A total investment of 176.4 billion yuan!30 bank fintech comparison comparison

Author:Zero One Finance Time:2022.09.07

Summary √ Digital transformation has become a strategic means for the transformation and upgrading of the banking industry. Zero -One think tank and digital lecture center sort out the 30th annual report of 30 banks in 2022. The Construction Bank introduced the progress of business, data, and technology. The bank builds the first retail wealth management business investment research platform "Fortune Alpha+"; CITIC Bank and Huawei have established a joint innovation laboratory. √ In terms of financial technology investment in commercial banks, in the first half of 2022, bank fintech investment continued to grow. For example Home Bank's attention to fintech is reflected in the number of fintech talents. In the first half of 2022, the Construction Bank announced the construction of talent projects with a number of colleges and universities, which aims to cultivate more fintech talents. Create a team of fintech professionals through a variety of talent projects.

Produced | Zero One Think Tank

Author | Li Xin Lu Yangyi

Catalog Introduction I. Bank Financial Technology Strategy: Decarnation of various banks (1) State -owned bank fintech strategy: comprehensive coverage, many construction results (2) joint -stock bank fintech strategy: each bank has its own focus (3) small and small small and small Bank Financial Technology Strategy: Small and medium -sized banks in developed regions are stronger. 2. Bank fintech investment: It is directly proportional to the overall scale of banks. The largest growth rate (II) shares bank fintech investment overview: China Merchants Bank's investment exceeds 10 billion, Bohai Bank growth rate is 68.75%(3) Small and medium -sized bank fintech investment. Fintech talent construction: The number of ICBC exceeds 30,000, Ping An Bank accounts for more than 20%. Four. Summary

Anterior

Digital transformation has become a strategic means for the transformation and upgrading of the banking industry, and the epidemic has accelerated the pace of digital transformation of the banking industry. In recent years, commercial banks have increased their investment in fintech. While changing the bank's business model, digitalization has established a new digital finance ecosystem. According to Wind data, in recent years, the banking industry's investment in fintech has continued to rise. According to the Zero 1 think tank and the digital workshop (Note: including 29 listed banks and one non -listed bank. In addition, the statistical analysis of this article is based on the above banks, as of August 31, 2022) Financial report, 2021, 2021 , 30 banks' financial technology investment totaling 176.416 billion yuan. Most bank fintech investment is growing. In the first half of 2022, China Merchants Bank's fintech investment invested 5.360 billion yuan, an increase of 6.03%year -on -year, accounting for 3.26%of the revenue ratio; Ping An Bank's financial technology capital expenditure and cost investment increased by 15.9%year -on -year; Everbright Bank 2022 In the first half of 2022, science and technology investment in the first half of the year of 2022 2.138 billion yuan, a year -on -year increase of 434 million yuan, an increase of 25.47%; Bank of Nanjing started 600 scientific and technological projects in the first half of the year, with an approved amount of 790 million yuan, accounting for 55%of the annual science and technology investment budget.

Banks can be divided into three echelons. The first echelon is a state -owned bank. Their business is all over the country. The scale and income are also at the forefront of all banks. Digital security protection, Xinchuang transformation of full stack systems, and financial cloud construction; many disclosure results in the first half of 2022, for example, ICBC created unified banks with open banks, and CCB introduced the progress of the "three major middle Taiwans". The second echelon is a joint -stock bank. The joint -stock bank is closely following the pace of financial technology. For example, in -depth promotion of digital transformation and development is a major direction of China Merchants Bank Fintech, while CITIC Bank values the construction of the base of digital infrastructure. In the first half of 2022, China Merchants Bank constructed the first retail wealth management business investment research platform in the industry; Minsheng Bank constructed cloud native applications and service platforms. The third echelon is small and medium -sized banks, and fourteen small and medium banks have invested about 10 billion yuan in fintech. The development of financial technology of small and medium -sized banks is generally linked to the economic development of the region. The financial technology of the developed regional city commercial banks such as Bank of Beijing, Bank of Shanghai, and Bank of Nanjing is rapid and comprehensive. Mentioned the bank's independent research and development and officially launched the "Yaoguang" distributed application development platform; Nanjing Bank in the first half of 2022 revolved around cloudization, online, and intelligent, comprehensively promoting financial infrastructure and capabilities systems, etc. The development of small and medium -sized banks is relatively backward.

At the same time, the value of various banks attaches importance to fintech is reflected in the number of fintech talents. The most financial technology employees are ICBC, reaching 35,000. There are four banks with more than 10,000 financial technology practitioners. They are Industrial and Commercial Bank of China, Construction Bank, Bank of China and China Merchants Bank. The banks with the largest proportion of fintech practitioners were Ping An Bank, reaching 22.14%, followed by SPDB, accounting for 10.64%.

1. Bank fintech strategy: all banks accelerate digital transformation

(1) State -owned bank fintech strategy: comprehensive coverage content, a lot of construction results

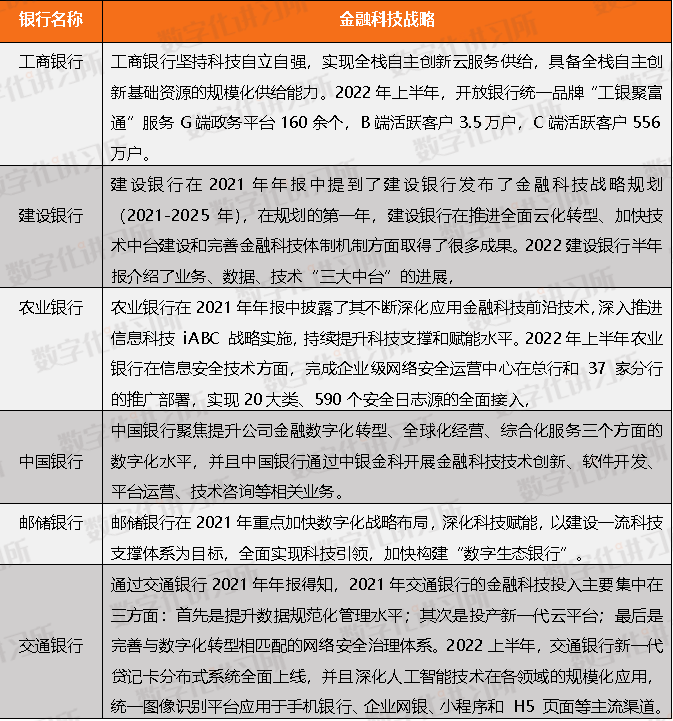

State -owned banks' overall fintech investment occupies the head position in all banks, and financial technology has also carried out earlier, and its development is relatively comprehensive. Most state -owned banks have detailed planning in the financial technology strategy, and are not limited to one field. They usually perform financial technology deployment at the same time in multiple aspects, especially in terms of financial cloud, technology platform construction, and digital construction. For example, ICBC, Construction Bank, and Bank of Communications have specific plans in the financial cloud; Construction Bank has accelerated the construction of China Taiwan and Taiwan; Bank of China focuses on digital transformation. Some state -owned banks are also promoting the development of various financial technology -related businesses such as blockchain technology, artificial intelligence and digital ecology. For example, Agricultural Bank of China attaches importance to the construction of blockchain and artificial intelligence, and applies blockchain to the blockchain to the blockchain to the blockchain to Pension management, credit risk control and other fields; postal savings banks have proposed the goal of accelerating the construction of "digital ecological banks". In general, the development of financial technology of state -owned banks ranks among the top in the banking industry and has a high degree of innovation, which provides an example for the financial technology construction of other banks.

According to the 2021 annual report, ICBC adheres to the self -reliance and self -reliance, and has a lot of construction results in fintech. In terms of platform construction, the financial cloud platform with the largest global banking industry, the strongest technical capabilities, and full business scenarios to achieve the full realization The supply of independent innovation cloud services in the stack, the first industry to implement the "One Cloud Core" architecture deployment, take the lead in completing the cloud platform's compatibility and adaptation of the general open platform and independent innovation technology system. Essence The first industry in the industry meets the requirements of private cloud level four and ecological cloud level security capabilities. In the semi -annual report of 2022, Industrial and Commercial Bank of China mentioned that it created the unified brand "ICBC Gathering Fulong", which can face government affairs platforms, industrial platforms, consumer platforms, and agricultural -related platforms to provide multiple financial services for platforms and platform users. Essence In the first half of 2022, there were more than 160 Government affairs platforms on "ICBC Gathering Fulong", 35,000 active customers on B -end, and 5.56 million active customers on C -end.

In September 2021, Construction Bank released the fintech strategic planning (2021-2025). In the first year of planning, Construction Bank has achieved many results in advancing the transformation of comprehensive cloudization, accelerating the construction of technology, and improving the financial technology system and mechanism. The 2022 Construction Bank semi -annual report introduced the progress of business, data, and technology. As of the end of June 2022, the "Business Central Taiwan" sorted out 440 standardization capabilities and has been applied to the entire bank's 49 scene platforms; " Data Zhongtai "Cumulative deployment of more than 100 data products such as user client labels, and more than 3,100 data services in the Data Zhongtai Service Station, with a peak of daily calls of over 2.9 million; The number of calls has doubled from the end of 2021.

In 2021, Agricultural Bank continued to deepen the front -edge technology of financial technology, further promoted the implementation of the IABC strategy of information technology, and continued to improve the level of scientific and technological support and empowerment. Agricultural Bank has achieved good results in high -tech applications such as big data technology, cloud computing, artificial intelligence technology, distributed framework, information security technology, network technology and blockchain technology, especially in terms of blockchain technology application The Agricultural Bank promoted the construction of the BAAS system of the blockchain cloud service platform, launched support services such as intelligent research and development, typical scene model boards, and applied blockchain to pension management and credit risk control and other fields. Agricultural Bank of China mentioned in the semi -annual report of 2022 that in terms of information security technology, the enterprise -level network security operation center has completed the promotion and deployment of the corporate network security operation center at the head office and 37 branches, and realizes the comprehensive access to 20 categories and 590 security log sources. Monitoring of the daily network security situation throughout the bank.

The Bank of China focuses on the digitalization level of the company's financial digital transformation, global operation, and comprehensive service, and solidly promote the four basic projects. Multi -job customer marketing models, realize post -loan management, strengthen data analysis, and enhance the application of data elements in the field of marketing, risk control and management. In addition, Bank of China has carried out financial technology innovation, software development, platform operations, technical consulting and other related businesses through China Banking and Financial Sciences.

In 2021, the Postal Savings Bank focuses on accelerating the digital strategic layout, deepening science and technology empowerment, aimed at building a first -class scientific and technological support system, fully realized scientific and technological leadership, and accelerated the construction of "digital ecological banks".

In 2021, the Bank of Communications' fintech investment was mainly concentrated in three aspects: first, to improve the level of data standardization management, promote the unified standards in the system architecture, and realize online services for data specifications, data assets, and index systems. , Synchronize the core system of the loan card of the pilot project and deepen the application of artificial intelligence technology; finally, improve the network security governance system that matches digital transformation, establish a unified security standard for the group, and improve the customer information security management system standard. In the first half of 2022, the new -generation loan card distributed system of Bank of Communications was fully launched to realize that the loan card system was relocated from the large aircraft to the open distributed architecture and running smoothly. Deepen the large -scale application of artificial intelligence technology in various fields, and the unified image recognition platform is applied to mainstream channels such as mobile banking, corporate online banking, applets, and H5 pages. It serves a total of 167 business scenarios with an average daily transaction volume of 1811,000. Table 1: State -owned Bank of Fintech Investment Strategy

Data Source: Company Annual Report, Digital Guyers, Zero One Think Tank

Note: 1. The data and data sorted by this article are from the bank 2021 annual report and the half -annual report of 2022. The same is the same;

2. The statistics of this article only include banks that disclose financial technology related businesses and data in the financial report. Banks that have not disclosed relevant information are not statistical for the time being, and the same is the same.

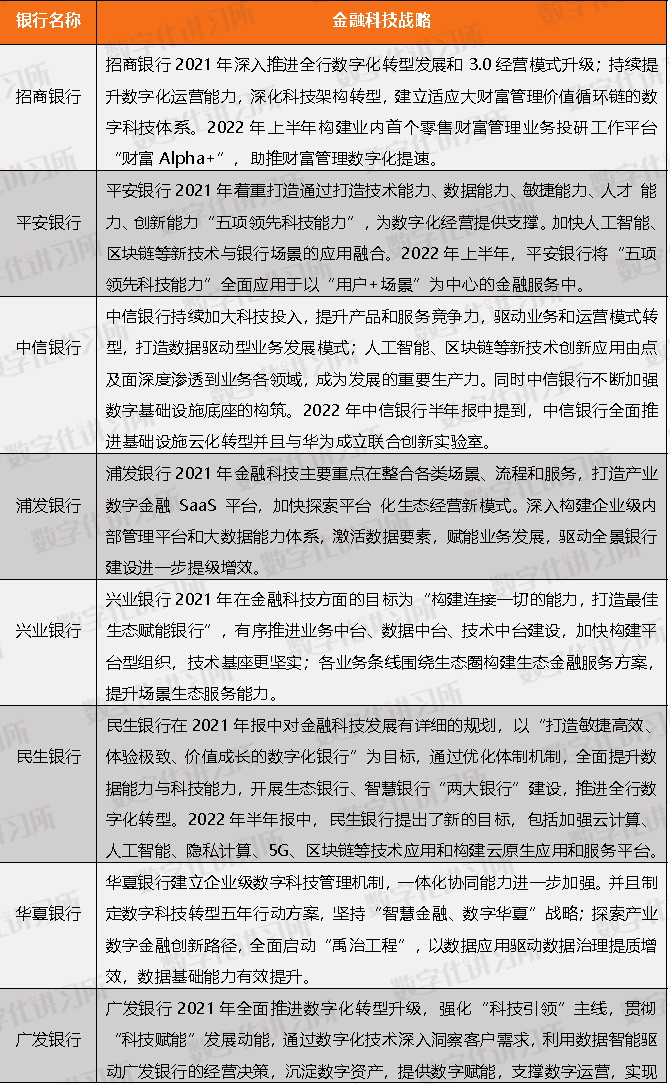

(2) Financial technology strategy of joint -stock banks: each bank has its own focus

Joint -stock banks have a clear goal in the financial technology strategy as a whole. For example, Ping An Bank focused on creating the "five leading scientific and technological capabilities" through creating technical capabilities, data capabilities, agility capabilities, talent capabilities, and innovation capabilities. The goal of science and technology is to "build the ability to connect everything and create the best ecological empowerment bank"; Minsheng Bank has a detailed plan for the development of fintech development in the 2021 report to "create digital banks with agility and efficiency, experience, and value growth. "The goal; Huaxia Bank adheres to the strategy of" smart finance, digital Huaxia "; Guangfa Bank comprehensively promoted digital transformation and upgrading in 2021, strengthened the main line of" technology leadership ", and implemented the" science and technology empowerment "development momentum; It is "Central and Taiwan architecture, data -driven, intelligent operation and maintenance, agile and efficient". Through the planning of the joint -stock bank annual report, it is learned in the planning of the fintech strategy that digitalization is the goal of most joint -stock banks in fintech. Some joint -stock banks also mentioned the application of platform construction, blockchain and artificial intelligence.

For example, in 2021, China Merchants Bank focuses on the main line of creating a large wealth management value cycle chain to further promote the digital transformation and development of the entire bank and the upgrade of the 3.0 business model; rely on "people+digitalization" to continue to upgrade customer service capabilities and explore future bank intelligent services New models; continuously improve digital operation capabilities, comprehensively improve internal operation and management efficiency; deepen the transformation of scientific and technological structures and establish a digital technology system that adapts to the value of great wealth management. In the latest semi -annual report of China Merchants Bank in 2022, it also mentioned that China Merchants Bank established the industry's first retail wealth management business investment research platform "Fortune Alpha+" around the needs of wealth management business scenarios and customer service needs, which promoted the increase in digitalization of wealth management.

Ping An Bank relied on Ping An Group, and in 2021, it focused on the "five leading scientific and technological capabilities" of technical capabilities, data capabilities, agility, talent capabilities, and innovation capabilities to provide support for digital operations. Accelerate the integration of new technologies such as artificial intelligence and blockchain with the application of banking scenes. In the first half of 2022, Ping An Bank comprehensively applied the "five leading scientific and technological capabilities" to financial services centered on "user+scene", promoting precise decision -making in the front, middle and background decisions, high resources, efficient operation and value improvement. Promote the goal of achieving the "three firsts", "three mention", and "three drops".

CITIC Bank ’s 2021 annual report shows that CITIC Bank continues to increase its investment in scientific and technological investment, enhance product and service competitiveness, drives business and operating model transformation, and creates a data -driven business development model; Increasing the comprehensive empowerment capabilities of fintech, new technologies such as artificial intelligence and blockchain have penetrated from point and face depth to all areas of business, becoming an important productivity for development. At the same time, CITIC Bank has continuously strengthened the construction of the base of digital infrastructure; in 2021, the core function of the artificial intelligence "CITIC brain" platform based on completely independent independent research and development has been basically completed; and it continues to deepen the empowerment of digital technology to the business field. In 2022, the CITIC Bank semi -annual report mentioned the latest achievements achieved by the bank's fintech, including: comprehensively promoting the cloud transformation of infrastructure, the infrastructure cloudization rate reached 99.7%; Financial digital innovation incubation center.

Pudong Development Bank's main focus of fintech in 2021 is to integrate various scenarios, processes and services, build an industrial digital finance SaaS platform, and accelerate the exploration of platform -based ecological operations. In -depth construction of an enterprise -level internal management platform and a big data capabilities system, activating data elements, empowering business development, and driving panoramic banks to further upgrade efficiency.

The goal of Industrial Bank in 2021 in terms of fintech technology is to "build the ability to connect all, create the best ecological empowerment bank", and orderly promote the construction of the business in the business, the data, and the technology. The foundation is more solid; the various business lines build an ecological financial service solution around the ecosystem to enhance the scenario ecological service capabilities. Minsheng Bank has a detailed plan for the development of fintech in the 2021 report. Minsheng Bank has a strategic positioning of the "Agile and Open Bank" in the new period of "Agile and Open Banks", formulated the "Implementation Strategy of Digital Financial Transformation of China Minsheng Bank" to clarify the direction of digital financial transformation throughout the bank. With the goal of "creating agile and efficient, experienced, and value growth", through optimizing the system and mechanism, comprehensively improving data and scientific and technological capabilities, the construction of the "two major banks" of ecological banks and smart banks to promote the digital transformation of the entire bank. 2022年半年报中,民生银行提出了新的目标,包括加强云计算、人工智能、隐私计算、5G、区块链等技术应用,开展实时数据规模化应用专项行动和在总行云、分行云、 Based on the "three clouds" of the ecological cloud, build a cloud native application and service platform.

Huaxia Bank's 2021 annual report pointed out that this year's comprehensive strength of science and technology has increased significantly. Huaxia Bank has established an enterprise -level digital technology management mechanism, and the integrated collaboration capabilities have been further strengthened. The number of development demand for production and production is close to double the year -on -year, and the technology productivity has effectively improved; and the five -year action plan for digital technology transformation is formulated to adhere to the "smart finance, digital China" strategy; explore the path of digital finance in the industry, form a path of digital finance in the industry, and form the Beijing -Tianjin -Hebei, the Yangtze River Delta, the Greater Bay, the Greater Bay, and the Greater Bay The district and the central and western regions of the central and western regions advance to break through and make a multi -blooming trend; comprehensively start the "Yuzhi Project", use data application -driven data governance to improve quality and efficiency, and effectively improve data basic capabilities.

Guangfa Bank (Note: For non -listed banks) In 2021, it comprehensively promoted digital transformation and upgrading, strengthened the main line of "technology leadership", implemented "scientific and technological empowerment" development momentum, adhered to customer -centric Serve the ultimate customer experience; focus on the focus of marketing, and build data applications in combination with the continuous emerging business scenarios of the industry to improve customer acquisition level. Strengthen product research and development innovation, continue to promote the coordinated layout of comprehensive financial products, and provide customized products according to the real needs of customers to enhance their own product differential competitiveness. Use data to intelligently drive the operating decisions of Guangfa Bank, precipitate digital assets, provide digital empowerment, support digital operations, and realize digital operations.

Bohai Bank revealed in the 2021 annual report that Bohai Bank closely focused on the financial technology transformation work ideas of "central and platform architecture, data -driven, intelligent operation and maintenance, agile and efficient", establish an enterprise -level system structure, create a new generation of core technical capabilities, and use clouds to use clouds. Calculation, artificial intelligence, big data, Yunyuan, FIDO, distributed database and other technologies, to accelerate the transformation of the Bohai Bank's "licensed fintech company". Bohai Bank revealed in the semi -annual report of 2022 that 2022 is the year of the digital transformation of Bohai Bank, and it will continue to increase the investment in fintech to improve the quality and efficiency of business development with science and technology.

Table 2: Financial technology strategy of joint -stock banks

Data Source: Company Annual Report, Digital Guyers, Zero One Think Tank

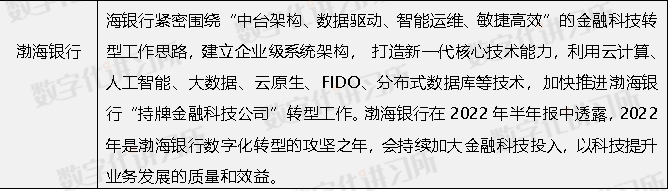

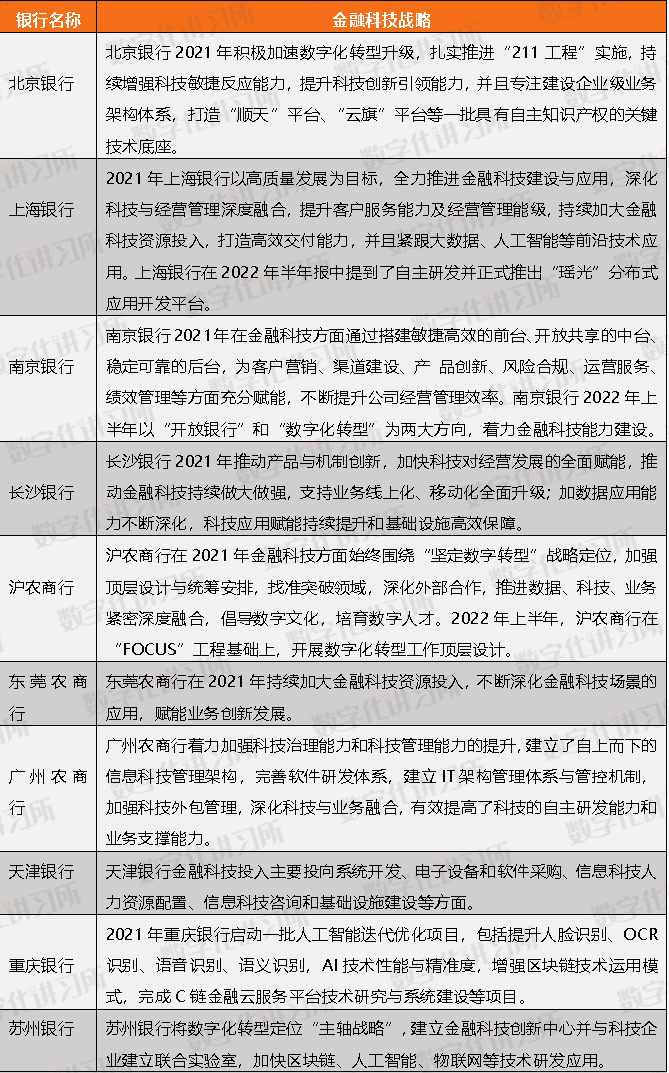

(3) Small and medium -sized bank fintech strategy: Small and medium -sized banks in developed regions have stronger financial technology capabilities

Compared with state -owned banks and joint -stock banks, small and medium -sized bank fintech strategies are concentrated in a certain aspect, such as Bank of Beijing in 2021 and focus on building an enterprise -level business architecture system to create a "Shuntian" platform and "cloud flag" platform. Wait for a group of key technical bases with independent intellectual property rights; Bank of Shanghai's main efforts on big data and artificial intelligence; Nanjing Bank of China in 2021 focuses on the establishment of agile and efficient platforms, etc. Digitalization process, such as Shanghai Rural Commercial Bank, Suzhou Bank and Qingdao Bank. Chongqing and Suzhou Bank also introduced high -tech such as blockchain such as blockchain. There are also small and medium -sized banks in 2021. Fintech mainly invested in the bank's APP construction and technology scenarios. Overall, there is still a lot of room for development in financial technology of small and medium -sized banks.

Among them, Bank of Beijing actively accelerated digital transformation and upgrading in 2021, solidly promoted the implementation of the "211 Project", continued to enhance the ability of scientific and technological agility, enhance the ability of scientific and technological innovation, and focuses on building an enterprise -level business structure system to create a "Shuntian" platform, " A group of key technical bases with independent intellectual property rights such as Yunqi "platform.

Bank of Shanghai disclosed in the 2021 report that in 2021, Bank of Shanghai aims at high -quality development, and fully promote the construction and application of fintech construction, deepen the in -depth integration Resource investment, creating high -efficiency delivery capabilities, and keeping up with cutting -edge technologies such as big data and artificial intelligence, focusing on promoting the construction of financial technology product systems such as business systems and service channels, and empowering the high -quality development of business and improvement of customer service experience. In the semi -annual report of the 2022, Bank of Shanghai mentioned the bank's independently developed and officially launched the "Yaoguang" distributed application development platform. The platform is based on the new generation of micro -service and the cloud native technical architecture system. It is a weapon for rapid improvement of independent research and development capabilities.

In 2021, Nanjing Bank has fully empower customers' marketing, channel construction, product innovation, risk compliance, operational services, performance management and other aspects of financial technology , Constantly improving the company's management efficiency. In terms of intelligence, new technologies such as artificial intelligence and biometrics are used to build smart finance. In the first half of 2022, Bank of Nanjing took the "open bank" and "digital transformation" as the two major directions. It focused on the construction of financial science and technology capabilities. , Digitalization of business and products, management and decision -making. Changsha Bank promoted the innovation of product and mechanism in 2021, accelerated the comprehensive empowerment of science and technology for business development, promoted the continuous and stronger fintech of fintech, and supported the comprehensive upgrade of business online and mobile; Can continue to improve and efficient infrastructure.

In 2021, the Shanghai Farmers and Commercial Bank always focused on the strategic positioning of "firm digital transformation" in terms of fintech, strengthening top -level design and overall arrangements, looking for breakthroughs, deepening external cooperation, promoting close and deep integration of data, technology, and business, advocating digital culture, cultivating cultivation Digital talents, enhance customer service digitalization, business operation digitalization, digital business decision -making, and create the image label of "smart finance, digital banks, quality services". In the first half of 2022, on the basis of the "FOCUS" project, the Shanghai Farmers and Commerce Bank carried out the top -level design of the digital transformation work, established a financial technology governance system for business science and technology integration, and established a rapid response, efficient, and high -quality product research and development system.

In 2021, Dongguan Rural Commercial Bank continued to increase investment in fintech resources, continuously deepened the application of fintech scenarios, and empower business innovation and development.

Guangzhou Rural Commercial Bank has focused on strengthening the improvement of scientific and technological governance capabilities and scientific and technological management capabilities, established top -down information technology management architecture, improved the software research and development system, established the IT architecture management system and management and control mechanism, strengthened science and technology outsourcing management, deepened science and technology and business Integration has effectively improved the independent research and development capabilities and business support capabilities of science and technology. Vigorously promote the implementation of the implementation of scientific and technological planning and the digital transformation of the entire bank, and effectively strengthen the scientific and technological support of business development and management and management.

According to the 2021 report of the Bank of Tianjin, Tianjin Bank Fintech Investment is mainly invested in system development, electronic equipment and software procurement, information technology human resources allocation, information technology consulting and infrastructure construction.

In 2021, Chongqing Bank launched a number of artificial intelligence iterative optimization projects, including improving face recognition, OCR recognition, voice recognition, semantic identification, AI technical performance and accuracy, enhance the blockchain technology application model, complete the C chain financial cloud service platform Technology research and system construction projects.

The Bank of Suzhou will use the "main axis strategy" of digital transformation, establish a fintech innovation center, and establish a joint laboratory with technology companies to accelerate the research and development and application of technologies such as blockchain, artificial intelligence, and the Internet of Things. Digital transformation projects, data labels, account opening process optimization, precision marketing models, RPA robots and other digital applications have initially achieved results.

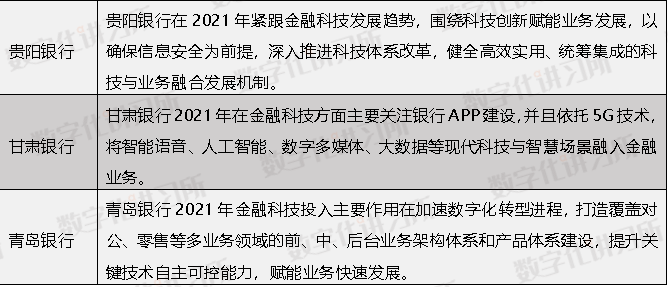

Guiyang Bank followed the development trend of fintech in 2021, focusing on the development of scientific and technological innovation to ensure the development of information security, in -depth promotion of the reform of the scientific and technological system, improved the efficient and practical, coordinated science and technology and business integration development mechanism, and released the Guiyang "Guiyang Bank Co., Ltd. 2021-2025 Information Technology Strategic Plan "continues to promote the implementation of fintech innovation solutions in terms of technology and business integration and digital transformation of business management.

Bank of Gansu mainly focused on the construction of banks in fintech in 2021, and relying on 5G technology to integrate modern technology and smart scenarios such as intelligent voice, artificial intelligence, digital multimedia, big data, etc. into financial business.

Qingdao Bank's main role in fintech in 2021 is to accelerate the digital transformation process, creating the front, middle and background business architecture systems and product system construction covering the multi -business fields such as pairs and retail, to enhance key technology autonomous and controllable capabilities, empower business business, and empower business business. Rapid development.

Table 3: Small and medium bank fintech strategy

Data Source: Company Annual Report, Digital Guyers, Zero One Think Tank

Second, bank fintech investment: proportional to the overall scale of the bank, the growth rate of banks exceeds 50%

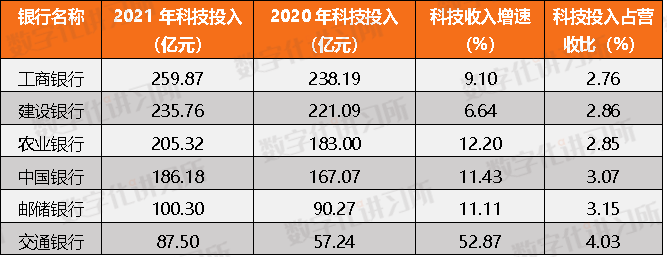

(1) Overview of financial technology input of state -owned banks: ICBC has the most investment, and the largest growth rate of Bank of Communications

As a leader in the banking industry, the investment in the banking industry, the investment in fintech in 2021 also occupied the head position among all banks. Among them, the financial technology investment of Industrial and Commercial Bank of China was mostly invested at 25.987 billion yuan. Compared with 2020, the investment increased by 9.10 year -on -year. %, Accounting for 2.76%of operating income. Followed by the Construction Bank, in 2021, the investment in fintech reached 23.587 billion yuan, the growth rate of fintech was 6.64%, and the operating income ratio was 2.86%. Agricultural Bank of China invested over 20 billion yuan in 2021 to 20.532 billion yuan. Compared with 2020, the investment growth rate of financial technology in Agricultural Bank of China exceeded 10%to 12.20%. Bank of China Fintech investment was 18.618 billion yuan, an increase of 11.43%year -on -year. Compared with the postal savings banks in 2021 and 2020, fintech investment exceeded 10 billion yuan for the first time, and the investment growth rate reached 11.11%. The bank with the largest investment growth rate of fintech is Bank of Communications. The Bank of Communications in 2021 Financial technology investment was 8.75 billion yuan. Compared with last year, the growth rate was 52.87%. The proportion of income also reached 4.03%, ranking first in state -owned banks. Table 4: State -owned Bank of Financial Technology Input situation

Data Source: Company Annual Report, Digital Guyers, Zero One Think Tank

(2) Overview of fintech investment in joint -stock banks: China Merchants Bank has invested more than 10 billion yuan, and Bohai Bank growth rate reached 68.75%

The joint -stock bank is another important banking system in addition to the state -owned banks in my country. In terms of financial technology investment, China Merchants Bank has maintained the most investment in financial technology investment. In 2021, China Merchants Financial Fintech investment reached 13.291 billion yuan, with an investment growth rate of 11.58%, accounting for 4.37%of operating income. Ping An Bank's investment in fintech in 2021 reached 7.383 billion yuan, and the growth rate of fintech investment was not high, only 2.40%. It was the lowest growth rate in joint -stock banks. CITIC Bank's fintech investment was 7.537 billion yuan, and the investment growth rate was 8.82%; Pudong Development Bank, Xingye Bank and Everbright Bank in 2021 also made more than 5 billion, respectively, 6.706 billion yuan, 6.364 billion yuan, and 5.786 billion yuan. Essence Minsheng Bank, Huaxia Bank, Guangfa Bank, and Bohai Bank in 2021 Financial technology investment was 4.507 billion yuan, 3.319 billion yuan, 3.101 billion yuan and 945 million yuan. Secondly, the growth rate of Guangfa Bank's investment was 35.71%, the investment growth rate of Industrial Bank was 30.89%, and the investment growth rate of Minsheng Bank was 21.75%. Except for China Merchants Bank, Ping An Bank and Guangfa Bank, the proportion of financial technology investment in other joint -stock banks accounted for about 3%of operating income.

Table 5: Financial technology investment in joint -stock banks

Data Source: Company Annual Report, Digital Guyers, Zero One Think Tank

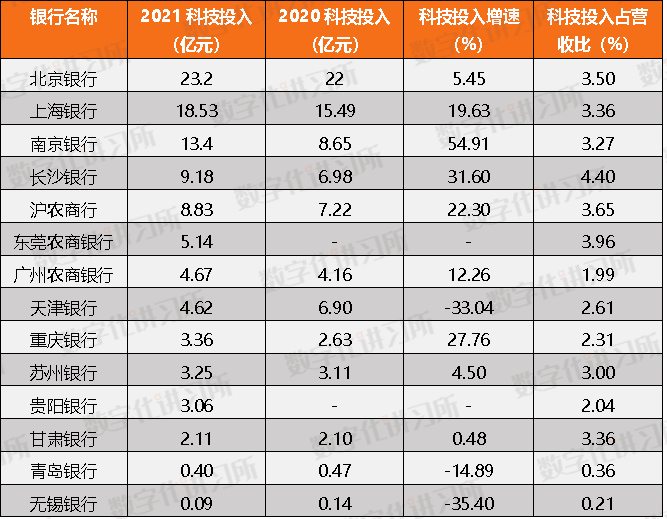

(3) Overview of financial technology investment in small and medium -sized banks: Limited to scale, not much investment in fintech

According to the disclosed scientific and technological investment in small and medium -sized banks, in 2021, the regional economic development status is directly proportional to the financial technology investment of small and medium banks in the region. For 2.32 billion yuan, Bank of Shanghai's fintech investment was 1.853 billion yuan, and Nanjing Bank was 1.34 billion yuan. It was also three banks with financial technology investment of more than 1 billion yuan in small and medium -sized banks. Changsha Bank and Shanghai Farmers and Commercial Bank's fintech investment was close to 1 billion yuan, which were 913 million yuan and 883 million yuan, respectively. The financial technology input of Dongguan Rural Commercial Bank and Guangzhou Rural Commercial Bank varies from 514 million yuan and 467 million yuan, and 5 banks have invested more than 100 million yuan in 2021. Chongqing Bank, Bank of Suzhou, Bank of Guiyang and Bank of Gansu, their financial technology investment is 462 million yuan, 336 million yuan, 325 million yuan, 306 million yuan, and 211 million yuan. The Bank of Qingdao and Wuxi Bank's fintech investment was less than 100 million yuan, which were 40 million yuan and 9 million yuan, respectively. In terms of the proportion of business income in fintech, most small and medium -sized banks account for about 3%, and individual banks account for relatively small. For example, Qingdao Bank and Wuxi Bank account for 0.36%and 0.21%, respectively.

In terms of the growth rate of fintech investment, Nanjing Bank has the largest growth rate, reaching 54.91%; followed by Changsha Bank, with an investment growth rate of 31.60%; Chongqing Bank's investment growth rate is 27.76%; Bank of Shanghai's technology investment has reached 19.63%; The investment growth rate of Guangzhou Rural Commercial Bank was 12.26%, and the growth rates of Bank of Beijing, Bank of Suzhou and Gansu were not 10%, respectively, 5.35%, 4.50%, and 0.48%. The value is Wuxi Bank, Bank of Tianjin, and Qingdao, with the growth rate of scientific and technological investment of -35.40%, -33.04%and -14.89%.

Table 6: Small and medium -sized bank fintech investment situation

Data Source: Company Annual Report, Digital Guyers, Zero One Think Tank

3. Fintech talent construction: the number of ICBCs exceeds 30,000, and Ping An Bank accounts for more than 20%

The development of bank fintech is inseparable from the construction of fintech talents. According to incomplete statistics from the Zero -One think tank and digital lectures, 25 banks disclosed the construction of the fintech talent team in the 2021 annual report. For example, the most proportion of fintech practitioners is Ping An Bank. High education, younger, and compound talent groups have become the backbone of their technology teams, and Ping An Bank organizes "Fintech Certification Learning". Improve all employees' science and technology consciousness and scientific and technological capabilities. ICBC introduced in the semi -annual report of 2022 that it has created a team of fintech professionals through talent projects such as "Science and Technology Elite", "Digital Elite" and "Direct Exchange"; expand. At the same time, increase the training and reserves of network security professionals. In the semi -annual report of the Construction Bank in 2022, it mentioned that it co -established the "Data Analyst" certification project with the University of Hong Kong, co -organized a master's degree in fintech with the Hong Kong University of Science and Technology, and the fintech elite class project with Xi'an Jiaotong University. At the same time, the "CCB -China Industry Financial Technology Elite Class" and "CCB -Guangcai Digital Finance Class" of the “CCB Financial Technology Elite Class”, “CCB -Guangcai Digital Financial Class”, “Smart Bank Management” professional master's degree projects, cultivated fintech talents. China Merchants Bank establishes a fintech talent training system, builds a smooth -collaborative and reasonable talent structure, continuously strengthens the financial technology awareness of employees throughout the bank, and enhances the digital thinking ability of employees of the bank. The latest 2022 semi -annual report released by China Merchants Bank shows that As of the end of June 2022, China Merchants Bank R & D personnel reached 10,392, an increase of 3.48%over the end of 2021, accounting for 10.00%of the total employees. Everbright Bank's scientific and technological personnel increased from 2361 at the end of 2021 to 2598 at the end of June 2022, and scientific and technological talents accounted for 5.11%to 5.69%. Minsheng Bank establishes a different local R & D center to quickly expand the scientific and technological talent team and improve the ability of R & D and delivery. The Bank of Nanjing continues to carry out talent introduction, drives business and technology in deep integration, and promotes the two -way penetration of "IT business, business IT", and set up a branch technology support team at the head office to jointly support and promote the construction of the entire financial technology system. In terms of fintech talent construction, ICBC has the largest number of financial technology practitioners, reaching 35,000, followed by Construction Bank, with 1,5121 employees; Bank of China ranked third with a number of people with a third place with a number of 12,000 people. Ping An Bank's financial technology practitioners accounted for the highest proportion, reaching 22.14%, which means that more than one -fifth of Ping An Bank employees are fintech practitioners. Pudong Development Bank's financial science and technology personnel accounted for 10.64%, and Bank of Shanghai's fintech practitioners accounted for nearly 10%to 9.05%. Agricultural Bank of China has the lowest proportion, only 1.99%.

Table 7: Statistics of bank fintech practitioners (2021)

Source: Company Annual Report, Digital Guyers, Zero 1 Think Tank

Fourth, summary

In 2021, the majority of banks' financial investment in the banks showed a state of growth. State -owned banks occupied the top in the number of fintech investment and the number of financial technology practitioners. Followed by joint -stock banks, joint -stock bank fintech investment exceeds 3 billion yuan except Bohai Yinhai. State -owned Bank and joint -stock banks have clear goals and deployments in both the development of fintech development. The financial technology of these two types of banks is far exceeded that of small and medium -sized banks. Small and medium -sized banks have relatively small investment in fintech. Three bank fintech investment is less than 2020. Small and medium -sized bank financial technology strategies are clearly proportional to investment. Due to scale and regional development, the financial technology construction of small and medium banks does The joint -stock bank is perfect, but many small and medium -sized banks still have certain planning and goals in fintech. In general, the overall fintech investment in the listed bank in 2021 is growing. In the annual report, many banks stated that they will increase their long -term investment in fintech to increase overall competitiveness and promote the long -term development of banks. And from the latest semi -annual report released in 2022, major banks still increase their investment in fintech, and pay more attention to the independent research and development capabilities of fintech. Major banks strive Enhance your competitiveness.

Each bank's attention to fintech also reflects the construction of fintech talents. The banks with the most financial technology practitioners are ICBC, reaching 35,000, and Ping An Bank's fintech practitioners account for the largest proportion at 22.14%. In the 2021 annual report, a number of banks focus on the construction of fintech talents. In the semi -annual report of 2022, a number of banks were published in specific training projects in the construction of fintech talents. Competitiveness in science and technology.

- END -

The newly revised Agricultural Product Quality and Safety Law will be implemented in New Year's Day next year; 215,800 acres of walnuts in Bachu County, Xinjiang will be harvested;

The blue word follows China Well -off Photography/Ning Ying's newly revised newly revised Agricultural Product Quality and Safety Law will be implemented on September 2 next New Year's Day. The Qual...

It is not easy for the summer grain harvest to provide solid support for the stable food production throughout the year

It's not easy to harvest summer grainRecently, a piece of wheat fields in Gaoyu Village, Meihua Town, Shijiazhuang City, Hebei Province ushered in the harvest. Deng Jinghui, a big grain family, has ci...