Hyaluronic acid "Freedom of Making Rich" is now turning off. Where is the next explosion?

Author:Poster news Time:2022.09.09

Zhongxin Jingwei, September 9th (Lin Yisi) Recently, hyaluronic acid head companies, beautiful guests, Huaxi Biological and Hao Haishengke have surrendered the transcripts in the first half of this year. Facing different challenges. At the same time, with the "rich myth" hyaluronic acid or now turning off, on the medical aesthetic track, the giants have different ideas, and the industry's trend is also changing quietly.

Performance differentiation giants have their own troubles

Rough comparison, Huaxi Biological's revenue is 3 lovers and 3 Hao Haishengke; but from the perspective of net profit, Huaxi creatures are slightly inferior to beauty guests, but the net profit of the two is at least Hao. Six times of Haishengke. It is not difficult to find that Hao Haishengke has been thrown behind two other companies.

On August 26, Hao Haishengke disclosed that the 2022 interim report showed that the company's net profit in the first half of the year fell nearly 70 % year -on -year.

Unlike Huaxi Bio and Aimei, in recent years, Hao Haishengke has expanded the industrial line through a series of mergers and acquisitions. Medical beauty is only one of many of its business sectors. The sequelae of frequent mergers and acquisitions have been reflected. In the first half of this year, Hao Haisheng's American subsidiary Aaren and the original domestic dealer's distributors stopped.

In addition to the impact on performance on performance, Hao Haisheng also listed many reasons: the impact of the epidemic factors in Shanghai from March to May, and the loss of gross profit brought by Hao Haishengke has a loss of more than 90 million yuan; In addition, the equity incentive plan has been implemented, and the company and subsidiary Ou Huamei science have confirmed that the share payment fee is about 14.87 million yuan and other factors.

It is worth noting that as of the end of June this year, Hao Haisheng's book still has 412 million yuan in goodwill.

In contrast to Hao Hai Shengke, the net profit of Huaxi Biological and Beauty Guests still increased by more than 30%at the same time. However, although the two giants' performance is bright, each has its own "troubles."

Huaxi Bio said in the interim report that the growth of operating income was inseparable from the sales revenue of functional skin care products by 77.17%year -on -year, and the raw material business increased by 10.97%year -on -year. The net profit attributable to the owner of the parent company increased by 31.25%, mainly due to the year -on -year increase in operating income.

In recent years, Huaxi Bio has continuously deployed the C -end market, forming a "raw material+terminal+skin care+food" pattern, and functional skin care products have become its main source of income. In the first half of 2022, the functional skin care business achieved revenue of 2.127 billion yuan, accounting for 72.46%of the main business income.

At present, Huaxi Biomotinal Skin Care has a brand such as moon and skin care, Quadi, which is the main frozen age, and Mibel, which is the best skin care, and BM muscle living with new fermented ingredients.

However, in the first half of 2022, the net profit margin of Huaxi Bio was only 16.12%, and it fell year by year. In the first half of 2021 and 2020, the indicators still reached 18.64%and 28.19%.

In income growth, due to functional skin care products, the decline in net interest rates is also inseparable from functional skin care products.

In the semi -annual report of 2022, Huaxi Biological admitted that due to the continued proportion of functional skin care business income to the company's overall business income, the company increased strategic investment in brand building, channel construction, and key talents. Improve to a certain extent. Although the company will actively introduce a series of measures to strengthen rate control, the net profit margin of the company's overall business may still decline.

Different from Huaxi Bio, Aimei focuses on medical and beauty injection products. It is an enterprise with the largest number of medical equipment for non -surgical medical cosmetics III medical devices.

At present, the beauty -type skin fillers that Aimei has been listed and approved is divided into gels and solution injection products. In recent years, it has launched Hi -style, Angels, Levle, Pokonida and other products. Fill in the dermis layer.

However, from the perspective of revenue and net profit growth, the performance of beauty guests in the first half of this year is far less than the same period last year. In the first half of this year, the growth rate of operating income of Aimei fell sharply from 161.87%in the same period last year to 39.70%. From the perspective of the product, Amei -Meike's solution and gel -type injection products achieved revenue of 643 million yuan and 237 million yuan, respectively. Among them, the operating income of solution injection products increased by 35.12%over the same period last year. The growth rate is very different.

Regarding performance fluctuations, Aimei said that the continuous and repeated epidemic situation in various places has brought a serious impact on offline consumption scenarios, especially first -tier cities with high sales revenue of the company, which have been stricter and long -term control. Facing large operating pressure.

In the first half of this year, the growth rate of net profit in Aimei also dropped sharply. The semi -annual report disclosed that the net profit attributable to shareholders of listed companies was only 38.90%year -on -year. During the same period last year, the net profit attributable to shareholders of listed companies increased by 188.86%year -on -year.

From the perspective of the secondary market, Wind data shows that since this year, Hao Haishengke's stock price has fallen 40.81%, Huaxi Biological has fallen 8.42%, and Aimei has risen by 1.97%. Less than two years before landing in A shares, Aimei went to Hong Kong stocks again to seek the listing of "A+H" stocks.

High gross profit margin, high sales expenses

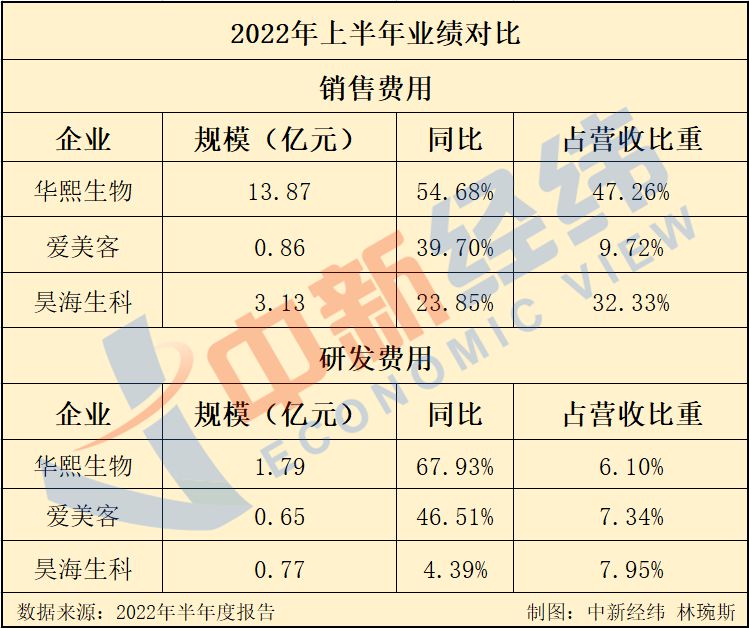

In the first half of 2022, the sales costs of Aimei and Hao Haishengke were not as good as one -third of Huaxi creatures. The research and development costs of the three companies accounted for not more than 10%of operating income. Zhongxin Jingwei found that Huaxi biological sales expenses accounted for nearly half of the operating income, of which more than half of the costs were online promotion service fees. However, in the first half of 2022, even if the growth rate of Huaxi biological research and development costs kept up with sales costs, even exceeding the sales cost, the sales cost during the reporting period was still 7.75 times the cost of R & D.

Huaxi Bio emphasized that the main reason for the increase in sales costs is that the company's sales scale continues to grow, and the expansion of sales teams has led to an increase of employees' salary year -on -year. In addition, the company vigorously develops online sales channels, and online promotion costs and advertising costs have increased significantly. The increase in R & D expenses is mainly due to the research and development of new products and new products in new areas, and the introduction of R & D talents, and cooperation with various universities and scientific research institutions.

However, in the past two years, the expensive expenses of high sales expenses have not been exchanged for the growth of Huaxi biological gross profit margin.

Zhongxin Jingwei combed and found that from 2019 to 2021, the sales costs of Huaxi Biological reached 521 million yuan, 1.099 billion yuan, and 2.436 billion yuan, respectively, an increase of 83.74%, 110.84%, and 121.62%year -on -year.

In the first half of 2022, the comprehensive gross profit margin of Huaxi Bio was only 77.43%, which was basically the same as 77.88%in the first half of last year. According to the financial report, from 2019 to 2021, the comprehensive gross profit margin of Huaxi Biological reached 79.66%, 81.41%, and 78.07%, respectively.

In contrast, although the sales costs of Aimei and Hao Haishengke have also increased year -on -year, they are far less generous than Huaxi creatures.

Although Aimei did not disclose the comprehensive gross profit margin in the semi -annual report, it can be seen from the gross profit margin of the company's products. In the first half of the year, the gross profit margin of gel -type injection products was as high as 96.05%, and the gross profit margin of solution injection products reached 94.07%.

It is worth noting that the gross profit margins of these two types of products have reached a new high in the first half of the year, and they once again love the title of "Medicine Meimao". According to the prospectus of Aimei Hong Kong stocks, from 2018 to 2021, the gross profit margin of gel injection products increased from 87.1%to 94.3%, and the gross profit margin of solution injection products increased from 88.3%to 93.4%.

From 2018 to 2021, the gross profit margin of Beauty was 87.2%, 91.7%, 91.4%, and 93.3%.

The beauty guest explained in the prospectus submitted by the Hong Kong Stock Exchange that the rising gross profit margin is mainly due to the (product) maintaining the ability to control the price and effective cost control. In addition, since 2019, the value -added tax rate for company skin fillers products has fallen to 3.0%. During the trading record, the business scale of other products of Bemeike is small, so the gross profit margin of a single or several other products may lead to fluctuations in the overall profit level of other products.

In the first half of this year, the overall gross profit margin of Haohai Shengke was 69.84%, a decrease of 4.69 percentage points compared with 74.53%in the same period last year. In the semi -annual report, Hao Haishengke explained that of which, the subordinate subsidiaries Ou Huamei and Nanpeng Optics both lowered Hao Haisheng's gross profit margin level.

It is understood that EndyMed, a subsidiary of Eu Waimei subsidiaries, focuses on radio frequency beauty equipment, Radi Kobe Optoelectronics focuses on laser beauty equipment, and its products are mainly exported to overseas markets.

While the gross profit margin decreased, Hao Haisheng's expenses were still decreasing. In the first half of this year, the company's sales costs increased by 23.85%year -on -year to 313 million yuan, and the management costs increased by 98.15%to 215 million yuan, the growth rate exceeded the current revenue growth rate. R & D expenses were 76.713 million yuan, an increase of only 4.39%year -on -year, far lower than the growth rate of revenue during the same period.

Where is the next explosion?

None of the three companies are not satisfied with the "king" of hyaluronic acid. Their ambitions are no longer limited to this. They are expanding opportunities other than injection of hyaluronic acid products, but they are only twisted in the process of entering the new field.

In May of this year, the beauty guest, which is still known as the "Moutai of the Medical and Beauty Circle", and the Korean botulinum leading company Huons Biopharma Co., LTD. Huons BIO's botulinum products, and as the only legal dealer specified in the latter's only legal dealer in the agreed distribution area (referred to as China), it imports and distributes. In June last year, Aimei has made capital increase and acquisition of some equity on the company.

At present, the injection developed by Aimei is in the clinical stage. This product that is suitable for moderate to severe frowning stripes is currently completed.

In addition, the project of Aimei entering the clinical and registration procedures is also favorable for the "weight loss needle". The project has currently completed phase I clinical trials.

As early as 2020, Aimei stated that slimming and weight management is one of the main projects of non -surgical medical cosmetology, and it is also an important business direction for the company to focus on the core main business and plan a strategic layout.

It is understood that the Licula peptide injection was initially treated with type II diabetes, which can be injected by the patient by themselves. Aimei disclosed that the clinical use of Licula-peptide injection is chronic weight management. The research and development product of this project is GLP-1 analog. It has significant effects in treating obesity and can meet the needs of fatigue and weight loss. Institutions, medical beauty institutions, etc. can be widely used. Zhao Yan, the chairman of Huaxi Bio, said more than once in public, "We are not only hyaluronic acid companies, but also hyaluronic acid is just our basic disk."

According to the prospectus disclosed by Aimei in June this year, the Ferrisan report shows that the average price of hyaluronic acid raw materials has gradually dropped from 210 yuan/g in 2017 to 124 yuan/g in 2021.

The report further explained that on the one hand, due to the advancement of hyaluronic acid production technology, it improved the fermentation efficiency of hyaluronic acid production and reduced the cost of hyaluronic acid production; on the other hand, due to the increase in the number of hyaluronic acid raw materials manufacturers. According to the Ferrisana report, prices are expected to continue to decline in the future due to the continuous improvement of technology, increased manufacturers and increasing competition in the meantime.

In the first half of 2022, functional skin care products are getting bigger and bigger. The revenue of raw materials business, medical terminal business, functional skin care products, and functional food business accounts for 15.69%, 10.21%, 72.46%and 1.50%of the company's main business revenue, respectively. From 2019 to 2021, the revenue of functional skin care business accounts for 33.63%, 51.15%, and 67.08%of the company's main business revenue, respectively.

Huaxi Biomedical Terminal Products is the company's independent research and development of medical terminal products in the field of hyaluronic acid biomedical materials, which are mainly divided into medicine and medical beauty.

Affected by the new coronary pneumonia's epidemic, the sales of medical terminal products in the second quarter were affected by varying degrees. Skin medical products achieved income of 208 million yuan, a year -on -year decrease of 5.37%. The main reason was caused by the impact of the new crown pneumonia and the company's active adjustment of product strategies and optimized product structure.

From the perspective of extended time, Huaxi biomagonic raw material business and medical terminal business is gradually shrinking. From 2019 to 2021, the revenue of raw materials business accounted for 40.35%, 26.73%, and 18.29%of the company's main business revenue, respectively, and medical terminal business revenue accounted for 25.93%, 21.88%, and 14.15%of the company's main business revenue, respectively.

Outside the basic disk, Huaxi Biological is also botulinum toxin. However, Huaxi Biological has planned for more than seven years, but it has made a bumpy progress, and eventually "a bamboo basket hit a while."

In August of this year, Huaxi Biological ended cooperation with Medytox with a letter of paper. After the cooperation agreement is terminated, Huaxi Bio will lose the agency of Botox products in Medytox in mainland China.

Medytox's main products include botulinum products, hyaluronic acid fillers, medical equipment, etc., which have share close to 40%since 2009.

The reason for the termination of the cooperation, the announcement explained that based on the administrative measures taken by the Ministry of Food and Drug Safety in 2020, the Medytox's series of products (including botulinum products) were commanded and destroyed, procedures for cancellation of product approval, and suspended manufacturing manufacturing manufacturing Commands for sales and use.

At the same time, the registered status of Botox products registered in China in China has been registered in the review and approval of the National Drug Administration of Drug Administration from November 11, 2019. Related products cannot be sold in China, so that Medytox cannot provide botulinum products to the joint venture company Huaxi Mimi in a legal way.

At the end of August, Zhao Yan, chairman of Huaxi Bio, announced that it would make collagen into the second strategic biological activity after hyaluronic acid, and released its latest collagen raw material products, including animal source collagen, reorganized human resources Collagen, hydrolyzed collagen (peptide), etc.

As for the Hao Haishengke, who has a relatively weak ability to make money in the "Three Giants", it is also trying to dilute the main business of hyaluronic acid.

In the field of medical beauty and wound nursing, in the first half of 2022, the three hyaluronic acid products of Hao Haishengke, including the first -generation hyaluronic acid product "Haiwei" (positioning in the public popularization of the public), the main organization filling function The second -generation hyaluronic acid product "Lanlan" (positioning mid -to -high -end) and the third -generation hyaluronic acid product "Hai Mei" (positioning as high -end) of the third -generation hyaluronic acid product that focuses on precision carving functions is 119 million yuan, which is 120 million yuan in the same period last year. Sales fell 0.20%compared to 0.20%. At present, the clinical trials of the fourth -generation organic cross -linking hyaluronic acid products have been completed, and they are actively promoting the follow -up work of the test.

Different from the botulinum toxin business bets from Huaxi Biological and Meimei, Hao Haishengke focused on the medical and optoelectronics business of the medical beauty, and chose the road "Buy and buy". Optical medicine beauty products.

The semi -annual report shows that the operating income of this product line mainly comes from Ohimi Fonei, a subsidiary of the Group. In the first half of 2022, in medical beauty and wound care products, RF and laser equipment revenue reached 144 million yuan, operating income accounted for 43.75%of the field of medical beauty and wound care, exceeding 36.32%of the hyaluronic acid business.

In February 2021, Hao Hai Shengke received a total of 205 million yuan in total investment to obtain 63.64%of European Himei Science, expanding the company's medical product line to radio frequency and laser medical equipment and home instruments.It also clearly states that if the integration effect of the company or business in the future cannot meet the expectations, the operational situation will not change, or it will cause the company to prepare for impairment of the goodwill in the company's acquisition, which will adversely affect the company's performance.If the performance of the investing company has not been expected or in poor management, the company has the risk of investing in investment loss or funds that cannot be recovered.(Zhongxin Jingwei APP)

- END -

The vegetable bag of a small green onion citizen has "the soul of Luzhou noodles"

Xie Wanling Cover Journalist Xu QingI did not expect that my little voice could be...

Strengthening the supervision of the EPC general contracting model can start from five aspects

The general contracting model of engineering packages refers to the company's entrusted by the owner of the company. According to the contract, the whole process or a certain stage of contracting the...