Guangyuan New Materials Breakthrough GEM: On the eve of IPO counseling, many shareholders are suspected of being "unprecedented" with the largest fund -raising project with the stock price?

Author:Daily Economic News Time:2022.09.06

In the production process of electronic products, electronic yarn and electronic cloth are the basic materials for producing copper -covering plates and printing circuit boards. At present, Electronic gauze (cloth) manufacturer Henan Guangyuan New Material Co., Ltd. (hereinafter referred to as Guangyuan New Materials) is being declared The GEM is listed. "Daily Economic News" noticed that Guangyuan New Materials conducted counseling registration in the Henan Securities and Supervision Bureau in December 2020 and officially entered the IPO counseling period.

Before entering the counseling period, in August 2020, the four institutions of Guangyuan New Materials transferred all the company's shares held, of which three transfer prices were 7.3 yuan/share, and the price was the three institutions in 2019 in 2019 In January, the investment price when the new material increased the new material of Guangyuan. In other words, after the three institutions held more than a year, when Guangyuan New Material was about to enter the IPO counseling period, it withdrew from the ranks of shareholders at its original price. For the reason for the exit of the original price of shareholders, the prospectus (declaration draft) did not explain in detail.

Photo source: Every time a reporter Wen Duo

The actual half production capacity of the ultra -fine electronic yarn project is a rough yarn

Guangyuan New Materials mainly produces electronic glass fiber products. It is specifically for electronic gauze and electronic cloth series products. The downstream is a copper -covered board, printing circuit board and other manufacturers. It is ultimately used for various electronic products such as consumer electronics and automotive electronics.

According to the IPO plan, Guangyuan New Materials planned to raise 2.6 billion yuan, of which 1.2 billion yuan was used for "annual output of 70,000 tons of high -performance ultra -fine electronic yarn production line construction project" (hereinafter referred to as ultra -fine electronic yarn project), 600 million yuan It is used for "annual output of 100 million meters of high -performance electronic cloth intelligent production line project", 500 million yuan for "annual output of 80 million meters of high -performance ultra -thin electronic cloth production line project", and 300 million yuan to supplement mobile funds.

According to the different diameter of the single wire, the electronic yarn is divided into thick yarn, fine yarn, ultra -fine yarn, extremely fine gauze and other types. The electronic cloth made from different thickness of electronic yarn is thick cloth, thin cloth, ultra -thin cloth and extremely thin cloth.

The prospectus (declaration draft) disclosed that due to technical restrictions, most of the domestic electronic gauze companies are concentrated in low -end fields. In the field, there are fewer domestic manufacturers that can mass -produce high -end electronic yarns. Among them, extremely fine gauze are led by a small number of companies such as Japan ’s Toyo and the United States."

It can be seen that thick yarn and fine yarn are the middle and low -end products of the electronic yarn, and the ultra -fine yarn and extremely fine yarn are high -end products. During the reporting period (2019-2021 and January to March 2022), the largest electronic yarn products in Guangyuan New Materials are rough yarn, and the main business income accounts for 19.49%, 15.40%, 21.47%, and 27.91%; The income amount and income ratio of ultra -fine yarn continued to decline, and the main business income accounted for 13.54%, 12.37%, 4.35%, and 3.23%, respectively.

For ultra -fine electronic yarn projects with an annual output of 70,000 tons, Guangyuan New Materials said that the implementation of this project is conducive to the company's accelerated layout of ultra -fine electronic gauze fields and obtain market -to -mortem advantages.

不过,记者在超细电子纱项目的环评文件上看到,该项目分两期进行,合计产能分别为G75纱3.5万吨、E225纱1.9万吨、D450纱8000吨、D900纱4000吨,以及C1200, BC1500, BC2250 and BC3000 gauze. According to the classification of electronic gauze, the G75 is a rough yarn, the E225 is fine yarn, the D450 gauze, and D900 gauze are ultra -fine gauze, the C1200, BC1500, BC2250 and BC3000 are extremely fine gauze.

In other words, the ultra -fine electronic yarn project with an annual output of 70,000 tons is actually 35,000 tons, and 19,000 tons are fine yarns. Only 16,000 tons are ultra -fine yarn and extremely fine gauze. "It seems to be suspected of being" not true ". However, the prospectus (declaration draft) did not explain the specific production capacity. Only the production capacity of some of the extremely fine gauze was listed. 800 tons of ability. "

The same situation also appeared in the fundraising project "annual output of 80 million meters of high -performance ultra -thin electronic cloth production line project". 25 million meters of thin cloth, ultra -thin cloth and extremely thin cloth production capacity is 11 million meters. For the project, Guangyuan New Materials said that the project implementation can promote the development of my country's high -end electronic cloth industry and help expand the company's high -performance ultra -thin electronic cloth product supply.

According to the composition of income, the income of the electronic cloth product of Guangyuan New Materials is mainly derived from thick and thin cloth, and the income accounts for relatively high income. The income amount and proportion of ultra -thin cloth and extremely thin cloth are relatively small.

During the reporting period, the production capacity of Guangyuan New Materials electronic gauze products was 90,400 tons, 90,400 tons, 95,300 tons, and 30,500 tons. The electronic fabric was equivalent to 196 million meters, 220 million meters, 282 million meters, and 85.707 million meters. Essence In this IPO, the Guangyuan New Materials Ramping Project plans to add 70,000 tons of electronic gauze capacity and 180 million meters of electronic fabric capacity. Compared with existing production capacity, it is large. It is still unknown whether it can be smoothly digested in the future.

How to cope with the expansion of the industry?

In fact, the production capacity of the two major fundraising projects above is mostly coarse, fine yarn, thick cloth, and thin cloth. At present, the main source of income sources of Guangyuan New Materials is also based on coarse yarn, fine yarn, thick cloth, and thin cloth. The market competition in the field is relatively fierce. "The price of electronic products in this category is affected by factors such as the sharp expansion of the domestic market capacity, the relationship between supply and demand, and changes in product structure." Guangyuan New Materials also fluctuated due to the above factors. During the reporting period, the company realized operating income of 828 million yuan, 866 million yuan, 1.699 billion yuan, and 384 million yuan, respectively, and the net profit realized was -416.14 million yuan, -74.22 million yuan, 529 million yuan, and 612.91 million yuan.

The sharp expansion of production capacity and the intensification of market competition affect the prices of related products. In 2019 and 2020, the price of products decreased significantly, resulting in the company's net profit loss; in 2021, it was affected by the strong demand for new production capacity and the end market. Product prices generally rose sharply, and the company's net profit increased to 529 million yuan.

However, the growth trend of product sales price has not continued. From January to March 2022, with the changes in the demand for downstream industries, the average sales price of the company's product sales declined to a certain extent. Therefore, there is a risk of declining business performance or even losing money. "Under extreme circumstances, even the risk of losing business profit from the previous year by more than 50%of the previous year or the listing of the year."

In terms of gross profit margin, the company's main business gross profit margin during the reporting period was 15.07%, 14.36%, 47.54%, and 29.38%, respectively. After the rose suddenly rose in 2021, a significant decline in declined. The average gross profit margin of the company's main business is 33.45%, 31.93%, 39.26%, and 36.67%, respectively. Except for 2021, the rest of the year is much higher than that of Guangyuan New Materials. The company said that there are differences in the category and proportion of product segmentation.

It is worth noting that in 2019 and 2020, Guangyuan New Materials has caused losses due to the sharp expansion of domestic market capacity expansion, so is the industry's production capacity expansion continues?

The glass fiber yarn production capacity of Chinese boulder (SH600176, a stock price of 14.54 yuan, and a market value of 58.21 billion yuan) ranks first in the world, with an annual production capacity of 2 million tons, and the production capacity scale ranks first in the world. "Strategic goals, continue to expand production capacity. In March 2022, China Boulder disclosed that it was planned to invest 400,000 tons of glass fiber production line construction projects through Jiujiangzi Company, with an investment amount of 5.076 billion yuan.

China Materials Technology (SZ002080, stock price is 23.62 yuan, and market value of 39.64 billion yuan) produced by rough yarn, electronic glass fiber cloth, etc., an annual production capacity exceeds 1 million tons. In June 2022, Sino -Materials Science and Technology announced that it intends to invest 3.684 billion yuan in Taiyuan, Shanxi to build an annual output of 300,000 tons of high -performance glass fiber intelligent manufacturing production line projects.

Honghe Technology (SH603256, a stock price of 6.92 yuan, a market value of 6.12 billion yuan) was listed in 2019. In 2021, the electronic glass fiber super fine yarn project in Huangshi, Hubei was put into production. In 2022, Honghe Technology has not yet announced its expansion plan. It is currently promoting the "annual output of 50.4 million meters of 5G for high -end electronic glass fiber development and production projects". It is expected to be completed in 2022.

Chongqing International Composite Materials Co., Ltd., like Guangyuan New Materials, is sprinting with the GEM IPO. It is planned to raise 2.481 billion yuan for the construction of ECT glass fiber intelligent manufacturing production lines and electronic yarn production lines. It is expected that production capacity will increase significantly.

It can be seen that after entering 2022, the comparable company expansion plan of the same industry is still continuing. How can Guangyuan New Materials cope with this trend? According to the prospectus (declaration draft), if the electronic glass fiber manufacturer cannot complete the product, it cannot complete the product. Upgrading and continuous cost reduction and efficiency, continuing low -level repeated investment and capacity expansion, may face losses and even eliminate. Therefore, the measures taken by Guangyuan New Materials include continuously strengthening R & D investment and improving the company's competitive capacity; predicting market demand and improving business income.

Five institutional shareholders refund the shares before and after IPO counseling

The prospectus (declaration draft) disclosed the changes in shareholders and shareholders during the reporting period.

In January 2019, Guangyuan New Materials conducted capital increase and shareholding, Huai'an Huida Equity Investment Center (limited partnership) (hereinafter referred to as Huai'an Huida), Ningbo Meishan Bonded Port District Zhongke Huican Entrepreneurship Investment Management Center (limited partnership) (limited partnership) (limited partnership) (limited partnership) The following referred to as Ningbo Zhongke), including Ningbo), has become the company's new shareholders. Based on the subscription price and the number of new shares, the price of the four institutions is 7.3 yuan/share.

In April 2019, Guangyuan New Materials conducted two capital increases, and the capital increase price was 7.3 yuan/share, while the number of shares held by the above four institutions did not change.

More than a year later, in August 2020, the shares of Guangyuan New Materials were transferred. Among the four institutions above, the three institutions except Huai'an Huida all transferred all the shares of Guangyuan New Materials held. The stock price is 7.3 yuan/share. At the same time, all shares are also transferred to the institutional shareholders Ningbo Meishan Bonded Port District Jinde Investment Partnership (Limited Partnership) (hereinafter referred to as Ningbo Jinde), and the transfer price is 7.15 yuan/share. The reporter noticed that Ningbo Jinde was established in July 2018. The shareholding time should not be far from the institutions such as Ningbo Zhongke. Guangyuan New Materials disclosed, "The above -mentioned shares transfer system is priced at the cost price of the transferor's shares." For the exit of the shareholders such as Ningbo Zhongke and other shareholders of Ningbo, the original price was exited at the original price, and the prospectus (declaration draft) did not explain in detail. It only shows that the pricing basis is "the investment price that combines the financing of Guangyuan New Materials as a reference."

In July 2021, Huai'an Huida will also transfer all the Guangyuan New Materials shares held by Huai'an, but the transfer price is not disclosed. In fact, in January and June 2021, Guangyuan New Materials introduced two institutional shareholders, and the capital increase price was still 7.3 yuan/share.

It is worth noting that the reporter inquired on the official website of the Henan Securities Regulatory Bureau that Guangyuan New Materials began to enter the IPO counseling period since December 2020. In other words, five shareholders of institutions withdrew from the ranks of shareholders before and after IPO counseling.

Among the five institutions shareholders, except for Huai'an Huida's nature, four institutions including Ningbo Zhongke are private equity investment funds. Receive the fund number. Among them, Ningbo Jinde has been liquidated in advance, and three institutions such as Ningbo Zhongke are "operating."

For the reasons for the withdrawal of the stock price and the capacity of the fundraising project, on August 31, the Ministry of Guangyuan New Materials Securities responded to the reporter of the Daily Economic News that in view of the current IPO silence In the future, please shall prevail the information on the Shenzhen Stock Exchange's disclosure of disclosure.

Daily Economic News

- END -

More than 60 % of the central reports increased by more than 60 % year -on -year. Three listed companies' comprehensive profit doubled year -on -year

Our reporter Zhang Ying Chu LijunSince August, listed companies have successively disclosed the performance of the 2022 interim report, and the interim report has once again become an annual big dr

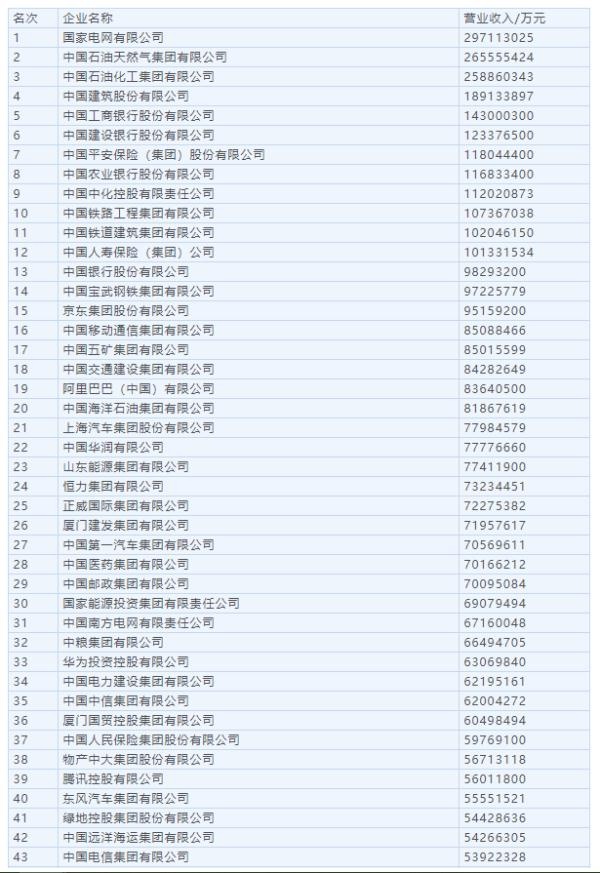

2022 Chinese Enterprise Fortune 500 announced, nine companies in Wuhan were selected

On September 6, the Chinese Enterprise Federation released a list of Fortune 500 C...