The "King Ning" revenue in the first half of the year was "lithium king" nearly 8 times the net profit of more than 2 billion yuan?

Author:Daily Economic News Time:2022.09.06

The lithium battery industry chain is one of the high -domestic investment in the domestic industry. Since the outbreak of new energy vehicles in 2021, "heat" is the keyword of the entire industry. From the upstream lithium ore, the midstream of the midstream, the electrolyte, the electrolyte, the diaphragm, etc., to the downstream lithium battery manufacturer, the hot track continues to emerge, and the entire industrial chain is "expanding production" at high speed.

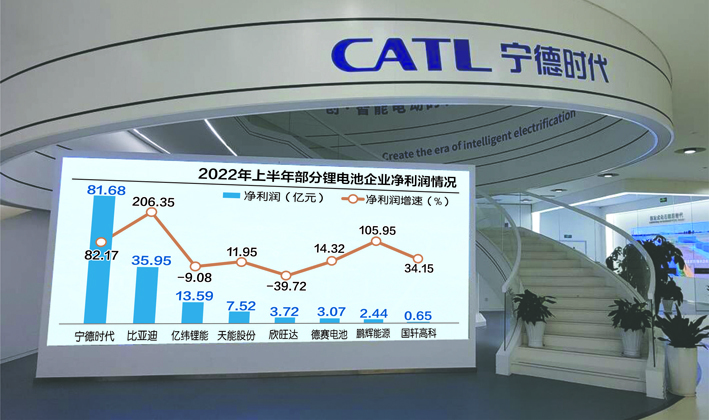

Data source: The company's semi -annual report every data map Liu Hongmei drawing

The sales of new energy vehicles have continued to grow high, and the lithium battery industry chain has benefited a lot. Under the new trend, what kind of performance does the lithium battery industry chain have in the first half of the year? Which segmented tracks have emerged?

On the whole, the upstream lithium source is undoubtedly a big winner, and both revenue and net profit have both increased high. Taking the "Lithium King" Tianqi Lithium industry as an example, in the first half of 2022, its revenue was 14.296 billion yuan, an increase of 508.05%year -on -year; net profit was 10.328 billion yuan, an increase of 119 times year -on -year.

At the same time, the revenue of downstream lithium battery manufacturers has also increased considerable, but the growth of net profit is slightly inferior. Taking the Ningde Times of Ningde as an example, in the first half of 2022, its revenue was 112.971 billion yuan, an increase of 156.32%year -on -year; net profit was 8.168 billion yuan, an increase of 82.17%year -on -year.

Upstream: "Salted fish turn over", lithium ore becomes a big winner

"Salted fish turn over" is a true portrayal of upstream lithium source manufacturers in the past year. 2022年中报显示,天齐锂业(SZ002466,股价110.77元,市值1818亿元)营收142.96亿元,同比增长508.05%;净利润103.28亿元,同比增长119倍,扣非后净利润同比Increase 479 times.

Tianqi Lithium Industry Interim Report is quite beautiful, but the company has also experienced a long trough. From the beginning of 2018 to the end of 2020, the price of lithium carbonate has gone through a low valley period for up to four and a half years. In November 2017, the price of battery -grade lithium carbonate once recorded the price of 168,800 yuan/ton. Since then, the price has fallen all the way. By the end of 2020, the price fell to 40,000 yuan/ton.

The Tianqi Lithium Industry acquired SQM23.77%of the equity of SQM for $ 3.5 billion in 2018. To this end, Tianqi Lithium has carried heavy debt and sought multi -party financing. In the 2019 and 2020 annual reports, Tianqi Lithium's asset -liability ratio was 80.88%and 82.32%, respectively.

Beginning in 2021, the price of lithium carbonate continued to rise, especially in the second half of 2021, showing an index level. In June 2021, the price of lithium carbonate of battery -level was approaching 90,000 yuan/ton. In December 2021, the price over 200,000 yuan/ton. During the Spring Festival, the industrial chain was scrambled to stock up, and the price of battery -level lithium carbonate soared again. By March 2022, it directly exceeded the 500,000 yuan/ton mark. Since then, the price of battery -grade lithium carbonate has continued to remain at a high of 500,000 yuan/ton.

With the rise in the price of lithium carbonate and the IPO of Hong Kong stocks, the status of Tianqi lithium industry liabilities gradually improved. In the 2021 annual report, its asset -liability ratio fell to 58.90%, and the 2022 interim reported further dropped to 45.55%.

The skyrocketing price of lithium carbonate caused the profit of the lithium battery industry chain to transfer upstream. The general characteristics of lithium ore enterprises are in the central characteristics that both revenue and net profit have skyrocketed, and the growth rate of net profit is even worse.

Ganfeng Lithium (SZ002460, stock price of 83.57 yuan, market value of 168.5 billion yuan) revenue increased by 255.38%year -on -year, and net profit increased by 412.02%year -on -year. Salt Lake (SZ000792, the stock price of 27.12 yuan, a market value of 147.3 billion yuan), Shengxin Lithium (SZ002240, the stock price of 53.49 yuan, a market value of 46.3 billion yuan), Tibet Mining (SZ000762, a stock price of 49.04 yuan, a market value of 25.5 billion yuan), and the Yahua Group (SZ002497, the stock price is 28.63 yuan, the market value is 33 billion yuan), Yongxing Materials (SZ002756, the stock price is 135.10 yuan, and the market value is 56 billion yuan). The net profit growth rate is higher than the growth rate of revenue.

It is worth mentioning that in the capital market, lithium ore companies are also popular. For example, as of the closing of September 6, the above -mentioned 7 companies including Tianqi Lithium and Ganfeng Lithium Industry have risen a significant increase. "Tianqi Lithium industry, the stock price rose 5%on the day.

Compared with the lithium industry chain, the cobalt industry chain seems relatively silent. Cobalt is the raw material of Twita's positive electrode material (nickel cobalt manganese). During the rapid development of ternary batteries, cobalt is higher than lithium. However, with the rise of lithium iron phosphate batteries, the asset market has fallen enthusiastically for the cobalt industry chain enterprises. Although the ternary battery is also growing at high speed, the limelight is obviously not here.

The interim report shows that Huayou Cobalt (SH603799, the stock price of 74.99 yuan, a market value of 119.8 billion yuan), Hanrui Cobalt (SZ300618, a stock price of 51.27 yuan, a market value of 15.9 billion yuan), Luoyang molybdenum industry (SH603993, stock price 5.05 yuan, 1091 market value of 1091 RMB 100 million in revenue increased by 117.00%, 37.34%, and 63.95%year-on-year; net profit increased by 53.60%, -14.21%, and 8.19%year-on-year, respectively.

The reporter noticed that as of the close of September 6, the stock prices of Huayou Cobalt, Han Rui Cobalt, and Luoyang molybdenum all rose, of which Huayou Cobalt Industry rose the largest increase at 2.45%. It is worth mentioning that when the lithium battery market was hot in 2017, it was known as "two cobalt" and "two lithium". Cobalt and Hanrui Cobalt.

Today, Huayou Cobalt has opened up a gap with Han Rui cobalt. In the first half of 2022, Huayou Cobalt's revenue was 31.018 billion yuan, and the revenue of Hanrui cobalt industry was 2.793 billion yuan. Huayou Cobalt's revenue is more than ten times more than the Han Rui Cobalt.

Luoyang's molybdenum industry has emerged in the field of cobalt resources with the Congo (Gold) TFM project and KFM project. However, the net profit growth rate in the report was only 8.19%, or due to the large number of negative negatives due to the preservation of the futures of the listed company in the first quarter.

Midstream: Good wind rely on power, lithium iron phosphate rises rapidly

Good wind relies on power. Compared with the upstream lithium ore companies, most of the midstream lithium battery materials companies have no net profit growth rate of the net profit. However, when the lithium iron phosphate battery is "limited", lithium iron phosphate positive pole material companies have also recorded better performance.

磷酸铁锂正极龙头企业当属德方纳米(SZ300769,股价313.30元,市值544亿元),2022年中报显示,上市公司营收75.57亿元,同比增长492.89%;净利润12.80亿元,同比Increasing 847.44%.

Since the beginning of 2021, a large number of chemical enterprises cross -border lithium iron phosphate is positive, and large -scale products are planned, such as the nuclear titanium white (SZ002145, the stock price of 8.18 yuan, a market value of 24.4 billion yuan), the Longbai Group (SZ002601, the stock price is 17.63 Yuan, a market value of 42.1 billion yuan). However, from the German -nano -reporting data, these cross -border manufacturers have not shocked their business.

It is the positive price of lithium iron phosphate that promotes the performance of German nano -nano -rising performance. According to data from China Business Industry Research Institute, from January to June 2022, the cumulative output of lithium iron phosphate batteries was 123.21GWh, accounting for 59.7%of the total output, and cumulative increased by 226.8%year -on -year.

In terms of price, the trend of lithium iron phosphate is similar to lithium carbonate. According to Wind data, in October 2020, the price of lithium nano -tin iron phosphate fell to 340,000 yuan/ton, rose to 100,000 yuan/ton at the end of 2021, and the price climbed to 141,100 yuan/ton in February 2022.

Prospering by lithium iron phosphate, the German nano -hairy profit margin is also increasing. The central report shows that its gross profit margin is 27.81%, a year -on -year increase of 6.15 percentage points.

In contrast, although the revenue and net profit of the Sanyuan Positive Listed Company are also increasing at high speed, the gross profit margin level is declining. Rongbai Technology (SH688005, the stock price of 100.72 yuan, a market value of 45.4 billion yuan), Dangsheng Technology (SZ300073, a stock price of 77.82 yuan, market value) The gross profit margin of technology and Dangsheng Technology was 14.40%and 21.17%; in the 2022 interim, the gross profit margin of the two listed companies was reduced to 12.86%and 17.75%, respectively.

Compared with the lithium iron phosphate's positive poles and triad positive dragon heads. The former is less affected by lithium carbonate price increases, and the gross profit level is still increasing. Maintain product competitiveness with the decline in its own hair rate.

The price trend of the ternary positive pole also shows this. Wind data shows that at the end of 2020, the price of three yuan 811 was 175,500 yuan/ton. By February 2022, the price rose to about 300,000 yuan/ton. During this time, the price of lithium carbonate rose more than 10 times, and the price of lithium iron phosphate rose more than three times, while the price of ternary 811 rose less than doubled.

In terms of other lithium battery materials, Ten times and electrolytic additive giants in 2021, Yongtai Technology (SZ002326, 28.55 yuan, a market value of 25 billion yuan) maintained at a high speed, revenue increased by 67.85%year -on -year, and net profit increased by 417.95%year -on -year. The diaphragm industry is still Ensijie (SZ002812, the stock price is 189.32 yuan, the market value is 169 billion yuan), Xingyuan material (SZ300568, the stock price is 22.97 yuan, and the market value is 294 yuan). In terms of speed and gross profit level, a large gap between other listed companies.

In terms of negative materials, the three giants have different revenue and net profit performance. Shanshan's revenue growth rate was 8.30%, and the net profit growth rate was as high as 118.65%. This is because Shanshan's shares are stripped off the positive material business, and the positive material business will not be merged from September 1, 2021. In addition, due to the acceleration volume of the header of the negative electrode material, negative shipments increased significantly. Therefore, in the context of low revenue growth rate, Shanshan recorded a high -speed growth of net profit.

The growth rates of Lai Lai Lai Lai Lai's revenue and net profit were basically the same, with 75.76%and 80.13%, respectively. In contrast, Betry's revenue rate was 142.47%, and the net profit growth rate was only 25.67%. It can be seen that the growth rate of Betry's net profit and the growth rate of revenue is obvious.

Downstream: Who is "working" for whom? Who "work" for whom? In the first half of 2022, the main line of the lithium battery industry chain was still transmitted to the upstream and downstream prices. In 2022, the entire new energy vehicle manufacturer is enough to increase the price of lithium batteries, and lithium battery manufacturers are even more difficult to speak, and the price increase of lithium carbonate upstream.

For the ten -fold increase in upstream lithium carbonate, the price increase of downstream battery factories to the entire machine plant is mild. Zeng Yuqun, chairman of Ningde Times (SZ300750, a stock price of 45.55.20 yuan, market value of 1.11 trillion yuan), said in the first quarter conference call of 2022 that the company did not have the right to speak in the industrial chain, but hoped to maintain the health and stability The price is added to you (downstream), and then run for a sum of money, so the company's price increase is very mild, and it is the idea of making long -term contributions to the new energy vehicle industry.

In July 2022, Zeng Yuqun once again stated: "Our lithium recovery rate has reached more than 90%." Zeng Yuqun emphasized that the currently proven lithium resource reserves can produce 160TWH lithium batteries. With the development of lithium resource exploration, there may be more discovery. The battery is different from petroleum, and after the oil is used, most materials in the battery can be used circularly.

"Ning Wang" was torn, and the "lithium king" Tianqi lithium industry was not outdone. The relevant person said that lithium recovery can theoretically, and it cannot be recovered on a large scale in theory. The room should be able to do it, but I haven't seen it in business. "

Judging from the central report data, the net profit growth of Tianqi Lithium far exceeds the growth rate of revenue. However, the growth rate of net profit in Ningde era was significantly lower than the growth rate of revenue. In the first half of 2022, Ningde Times revenue was 112.971 billion yuan, an increase of 156.32%year -on -year; net profit was 8.168 billion yuan, an increase of 82.17%year -on -year.

In contrast, the Ningde Times revenue was about 8 times that of Tianqi Lithium, but Tianqi Lithium Industry made 10.328 billion yuan in the first half of the year, and net profit was 2.16 billion yuan more than the Ningde era. The battery factory has worked hard for half a year, and to a large extent "work" for upstream lithium ore companies.

This is still the case in the Ningde era of lithium batteries, and other manufacturers can imagine it. Fenng Technology (SH688567, a stock price of 31.80 yuan, a market value of 34.1 billion yuan) in the first half of the year's revenue growth rate of 495.48%, net profit is still negative; 100 billion Lithium (SZ300014, 94.80 yuan, market value 180 billion yuan) revenue increase increase The speed is 127.54%, and the net profit is growing negatively.

Compared with the level of gross profit margin, Tianqi Lithium and Ganfeng Lithium Industry were 80.13%and 60.46%, respectively, while Ningde Times, Guoxuan Hi -Tech (SZ002074, stock price of 34.68 yuan, market value of 61.7 billion yuan), Fu Neng Technology, Yiwei Lithium Energy The gross profit margin was 18.44%, 13.85%, 13.34%, and 14.64%, respectively.

Obviously, the profit distribution of the lithium battery industry in the future may depend on the price trend of lithium carbonate.

Daily Economic News

- END -

12 Insurance companies' latest solvency does not meet the standards of 80 insurance companies, the comprehensive solvency of the comprehensive solvency of the comprehensive solvency of the comprehensive settlement rate declines

Reporter Su XiangzhengAs of August 10, 147 insurance companies have disclosed the solvency report in the second quarter. According to statistics from the Securities Daily reporter, among them, the c

Land and Sea Union opened the new bureau, Guangdong and Guizhou, to join hands with the new chapter

Recently, during the study and inspection of the party and government delegation of Guizhou Province, Zhanjiang Municipal People's Government signed the Co -construction of the Western Land -to -Sea...