The "folding" rivers and lakes of the 800 million Chinese insulation cup: The price of small factories is rolled, the export orders of large manufacturers have skyrocketed, but the domestic brand brand that has not yet appeared

Author:Daily Economic News Time:2022.09.06

A few years ago, a photo of a black leopard band Zhao Mingyi was circulating on the Internet with the photos of the insulation cup. At the Tokyo Olympic Games last year, Chinese athletes were holding hot water with the insulation cup, making the Chinese insulation cup a mysterious power from the East in the eyes of countries.

Chinese people love to drink hot water is engraved in genes. The world's first thermos bottle was born in the UK at the end of the 19th century, but now China, which is far from the other end of the Asia and Europe, has become the largest producer of the thermal insulation cup. Data show that the annual output of the Chinese insulation cup reached 800 million, with more than 60 % of the OEM exports.

The "Chinese Cup Capital" Zhejiang Yongkang contributed 80%of my country's thermal insulation cup output. In 2011, the first Harus (SZ002615, the stock price of 7.83 yuan, and a market value of 3.239 billion yuan). Ten years later, in Wuyi County, which is adjacent to Yongkang, Jiayi (SZ301004, a stock price of 31.7 yuan, a market value of 3.17 billion yuan) caught up with the pace of Haros's listing; Promise also launched an impact on the capital market.

Through three corporate financial data that have been listed or planned to be listed, we can insight into the "folding" rivers and lakes of China's largest insulation cup factory -the pyramid in the Chinese insulation cup market, the bottom is hundreds of thousands of small workshops and small factories, The top is the foundry, the top is a well -known high -end brand, and the three stratums are obvious.

When the small manufacturer raised the price war and the profit was as thin as each product, the large factory's OEM export order had skyrocketed, but it still faced a low value -added problem. The "throne" of the top high -end insulation cup brands belongs to the international brands such as the magician, the pictorial, the tiger, and the Stanley. So far, there is no seat for Chinese companies.

Industrial gathering: from the hometown of hardware to the capital of China Cup

Yongkang, located in central Zhejiang, is a county -level city managed by Jinhua City. It has a well -known national hardware industry base. In the 1990s, the production technology of overseas cup pots was introduced to China. With the help of hardware industry such as stainless steel, the insulation cup industry began in Yongkang and has now developed into a local pillar industry. In 2010, Yongkang was also awarded the title of "China Cup Capital" by the China Light Industry Federation.

"Yongkang first did a hardware business, selling pots and pans, mechanical parts, and slowly extended to the thermal insulation cup." Capital factory, covering an area of more than 10,000 square meters. He mentioned that it takes more than 30 processes to make a thermal insulation cup, including pipeline, water swelling, welding, vacuum, polishing, spraying and other links.

Photo source of thermal insulation cup production equipment in Zhejiang Juxian Cup Industry: Interviewee Conferry

He introduced to the "Daily Economic News" reporter that in the surrounding area of Yongkang, the thermos cup factory is very dense and different. "Yongkang estimates that there are hundreds of thermos cup factories, and there are many small workshops." Mr. Zhou said.

According to statistics from the local cup pot industry association quoted in January 2020, Yongkang Daily showed that in 2019, Yongkang City had more than 300 insulation cup production enterprises, more than 200 supporting companies, and more than 60,000 employees.

According to China's quality report in July 2020, the annual output of about 800 million domestic thermal insulation cups was only 600 million in Yongkang. At present, the output value of the Yongkang Cup pot industry exceeds 40 billion yuan, accounting for 60%of the country, and exports account for more than 80%of the country.

An interesting action is that in 2020, the Yongkang Stainless Steel Products Industry Association was renamed the Yongkang Cup Hug Industry Association. Born in the local hardware industry, it is now alone.

In recent years, Jinhua City has introduced a number of policies to promote the development of the pot industry, including the release of the "Jinhua Has Insulation Cup (Pot) Industry Cultivation Plan", and established the Jinhua Has insulation cup (pot) Industry Alliance to invest 1.036 billion yuan in construction. Yongkang Hardware College of Zhejiang University of Technology.

Capital Road: Can the thermal insulation cup support a IPO?

In addition to Yongkang, Wuyi County, which is also under the jurisdiction of Jinhua City, is also the main production area of the thermal insulation cup pot industry. The two major thermal insulation cup listed companies are from these two places. In 2011, Harus, located in Yongkang, landed in the capital market and became the "China's the first share of the Insulation Cup in China"; after a lapse of ten years, in 2021, Jiayi, located in Wuyi, was also successfully listed.

These two listed companies can largely represent the industrial characteristics of the domestic thermal insulation cup industry -mainly exported by OEM. In developed countries and regions such as Europe, the United States, Japan and South Korea, residents will use different styles or functions of stainless steel vacuum insulation utensils according to their needs in home, office, school, parenting, and outdoor. market. Considering the cost factors such as labor and land, the production of insulation utensils in developed countries and regions has gradually shifted to developing countries represented by China.

The annual report shows that Hals and Jiayi's customers have a certain rearmination, both internationally renowned, including the American PMI (Starbucks, Stanley), the United States S’Well, and Japan's Takeya. In 2021, Hals realized operating income of 2.389 billion yuan, of which the international market achieved sales revenue of 1.954 billion yuan, accounting for 83.34%; Jiayi achieved operating income of 586 million yuan, of which overseas sales reached 511 million yuan, accounting for the proportion of the proportion of them, accounting for the proportion of the proportion of them, accounting for a proportion of them, accounting for a proportion of them, accounting for a proportion of them. 87.34%. In July of this year, there was another insulation cup company Hino shares in the market. It was located in Nantong, Jiangsu 400 kilometers north of Yongkang, and belonged to the Jiangsu and Zhejiang manufacturing industry gathering circle. This time, Hino obviously did not want to be the "third child", but distinguished himself from the first two listed companies that mainly engaged in foundry business. It was the banner of "the first stock of the insulation cup independent brand".

In the prospectus, the banner of Hino shares clearly proposes that it is different from the listed company with his peers- "The company has been engaged in the research and development, design, production and sales of independent brand cup products, and has the" Hino "brand ... Currently Shanghai and Shenzhen Securities Securities currently The exchanges have not yet been based on independent brands. "

In the case of the industry's universal OEM, can a company specializing in independent brands, can the high value -added brought by independent brands make Hino's favor from investors? The independent brand track of the thermal insulation cup is "sexy"?

The pain of the foundry: 30 yuan from the factory price, selling 30 US dollars in overseas

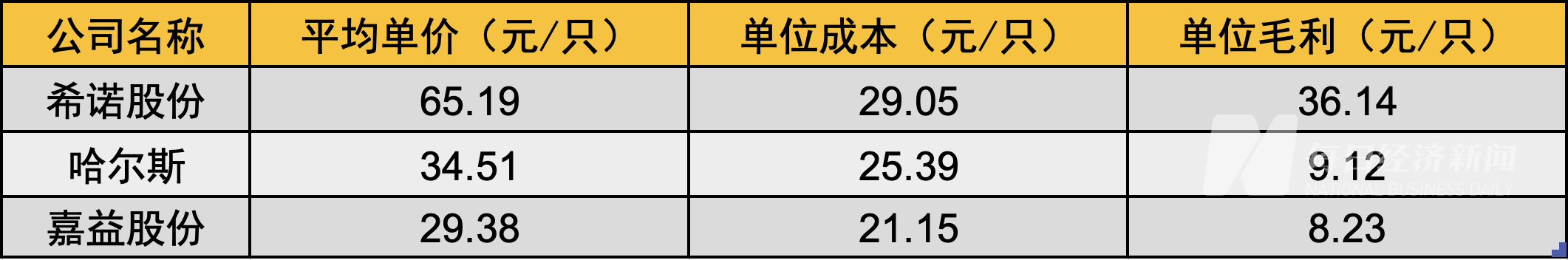

Open the financial data of these three cup -pot companies, we can see the significant difference between China's insulation cup independent brand and foundry production.

First of all, in terms of sales unit price, the average unit price of Heno's stock products in 2021 was 65.19 yuan/piece. Looking at the two listed companies, Haros' sales in 2021 were 65.1198 million, and operating income was 2.247 billion yuan. The calculation of the sales unit was 34.51 yuan/piece; the sales volume of Jiayi shares in 2021 was 19.452 million, and the business was business. The income is 571 million yuan, and the sales unit price is 29.38 yuan/piece.

It can be seen from the above, the sales unit price of the Hipo Has thermal insulation cup exceeds 60 yuan, while the sales unit price of Harus and Jiayi shares is only about 30 yuan. The former is nearly twice the latter two.

The cost of the same method above can be seen that the cost of thermal cup unit of Hino, Haros, and Jiayi shares is 29.05 yuan/piece, 25.39 yuan/piece, and 21.15 yuan/piece. Compared with the gap between two times the price, the cost of the three companies does not have much gap. This means that the price premium at the cost of Hino shares is higher. Each selling cup is sold for about 36 yuan, which has a more significant pricing power, which reflects the added value brought by the brand.

The unit price, unit cost and unit gross profit comparative data source of the three major cup pot companies: financial report, prospectus, reporter calculation

Second, in terms of gross profit margin, the comprehensive gross profit margins of Hino, Haros, and Jiayi shares in 2021 were 56.01%, 26.13%, and 28.73%. About times.

Third, in terms of profit level, Hino's operating income was 700 million yuan in 2021, and net profit was 196 million yuan. During the same period, Haros achieved operating income of 2.389 billion yuan, with a net profit of 148 million yuan. This means that Hino shares reached a larger profit than Hals's revenue scale. Jiayi shares are lower than Hino's shares in both income and profits.

Comparison of the income and net profit of the three large cups of pot companies: financial report, prospectus

However, do you have to worry about making independent brands? the answer is negative. What Hino shares is to face is higher risk of sales at higher inventory, and there is a higher sales fee rate than peers.

First of all, in terms of inventory, the prospectus shows that the inventory turnover rate of Hino, Haros, and Jiayi in 2021 is 1.56, 3.47, and 4.71, respectively. Hino shares are significantly lower than those of peers. Since the establishment of the company, it has operated its own brand business, and in order to ensure the quality of the product, the company is mainly based on independent production. With the growth of the company's revenue, the company's raw materials and finished products have increased year by year. In addition, from 2019 to 2021, the book value of Hino's stock inventory accounted for 34.55%, 38.31%, and 41.50%, respectively, at a high level.

Secondly, in terms of sales costs, the promotion of independent brands requires a lot of money. In 2021, Heno's sales cost was 10.19%. "Daily Economic News" reporters calculated the sales costs of two other companies, Haros and Jiayi shares in the same period, which were 6.32%and 2.49%, respectively, which was lower than Hino.

The comparison of the above financial data reveals the pain of the foundry in the thermal heating cup industry. Behind the tide of the presence of the insulation cup is the helplessness of the pricing power in the hands of others.

"Daily Economic News" reporter visited the Guangzhou Friendship Store in early September. In the insulation cup counters of the mall, no domestic brands were seen. It can be seen that Germany's ate magicians, Japan's Elephant India and Tiger brand and other international brands. These brands are all There is a century-old development history, the price is basically over 200 yuan, and the price of a small amount of high-end insulation cups can reach 500-600 yuan.

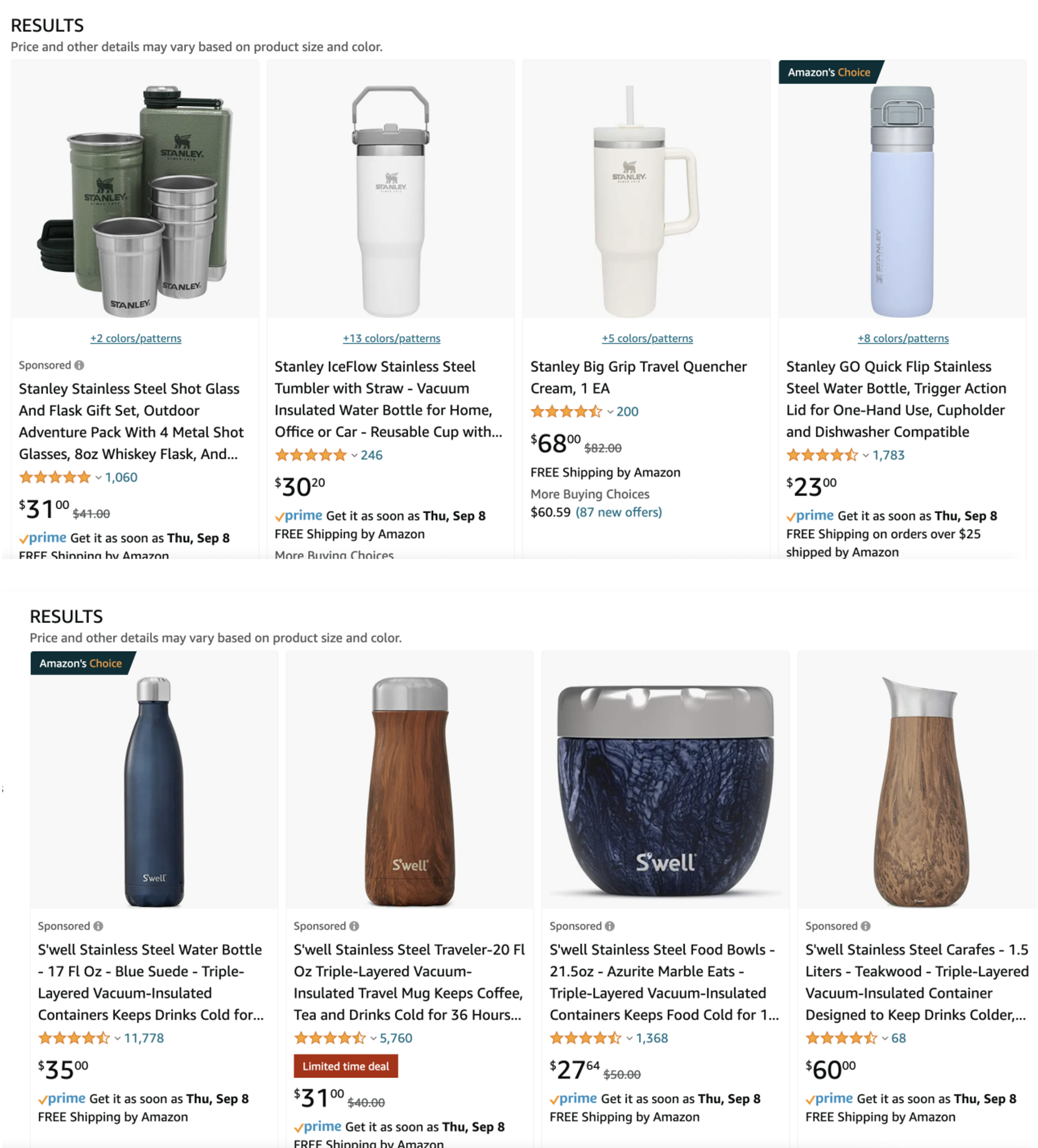

The German meal magician selling for more than 300 yuan Thermos cup source: Every reporter Wang Fan, a reporter, also inquired about the main customers of Haros and Jiayi's main customers in Amazon, STANLEY, S'well, Japan Takeya for the United States and Japan. Most of the consumer prices are priced at $ 30. According to the aforementioned data, the average price of the insulation cup of Harus and Jiayi shares is only about 30 yuan, and the price gap between the front and rear prices is different.

Most of the internationally renowned brands of Amazon platform are about $ 30. Source of about $ 30: Screenshot of the platform

Matthew effect: Small factories have a small profit, and the orders of large factories skyrocketed

The Chinese thermal insulation cup industry market is relatively scattered. In addition to Jiangsu and Zhejiang, my country's insulation cup production capacity is also distributed in the eastern coastal and North China regions such as Guangdong, Anhui and Shandong.

Based on the total scale of China's cup market of 32.603 billion yuan in my country's cup market in 2021, and the calculation of the operating income of 700 million yuan in the same period, Hino's market share was only 2.15%. The other two listed companies are mainly exports, and their domestic sales share is also small. Then, in addition to the internationally renowned brands at the top of the pyramid and the visible listed companies at the top of the pyramid, there are small and medium -sized manufacturers scattered in all corners and thousands of.

"The threshold of our industry is relatively low. As long as there are equipment, we can do it. More and more factories, the imitation is fast, and the homogeneity is serious." Most of the customers with levels below the middle, and there are many seemingly the same thermos cups on the market. They do n’t know how to distinguish good and bad. This causes the price of dozens of dollars for cups and the profits are very thin. "

Picture of the robotic arm production line of Zhejiang Juxian Cup Industry Source: Interviewee Conferry

Although the factory covers an area of more than 10,000 square meters and has the intelligent production of robotic arm, the annual output value is tens of millions, and it is a medium -sized scale in Zhejiang. It is the range of 10-30 yuan. When the market is better in the past 2018-2019, a cup can earn 5-6 yuan, and now it can only earn 2 yuan. "

There are many small workshops, fierce competition, high quality, and serious follow -up. This is a problem to be solved in front of the Chinese thermal insulation cup industry. You may have an impression that in the past ten years, the classic models of the Black Subtraction headed to the wholesale markets of major daily necessities have become the "classic models" for supporting small factories, but behind it is the lack of innovation research and development, which has led to a large industry and no or not. powerful.

A water cup manufacturer from Guangzhou is also impressed by the industry: "There are too many cups now, and the industry competition is great." "Daily Economic News" reporter learned that in the base of the Chinese insulation cup industry, although there are small and medium manufacturers It is also trying to make a brand, but it is essentially centered on production lines and equipment. It lacks the brand's continuous investment and is difficult to form brand power. Under the Internet wave, small and medium -sized manufacturers are more willing to accept the OEM orders from domestic e -commerce customers. "The sales volume of the Internet and e-commerce will be slightly larger. We supply many e-commerce customers. Taobao, JD, Tmall, Pinduoduo, Douyin, and fast hands are available. The terminal retail price is about 69-79 yuan."

The lack of innovation power and brand power has also gradually enlarged the thermal insulation cup industry. Mr. Zhou said: "The price of independent brands will not be overwhelmed, and the profit will be relatively high, but the popular products like us will become thinner and thinner."

When domestic small and medium factories are still fighting for a price war, foreign brands have begun to increase orders to large foundries in China. The semi -annual report of Hals and Jiayi showed that Haros's operating income increased by 20.71%, and net profit attributable to mother was 124.29%. Jiayi shares double double revenue profits, increased by 109.50%and 162.21%, respectively. The company said that the change was mainly due to the increase in overseas customers' orders.

Mr. Zhou believes that there is not much difference in the technology of thermal insulation cup industry. The main difference between different brands and factories is the design of craftsmanship and style patterns. Whether it can achieve upgrading and development depends on the brand and R & D investment. "Even if we produce products like the magician, we can't sell it because there is no brand." He said.

However, small and medium -sized manufacturers have concerns about the road of thermal insulation cup brand upgrade. "Because the industry plagiarism is relatively fast, we currently do not have our own R & D team to open a new model. If we have to cultivate a team, we need to invest a lot of funds. Cultivate. "

So, will the Chinese insulation cup industry be born in a Chinese "meal magician"? It can be seen that the high -end process of domestic thermal insulation cup consumption demand has been opened. According to the data of iResearch, domestic high -end cup pot products are expected to compoundly in the next five years by 21.50%, which is higher than the overall cup pot market 11.61%of the 11.61%of the overall cup pot market In the growth rate, the insulation cup gradually changed from a durable product to fast -moving consumer goods.

Looking back, can the planning to the market that is planning to be listed gives the market for marketing for domestic cup pot brands? However, with its current 700 million yuan annual revenue scale, Hino shares will be a time -days test to become a domestic high -end insulation cup brand.

"Daily Economic News" reporters interviewed Hino shares in response to issues such as market competition and future layout, and sent an interview email to the company.Daily Economic News

- END -

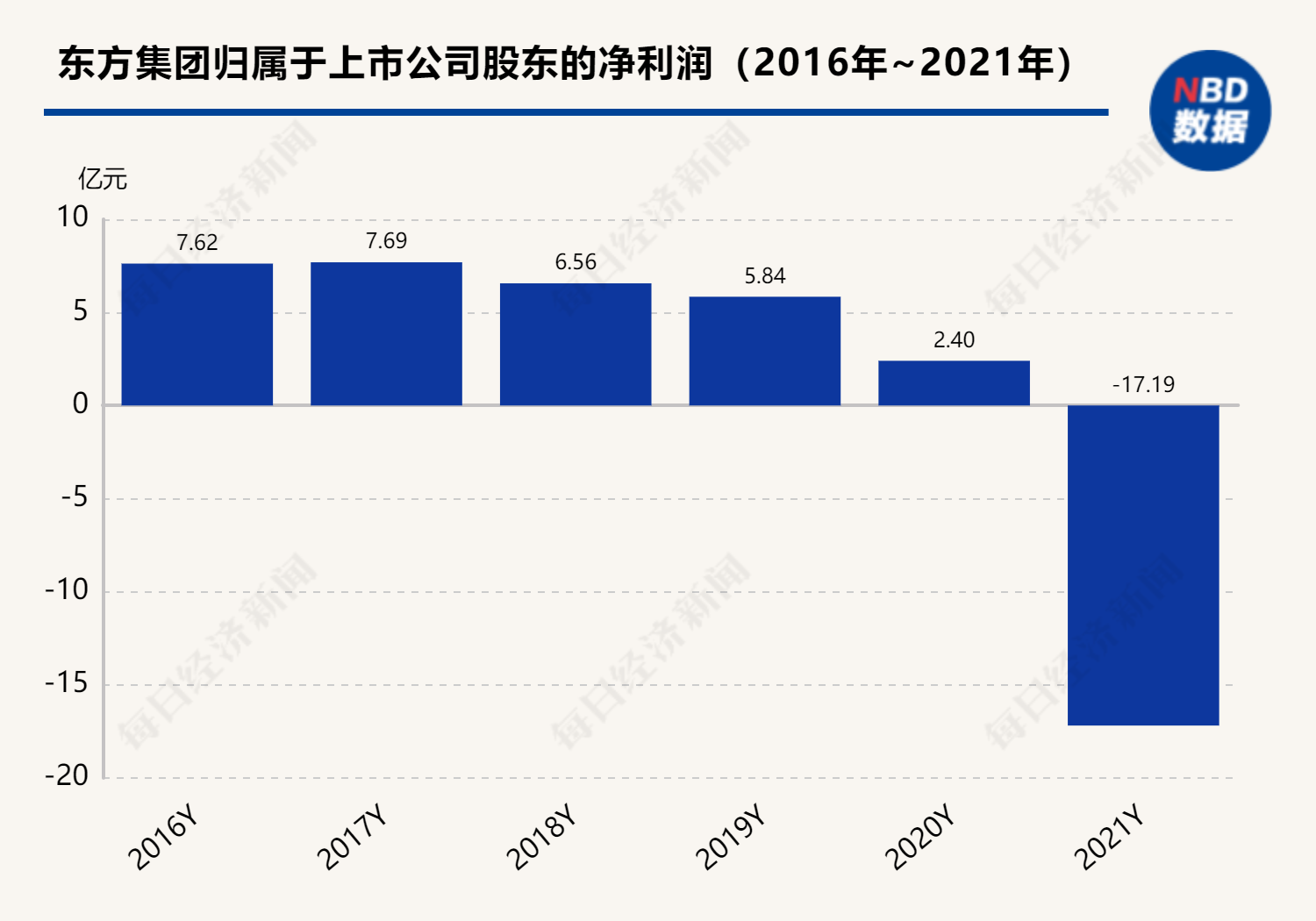

The 43 -year -old vice president is suspected of private division of state -owned assets and bribery. The crime of bribery was surveyed to investigate Oriental Group's response: it has nothing to do with the company

In the evening of this (June 20), Oriental Group (SH600811, the stock price was 2....

[2022 China has an appointment] Red and red fire!Ningxia wolfberry harvest

Each gemstone, glowing on the branches, a series of agate, shining in the mountain...