E -commerce monetization rate is only 1.1%!Can you solve your growth dilemma when entering the B -side?

Author:Investment Times Time:2022.09.07

The first quarter -quarter profit of the domestic branch of Kuaishou was 93.623 million yuan, which has improved compared to more than 1 billion yuan in losses in the same period last year, but the company's stock price is still difficult to have a trend of upward trend.

"Investment Times" Researcher Prince Xixi

Why is the domestic business profitable in a single quarter?

Kuaishou Technology (hereinafter referred to as Kuaishou, 1024.HK) recently disclosed the results of the second quarter and the first half of 2022. In the second quarter of this year, the company realized revenue of 21.695 billion yuan, an increase of 13.4%year -on -year; net loss was 3.176 billion yuan, a loss of 54.9%year -on -year losses. After adjusting EBITDA, it turned a profit year -on -year, recorded 407 million yuan, and domestic business also achieved a single quarter profit.

For the first time, the domestic branch profit was 93.623 million yuan, which was obviously improved compared to the loss of more than 1 billion yuan in the same period last year. However, the performance of the performance disclosed the next day, the stock price of Kuaishou did not rise, but it fell 8.12%. It closed at HK $ 69/share (no right, the same below), and fluctuated on the next few trading days. As of the closing of September 6, the company's stock price closed at HK $ 64.8/share, a decline of more than 80 % compared with the listing high. The capital market responded to the company's performance "cold".

Researchers from the Data "Investment Times" found that the Q2 company first ranked domestic and foreign businesses for the first time, and there are still more than 1.5 billion yuan of unspecified projects under the "operating profit" item. Whether it is profitable, it is unknown. In the quarter, the company's equity incentive expenditure was 1.718 billion yuan, the depreciation and amortization of related assets were 1.647 billion yuan. These two items contributed nearly 3.4 billion yuan for the adjustment of the EBITDA index. Some people in the industry believe that the relevant indicators are positive and only have accounting significance.

In addition, in the second quarter, the company's online marketing business revenue increased by 10.5%year -on -year, the growth rate was lower than the previous quarter. In the third quarter, the core driving force of the business will still come from the growth of total traffic, and external circulation advertisements may continue to be under pressure. Although GMV (total e -commerce transaction) increased by 31.5%year -on -year to 191174 billion yuan, the growth rate was also lower than the first quarter, and the monetization rate of e -commerce was also low. It was difficult to rely on GMV to increase the revenue of e -commerce.

It should be noted that the current short video track competition is fierce. WeChat video number has become an integrated platform for creators (merchants) to provide from content to commercial monetization. Quick hands or have been trapped in the difficulty of growth.

In response to the company's performance, whether the traffic is top, e -commerce content, and ecological differentiation, etc., the email communication outline of the Investment Times has not received a reply as of the press time.

The net loss in the first half of the year was 9.43 billion yuan

In the first half of 2022, Kuaishou realized revenue of 42.762 billion yuan, an increase of 18.3%year-on-year; net loss was 9.43 billion yuan, a narrowing of 85.4%year-on-year; the net loss rate was -22.1%, which was also greatly narrowed from the same period last year.

Among them, in the second quarter, the company realized revenue of 21.695 billion yuan, an increase of 13.4%year-on-year; net loss was 3.176 billion yuan, and the loss was narrowed by 54.9%year-on-year; After adjusting EBITDA, it turned to a profit of 407 million yuan year -on -year.

In other words, before and after the adjustment of the accounting standards, the company's profit difference was about 3.583 billion yuan. The differences between IFRS (IFRS) and NON-IFRS are mainly two aspects, one is the one-time profit and loss of asset disposal income, asset impairment, and investment income; The impact of non -cash income and other amortized. After adjusting EBITDA, the impact of the above factors is needed to reflect the company's profitability.

It can be seen that the data of Q2 in Q2 in 2022 was as high as 1.718 billion yuan. In addition, the total of 1.647 billion yuan in property and equipment depreciation, depreciation of the right to use, and the sales of intangible asset stalls were 1.647 billion yuan. These two items have influenced the company's "uplink" of the EBITDA indicator of nearly 3.4 billion yuan, coupled with the company's net loss in the second quarter, which has narrowed significantly, and jointly adjusted EBITDA under the influence of the company.

In addition, the company also ranked domestic and overseas operations for the first time. In the second quarter, domestic revenue realized revenue of 21.592 billion yuan and operating profit of 93.623 million yuan; overseas revenue was 103 million yuan, and operating losses were 1.606 billion yuan. Listing at home and abroad, or to highlight the domestic profitability in a single quarter, but it should be noted that there will still be-1.547 billion unparalleled projects in the quarter. Whether it is profitable.

However, it is undeniable that the achievement of the "cost reduction and efficiency" of fast hands has already appeared. In the second quarter, the company's sales cost increased by 10.9%year -on -year to 11.925 billion yuan, but the bandwidth costs and server hosting costs and employee benefits were effectively controlled, and both decreased by more than 20%year -on -year. At the same time, the company's sales and marketing expenses also decreased by 22.2%year -on -year to 8.762 billion yuan, accounting for 58.9%in the same period of the previous year to 40.4%, which has decreased for five consecutive quarters of the company.

2022 Q2 fast domestic and overseas operations (1,000 yuan)

Data source: company financial report

Business growth is weak?

The control of bandwidth and other costs is due to the optimization of the company's technical level. At the beginning of August, the company launched the video cloud service brand StreamLake, the SOC chip SL200, and released the three types of solutions for video AI to enter the B -end market. Behind this may reveal the anxiety of fast -handed performance growth. The business of Kuaishou includes online marketing services, live broadcasts, and other services (including e -commerce). Data show that in the second quarter of 2022, the company's online marketing business contributed revenue of 11.006 billion yuan, an increase of 10.5%year -on -year, and the growth rate has slowed down from the previous quarter. In the first half of the year, the core business contributed revenue of 22.358 billion yuan, a year -on -year growth rate of only 20.7%, which was far below the "three -digit" growth rate of the same period last year.

The essence of online marketing business is advertising, and it can be divided into external and internal circulation advertisements. The former income comes from external businesses, and the latter's income comes from traffic purchases from merchants and people in the platform. Hua'an Securities believes that benefiting from the improvement of e -commerce GMV, the company's Q2 internal circular advertising has a year -on -year growth rate higher than the overall advertising business; affected by the macroeconomic and advertiser's budget conservative, external circular advertising is under pressure.

Debon Securities stated that the driving force of the advertising business mainly comes from: the growth of total traffic, the increase in the advent loading rate (advertising loading rate), and the improvement of ECPM (the advertising income obtained by a thousand display). In the second quarter, the DAU (average daily active user) of Kuaishou was 347 million, a year -on -year increase of 18.5%and 0.5%. 38.7%, far higher than the growth rate of income, means that the contribution of Ad load and ECPM is negative.

At the same time, Debon Securities believes that the core driving force of Q3's business will still come from the growth of total traffic, and AD load and ECPM contribute or narrow. Specifically, the performance of internal circulation advertising is related to the growth rate of e -commerce business. External circular advertisements need to expand new advertisers.

Looking at the live broadcast business, Q2's live broadcast revenue of the company was 8.565 billion yuan, an increase of 19.1%year -on -year; the first half of the year was 16.407 billion yuan, a year -on -year growth rate of more than 10%, but the scale still lags behind the same period in 2020. The growth logic of the live broadcast business mainly depends on the number of live paids and paid ARPPU (the amount of single -person paid). In the second quarter, the average monthly paid user of Kuaishou's live broadcast was 54.2 million, a year -on -year increase of 21.8%; rough calculation, the corresponding ARPPU was 52.7 yuan, a year -on -year decrease of 2.3 percentage points.

In the second quarter, other service contribution revenue was 2.124 billion yuan, an increase of 7.1%year -on -year; the GMV of Kuaishou was 191174 billion yuan, a year -on -year increase of 31.5%. In the first half of the year, other services contributed 3.997 billion yuan in revenue, and GMV increased by 38.8%year -on -year to 366.250 billion yuan, and the growth rate also slowed significantly compared with the same period of the previous year.

And other services are mainly live e -commerce. In addition to the number of users of e -commerce business, in addition to the number of users, it depends on the penetration rate, user repurchase rate, customer unit price, and e -commerce monetization rate of e -commerce users. Compared with the above -mentioned e -commerce revenue and GMV, it is clear that the latter has limited effect on fast -handed e -commerce revenue. The current company's monetization rate (other service revenue/GMV) is still low and maintained at 1.1%level. There are difficulties to increase e -commerce income.

2022 Q2 and the first half of the year's fast -handed business income (1,000 yuan)

Data source: company financial report

- END -

National Bureau of Statistics: The situation where the service industry continues to recover has not changed

On the morning of August 15th, a press conference was held. Fu Linghui, a spokesma...

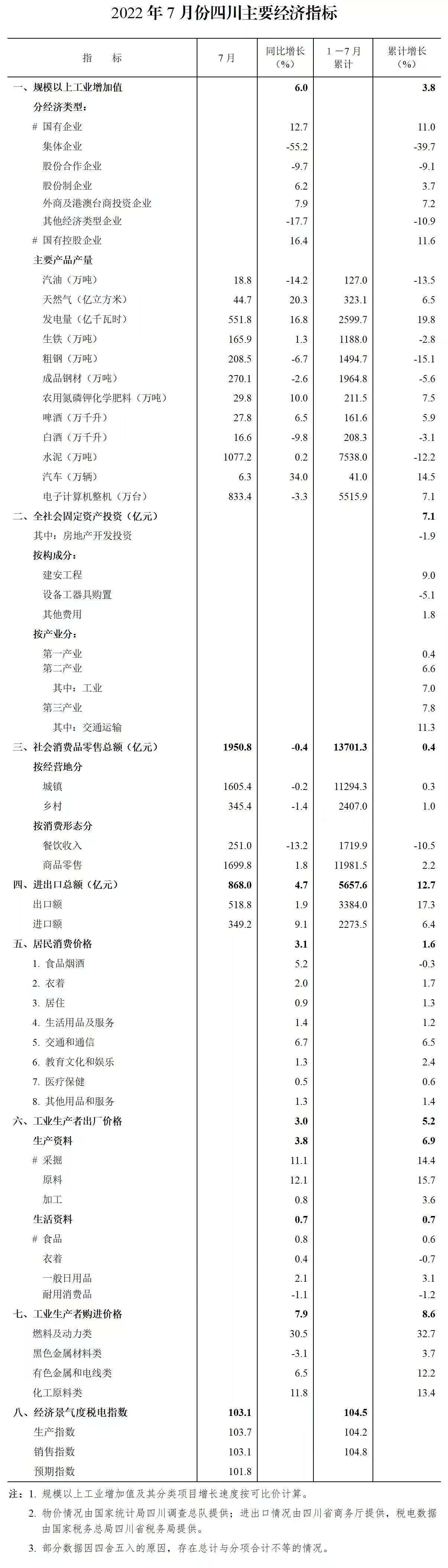

From January to July, consumer prices in Sichuan rose 1.6% year-on-year social consumer goods total retail sales slightly increased slightly

On August 16, the Sichuan Provincial Bureau of Statistics released the main indica...