After the 80s, the employees of the brokerage firms used 133 stocks of their uncle accounts, and the CSRC issued a ticket of 200,000 yuan

Author:Huaxia Times Time:2022.09.07

China Times (chinatimes.net.cn) reporter Chen Feng reporter Qiu Li Beijing report

A fierce operation is as tiger, and the income is still negative.

Recently, the CSRC announced a decision on administrative penalties. Kong Mouyi, an employee of the post -80s securities firms, "borrowed" his uncle's securities account. In the past year, 133 shares were traded crazy, and the cumulative transaction volume was as high as 45.743 million yuan. In the end, the CSRC issued a ticket of 200,000 yuan.

According to regulatory investigations, Kong Mouyi was a securities practitioner during the case, and worked at the Securities Investment Department of the Founder Securities Asset Management Branch to serve as the person in charge of investment manager and rights and interest research.

What is the impact of Kong Mouyi's illegal stocks' punishment for being punished by the other party? The reporter of Huaxia Times contacted the Founder Securities Securities and Secretary Office and the Securities Affairs Department. The relevant staff said: "He is no longer an employee of our company."

Lawyer Ma Jia, a senior partner of Shanghai Randy Law Firm, analyzed the reporter of the Huaxia Times that securities practitioners have information advantages. Due to their job work, they may master the uninterrupted information that general investors can understand and restrict securities practitioners stocks. It is a necessary link to build an open, fair and fair securities market environment.

Brokerage employees traded crazy transactions

It is reported that Kong Mouyi stocks use his uncle's personal account, and the mobile phone number left by the account is Kong Mouyi's mother's mobile phone number. From April 2019 to May 2020, the account traded 133 stocks such as "CITIC Securities" and "Ping An Bank", which bought a total of 22.8856 million yuan in transactions, and sold a total of 22.6887 million yuan, with a total turnover of 4557.43 10,000 yuan. From the perspective of the transaction data alone, in about this year, Kong Mouyi's order transaction was relatively frequent.

Why do securities company employees have been banned from violations of regulations? In an interview with the reporter of the Huaxia Times, lawyer Zhang Shengli, a Beijing Yunding Law Firm, said that there are three reasons: First, the legal concept is weak, the criteria for the identification of illegal stocks do not understand, and the illegal understanding of the illegal stocks is insufficient; the second is to understand the illegal stocks; The pursuit of economic stimulus, blind self -confidence believes that the information advantage obtained through the job must be able to become income through stock trading; third, the individual is lucky and underestimates the professionalism and fineness of my country's capital market supervision.

Attorney Zhang Shengli pointed out that the governance of this adverse phenomenon often requires long -term legal education and institutional compliance self -examination. The promotion of administrative penalties and punishment will help strengthen the sense of responsibility of institutional personnel and also help clean up this adverse phenomenon.

Lawyer Ma Jia analyzed to reporters that the current "Securities Law" has strengthened the punishment of related illegal acts. "The fine" is not heavy.

Finally, the stock speculation loss is 133,000 yuan

However, in the end, the bamboo basket hit the water.

As a senior brokerage asset management investment manager, Kong Mouyi not only did not obtain any profit, but had a cumulative loss of 133,000 yuan. In the end, he was fined 200,000 yuan for illegal trading stocks.

The Securities Regulatory Commission pointed out that as a employee of the securities company, Kong Mouyi used the actual control of and used the "Liu Mingsing" Caixin Securities account for stock trading. It violated the provisions of Article 40, paragraph 1 of the Securities Law, and constituted the " The behavior mentioned in Article 187 of the Securities Law. According to the facts, nature, plot, and social harm of the parties' illegal acts, the CSRC decided to impose a fine of 200,000 yuan on Kong Mouyi.

At present, the official website of the China Securities Industry Association has not been inquired about Kong Mouyi's latest job.

Data show that in March 2020, Kong Mouyi joined the Founder Securities Asset Management Branch. During his tenure in Founder Securities, Kong Mouyi, as an investment manager, has successively managed "Founder Securities Gold Cube's one -year mixed -type collection asset management plan, Founder Securities Gold Harbor held a six -month holding bond collection asset management plan" Only products.

One year after Kong Mouyi joined, in May 2021, Founder Securities issued a fund manager change announcement that Kong Mouyi left the management position of the two products because of "personal reasons". At this time, the final transaction date of the "Liu Mingsing" account of Kong Mouyi, the "Liu Mingning" account, only two months at the last trading date of the account.

Founder Securities earned 1.4 billion yuan in the first half of the year

Despite the frequent news of employees, Founder Securities still handed over a bright semi -annual report.

Affected by the market conditions, the performance of securities firms in the first half of the year encountered "landslides", especially the self -operated business has become the "victory player" for the performance of brokerage. However, Founder Securities' performance in the first half of the year has increased against the market.

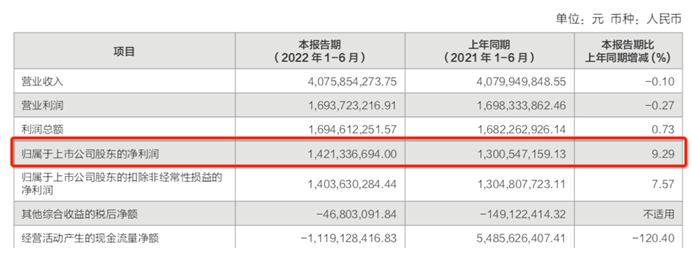

The performance report of the 2022 semi -annual performance shows that Founder Securities achieved operating income of 4.076 billion yuan in the first half of the year, which was basically the same compared with the same period of the previous year; the net profit attributable to shareholders of listed companies was 1.421 billion yuan, an increase of 9.29%year -on -year, a 6 -year high in the same period.

Among them, in terms of fixed income investment, Founder Securities achieved a high -leveraged neutral long -term strategy to achieve revenue of 690 million yuan, an increase of 183.23%over the same period of the previous year. %, Accounting for 51%of the number of ETFs in the Shanghai and Shenzhen Exchange, ranking the top 4 in the industry.

At the performance briefing on August 23, He Yang, secretary of the board of directors of Founder Securities, said that the growth of operating performance in the first half of the year was three main reasons: the first is that the balance sheet was opened, and the allocation income increased significantly;The cycle and the market fluctuate; the third is to adhere to the prudent business philosophy and achieve zero impairment.Editor: Editor Yan Hui: Xia Shencha

- END -

Fusong County, Jilin Province: Green Water Qingshan is stationed in happiness

[Enter the county seat to see development]The long white mountains are endless, and a road winds up in the lush dense forest. On the roadside, there are ginseng land in Dafang Village, Wanliang Town,

Liu Run's public account is a week -a -week, so stay tuned for laughing

The article comes from the diligent calendar