESPLC, etc. subscribed for tens of millions to hundreds of millions of yuan.

On September 6, Fosun Pharmaceutical's latest closing price was 35.42 yuan, which has fallen by nearly 16%from the fixed price of 42 yuan, which means that these institutional investors have floated at least 700 million yuan in the past month.

Edit: Joey

- END -

The Development and Reform Commission promotes consumption in key areas

The National Development and Reform Commission held a notice in the first half of the development and reform situation.The meeting mentioned that consumption recovery in key areas, vigorously enhance

V Guan Finance Report | The "second -generation enterprise" after the 85th of Zhejiang was taken for mandatory measures!Joy Zhixing: Personal matters

Zhongxin Jingwei, September 9th. The rejuvenation of Joy Zhixing was taken for compulsory measures. Joy Zhixing announced on the evening of the 9th that it was notified by Luo Yanhao's family that Luo...