New Economy Ten Years | Interview with Liu Bo, Vice President of Xinwang Bank: Technical change profoundly affects the bank's business model

Author:Zhongxin Jingwei Time:2022.09.09

Editor's note: The boundary between the new economy and the traditional industry is gradually abundant. In the past ten years, how does new economic companies build new game rules? How can traditional industries be transformed by new economy? What new tracks and new air outlets will emerge in the future? Zhongxin Jingwei launched a special report of the "Ten Years of the New Economy" to record the typical stories of the new economy and new formats, in order to reflect the magnificent journey of China's economic transformation and development.

Liu Bo, deputy governor and chief operating officer of Xinwang Bank, confessed

Zhongxin Jingwei, September 9th (Wei Wei) When talking about banks, many people think of some large state -owned banks. In recent years, private banks have begun to emerge, especially digital banks in private banks. They have Internet genes in congenia, and mainly serve the majority of small and medium -sized enterprises, becoming a force that supports the real economy.

Among them, Xinwang Bank was established on December 28, 2016. It is the seventh private bank in the country and a new generation of digital native banks. "New Network Bank itself is also the product of the new technology and new era. At the same time, the transformation of technology also profoundly affects the bank's business model." When talking about the changes brought about by the new economy to commercial banks, the Deputy Governor and Governor of the Xinwang Bank and the Vice President of the Bank of China Bank Chief operating officer Liu Bo said to Zhongxin Jingwei.

From the birth of the new network bank, it has its own Internet genes and rely on digital technology to provide customers with full -time, all -time, and full -time financial services for customers across the country. Xinwang Bank not only represents the new economic forces in commercial banks, but also provides differentiated and customized financial services for the vast new economic format.

The new economy deeply changes the business model of commercial banks

"New Economy" is one of the keywords for China's high -quality development over the past decade. Liu Bo said that the new economy first appeared around 1996 and mainly included new economic formats that have spawned information technology and system innovation. From the general understanding of the public, the Internet of Things, the Internet, and artificial intelligence are considered a representative form of the new economy. The rise of new formats has gradually become a new economy, and it is also an important part of the current economy.

For the new economic format, what challenges and opportunities are faced with financial institutions? In Liu Bo's view, the use of the original model and method may not meet the rapid and convenient service needs of new economic enterprises. From the perspective of the risk prevention and control measures of mainstream commercial banks, it may not be fully matched. "It is the emergence of new formats and new models that a new bank like Xinwang Bank can embrace such opportunities and get a wider market." Liu Bo said.

From another perspective, Liu Bo pointed out that the new network bank itself is also the product of the new technology and new era. At the same time, the transformation of technology also profoundly affects the bank's business model. Zhongxin Jingwei noticed that Xinwang Bank had been selected as "the key cultivation enterprise in Chengdu New Economy in 2020".

Liu Bo said that thanks to the improvement of the efficiency brought about by technological changes, the number of lending pens of Xinwang Bank in the first half of this year exceeded 30 million, and the number of loans per month is about 5 million. It is difficult to achieve. Even if it is achieved, the cost will be very high. It is precisely because of the breakthrough of technology that the cost of risk decision -making and a large amount of computing and storage of risk decision -making involved in these more than 30 million strokes has been greatly reduced.

Based on big data and positioning technology, commercial banks can also understand customers more accurately. "With the customer's initiative to provide authorization information, banks can know whether the customer is working stably every day in a company or his company is operating stably, and the technical generating data can be used as a means of risk prevention and control." Liu Bo said.

It is understood that technology has become the core driving force for new network bank big data intelligent risk control and financial open platform operation. It also lays economic feasibility and technology for reducing financing thresholds, improving financing efficiency, reducing financing costs, and providing inclusive financial services feasibility.

At the same time, he also mentioned that the processing of data also affects the business form and model of commercial banks. Through big data analysis, the Bank of New Network found that in the areas of immune, customers' financial demand activity often tends to rise.

For example, during the epidemic in Shanghai, Xi'an, Chengdu and other places, corporate operators need to pay wages for employees, but they cannot handle their business at the bank cabinet. Through the support of new technologies, banks can use online ways to enable customers to enjoy online. At financial services, the proportion of new online banking business is closer to 100%. Xinwang Bank through "good people's loan", "good commercial loan", "good enterprise E loan" and other "non -contact" online financial services to help the new citizens of the "contact" service industry resisting. In the first half of this year 40 billion yuan.

Data show that as of the end of June 2022, in terms of digital credit, anti -fraud, big data applications, etc., Xinwang Bank has submitted over 430 technical patent applications, with more than 120 approved, and the patent application volume and batch are all positions. Standing in the forefront of my country's banking industry. "In fact, the new economy is really technology, so New Network Bank is constantly practicing in this regard." Liu Bo said.

Differentiated competition advantages support the development of new economic entities

As a beneficial supplement for private banks, as a mainstream commercial bank, it is one of the tasks that to cover the areas that the mainstream commercial banks may not be able to cover and provide financial support for the new economic format.

In Liu Bo's opinion, the main business direction of state -owned banks and shares is mainly based on large -scale public enterprises, which also played the role of its cockpit stones and is the main force of the base. But overall, there are still a large number of small and micro enterprises and terminal retail financial demand have not been fully met. "Xinwang Bank has its own exploration in this regard. At present, it can be used to expand the market through technical models and commonly developing customers." Liu Bo said that state -owned banks and shareholders serve the aorta. Private banks serve capillaries. There are more cooperation than competition.

In addition to the Bank of China Bank, the city commercial bank is also a force to support local financial services. Liu Bo believes that city commercial banks have been deeply cultivated in the local area. It has been operating in the local area for many years, and has more innate advantages, but most of them can only exhibit the industry through offline ways. The new network bank can serve nationwide. Relatively speaking, the development path of the two is different.

When it comes to differentiated competition advantages, Liu Bo pointed out that in the first time, in serving the new economic environment, the new economic entities emphasize the national integrated market. In particular, the entity of the enterprise may be established in a city, but it can radiate the country and its dealers. , Suppliers and consumers all come from all over the country. Xinwang Bank can provide enterprises with integrated solutions, which can provide enterprise dealers, suppliers, and consumers, including full -link financial services.

Secondly, Liu Bo mentioned that the advantage of Xinwang Bank is that the product is more suitable for customer reality. He uses the "borrowing and repayment" to public loan products. "For the banking industry, it is still very difficult to follow, especially the small and micro enterprises, and all products of Xinwang Bank can basically be borrowed. Also, this is in line with the operating characteristics of small and micro enterprises. "Liu Bo explained that enterprises are not lacking money every moment, and they may borrow a sum of money to sell the loan. At present, many banks on the market are not allowed to allow customers to allow customers With the borrowing and repayment, the actual demand for the customer's use is only one month, but it has to be loaned for one year, and it needs to pay a year's loan interest.

Liu Bo introduced that the average loan cycle of Xinwang Bank was only about 70 days, and the customer returned to the bank immediately after the weekly turn. Calculated because the actual interest time is short, it is more cost -effective for customers.

In the end, Liu Bo pointed out that the service response of Xinwang Bank's service response is fast. You only need to apply online. After the customer authorizes and fills in the relevant materials, the average review can be released for 20 seconds, saving the cost of time for customers, and it is in line with the new economic entity. Requirements for service response speed.

Recently, affected by the epidemic, some small and micro enterprises in Chengdu are facing the pressure of capital turnover. Mr. Xu is the owner of an exhibition company. In early August, a art exhibition he was in charge of preparation had to be postponed. At the end of August, he found that he had a credit limit of more than 100,000 yuan in the "Good Enterprise E Loan" at Xinwang Bank, and he paid 50,000 yuan to the workers in time. Since the end of last year, he has used the "Good Enterprise E loan" of Xinwang Bank seven times.

Provide customized products for different formats

What are the difficulties in serving the new economy format? Liu Bo admits that one of the difficulties is that the breadth of the data sample is large, and the depth of time is insufficient. "In the long river of time, these new economic formats have not experienced a complete economic cycle. When judging it, we need to hold a cautious attitude. We are confident to do this, which requires longer time dimensions to verify. "Liu Bo said.

Specifically, the New Network Bank provides customized products for different new economic formats, and judges the situation of the enterprise in multiple dimensions.

According to Liu Bo, new economic enterprises or technology -based enterprises have unstable revenue and not many fixed assets. Therefore, Xinwang Bank will use multiple dimensions to portraits the enterprise.

"When the user authorizes the data to the bank, the bank will inquire about the data, and the background robot will portrays customers. Each customer will distinguish multiple models. The situation, etc. For everyone's credit quota and pricing, it is basically a customized product of one household. "Liu Bo said.

For example, Liu Bo said that there are two types of customized products launched by the New Economy entities: First, the green credit products for green energy -saving enterprises, such as new energy battery companies, electric vehicle companies, etc. Higher and interest rates also have corresponding discounts; the second is to cooperate with the science and technology enterprise, the new network bank and the government and investment institutions, through the list of enterprises screened by the two, and then based on some information of the investment companies, the batches of design model matching match The status quo of the enterprise and adopt a customized business strategy.

Talking about the business strategy of New Wanxin Bank for science and technology innovation enterprises, Liu Bo said that in the early stage, it could provide low -interest loans to science and technology enterprises. At the same time, after agreed with the enterprise to be listed, its main account will be opened in Xinwang Bank. In this way, the service of Xinwang Bank in the upstream and downstream of the company can also be extended, and the bank's deposit will be improved, which is also one of the innovations of Xinwang Bank.

Due to the short time of the new economy, what measures should commercial banks take their risk prevention? Liu Bo believes that regarding the new economic format, no banks can ensure that there are thousands of risk prevention, and the subsequent development of a new economic subject also has uncertainty.

Liu Bo pointed out that Xinwang Bank has three advantages in risk management. First of all, the number of samples is large. For example, the number of loans of new loans of Xinwang Bank is about 5 million, of which the number of small and micro -customer loan lending strokes can reach hundreds of thousandsPen.The accumulation of samples makes the Xinwang Bank's grasp of risk control more accurate; secondly, the choice is large. Due to the large number of customers, you can choose to comprehensively evaluate better customers for service. This brings cautious confidence to risk judgment.And space; Finally, long -term business business, this is the concept of the bank's management team."We have to run for a long time. We need to be more awe of risks and pursue development steadily." Liu Bo said.At the same time, he emphasized that during the epidemic, New Network Bank's cautious principles were issued as much as possible to escort the steady operation of the real economy.(For more reports, please contact Wei Wei, the author of this article: [email protected]) (Zhongxin Jingwei APP)

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

Fu Anna: Clarifying market rumors about the overdue payment of CITIC Securities' fixed income wealth management products

Every time AI News, Fu Anna (SZ 002327, closing price: 7.06 yuan) issued an announ...

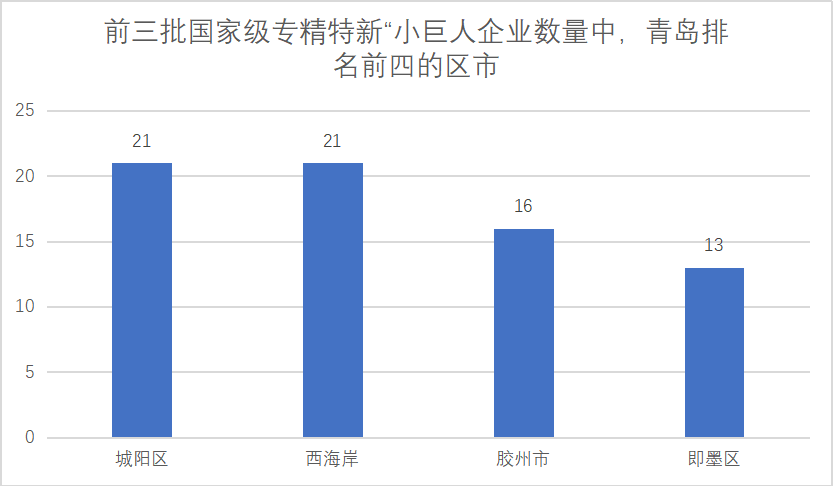

Specialty in the capital tide | "Specialized Specialty New" the eighth city of the country, revealing the "practice secrets" in Qingdao

Fengkou Finance Reporter Bai JuIf the quantity and quality of listed companies bec...