Henan Province has issued 14.5 million yuan in "Stable Foreign Trade" fiscal and financial policy awards

Author:Dahe Cai Cube Time:2022.06.20

[Dahecai Cube News] According to the Henan Provincial Department of Finance, recently, the provincial finance has issued 14.5 million yuan in funds for the "Stable Foreign Trade" fiscal and financial policy in 2022 to set up a "export tax refund fund pool", "foreign trade loan" and the actual operating effect. Good Nanyang, Anyang and other places are rewarded, supporting the effective reduction of operating costs of foreign economic and trade enterprises, and promoting the development of the foreign trade industry.

Establish an export tax refund fund pool

Due to the slow export tax refund and long cycle, corporate funds have to be used separately. In response to this issue, the provincial finance encourages cities to set up a foreign trade export tax refund fund pool with a public service nature guided by fiscal funds. Before the tax refund procedures are completed, the enterprise prepaid funds to solve the problem of corporate funds, and at the same time use banking wind Control the system to ensure the security of financial funds. Provincial finances are given no more than 30%of rewards in accordance with the financial investment funds of the provincial municipality and combined with the actual annualized utilization rate. As of now, a total of 9 provinces have set up tax refund funds, which has issued 395 million yuan in tax refund weeks and 63 beneficiary companies.

Nanyang is a large agricultural city. The export of agricultural products involved in the city accounted for 56%of the city's exports. The export tax refund cycle has become a "block tiger" for the development of agricultural export enterprises. In order to help enterprises shorten the export tax refund cycle and accelerate the flow of funds, Nanyang City's first export tax refund weekly capital pond in the province will be invested by the municipal financial capital of 35 million yuan to entrust Nanyang Industrial Investment Group Co., Ltd. to manage and operate. Household management and special funds. "In order to provide more efficient and convenient business services, we have developed an online business processing system. In the past, the agricultural and foreign trade enterprises were involved in the agricultural and foreign trade enterprises as soon as possible. The turnover has entered the corporate account, and it can even be available on the day of the application, which greatly alleviates the pressure of corporate funds. "On June 15, Zhang Yang, general manager of Nanyang Industrial Investment Group's risk control audit department.

For more than two years, a total of 37 foreign trade enterprises have handled the 713 tax refund weekly transfer business, issued 270 million yuan in tax refund weeks, involving export value of 3.63 billion yuan, effectively driving the stable development of Nanyang's foreign trade. For enterprises to open up the international market, the Municipal Commerce Bureau actively reduced the damages of more than 100 million yuan in defaults. Since the beginning of this year, a total of 13 agricultural export enterprises have handled 75 tax refund weeks, and the tax refund weekly was 42.87 million yuan, involving the value of the goods 600 million yuan.

Qiao Ying, general manager of Nanyang Jingtang Agricultural Technology Co., Ltd., said, "We have accumulated a total of 20.58 million yuan in turnover, solving the company's capital pressure, especially during the period of difficulty in the epidemic. The export volume in 2021 has increased by nearly 50%. "

"Foreign Trade Loan" is urgent

Our province's foreign trade export enterprises are "more, small, scattered, and weak". Some companies are "dare not pick up, and they are unable to connect." In order to solve the problem of financing, the provincial finance encourages provinces to set up foreign trade credit reserves, choose to determine the "foreign trade loan" cooperative financial institutions, and use financial funds to invest in leverage financial capital. The principle of establishing a loan loss for foreign trade enterprises will be established, and cooperative banks will guide cooperative banks to reduce the requirements for pledge of physical assets of small and medium -sized enterprises in foreign trade, expand the scale of trade financing scale such as export credit insurance policies, pledge of export tax refund accounts, accounts receivables, and export orders. Provincial finances are given no more than 30%of one -time rewards in accordance with the actual loan scale and leverage in accordance with the actual loan scale and leverage.

As of now, there have been "foreign trade loans" in 6 provinces, 436 million yuan in loans, and 112 beneficiary companies. Provincial finances arranged 25.5 million yuan from special funds for foreign economic and trade development to reward Nanyang, Anyang, Hebi and other places with good actual operating conditions.

In accordance with the principles of "government guidance, market operation, professional management, and risk sharing", the municipal finance raises 15 million yuan. The Economic Development Group Co., Ltd. is responsible for specific undertaking. The specific loan business has enlarged the funds injected by the municipal finance by more than 10 times, and the export value of the previous year is less than 60 million yuan (inclusive), the production and operation is stable, the bank's credit is better, and the foreign trade enterprise with foreign trade orders will issue loans. As of May 2022, the three banks had a total of 67 banks, with a total amount of 116.665 million yuan. As a result, 32 companies in the city made a profitable role in escorting the steady development of Anyang's foreign trade enterprises.

Affected by the epidemic of Henan Le Shu Electronic Commerce Co., Ltd., it is difficult to find a container, and the company's mobile funds are tight. Through the Policy preaching of the Anyang Commercial Bureau, a total of 797,000 yuan was successfully applied for a total of 797,000 yuan, which increased the liquidity of funds and promoted the normal production and operation of the enterprise. In 2021, the company's export volume increased by about 50%year -on -year. "This order is very important for us. At that time, the corporate funds were in difficulties. When we were in an unprepared exhibition, the business department introduced us to the new 'foreign trade loan' policy launched in our city. The interest is low, the procedures are simple, and the loan is also very fast. It solves the problem of our capital turnover in time. "The company's staff introduced.

In the next step, the provincial finance will continue to increase its work with relevant departments, gradually reduce the threshold for policy enjoyment, expand the scope of beneficiary enterprises, guide financial institutions to optimize supporting product design, and adapt to the diversification of foreign trade enterprises "a large number of small amounts and small turnover".2. Personalized financial needs, reduce the condition of loan physical assets, and expand the scale of financing credit scale such as foreign trade orders, export credit insurance policies, pledge of export tax refund accounts, and accounts receivables.Responsible editor: Chen Yuyao | Review: Li Zhen | Director: Wan Junwei

- END -

Let the financial "live water" benefit more local financial regulatory bureaus of the mark

Finance is the blood of the real economy. Among the latest 50 articles in our province, there are a lot of content involving the financial sector. On the 12th, Wang Zhanbei, a member of the Party Gr

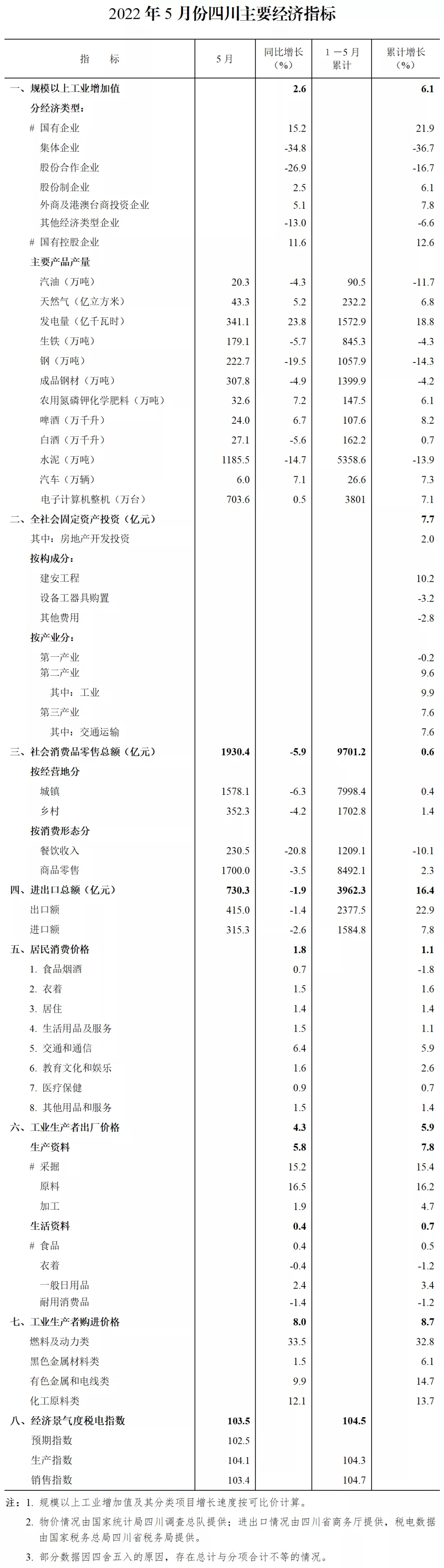

From January to May, the added value of the Sichuan regulations increased by 6.1% year-on-year

Cover reporter Xiong YingyingOn June 16, the Sichuan Provincial Bureau of Statisti...