The sales of the core product PD-1 Tripley Mippling will gradually improve the Junshi creature reply 3.969 billion in questioning letters

Author:Daily Economic News Time:2022.06.20

On June 20, the Junshi Bio-U (SH688180, the stock price was 80.37 yuan, and the market value was 73.2 billion yuan) announced the review and inquiry letter of the Shanghai Stock Exchange's schedule of 3.969 billion yuan.

In the review of the inquiry letter, the focus of the Shanghai Stock Exchange required Junshi Bio to supplement the business situation, the fundraising project, the financing scale, and financial investment.

Among them, the core product of PD-1 Tripley Mipide has received the focus of the Shanghai Stock Exchange. Junshi Bio is required to explain the reasons for the decline in the revenue of the product last year, and the company's related considerations of the research and development pipeline layout and research and development investment in key projects Essence

In the reply letter, Junshi Biological also explained the reasons for the decline in sales of the company's core product PD-1 Tripley Mippling in 2021, and said that the impact of related unfavorable factors will gradually decrease. Domestic sales will gradually improve.

It is required to explain the rationality of multiple early R & D pipelines at the same time

At the beginning of March this year, Junshi Bio released the "A -share Stock Plan for Specific Objects in 2022", which plans to raise funds not more than 3.98 billion yuan. It is used for innovative pharmaceutical research and development projects, Shanghai Junshi Biotechnology headquarters and research and development base projects. Compared with the plan, the amount of fundraising was slightly adjusted in the application for the proposal issued on June 20, and the amount of fundraising was slightly adjusted, from no more than 3.98 billion yuan to no more than 3.969 billion yuan.

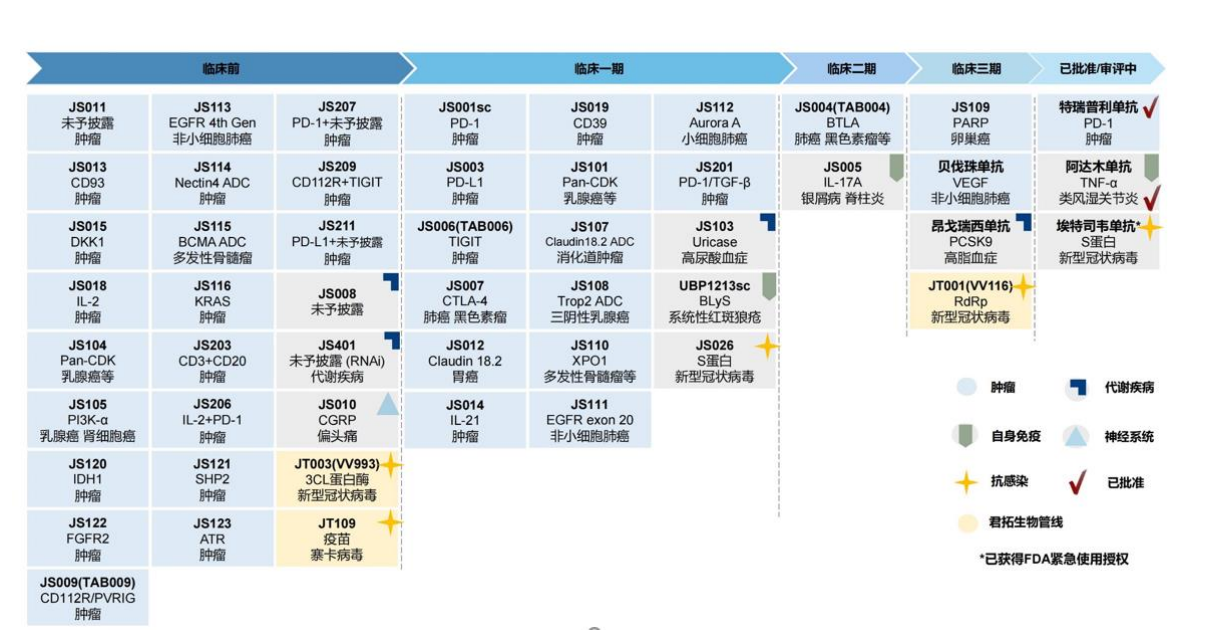

Image source: Screenshot of Junshi Biological Ramping instructions

According to the information disclosed by Junshi Bio, the company intends to use the raised funds of 3.671 billion yuan for the clinical research and preclinical research of innovative drugs. The key pipelines include JS001 (PD-1 Terptari Mippitive) subsequent domestic and overseas clinical research and development, JS004 JS004 (BTLA monoclonal) clinical research and development projects such as domestic and foreign clinical R & D, JS111 (targeted small molecule inhibitors), etc.

Junshi Biological Research Product R & D Progress Picture Source: Junshi Bio inquiry letter

It is worth noting that in these key investment in R & D pipelines, Junshi Biological has planned the international multi -center clinical research for it, and the Shanghai Stock Exchange also requested the company to explain the feasibility and necessity of planning the clinical research of international multi -center.

In response, Junshi Bio responded that the domestic tumor immunotherapy market is increasingly competitive. The European and American markets mainly based on the United States are broad, and there are huge unsatisfactory clinical needs in the global market. It is necessary for the company to seek innovative drug products. " Go to sea. " Junshi Biological also stated that the company planned international multi -center clinical research, and based on this related research, it was relatively stable and economical to apply for drug listing applications to the FDA.

In the review of the inquiry letter, the Shanghai Stock Exchange also focused on the current business status of the Junshi creature "burning money and lack of money": As of the end of the first quarter of 2022, the Junshi creatures have not achieved profitability and the cumulative loss of 4.785 billion yuan has not been made up. At the same time, the company's R & D investment continued to increase. The annual investment cost was 2.069 billion yuan, a year -on -year increase of 16.35%.

The Shanghai Stock Exchange requires Junshi Bio: "Combined with the company's overall consideration of R & D progress, research and development layout, sales of sales after the listing of major products, a huge investment in research projects, and continuous large losses, etc. The reasons and rationality of the early R & D pipeline and the newly added research and development pipelines were added compared to the previous raising projects. "

In response, Junshi Bio responses stated that although high -intensity R & D investment will cause the company to face large losses in the early stage of development, it is the key to maintaining the company's core competitiveness. As more and more research products are approved by the State Drug Administration and FDA, the company will obtain benefits. Other listed companies in the same industry, such as Baiji Shenzhou, and Cinda Bio, have maintained high -intensity R & D investment in multiple R & D pipelines without continued large losses. If the company fails to plan a number of early R & D pipelines in advance and enrich the company's depth and breadth of the product pipeline, it will lead to gradually falling into the wind in the domestic innovative pharmaceutical industry market competition.

The fundraising funds will still be focused on PD-1

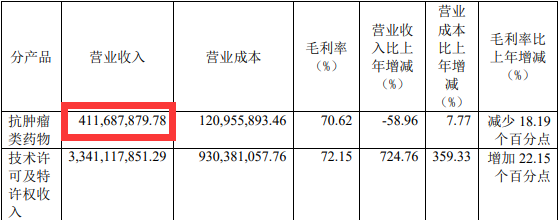

As the only drug that is currently approved by Junshi Bio, the PD-1 Tripley Midtoids last year's operating income of 412 million yuan, a year-on-year decrease of 58.96%, and a decrease of nearly 600 million yuan from 1003 billion yuan in 2020. This is also this. Tripley Mipide has the lowest annual sales since the end of 2018.

Picture source: Junshi Biological Annual Report

Junshi creatures attributed Tripley's resilience to the impact of three factors. One is that Tripley Mippling reduced the price by more than 60%after entering the medical insurance; Several rounds of adjustments have been carried out; the third is that the domestic market PD-1 product commercialization competition is becoming increasingly fierce.

The phenomenon of the decline in the core product income of Tripley Mipide has also received the focus of the Shanghai Stock Exchange. Junshi Bio is required to "combine the factors that cause the Treepley Meticuke's revenue in 2021 to analyze whether the income of related product revenue continues to continue Downward trend".

In the announcement, Junshi Biological disclosed that in the first quarter of 2022, the company's Tripley's sales revenue increased by 211.69%from the fourth quarter of 2021, an increase of 34.05%in the first quarter of 2021. The sales activities in the domestic market gradually came out of the trough. In response to the future sales income trend of Tripley monoclonal anti-anti-resistance, Junshi Bio said that under the background of the PD-1 market scale year by year, with the gradual stability of the company's commercial team, Tripley Monopoly continued to be included in national medical insurance The price reduction of the directory has slowed significantly compared with the initial income, and more large indications in the future complete the phase III registered clinical research and enter the stage of commercialization. The situation has gradually improved. The announcement shows that Junshi Biological intends to use 860 million yuan of funds to invest in JS001 (PD-1 Tripley Mippling) subsequent domestic and overseas clinical research and development. From the perspective of the investment in raised funds One of the R & D pipelines of Junshi Biological Investment.

In the inquiry letter, the Shanghai Stock Exchange also requested Junshi Biological description to the company's relevant considerations of the layout of R & D pipelines and research and development investment in key projects. In this regard, Junshi Biological believes that, given that PD-1 monoclonal antibody is the cornerstone drugs for tumor immunotherapy, the strategy of the company's layout of the research and development pipeline of other anti-tumor products is mainly large-molecular drugs centered on Tropley Miproke as the center as the center , Supplemented by small molecular drugs, actively explore joint medications in order to achieve the effect of synergistic anti -tumor.

First of all, in order to solve the problem of drug resistance after PD-1 treatment, the company actively explores a combined treatment strategy based on the characteristics of patients' immunohissenal environment, such as the company's research products JS004, JS006, JS009 and other joint Treepley monoclonal treatment.

Secondly, in order to solve the problem of cold tumors in tumor immunotherapy, the company has developed multiple items for the normalization of immune microcirculation microcirculation blood vessels, such as JS013, JS019 and other products that target micro -vascular microvascular high -blood vessels.

Third, in order to solve the source of tumor immunotherapy, that is, many patients lack or have less tumor -specific T cells and cannot respond to immunotherapy. In this regard, JS014, JS018 and other products in the company's pipelines can activate T cells from the source. JS014 has a good synergistic effect with Tripley Mippling, which can increase lymphocyte infiltration in tumor microenvironment.

Daily Economic News

- END -

The Federal Reserve's fierce interest rate hike "Domino effect": European and American stocks encountered vacant tide, the yen was sniped

21st Century Business Herald reporter Chen Zhi Shanghai reportAfter the Fed's significant interest rate hike 75 basis points caused the economic recession to worry about heating up, hedge funds once a...

"Number" read the local economy: the potential in stress

In May, Jiangsu Province's industrial investment increased by 12.0%year -on -year, higher than 0.9 percentage points nationwide; Shandong Province's Four New economic investment increased by 16.8%,...