Laiwu Banking Regulatory Supervision Bureau strengthen financial services guarantee to help the economic development of the economy

Author:Yellow River Finance Time:2022.09.07

Since the beginning of this year, the Laiwu Banking Regulatory Supervision Branch has focused on stabilizing the economic market and serving the overall situation of local economic situations, actively developing its strength, relying on efforts, strengthening linkage, deepening the implementation of various policies for stabilizing enterprises and benefiting the people. Concern and suggestions to help the city's economic development steady quality and quality.

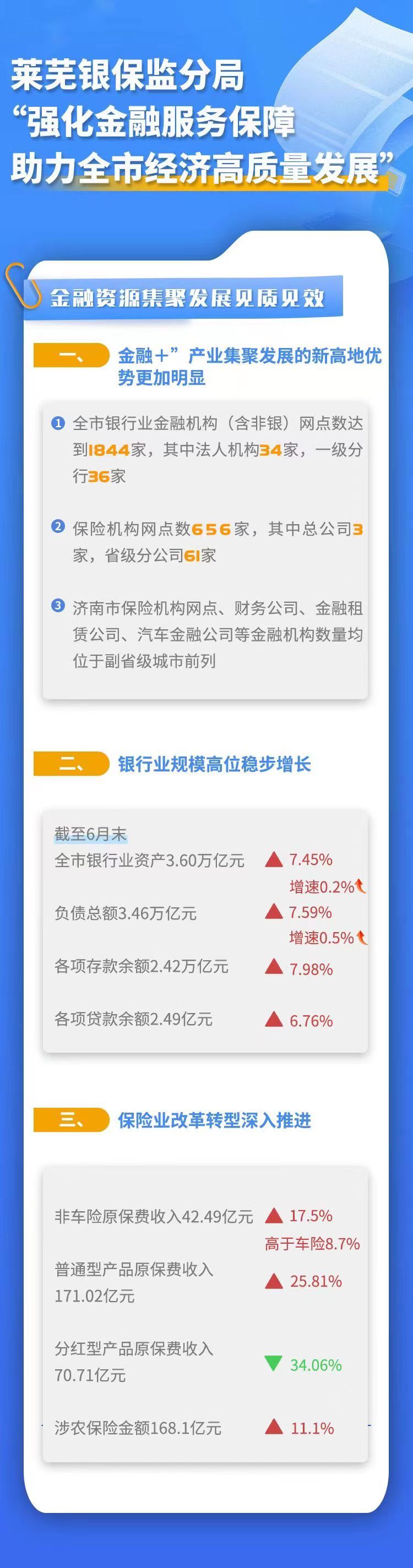

1. The development of financial resources is effective.

First, the advantages of the "financial +" industrial agglomeration and development are more obvious. As of the end of June, the number of outlets in the city's banking financial institutions (including non -silver) reached 1,844, including 34 legal person institutions and 36 first -level branches; 656 insurance institutions outlets, of which 3 were headquarters, and provincial branches 61 Family. The number of financial institutions such as Jinan insurance institutions, financial companies, financial leasing companies, and automotive finance companies are at the forefront of sub -provincial cities. The financial organization system of multi -level, wide coverage and functional complementarity brings strong vitality to economic and social development. Essence Second, the scale of the banking industry has grown steadily. As of the end of June, the city's bank industry assets and total liabilities reached 3.60 trillion yuan and 3.46 trillion yuan, respectively, an increase of 7.45%and 7.59%from the beginning of the year, respectively, and the growth rates increased by 0.2 and 0.5 percentage points year -on -year. The balance of various deposits was 2.42 trillion yuan, an increase of 7.98%over the beginning of the year; the balance of each loan was 249 million yuan, an increase of 6.76%over the beginning of the year. Third, the reform and transformation of the insurance industry have been further advanced. The comprehensive reform of the car insurance has achieved remarkable results. Non -auto insurance premium income was 4.249 billion yuan, an increase of 17.5%year -on -year, which was 8.7 percentage points higher than the auto insurance. The personal insurance protection function continued to increase. The original premium income of ordinary product products was 17.102 billion yuan, an increase of 25.81%year -on -year, and the original premium income of the dividend products was 7.071 billion yuan, a year -on -year decrease of 34.06%. The goal of "bidding, expansion, and product increase" of the agricultural insurance business continued to advance, and the amount of agricultural insurance involved was 16.81 billion yuan, an increase of 11.1%year -on -year.

2. It is effective to help enterprises bailout financial services.

The first is to increase supervision and supervision. Faced with the phased difficulties in the emergence of economic recovery, a series of documents such as the "Notice on Further Strengthening the Implementation of the State Council's Stability and Steady Stability of the State Council" and other series of documents, strengthen financial services in key industries, ensure that financial support policies reach the grassroots level directly at the grassroots level , Benefit enterprises and people. In the first half of the year, the city's banking institutions invested in wholesale retail, transportation, catering accommodation, and cultural and physical entertainment. The balance of severe industry loans was 616.348 billion yuan, an increase of 8.57%from the beginning of the year, and 1.8 percentage points higher than the growth rate of various loans. The second is to optimize the service of funds. Implement the measures such as interest rate cuts, loans continuation, and no repayment of renewal loans, and guide banking institutions to "one enterprise, one policy" to help market entities cross the difficulty and reduce burden. Since the beginning of this year, a total of 18.225 billion yuan has not been repaid for various types of enterprises. The third is to focus on weak fields. Strengthen the assessment of inclusive work, monitor the level of loan interest rates of inclusive small and micro enterprises in the quarter, promote financial institutions to strengthen resource guarantee, and help small and micro enterprises to "climb upside down". As of the end of June, the city's inclusive small and micro -enterprise loan balance was 173.829 billion yuan, an increase of 18.38%over the beginning of the year, which was 11.62 percentage points higher than the growth rate of various loans; Households; the average interest rate of the newly issued inclusive small and micro enterprises is 4.95%, a decrease of 0.22 percentage points from the beginning of the year. The "two increases" goal of the "two increases" goal, and the financing cost of small and micro enterprises continues to decline.

Third, the increase in financial services in key areas increases efficiency.

The first is to support the upgrade of local industrial structure. Promote banking institutions to implement the strategy of strong industrial city, support the ecological protection and high -quality development of the Yellow River Basin, and promote the conversion of new and old kinetic energy. The balance of medium- and long -term loans in the city's manufacturing industry is 78.275 billion yuan, an increase of 16.54%over the beginning of the year. Increase the support for import and export, and the amount of credit insurance for exports is 57.296 billion yuan. The second is to actively integrate into the construction of the financial reform pilot zone. Formulate supporting work plans and task lists to help build a multi -level, professional, and specialized science and technology innovation financial system. Organize the banking insurance industry to support the high -quality development actions of SMEs in SMEs, and explore the pilot of innovation of comprehensive financial services. As of the end of June, there were 20 special banking institutions such as science and technology branches, 7 scientific and technological special insurance institutions such as science and technology branches, and 6 banks set up science and technology and finance departments. The third is to help improve the well -being of public people's livelihood. Focus on the protection of people's livelihood, strengthen policy support, and optimize the financial services of "new citizens". As of the end of June, the city has launched more than 140 new citizens' exclusive credit products, with a loan balance of 13.705 billion yuan; more than 90 insurance products have been launched, providing more than 400 exclusive insurance guarantees for more than 400 insurance guarantees 100 million yuan. Focus on key areas of agricultural and rural areas, and optimize the quality and efficiency of the county financial services. Banks and insurance basic financial services achieve two full coverage of administrative villages and townships. The growth rate of item loans is 2.54 percentage points.

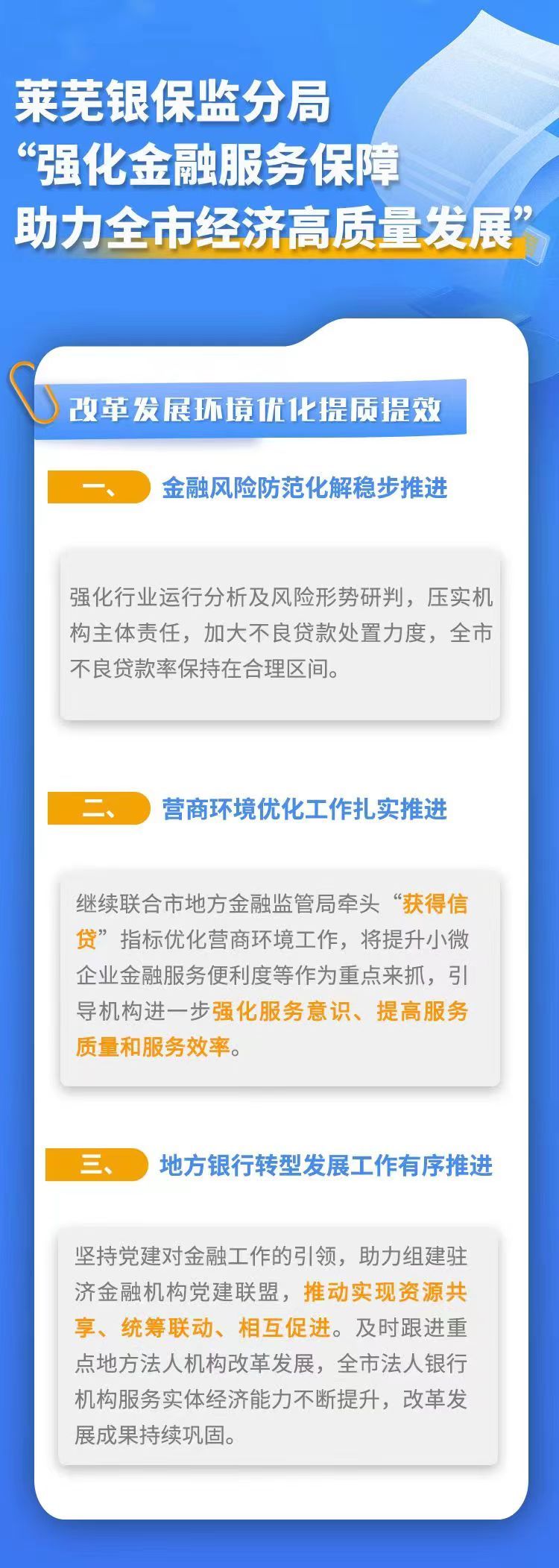

Fourth, reform and development environment Optimize quality and improvement.

First, financial risk prevention and resolution are steadily advanced.Strengthen industry operation analysis and risk situation research and judgment, implement the main responsibilities of the institution, increase the handling of non -performing loans, and the city's non -performing loan ratio remains in a reasonable range.Second, the optimization of the business environment is solidly advanced.Continue to cooperate with the Municipal Local Financial Supervision Bureau to optimize the business environment of the "acquisition of credit" indicators, and to improve the convenience of small and micro enterprises' financial services as the focus, guide institutions to further strengthen service awareness and improve service quality and service efficiency.Third, the transformation and development of local banks has been promoted in an orderly manner.Adhere to the leadership of party building in financial work, help the establishment of party building alliances in Jiji financial institutions, and promote the realization of resource sharing, overall planning, and mutual promotion.The reform and development of key local legal entities will be followed in a timely manner.Reporter: Li Dong Correspondent: Li Jingjing

- END -

"Currency Trends Fashion Trends" live broadcast!

Open the design veil of Panda coins and understand the fashion trend of coins. Pan...

People's Daily praised Qingdao Jiaozhou Shanghe Demonstration Zone: Encourage innovation and entrepreneurship, gather talent technology gathering

Feel the vitality of China's booming developmentIn recent years, China has insiste...