What happened to the RMB exchange rate near the 7 yuan era?Is it "broken 7"?

Author:Peninsula Metropolis Daily Time:2022.09.08

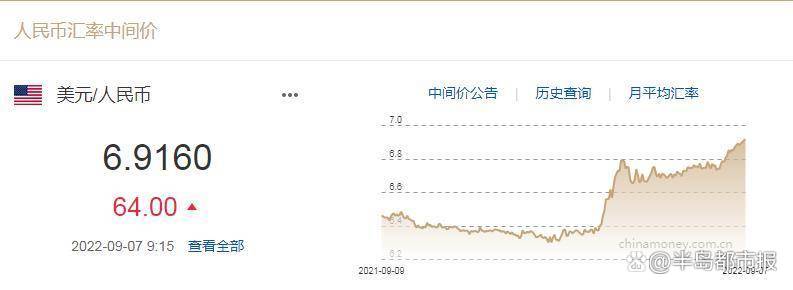

The exchange rate of the RMB to the US dollar is approaching the era of 7 yuan. Whether the renminbi will "break 7" attracts attention.

The People's Bank of China authorized the China Foreign Exchange Trading Center to announce that the intermediate price of the RMB exchange rate of the RMB market in the inter -bank foreign exchange market on September 7, 2022 was: 1 US dollars to RMB 6.9160, which was reduced by 64 basis points from the previous trading day.

In addition, the exchange rate of the US dollar to the US dollar fell below the 6.97 yuan mark, and the offshore RMB's exchange rate against the US dollar fell below the 6.99 yuan mark at a time, close to "breaking 7".

Why does the RMB exchange rate depreciate?

The decline of the RMB exchange rate is affected by various factors, which is mainly related to the adjustment of the US overtime monetary policy.

Data show that the US dollar has appreciated by 14.6%since this year. In the context of the appreciation of the US dollar, other reserve currencies in SDR baskets have depreciated significantly. From January to August, the euro depreciated by 12%, the pound depreciated by 14%, the Japanese yen depreciated the depreciation of the yen. 17%, the renminbi depreciates 8%.

Wang Youxin, a senior researcher at the Bank of China Research Institute, said that due to factors such as the Fed will continue to raise interest rates and the weak euro, the external US dollar index continues to rise, bringing pressure on the RMB exchange rate.

However, compared with other non -US dollar currencies, the depreciation of the RMB is the smallest. Liu Guoqiang, deputy governor of the central bank, stated at a routine blower at the State Council on the 5th that the RMB depreciation is relatively small, and in the SDR basket, it should be said that in addition to the depreciation of the US dollar, the renminbi appreciate Other currencies of SDR baskets are also depreciated. In the SDR currency basket, a basic situation is that the US dollar appreciates and the RMB has also appreciated, but the appreciation of the US dollar appreciation is greater. Therefore, the renminbi did not have a comprehensive depreciation.

A basket of monetary data map.

What is the impact of the depreciation of the renminbi?

Generally speaking, after the depreciation of the renminbi, studying abroad, shopping, etc. will increase costs, while importing will be under pressure, but it is a good good for exports.

According to the data released on the 7th, the General Administration of Customs showed that in the first eight months of this year, the total value of my country's import and export value was 27.3 trillion yuan, an increase of 10.1%over the same period last year. Among them, exported 15.48 trillion yuan, an increase of 14.2%; imports were 1.182 trillion yuan, an increase of 5.2%.

Bai Ming, deputy director of the International Market Research Institute of the Ministry of Commerce, told China Singapore Finance that the depreciation of the local currency will help export enterprises to increase export revenue and increase competitiveness and profitability. However, the depreciation of the RMB exchange rate is also a double -edged sword. Exporting companies increase their income by depreciation of the RMB exchange rate, but if too much imported raw materials and components are used, it is likely to increase expenditure due to the depreciation of the RMB exchange rate.

Wen Bin, chief economist of China Minsheng Bank, told China Singapore Finance that for China's import and export foreign trade enterprises, do not have to gamble the RMB risk management to ensure the normal production and operation of the enterprise.

Is the RMB "broken 7"?

For the future trend of the RMB exchange rate, the current market is generally concerned about whether it will fall below the integer gate of 7.

CITIC Investment pointed out that in the context of the significant enhancement of RMB and the US dollar, the future trend of the RMB exchange rate depends more on the US dollar index. Therefore, the renminbi has depreciated or even "breaking 7" pressure, but the impact of this round of depreciation on capital flow is not strong, and expectations will not be significantly weakened.

Zhong Zhengsheng, chief economist of Ping An Securities, believes that the RMB exchange rate in this round is likely to "break 7". Compared to the US dollar position, the current point of the RMB exchange rate is still significantly strong. However, the point of the RMB exchange rate is not the most important. Whether my country's cross -border capital flow is stable is the essence of the problem. After the two rounds of RMB 7 "in August 2019 and early 2020, the 7th point itself is not easy to cause the so -called super -adjustment.

Liu Guoqiang, deputy governor of the central bank, believes that the trend of the long -term RMB should be clear, and the future world's recognition of the RMB will continue to increase, which is a long -term trend. However, this should be like this in the short term. Both directional fluctuations are normal, with two -way fluctuations, and there will be no "unilateral cities", but the point of the exchange rate is not allowed. Don't bet on a certain point. Reasonable and balanced, basic stability is what we like to hear, we also have the strength to support. I don't think there will be any accidents or an accident.

What if "Break 7" should be seen?

In fact, since the "811" exchange reform in 2015, the RMB exchange rate has appeared "Break 7" in 2019 and 2020.

On August 5, 2019, the relevant person in charge of the People's Bank of China responded to the RMB "breaking 7" that the RMB exchange rate "broke 7". This "7" is not age. It will be thousands of miles through the water; "7" is more like the water level of the reservoir. It is higher in the water period. At the time of the dry period, it will fall again.

Guan Tao, the chief economist of BOC Securities, believes that it should usually look at the wide volatile market of the RMB exchange rate. Now, regardless of the government or the market, the tolerance and adaptability of the two -way fluctuation of exchange rates and broad shocks are greatly enhanced.

From September 15th, the central bank will reduce the two percentage points of the foreign exchange deposit reserve ratio of financial institutions, that is, the foreign exchange deposit reserve ratio will be reduced from the current 8%to 6%.This is the second foreign exchange "reduction" this year.Experts believe that the central bank's move to release positive signals to the market will help stabilize the RMB exchange rate expectations and avoid irrational overruns.(China News Network)

- END -

Customs increase in taxes in the first half of the year

Xinhua News Agency, Beijing, July 16th (Reporter Zou Duowei) The reporter learned ...

The results of the credit evaluation results of Hebei Patent Agency and related patent agents were announced

Recently, the Hebei Provincial Market Supervision Bureau issued a notice announced...