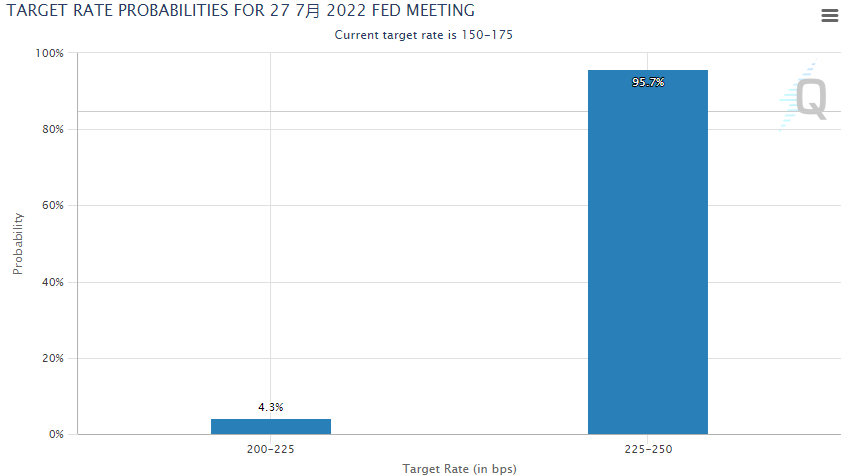

The probability of 75 basis points raised in July to 95.7%.

Author:Daily Economic News Time:2022.06.20

On June 19, Eastern time, the Federal Reserve director and the Federal Public Marketing Committee (hereinafter referred to as FOMC), Christopher Waller, said that if US economic data is as expected, he will support the Federal Reserve in July meeting 75 basis points raised again. "The Federal Reserve's‘ go all out ’to reshape the price stable," he said.

Waller and the recent eagle speeches of many senior Federal Reserve officials have allowed the federal futures market to raise interest rates on the Fed again next month. As of press time, the Zhishang Institute's "Fedwatch) tools show that the futures market believes that the probability of the Fed's 75 basis points at the end of next month is currently 95.7%, while the probability of 50 basis points in interest rate hikes is only 4.3%.

Behind the Fed's radical interest rate hike is the highest inflation in the United States in 40 years. US Treasury Secretary Yellen made a public speech on Sunday saying that the US economy decline may be avoided, but high inflation may accompany the entire 2022.

On the impact of high inflation on the Fed's monetary policy, David Zervos, the chief market strategist of the investment bank Jeffrey, said in a comment email sent to the reporter of "Daily Economic News" that although many people will be The CPI in May is regarded as one of the reasons for the Federal Reserve's position to turn eagle, but for FOMC, market inflation expects rising problems. "We expect the Federal Reserve to continue to curb inflation as the first priority."

The Federal Reserve switched to "eagle", and the probability of raising 75bp in July to 95.7%

The Fed FOMC currently estimates that the Fed will raise the federal fund interest rate from the current range of 1.50%to 1.75%to at least 3.4%.

Reuters reports that inflation measured by personal consumption expenditure (PCE) has reached three times that of the Fed's 2%target. In this regard, Waller said, "This is what I am most worried about." He also added that the interest rate quickly raised interest rates to neutral levels and entered the restricted interval. It is necessary to slow down demand and suppress inflation.

Waller said that if US economic data is as expected, he will support the Federal Reserve to raise interest rates at 75 basis points again at the July meeting. He believes that the tightening of monetary policy may push the current unemployment rate to 4%to 4.25 or even higher. He added, "But my goal is to slow down the US economy, and the market's concerns about the Fed's interest rate hikes will lead to economic recession a little too much."

In addition to Voller, Neel Kashkari, chairman of Minneshlis, (Note: Non: Non -2022 FOMC Ticketing Committee) also said on Friday that he supported the Federal Reserve to raise interest rates 75 basis points in July.

Kashkali wrote in a blog post, "I support the federal fund interest rates at 75 basis points at this week's meeting, and may support such actions again in July." He also said that the July meeting also said that the July meeting The subsequent "prudent strategy" may continue to raise interest rates 50 basis points until the inflation rate has dropped to 2%smoothly.

In addition, just three weeks ago, Raphael Bostic, president of Atlanta Federal Reserve, who said not to raise interest rates too quickly, Note: Non -2022 FOMC Ticketing Committee) Recently, he also suddenly "turned the eagle", and Bostek not long ago It has warned that the Fed may need to suspend the tightening policy in September to evaluate the economy. Today, Bostek has changed his previous attitude, supporting the Federal Reserve ’s interest rate hike last week, and said that the policy needs to be more powerful.

"Daily Economic News" reporter noticed that the market is now obviously more inclined to raise interest rates 75 basis points. As of press time, the Zhishang Institute's "Fedwatch) tools show that the futures market believes that the probability of the Fed's 75 -basis point next month is 95.7%, while the probability of 50 basis points in interest rate hikes is only 4.3%.

Image source: "Federal Reserve Observation" tool

Every reporter also noticed that with the 40 -year high brush in May, almost all Federal Reserve policy makers have become eagle characters -the Monetary policy statement announced by the Federal Reserve last Wednesday showed that all 11 ticket committees were George, the president of Kansas City, does not agree with 75 basis points in interest rate hikes, but is more inclined to raise interest rates 50 basis points.

George stated in a statement last week that the maximum interest rate hike in the past 30 years, coupled with the shrinkage operation, brought uncertainty to the economic prospects. "We adjust the speed of policy interest rates," George said in a statement issued last Friday. "The impact of policy changes on the economy is lagging. Major and sudden changes may make families and small businesses feel uneasy when necessary adjustments."

David Zelworth said in a comment email sent to the reporter of "Daily Economic News", "Although many people regard the CPI in May as one of the reasons for the Federal Reserve's position, for FOMC, the market The problems brought by inflation expectations are much bigger. The latest survey by the University of Michigan in the United States shows that the market's expected short -term inflation rate in the United States has increased from 3%to 3.3%. Although this change seems to be small, if this change seems to It is expected to continue to rise to 3.5%(it seems that this is likely to happen), then we will see high inflation expectations that have never been seen since the early 1990s. We expect the Fed to continue to suppress inflation as the first priority. "

Yellen said that the US economy decline may be avoided, but high inflation may run through 2022 concerns about the market's concerns about American inflation and economic prospects. The US Treasury Secretary Yellen said on June 19 local time that many Americans are worried about the economic recession. " It is not imminent, but "high to unacceptable prices" may be accompanied by consumers throughout 2022.

"From the beginning of the year, our inflation is high, which will lead to higher inflation this year. I expect the US economy to slow down, but decline is not inevitable. With the recovery of the economy and labor market, it has reached full employment. The level of the employment market has been growing at a very fast speed, "Yellen said.

Yellen believes that high inflation is "global, not partial." She believes that the interruption of energy supply caused by Russia and Ukraine's conflict, as well as the new crown pneumonia epidemic, has caused high inflation, and "these disadvantages are unlikely to immediately subscribe, and there are too many uncertain factors related to the global situation."

Cleveland Federal Reserve President, FOMC ticket committee Meters in 2022 also in favor of Yellen's point of view. On June 19, local time, Mest said in an interview with foreign media that the U.S. inflation rate will gradually move down from the current level, which will take two years to drop to the Fed's 2%target.

In addition, Mest said that despite the slowdown of growth, she predicted that she would not have economic recession. Mest said that the US economic growth is indeed slowed and the unemployment rate has indeed risen slightly. This is acceptable, and the United States hopes to see that demand can slow down to keep it consistent with the supply.

Unlike the two policy makers, some Wall Street Investment Banks are relatively pessimistic about the US economic prospects. For example, JPMorgan Chase strategist said that due to the fact that the Fed's policy was wrong, the S & P 500 Index hinted that the possibility of the current US economic decline was 85%.

Morgan Chase quantitative analysts and derivative strategists Nikolaos Panigirtzoglou and others wrote in the report: "Overall, the concerns of market participants and economic entities seem to have intensified the risk of recession. If they firmly believe in their judgments and act according to this, such as cutting investment or expenditure, then the decline prediction may be self -realized. "

James Gorman, CEO of Morgan Stanley, also said that with the continuous wrestling of the Fed and inflation, the possibility of economic recession in the United States is rising, but it is unlikely to be a serious decline. In addition, early this month, Citi Bank CEO Jane Fraser also warned that the US economy was difficult to escape from recession.

Daily Economic News

- END -

Lanshi reinstallation of 1500 tons/year nano -iron phosphate orthopedic material front -drive demonstration project smoothly drove CCCons

On June 16th, Lanzhou Lanshi Heavy Equipment Co., Ltd. (referred to as Lanshi Repa...

Dacheng: Full load production of industrial enterprises

Since 2022, Dacheng County has scientifically planned and opened up new development paths. With the support of various beneficiaries policies, the county's industrial enterprises have increased their...