Treasury market Fengyun | It is worth buying no more than 550 million yuan convertible bond Moody's low -down reduction of ocean group corporate family rating

Author:Zhongxin Jingwei Time:2022.09.07

Zhongxin Jingwei, September 7th (Lei Zongrun) On September 7, Shibor's short -end varieties are on the board. The overnight varieties were reported to 1.113%, 7.5bp reported to 1.524%in 7 days, and 1.403%of the upward of 1.7bp in 14 days, the one -month period was the same as the previous day. Judging from the news, what news is worthy of attention in the bond market? Jingwei Jun combed you one by one.

[Research Focus]

Central Bank: 2 billion yuan 7 days of reverse repurchase operation

Wuhan Contemporary Technology: "H21 Contemporary 2" holder meeting passed the interest exhibition proposal

Oceanwa Holdings: Some of the shares of the listed company were auctioned to complete the transfer

Shengzhou State -owned Assets: Enterprise Headquarters is subject to self -discipline by bond business

Ocean Capital: Adjust the "20 Far -funded 01" debt payment plan, and extend the day of redemption day

S & P: Decrease Xuhui Holding Group's long-term issuer credit rating to "BB-", looking forward to "negative"

Moody's: Dowards the corporate family rating of the Ocean Group to "BA2" and look forward to "negative"

Fitch: Confirm the "BBB+" rating of Zhengzhou Real Estate, and the prospects are stable

【Macro Express】

Central Bank: 2 billion yuan 7 days of reverse repurchase operation, winning bid interest rate 2.0%

On September 7, the Central Bank announced that in order to maintain the liquidity of the banking system reasonable and abundant, September 7 launched a 7 -day reverse repurchase operation by interest rate bidding, with a bid interest rate of 2.0%. Wind data shows that there are 2 billion yuan of reverse repurchase expiration today, so the day is completely hedged to the period.

【Entreprise's news】

Wuhan Contemporary Technology: "H21 Contemporary 2" holder meeting passed the interest exhibition proposal

On September 7, Wuhan Contemporary Science and Technology Industry Group Co., Ltd. announced that "H21 Contemporary 2" 2022 The Second Organizer Meeting of 2022 voted for the "Proposal on Change the" H21 Contemporary 2 "interest payment plan", that is, the "H21 Contemporary Contemporary Contemporary 2 "This year (September 9, 2021 to September 8, 2022) pays the interest exhibition period to September 9, 2023.

Oceanwa Holdings: Some of the shares of the listed company were auctioned to complete the transfer

On September 7, China Oceanic Holding Group Co., Ltd. announced that on September 2, the company's holding subsidiary pan -sea holding of the China Securities Registration and Clearance Co., Ltd. Shenzhen Branch system learned that the company was auctioned by judicial auction Holding 270 million shares has completed transfer registration procedures.

Kangmei Pharmaceutical: Share shares held by shareholders Kangmei Industrial are transferred by judicially

On September 7, Kangmei Pharmaceutical Co., Ltd. announced that it was recently learned that the company's shareholders Kangmei Industrial holding 148 million unlimited sales of unlimited and circulating shares has been judged.

Shengzhou State -owned Assets: Enterprise Headquarters is subject to self -discipline by bond business

On September 6, Luzhou State -owned Capital Operation Co., Ltd. announced that the dealer association punished the company's headquarters on September 1, 2022 to warn the company. Report criticism.

Ocean Capital: Adjust the "20 Far -funded 01" debt payment plan, and extend the day of redemption day

On September 6, Ocean Capital Co., Ltd. issued an announcement saying that the first bond holder meeting of 2022 in 2022 was held to review and passed the "Notice on the Removal of the Congress of the Bond of the Bonds, temporarily temporarily, and temporarily. The proposal of the proposal and the procedures of the programs related to the ticket "and the" Mobs on Adjusting the "20 Fortune 01" redemption plan and providing credit enhancement measures. The adjusted "20 Far -funded 01" redemption plan shows that the payment date of the debt is September 9, 2023.

【Rating changes】

S & P: Decrease Xuhui Holding Group's long-term issuer credit rating to "BB-", looking forward to "negative"

On September 7, S & P announced that the long-term issuer's credit rating of Xuhui Holdings (Group) Co., Ltd. was lowered from "BB" to "BB-", looking forward to "negative" The rating is lowered from "BB-" to "B+".

United International: Low the long -term distribution of Huijing Holdings to "CCC+"

On September 7, the United International report stated that the long -term issuer rating of Huijing Holdings Co., Ltd. was lowered from "B+" to "CCC+" and looked forward to "negative". United International will remove the company's long -term issuer rating out of the list of negative observations of rating.

Moody's: Low the corporate family rating of the Ocean Group to "BA2" and look forward to "negative"

On September 6, Moody's report said that the corporate family rating of the Ocean Group Holdings Co., Ltd. was lowered from "BA1" to "BA2" and looked forward to "negative".

Fitch: Confirm the "BBB+" rating of Zhengzhou Real Estate, and the prospects are stable

On September 6, Fitch confirmed that Zhengzhou Real Estate Group Co., Ltd.'s long -term foreign currency and local currency issuer's breach of contract was rated as "BBB+", which was stable. The mortgage notes are rated "BBB+".

Moody's: List of relevant rating of Lifeng Company into the List of Declined Observation

On September 5, Moody's report said that the relevant rating of Lifeng Co., Ltd. was included in the list of observation, including the "BAA3" issuer rating, "BAA3" senior unsecured bond rating, "(P) BAA3" senior unsecured unsecured unsecured unsecured unsecured unsecured unsecured Medium -term bill planning rating, "(P) BA2" priority shares medium -term bill planning project rating and "BA2" secondary permanent capital securities rating. The company's rating outlook was "negative" before. 【New debt issuance】

Kyushu: Issuing 5 billion yuan ultra -short -term financing coupon was registered

On September 7, Kyushu Tong announced that the company received the "Registration Notice" issued by the China Banking Market Dealer Association. Effective within 2 years. The company can issue ultra -short -term financing vouchers in installments within the validity period.

Capital Venture Capital: It is intended to issue up to 21 million Hong Kong dollars for conversion debt

On September 7, the capital Venture Capital announced that the company entered into a distribution agreement with the distribution agent. Based on this, the company had the conditions to agree to the issuance and distribution agent. A total of HK $ 21 million is convertible.

It is worth buying: It is intended to issue no more than 550 million yuan of convertible bonds

On the evening of September 6, it was worth buying and issuing an announcement saying that it was planned to issue no more than 550 million yuan of convertible bonds for digital content platform construction projects, commodity digital intellectual management platform construction projects, and supplementary mobile fund projects. (Zhongxin Jingwei APP)

(The views in the article are for reference only, do not constitute investment suggestions, have risks in investment, and need to be cautious to enter the market.)

Copyright Copyright Copyright, without written authorization, no unit or individual may reprint, extract or use it in other ways.

Editor in charge: Li Zhongyuan

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

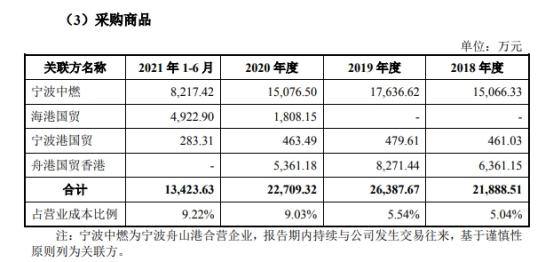

The affiliated transaction amount super total purchases of Ningbo Oceanic Financial Suspects to be solved

The 18th issuance and review committee of the Securities and Futures Commission is...

The third anniversary of LPR reform: Breaking the hidden limit of loan interest rates to the lower limit of the company's financing costs continued to decline

The reform of the loan market quotation interest rate (LPR) has ushered in the thi...