The Bin Bank of China Bank Card Blue Book: 8.62 trillion yuan in credit balance, the fraud rate decreased for five consecutive years

Author:21st Century Economic report Time:2022.09.09

21st Century Business Herald reporter Li Yue Beijing report

On September 9, the China Banking Association released the "Blue Book of the Development of the Bank of China Card Industry (2022)" (hereinafter referred to as the "Blue Book"). The bank card industry professional report.

"Blue Book" shows that as of the end of 2021, in terms of card issuance, the cumulative number of card issuance of bank cards issued 9.25 billion, which was 270 million new cards that year, an increase of 3.0%year -on -year, and the growth rate slowed down year by year. A trillion yuan, an increase of 33.8%year -on -year; in terms of acceptance, a total of 27.983 million households accepted in my country, a decrease of 3.3%year -on -year. The balance was 8.62 trillion yuan, an increase of 8.9%over the previous year; the total amount of credit cards had been overdue for half a year of overdue uncomfortable credit, a total of 86.04 billion yuan, an increase of 2.6%year -on -year; bank card fraud rate was 0.32bp, a decrease of 0.43bp from the previous year, and achieved a decrease of five consecutive years.

In 2021, the "Personal Information Protection Law", "Notice on Promoting the Marketing Reform of Credit Card overdrawn interest rates", "Notice on Further Promoting the Standardous Healthy Development of Credit Card Business (Draft for Solicitation)" (Note: officially released in July 2022) and so on. The issuance of relevant policies and regulations of the bank card industry will further regulate the development of the bank card industry.

"Under the guidance of a series of policies and regulations, commercial banks adhere to standardized operations, comprehensively sort out the scope, purpose and methods of processing personal information activities before the evaluation of the pre -loan, loan, and post -loan. The market -oriented reform plan effectively improves the quality of credit card assets, further restricts the rate of sleep cards, strictly controls over -credit, strengthens the management of capital flow, strengthens the management of cooperative institutions, effectively protects consumers' legitimate rights and interests, and prevent systemic financial risks. Essence

"Blue Book" shows that in 2021, the development of the bank card industry also faces many challenges such as the onlineization of fraud risk, external risk conduction, and black -gray complaints. In this regard, the bank card industry adheres to the long -term prudent risk management concept, actively responds to risk challenges, strictly controls the access, strengthen comprehensive credit management, increases the disposal of non -performing assets, strengthen the control of funds, and continuously improves digital anti -fraud. In 2021, the overall risk of the credit card industry eased from 2020, and the asset quality was better.

In the "Blue Book", the person in charge of the credit card business of many institutions expressed his views on the development of credit cards. Xue Yaqin, President of Agricultural Bank of China Credit Card Center, believes that the development of credit cards must be based on a new stage of development, implement new development concepts, take the opportunity to build a new development pattern, with the "big of the country", deepen the political and people's understanding of financial work, follow the country Expand the strategy of domestic demand, coordinate and coordinate the six dimensions of "value creation, efficiency efficiency, scale speed, customer quality, risk management, and safety security", expand consumer scenarios, stimulate consumer potential, and give full play to the role of credit cards on social consumption, practice practice, practice The original intention of "people's finance to the people".

Wang Bo, general manager of China Merchants Bank Credit Card Center, said that national strategic leadership and continuous operation of enterprises have pointed key points to "people". In the new situation, high -quality development must be achieved. Customers create value. Specifically, you can start with the four dimensions of implementing "risk -based", adhering to "paying for the people", strengthening the protection of consumer rights, and deepening digital transformation.

"Digital development will accelerate the promotion of credit card business from offline records to the future forecasting future, and promote the standardization, digital, and intelligent level of customer acquisition, marketing, payment, credit approval, risk management, and customer service. Time and user experience. "Chen Dapeng, president of Minsheng Bank Credit Card Center, said.

Zhang Hua, general manager of the Credit Card Center of Guangfa Bank, focuses on the young card group from the perspective of a product manager. He mentioned that "as a" bridge "product for other bank retail businesses such as link consumption and wealth management, credit cards can provide credit consumption services At the same time, the introduction of other retail businesses provide safe and reliable financial management services for post -95s, which not only helps to realize the ideal life of the post -95s to realize the 'side lace earning', but also allows customers to gradually improve their activity in experiential comprehensive financial services. "

- END -

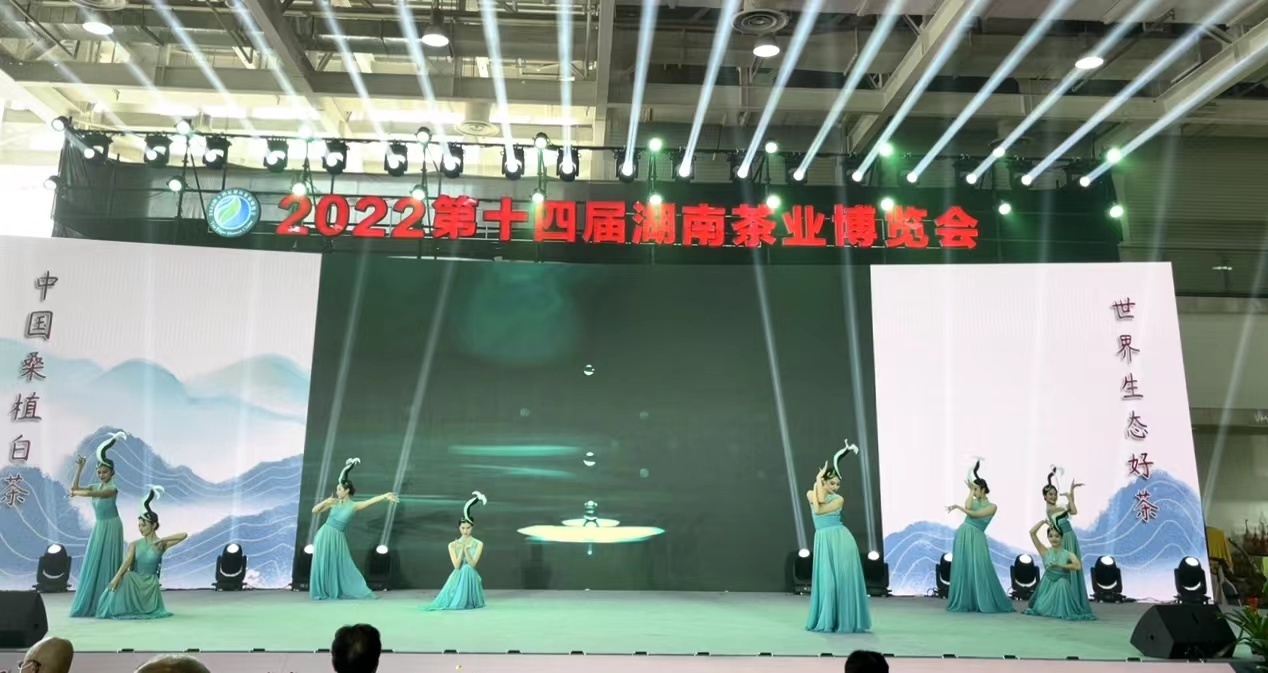

Sangbai tea into the tea industry "Dark Horse" 7 years occupying 4%of the national white tea market share

The reporter learned from the 14th Hunan Tea Expo Sangbai Tea Special Promotion Co...

The first store of the tongue hero closed the "Lu's play"?

In the venture capital circle, it seems that entrepreneurs will never go bankrupt....