After more than two months to reproduce the listed bank's shots to stabilize the stock price

Author:Securities daily Time:2022.09.10

10SEP

On the evening of September 8th, Lanzhou Bank announced that the bank's A -share shares have reached the start -up condition of triggering stable stock price measures. Reporter Lu Dong Lanzhou Bank disclosed on the evening of September 8 that the bank's shares have reached the start -up condition for triggering stable stock price measures, and will soon be about to trigger the stable stock price measures, which is about to be about to trigger the stable stock price measures, and will soon be about to trigger the stable stock price. Formulate a stable stock price plan. Since the beginning of this year, many banks have launched an increase in holdings of important shareholders or directors and executives in terms of stable stock price measures. Underestimated signal. According to the announcement of Lanzhou Bank, from August 12th to September 8th, the bank's A -share shares have closed for 20 consecutive trading prices of less than 4.53 yuan/share, reaching the start -up conditions for triggering stable stock price measures. Formulate a specific plan for stable stock prices. Since 2022, the number of banks that have announced stable stock prices have increased to 9. The data showed that in May and June this year, it was a peak period for the starting conditions for the start of the stable stock price measures to trigger the stable stock price measures. During this period, a number of banks, including postal savings banks, launched a stable stock price plan. More than two months after a short period of stagnation, Lanzhou Bank became the first bank to announce the upcoming stock price after entering the second half of the year. According to the "Securities Daily" reporter, in addition to the Lanzhou Bank, there are 8 companies including Chongqing Rural Commercial Bank, Bank of Chongqing, Xiamen Bank, Ruifeng Bank, Zilu Bank, Zhejiang Commercial Bank, Suzhou Bank, Postal Savings Bank, etc. Banks have implemented a stable stock price plan. The types of these banks cover all listed banks such as state -owned banks, joint -stock banks, urban commercial banks, and rural commercial banks. As of now, the stable stock price measures of the Chongqing Rural Commercial Bank and Chongqing Bank have been completed. According to the announcement disclosed by the Postal Savings Bank recently, the bank's controlling shareholder's postal increase has also exceeded 50%of the lower limit of the holding plan. Lu Changshun, chief researcher of Shanghai Zhonghe Yingtai Financial Consultant Co., Ltd., said in an interview with the Securities Daily that the important shareholders or directors of the listed banks and executives must take out the "real gold and silver" to stabilize the stock price. Increasing the main body of the main body of the bank's future development prospects and the recognition of the value of bank investment can also maintain the interests of small and medium investors, and will boost and stabilize the stock price of banks to a certain extent. The reporter noticed that since the beginning of this year, in addition to the banks that have increased their holdings due to the start of the stable stock price measures, important shareholders or "director supervisors" including Industrial Bank, Bank of Nanjing, Bank of Beijing, etc. Increasing holdings and fully transmitting the company's stock price to the market that may be underestimated. After more than two months of stagnation, there were also the starting conditions for listed banks to touch the stable stock price measures, which is obviously related to the recent downturn in the bank sector. Although the performance of the semi -annual report of the listed bank is good as a whole, since entering the second half of the year, the sector index has the next step. According to the Flush iFind data, as of the closing of September 9 since July, the cumulative decline in the banking sector was 9.45%, ranking fifth among the one -level industry index. At the same time, the latest municipal net ratio (overall method) of the banking sector is only 0.44 times, while the market ratio of all A shares in the same period is 1.56 times. Lu Changshun believes that in the case of good performance in the first half of this year this year, the overall decline adjustment has still been adjusted in more than two months. The main reason may be related to the expectations of real estate. Dowager.

Recommended reading

Why did the ST dawn of 17 daily limit boards suddenly skyrocketed in 21 trading days?

Polycrystalline silicon is now 100 billion yuan! Can contradictions in supply and demand next year be alleviated?

Picture | Bag Picture Network Station Cool Hero Production | Zhang Xin

- END -

Determine positive!Emergency suspension!

June 17thThe official website of the General Administration of Customs issued a nu...

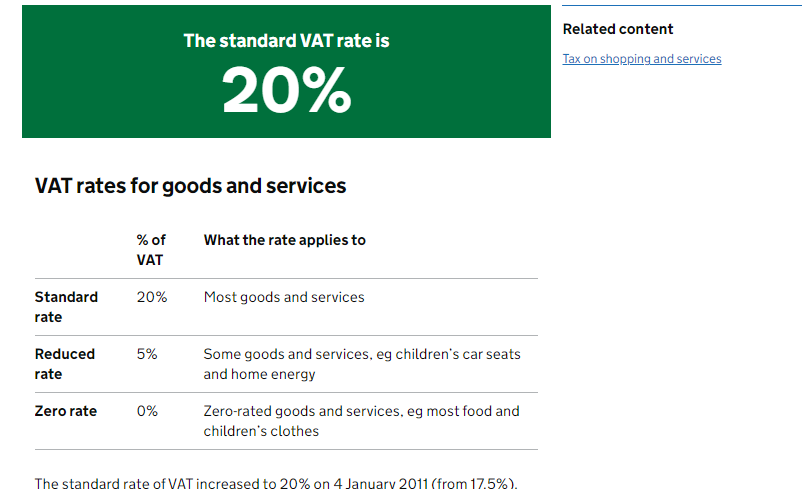

Is British inflation rescue?Foreign Minister considers the decline to reduce the value -added tax to 15 %

Recently, the British Consumer Price Index (CPI) has increased by 10.1%year -on -y...