The Chinese Stock Exchange Medical V -shaped rising redness returned to 10,000 points, and it once hit a new low since March 2020

Author:Capital state Time:2022.09.07

In the early morning of the 7th, the opening of the medical sector fell more than 1%, and the SCR medical index fell below the 10,000 -point integer mark in the market, setting a new low since March 2020. As of 10:30, the medical sector has continued to rise after a short period of time, and the CSI Medical Index once again stood up to 10,000 points.

After 14 months of continuous adjustment, the valuation of the medical sector has fallen sharply, and the latest has fallen below 26 times. It is lower than the time interval of more than 99.7%of history. Corresponding to the greatly contracted valuation, the overall fundamental performance of the sector is under pressure, and the performance is not stressful. Continue to grow steadily.

Hu Jie, the fund manager of the medical ETF (512170) fund manager, said that from the published data, in the first half of 2022, the overall income and profit level of the medical sector still showed a growth in the first half of last year. According to the overall method, the main business income of the SCR medical index is 42%, and the net profit growth rate is 45%. More than%; from the expected data of 2022, its annual net profit growth rate is about 46%, which reflects the high growth of the medical sector. Among them, the concept of CXO is the highest. The total profit of the eight CXO concepts of the section exceeds 10.3 billion yuan, an increase of 82%year -on -year compared to the 5.6 billion yuan in 2021! Looking forward to the market outlook, CXO, medical equipment and other sectors will still show high prosperity, and the terminal demand for consumer medical and medical consumables will show a trend of recovery. In addition, from the policy point of view, we see that the medical device sector may usher in the policy turning point.

China -Thailand Securities said that it is optimistic about the replacement of imported medical equipment under innovation and global development. In the short term, the integrated expansion may have a certain impact on the relevant varieties, but the long -term trend of the industry has not changed.

Xingye Securities believes that the pharmaceutical sector is currently at a strategic bottom and has the characteristics of policy bottom, valuation bottom, and positions. Standing at the current point, we reiterate the point of view of the sector again, optimistic about the drug sector that shows the operating reversal state, the high -speed growth track life sciences, and the consumer medical care about valuation switching.

In terms of funds, the largest medical ETF (512170) of the two cities has continued to receive funds in this round of adjustment. According to the latest data from the Shanghai Stock Exchange, the net growth of the fund share of the medical ETF (512170) fund since 2022 has increased by more than 11.6 billion copies. The leverage funds are also adding positions simultaneously. Medical ETF (512170) yesterday's financing purchase amount reached 65 million yuan, and the latest financing balance rose to 510 million yuan. It refreshed the listing high for 3 consecutive days, and increased by 50%in the second half of the year!

- END -

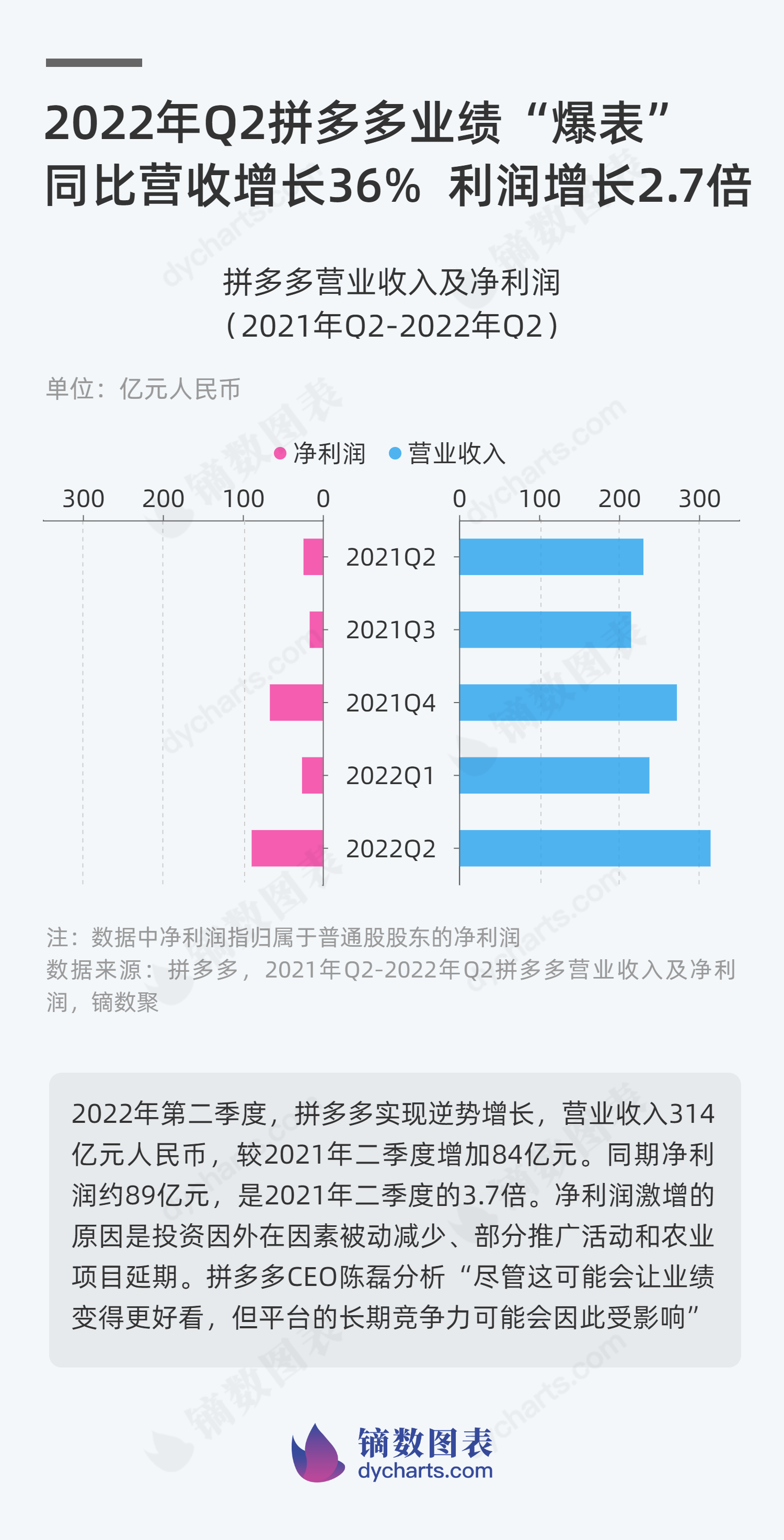

2022 Q2 Pinduoduo's performance "exploded" to achieve adversity growth

In the second quarter of 2022, Pinduoduo achieved adversity growth, with operating...

Detailed explanation of fun shop Luo Min was hacked by Dong Yuhui, netizens: Don’t think we forgot to make fun stages

Flower Finance OriginalLuo Min, the founder of the 19 -hour marathon live broadcas...