"100 million deposits are deducted by the bank for no reason": illegal guarantee for 337 million yuan in illegal guarantee

Author:Zhongxin Jingwei Time:2022.06.20

Zhongxin Jingwei June 20th (Ma Jing) "Listed companies told banks to deduct 100 million deposits for no reason" have made new progress: the partner*ST amethyst said on the 18th that bank deducting deposits and deposit orders disclosed earlier The pledge guarantee is related to.

People insiders in the banking industry told Zhongxin Jingwei that the pledge guarantee of this deposit depository generally signed a relevant pledge agreement and stated that if the guarantor could not perform the debt, the bank could exercise its rights through the deposit.

As for whether listed companies and related banks have procedurals such as procedure and other aspects of responsibility identification, Xu Feng, a lawyer of Shanghai Jiucheng Law Firm, believes that the disclosure information in the current announcement is limited and cannot be qualitative for the time being.

Is it because of no reason? It's all "disasters" caused by illegal guarantee

On June 16, the listed company of Science and Technology Board*ST Ameli issued an announcement saying that it deposited 85 million yuan in regular deposits in Henan's Lu's Rural Commercial Bank Co., Ltd. (hereinafter referred to as "Lu's Rural Commercial Bank"), but Lu The Rural Commercial Bank deducted 75.7585 million yuan in March 2022, and the current deposit of 22.9254 million yuan in current deposits that were unprecedented on the 28th of the same month were superimposed on the 28th. In the subsequent negotiations, Lu's Rural Commercial Bank only agreed that*ST amethyst was transferred to 3.3931 million yuan, and the remaining 9.2415 million yuan still refused to apply for fund transfer business. *ST amethyst, he refused to apply for the bank's UKEY reporting and fund transfer business, and asked the defendant to return 108 million yuan (temporary planning), and assumed litigation costs and preservation costs. At present, the case has not been tried.

However, nearly two days after the news was fermented, the*ST amethyst also issued a supplementary announcement saying that the aforementioned expression could cause ambiguity and misunderstanding. The deduction of regular deposits was related to previous violation guarantees.

*The ST amethyst announcement mentioned that it was found that the company provided a guarantee for ten companies including Sanmenxia Mori Housing Information Consulting Co., Ltd. with a regular deposit deposit of Lu's Rural Commercial Bank. , The above guarantee has not fulfilled the company's decision -making procedures and information disclosure obligations.

After the above -mentioned supplementary announcement was released, the Shanghai Stock Exchange issued a regulatory letter to the*ST amethyst, involving*ST amethyst, directors, intermediary agencies and related personnel.

The chairman of the chairman "bypasses the company" to teach the guarantee, and the deposit pledge has been deducted without the expiration

According to the media reports, and the previous announcement of the*ST amethyst found that the company's "anger" was not simple behind the bank.

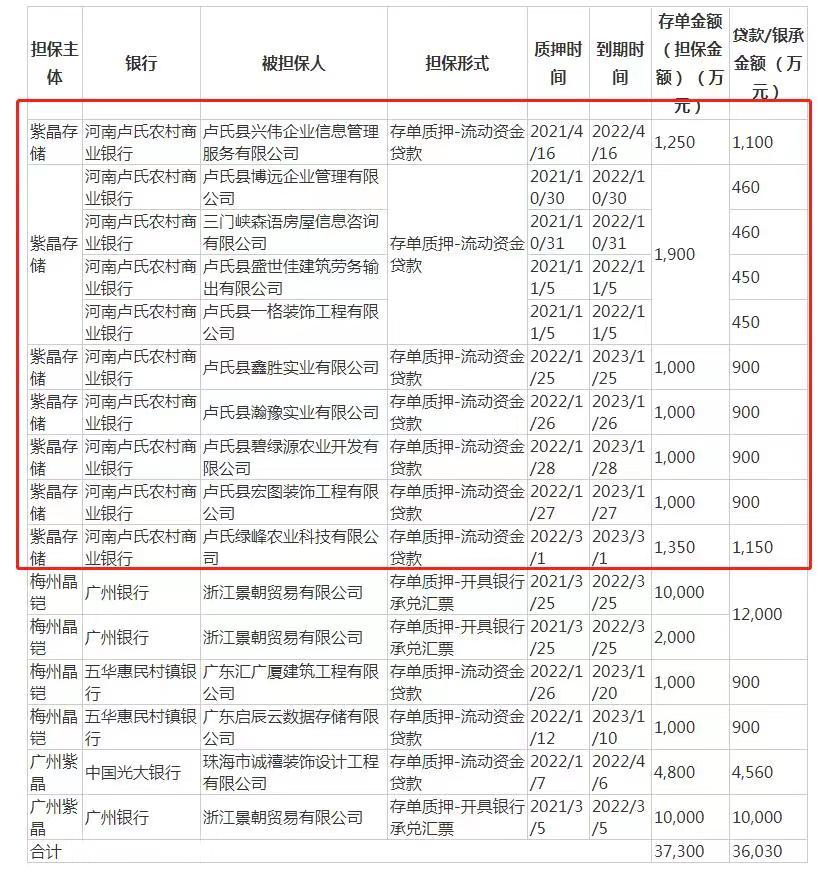

The source of all this lies in the "self -exposure" of*ST amethyst on March 14. The company announced that it found that as of March 10, 2022, the company and subsidiaries Guangzhou amethyst and Meizhou Jingkai existing in the case of regular pledge guarantees provided by bank regular deposits, the total amount of 373 million yuan, a total of 14 The third party of the family offers 16 guarantees. The illegal guarantee involves 4 banks, namely 10 guarantees for the Lu's Rural Commercial Bank, 3 banks in Guangzhou, 2 in Wuhua Huimin Village Bank, and 1 China Everbright Bank.

*ST amethyst 16 illegal guarantee Source: Company Announcement

*ST alarm also said that with the company, one of the actual controllers and chairman Zheng Mu confirmed that the above -mentioned violation guarantee matters were arranged for the completion of their own intentions, and the relevant procedures did not fulfill the obligations or information disclosure obligations stipulated by the company's articles of association.

The announcement on April 19 showed the details of the deduction of the deposit. As of March 10, 2022, the amount of 7 fixed deposits related to the illegal guarantee of the Lu's Rural Commercial Bank was 850 million yuan, and the balance of the deposit period was 26.2943 million yuan. Among them, the seven time deposit orders were deducted for 75.7585 million yuan on March 20, 2022 in the name of "buckle", and the current deposit was deducted 22.9254 million yuan on March 28, 2022, The deduction amount is 98.689 million yuan.

Subsequently, the Shanghai Stock Exchange issued an inquiry letter, pointing out that the above-mentioned fund deduction occurred from March 20th to 28th, 2022, but the company was not disclosed in the announcement of the early announcement of the initial guarantee guarantee. And according to the preliminary announcement, the depository pledge did not expire during the deduction. The Shanghai Stock Exchange requires*ST amethyst to explain three matters, including the reasons and basis for verifying the deduction of the bank's deduction when the pledge is not expired. The flow is clearly explained whether the fund deduction involves actual controllers, directors and supervisors, and its affiliated parties to hollow out the listed company and infringe the rights and interests of small and medium shareholders.

At present,*ST amethyst has not yet given a clear reply on the above inquiries. Zhongxin Jingwei issued an interview letter to the official mailboxes of the*ST amethyst and the official mailboxes of the Lu's Rural Commercial Bank on the procedures and risk control procedures and risk control of the depository deduction.

The risk of deduction of the deposit list has long been closer, and the effectiveness of the pledge contract is still yet to be ruled

However, judging from the situation of*ST amethyst and three other related banks, the risk of deducting the deposit deposit has long been closer.

Announcement on March 14 shows that*ST amethyst debt in Guangzhou's 100 million yuan deposit deposit guarantee has expired on March 5, 2022, and then was transferred to the beyond bank on March 11, 2022 If the account, other guarantee parties fail to pay bank debt on schedule, and the rest are risk of being deducted for bank deposit orders used for violations. And Lu's Rural Commercial Bank is not the first bank to "start first". Announcement on March 17 shows that*ST amethyst is stored in Everbright Bank for 48 million yuan in regular deposit capital for illegal pledge guarantee. It was originally pledged on April 6, 2022, but was as early as March 16th. Deduading 45.93 million yuan.

A public business person in the Tianjin Sub -branch of Zhongxin Jingwei learned that the public business of Tianjin Sub -branch learned that the pledge guarantee of the deposit depository generally signed a relevant pledge agreement and stated that if the guarantor could not perform the debt, the bank could exercise its rights through the deposit.

A state -owned bank branch also told the manager of the public business department that this third -party deposit pledge business can be deducted from the guarantee's deposit without the court's rules.

However, whether listed companies and related banks have procedurals such as procedurals and other responsibilities have yet to be disclosed more information. Xu Feng, a lawyer of Shanghai Jiucheng Law Firm, told Zhongxin Jingwei that he was also very concerned about the illegal guarantee of*ST amethyst. Although many people now question, the disclosure information in the announcement is limited, the ins and outs of the dragon are not clear, the details and evidence are not sufficient, and it is not qualitative for the time being.

It is worth noting that, as an intermediary agency entrusted by a listed company, the opinions given by the listed company's entrusted agencies are the opinions given by the illegal guarantee of the*ST amethyst: the initial consideration of*ST amethyst and the subsidiary's depository pledge guarantee contract There are large flaws in the effectiveness. The final guarantee contract and the amount of specific claims must be confirmed by the court's effective referee document.

The announcement shows that before the prosecution of Lu's agricultural business bank,*ST amethyst claims to prosecute three other banks such as the pledge contract without effectiveness and return regular deposit. Two illegal guarantees related to Wuhua Huimin Bank, one guarantee has returned the corresponding loan principal due to the guarantor, and the other has reached a settlement, but other litigation has been accepted. This means that there are 14 violations of regulations. The guarantee is on the edge of risk.

Zhongxi Accounting Firm stated in the*ST amethyst "Special Audit Report of Non -operating Funds Occupation and Other Related Fund Exchange Tables", "We found illegal guarantees in the internal control audit of*ST amethyst company in the internal control audit of the company. Major defects, this defect is a major defect for governance layer over internal control. We cannot express opinions on*ST amethyst company's 2021 non -operating funds occupation and other related exchanges. "

The sponsor and supervision agency Zhongxin Construction Investment once again emphasized in the announcement on June 18. As of now,*ST amethyst is in the investigation of the investigation of the CSRC due to the suspected information disclosure of the law. The problem of violation guarantee may lead to the company's responsibility for relevant guarantee, which will cause the company to confirm the expected liabilities and losses, which may cause liquidity difficulties, which will cause the risks of the company's continuous operation capabilities such as restrictions on the development of the main business and the large -scale resignation of employees. Essence

Since the Shanghai Communications Institute has issued the first inquiry letter on March 14th, the former "first share of light storage"*ST amethyst has been trapped in the vortex of illegal guarantee for three consecutive months, and it has not yet gone out. (For more report clues, please contact the author Ma Jing: [email protected]) (Zhongxin Jingwei APP)

(The views in the article are for reference only, do not constitute investment suggestions, have risks in investment, and need to be cautious to enter the market.)

Copyright Copyright Copyright, without written authorization, no unit or individual may reprint, extract or use it in other ways.

Editor in charge: Li Zhongyuan

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

Social security information system switching period hotspot questions answers

1. How does the city's social security business apply for the city's social security business in June 2022?Answer: The province's social insurance information system is planned to implement system swi...

Tongshan: Hold the Chinese Medicinal Materials Industry Investment Promotion Conference

On June 6, the China Medicinal Materials Industry Investment Promotion Conference...