The "State -owned Assets Report" exclusively interprets 2022 Chinese enterprises 500: Three years of reform to promote the efficiency and efficiency of state -owned enterprises significantly improved

Author:State -owned Assets Xiaoxin Time:2022.09.10

Xiaoxin said

not

On September 6, the Chinese Enterprise Federation and the Chinese Entrepreneurs Association released the "Top 500 Chinese Enterprises" list and their analysis reports. The "State -owned Assets Report" exclusive combing and understanding list found that: the threshold for Chinese companies' Top 500 entered siege has continued to increase, and the threshold for asset finalists has been higher than the top 500 of the US companies for two consecutive years. In terms of financial indicators, it still accounts for a prominent position; thanks to optimizing supervision and deepening reforms in recent years, especially the three -year operation of state -owned enterprise reform, the efficiency and benefits of state -owned enterprises on the list have generally improved significantly. Xiaoxin share the full text for you--

2022 Chinese Enterprise Fortune 500 released

Three years of reform have promoted the significant improvement of the efficiency and efficiency of state -owned enterprises

On September 6, 2022, the Chinese Enterprise Federation and the Chinese Entrepreneurs Association (referred to as the China Enterprise Federation) held a press conference in Beijing to release the list of "Top 500 Chinese Enterprises" and their analysis reports.

The reporter learned at the press conference that in 2021, China's Fortune 500 companies insisted on steadily pursuing the general tone, focusing on promoting high -quality development, and achieving new achievements in the aspects of stronger and superiority, whether it is operating income, or profit Total and net profit have achieved rapid growth in general.

Among them, state -owned enterprises still occupy a prominent position in main indicators such as income and assets. It is worth noting that since the implementation of the three -year action plan of state -owned enterprise reform, the efficiency and benefits of non -financial state -owned enterprises have improved significantly, and the efficiency and efficiency of local state -owned enterprises have also improved.

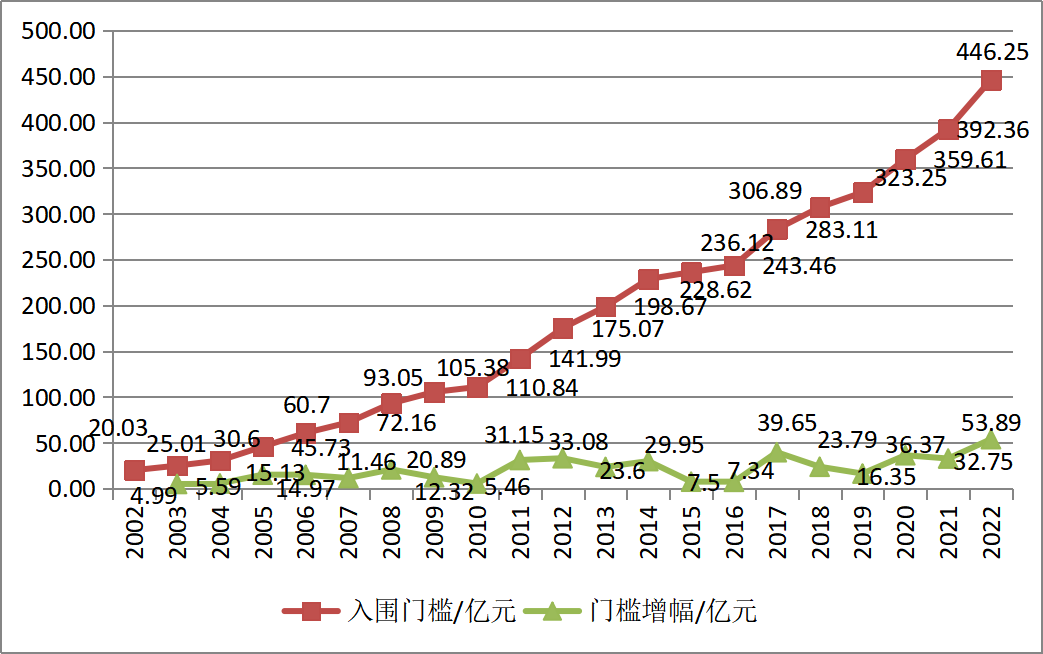

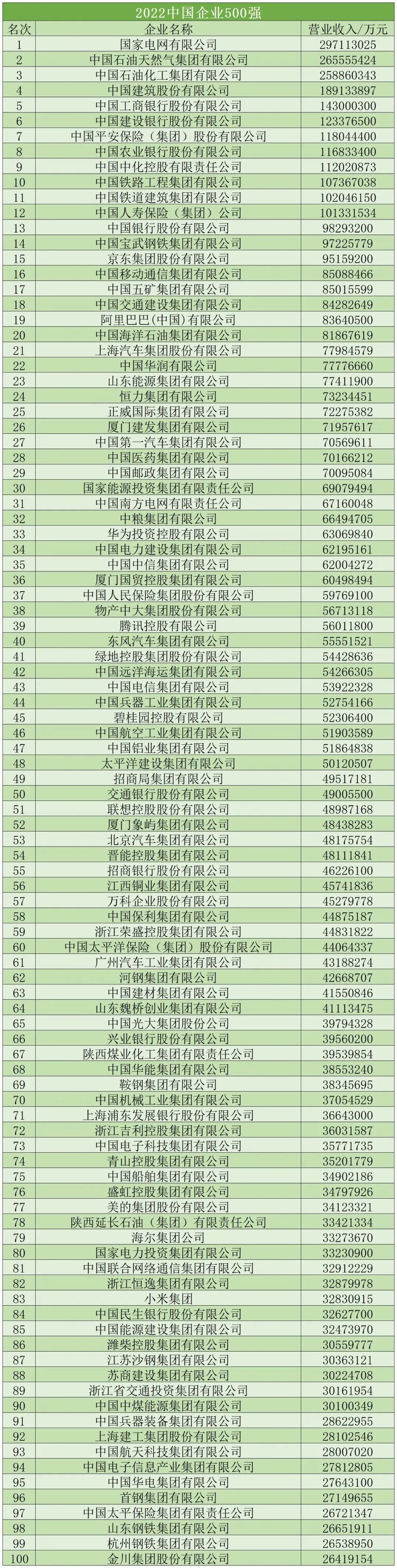

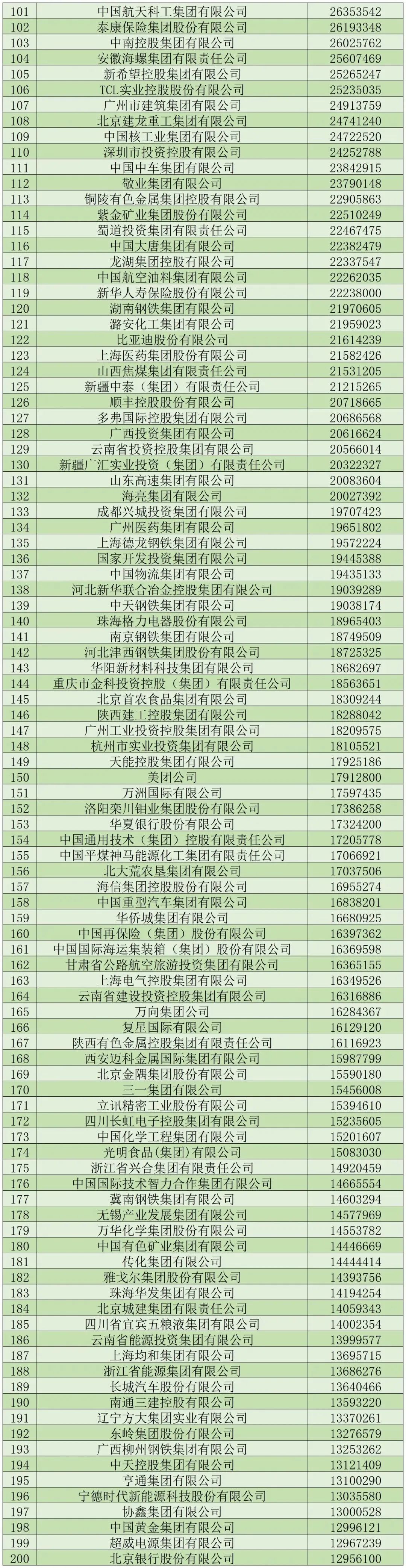

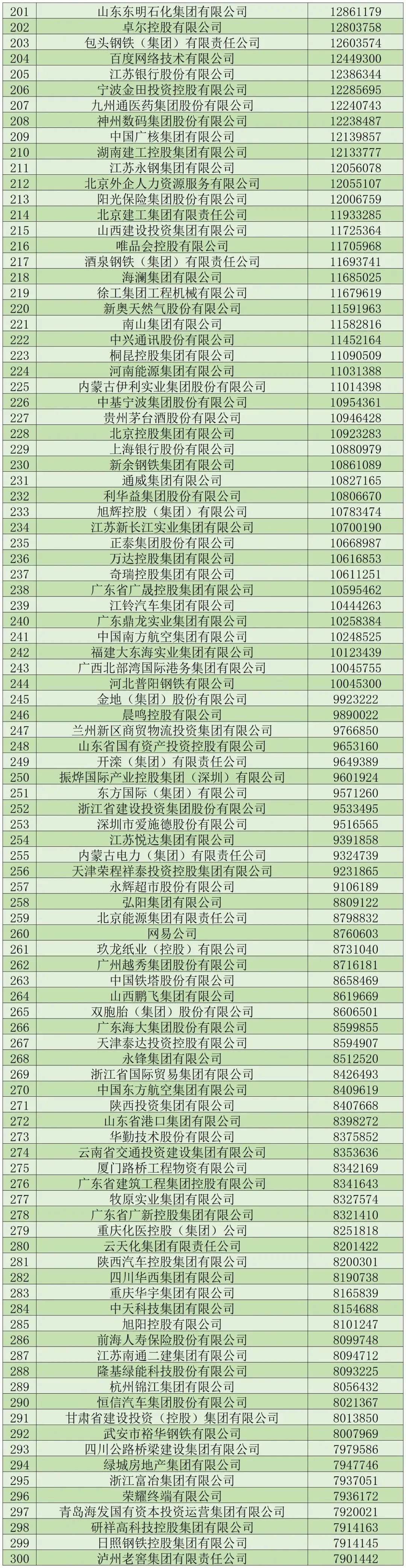

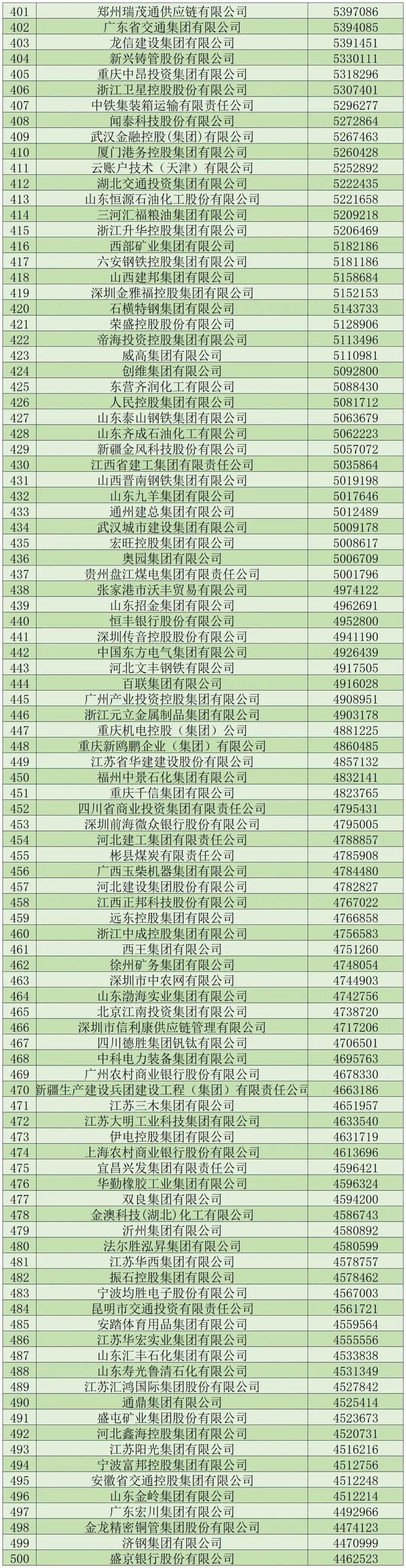

Chinese enterprises continue to maintain a scale expansion, China Sinochem and other central enterprises have joined the trillion -level enterprise clubs

The threshold of the Fortune 500 of Chinese companies continued to increase. 2022 Chinese companies ranked 500th in the top 500 companies, and their operating income was 44.625 billion yuan. Compared with the 500 Chinese companies in the previous year, the threshold for the finalist was 5.389 billion yuan, an increase of 13.74%. Since the first release of the "Top 500 Chinese Enterprises" list, the threshold for finalists has been raised, and this year has achieved the 20 consecutive increase of the finalist threshold. From the absolute value, this is the year when the threshold of the 500 Chinese enterprises has increased the most. It was converted into US dollars. The threshold for the 2022 China Fortune 500 was 6.917 billion US dollars, which was higher than 2022 US 500 entry thresholds (US $ 6.394 billion).

Among the 2022 Chinese enterprises, there were 244 companies with operating income of more than 100 billion yuan, an increase of 22 from the top 500 Chinese enterprises in the previous year, and the number of 100 billion club companies was significantly more than the previous year. 18 of them are new companies this year. 197 are 100 billion -level companies on the list last year. 29 are companies that were on the list last year but operating income below 100 billion yuan. Among the 222 enterprises of the top 500 100 billion clubs in 2021, 25 have withdrawn the list of 100 billion clubs for different reasons.

In 2022, there are 12 trillion -level companies in the top 500 Chinese enterprises. The number of Chinese trillion -level large enterprises exceeds 10 for the first time, which also confirms the prediction of the growth of trillion -level enterprises last year. Except for the National Grid, China Petroleum, Sinopec, China Architecture, Industrial and Commercial Bank of China, China Construction Bank, Ping An of China, and Agricultural Bank of China, China Sinochem, China Railway Engineering Group, China Railway Construction Group, and China Railway Construction Group, China Railway Construction Group, China Railway Construction Group, China Railway Construction Group, China Railway Construction Group, China Railway Construction Group, China Railway Construction Group, China Life Insurance has become a new member of trillion -level enterprises.

The threshold and its changes in the 500 Chinese enterprises and their changes

The growth rate of the total profit and net profit of Chinese companies' top 500 and net profit slowed down

2022 Chinese companies achieved a total of 6024.207 billion yuan in total profits, an increase of 0.36%compared with the previous year, but the growth rate fell 7.39 percentage points from the previous year. The net profit was 4463.468 billion yuan, an increase of 9.63%over the previous year, and the growth rate increased by 5.04 percentage points over the previous year.

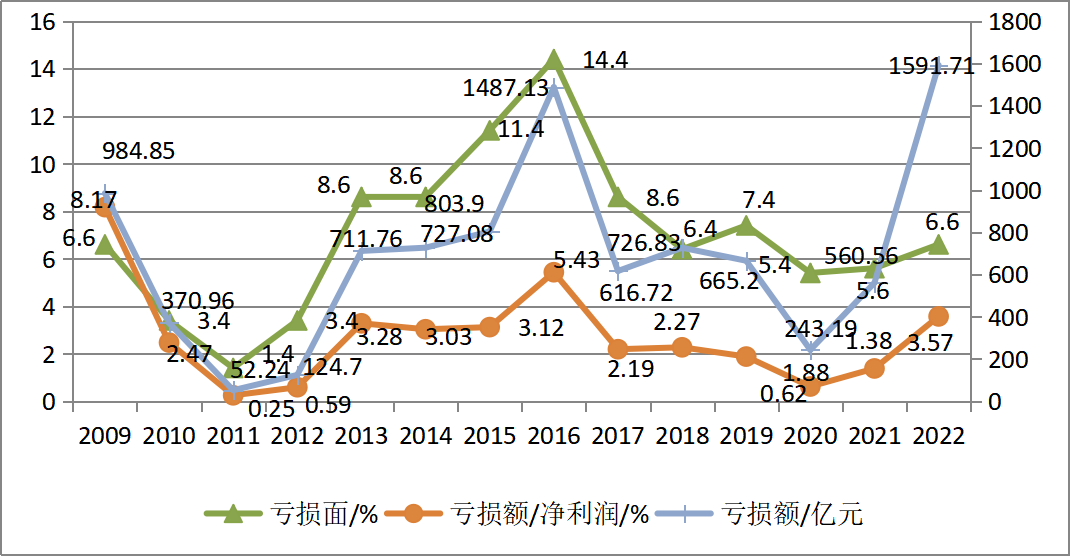

The losses and losses of the top 500 Chinese companies have increased the second year in a row. Among the 2022 Chinese companies, there were 33 companies with losses, with a loss of 6.6%, an increase of 1.0 percentage points from the top 500. The total loss of 33 companies was 159.173 billion yuan, and the amount of losses increased by 183.95%compared to the previous year. Enterprise losses are roughly equivalent to 3.57%of the total net profit of the top 500 Chinese enterprises in 2022, which is significantly higher than 1.38%of the top 500 in the previous year. The average losses of companies in the loss of money were 4.823 billion yuan, which was much higher than the top 500 of the previous year. Regardless of the loss, or the loss of the losses from the company, or the comparison of the company's total losses and the total net profit of the top 500, both have been increased for two consecutive years.

Top 500 net profit and growth trend of the total net profit of Chinese enterprises

The trend of changes in the loss surface and loss amount of Chinese enterprises

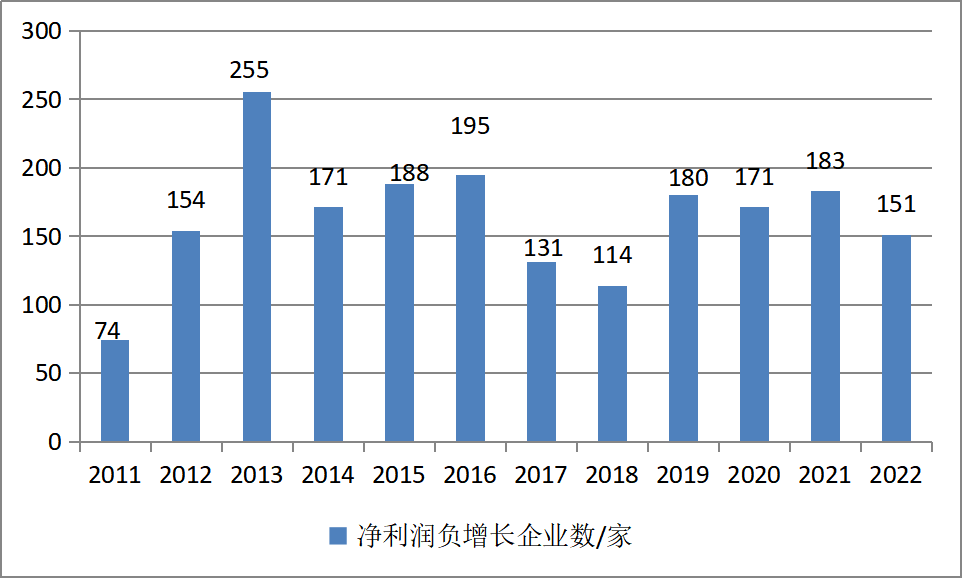

Chinese companies' top 500 net profit negative growth companies fluctuate in the number of enterprises

The main economic indicators of state -owned enterprises are dazzling

The results of the three -year action of state -owned enterprise reforms appeared

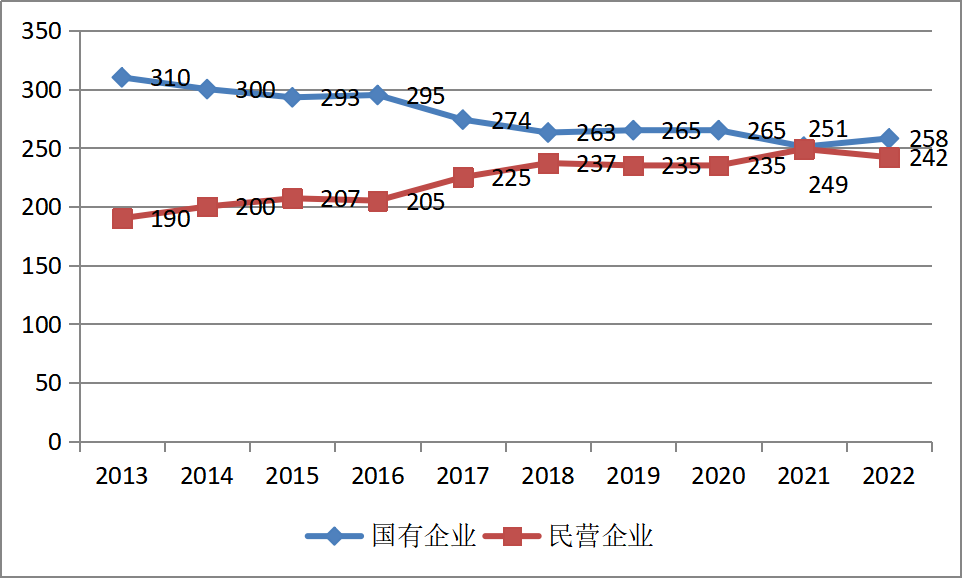

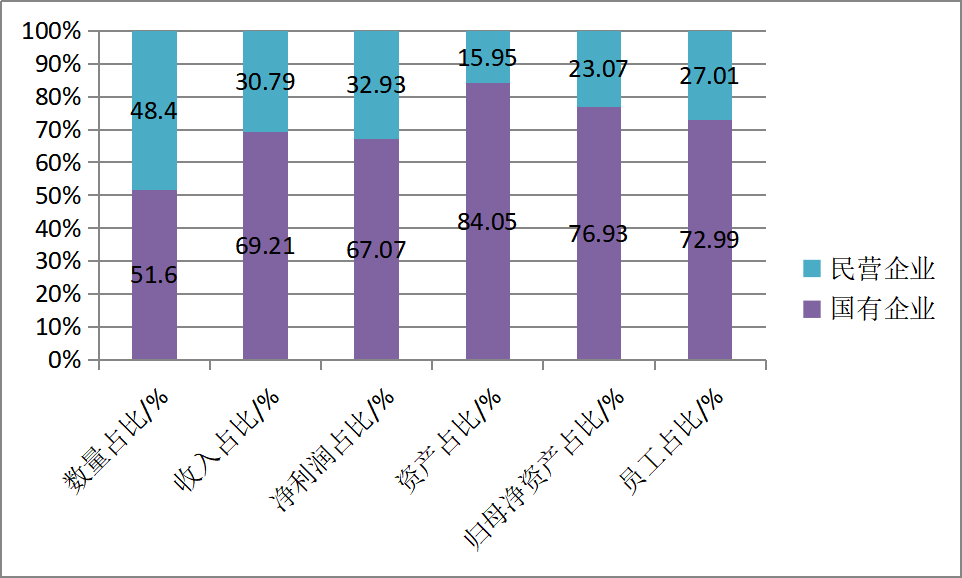

Among the 2022 Chinese companies, there were 258 state -owned enterprises, an additional 7. State -owned enterprises still have a prominent position in main indicators such as income and assets. Among the 2022 Chinese enterprises, 258 state -owned enterprises' operating income was 7.092 trillion yuan, accounting for 69.21%of the total income of the total 500 business; net profit was 2993.474 billion yuan, accounting for 67.07%of the total 500. The proportion of state -owned enterprises in the above indicators is obviously higher than its proportion, and they are all increased from the top 500 in the previous year. Since the implementation of the three -year action plan of state -owned enterprise reform, the efficiency and benefits of non -financial state -owned enterprises have improved significantly. Among the 2022 Chinese enterprises, the per capita operating income of non -financial state -owned enterprises has increased by 437,100 yuan from non -financial central enterprises among the top 500 Chinese companies, and the per capita net profit has increased by 17,500 yuan. The asset turnover rate has accelerated by 0.07 times/year; Income profit margins, asset profit margins, and net asset profit margins have increased by 0.25 percentage points, 0.29 percentage points, and 0.74 percentage points, respectively.

During the same period, the total per capita operating income and per capita net profit of the top 500 Chinese enterprises increased by 562,400 yuan and 201,000 yuan, but the asset turnover rate was unchanged, and the income profit margin, asset profit margin, and net asset profit margin decreased by 0.17 respectively. A percentage point, 0.05 percentage point and 0.49 percentage points. In general, it can be considered that under the decline in the overall efforts of the top 500 Chinese enterprises, the efficiency of non -financial state -owned enterprises has not increased. This should be largely. It is the positive result of the release of the three -year operation dividend of state -owned enterprises.

The implementation of the three -year action plan of state -owned enterprise reform has also promoted the improvement of the efficiency and efficiency of local state -owned enterprises, but the overall improvement is not as good as non -financial central enterprises. Among the top 500 Chinese enterprises, the per capita operating income and per capita net profit margin of local state -owned enterprises increased by 696,300 yuan and 18,800 yuan from local state -owned enterprises among the top 500 Chinese enterprises, respectively. After slowing down 0.04 times/year, the profit margin and net asset profit margin decreased by 0.12 percentage points and 0.32 percentage points, respectively. This undoubtedly reflects the active contribution of local state -owned enterprises and state -owned enterprises in recent years, and the three -year operation of state -owned enterprise reform to the profitability of local state -owned enterprises.

Top 500 Chinese Enterprises Top Family Structure Structure Change Trends

2022 The proportion of major indicators of Chinese enterprises 500 state -owned enterprises and private enterprises

The continuous evolution of Chinese enterprise 500 forced industry structure continues to evolve

The number of manufacturing companies has continued to increase the service industry to decrease

Among the top 500 Chinese enterprises, the number of manufacturing companies has continued to increase, and the service industry and other companies have decreased. Among the 2022 Chinese enterprises, 256 manufacturing enterprises are 256, an increase of 7 from the top 500 in the previous year, and the second year has maintained an increase. , Both decreased for two years.

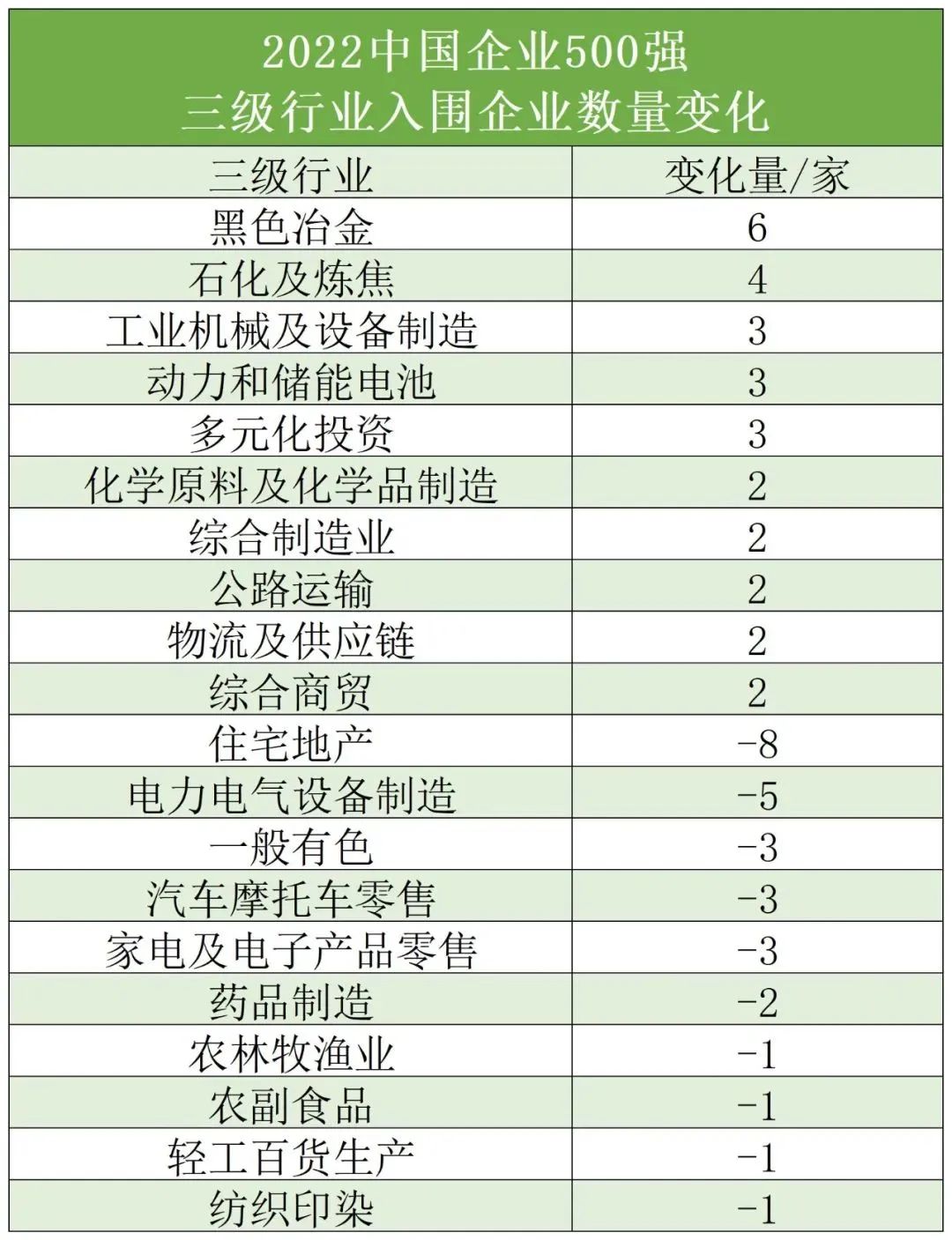

Among the top 500 Chinese companies, the number of shortlisted companies in some industries has changed significantly, reflecting the continuous adjustment of the Fortune 500 industry structure in the process of economic recovery. The black metallurgical industry ushered in a rapid recovery, with 6 shortlisted companies in the shortlisted enterprises and ranked first in the industry. Home, two net increases in chemical raw materials and chemical manufacturing, and 2 net increases in the computer and office equipment industry. The overall recovery of the productive service industry is better, and two industries: highway transportation, logistics and supply chains, and comprehensive commerce have increased by 2.

Some industries have continued to be impacted, and they are still under great development pressure in the economic recovery, and industry revenue growth is weak. The residential real estate industry has been impacted the most, and the net reduction in the shortlisted enterprises; the power electrical equipment manufacturing industry has also been greatly affected, and the entire industry has a net reduction of 5. Some retail fields are also greatly affected, and the retail industry of automotive motorcycles, home appliances and electronic products are all reduced by 3. The pharmaceutical manufacturing industry also adjusts and changes in the recovery, reducing 2 in nets. Among the 2022 Chinese enterprises, the first time there are educational service companies on the list.

The top 500 R & D investment in Chinese enterprises has continued to increase

Non -financial central enterprises research and development investment far exceeds other companies

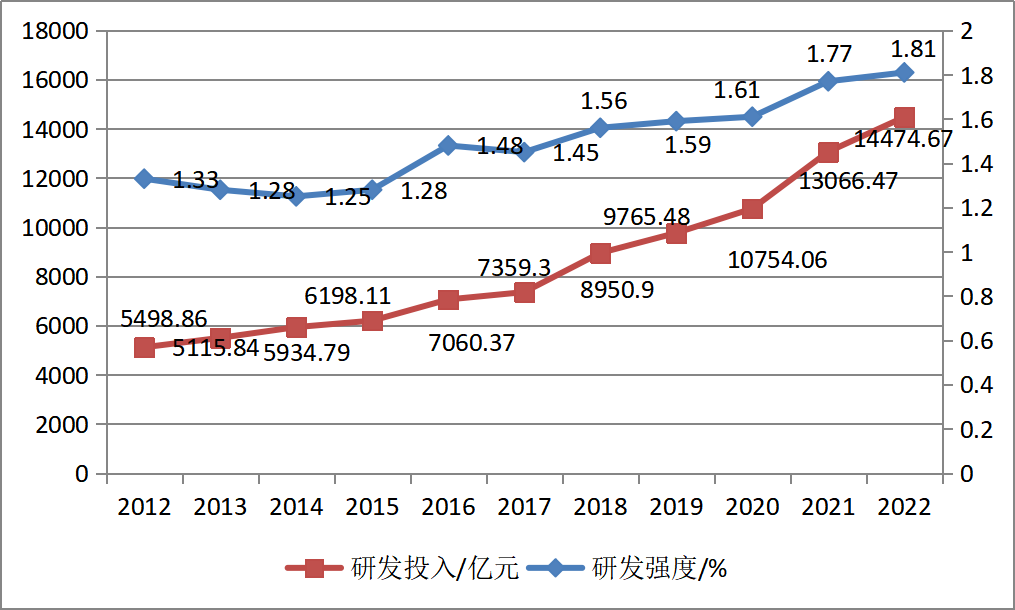

The R & D investment of the top 500 Chinese enterprises has maintained a growth trend. 2022 Chinese companies invested a total of 1447.467 billion yuan in R & D expenses, an increase of 140.82 billion yuan compared with the Fortune 500 last year, an increase of 10.78%. Compared with the same caliber, R & D investment increased by 21.73%, and enterprise R & D investment remained compared Fast increase. The average R & D investment of the enterprise was 3.357 billion yuan, an increase of 14.07%over the average R & D investment in the last year.

The top 500 R & D intensity of Chinese companies ushered in five consecutive rises. The total R & D investment of the Fortune 500 enterprises in 2022 accounted for 1.81%of its total operating income, and the R & D intensity increased by 0.04 percentage points from the Fortune 500 in the previous year. The top 500 R & D intensity of Chinese companies ushered in five consecutive rises and innovated a new high with statistical data. Generally speaking, in the past 10 years, the top 500 R & D intensity of Chinese enterprises has increased from 1.33%to 1.81%, showing a growth trend.

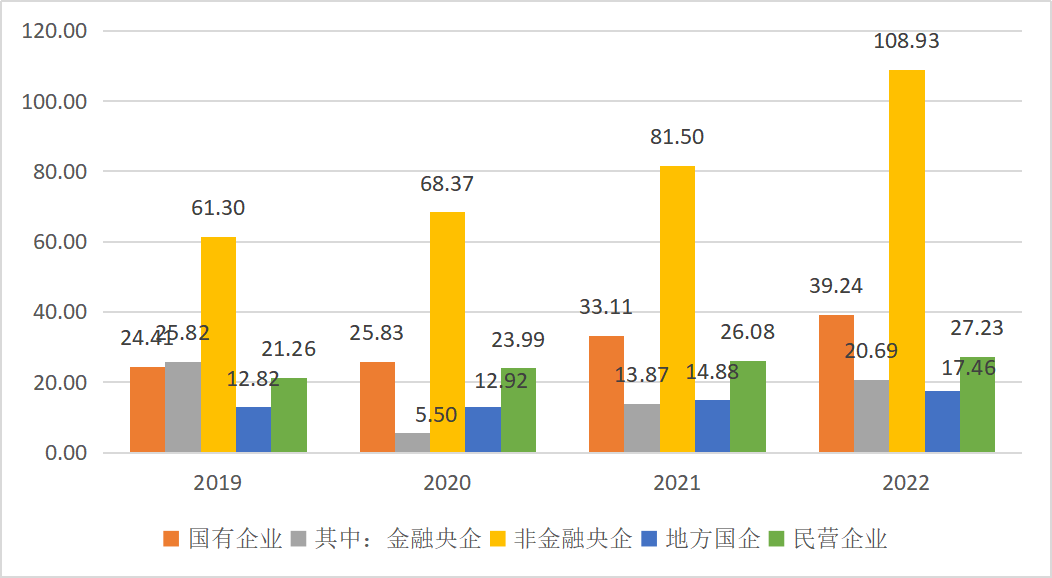

Non -financial central enterprises have continued to grow and continue to lead other companies. Among the 2022 Chinese enterprises, 52 non -financial state -owned enterprises invested a total of 566.449 billion yuan in R & D expenses, accounting for 39.16%of the total R & D expenses of the total 500; non -financial central enterprises' average R & D investment was 10.893 billion yuan, which was an average of the top 500 companies in the previous year. R & D investment increased by 33.66%. From the horizontal comparison, the average R & D investment of non -financial central enterprises is significantly higher than that of financial central enterprises and local state -owned enterprises, and it is also significantly higher than private enterprises. From the perspective of R & D intensity, the research and development intensity of non -financial central enterprises is 1.91%, which is much higher than that of financial central enterprises and local state -owned enterprises, but it is significantly lower than 2.31%of private enterprises. In addition, the high -end equipment manufacturing industry has continued to lead in research and development. In the industry ranking in the industry with R & D intensity and per capita R & D expenses, the communication equipment manufacturing industry ranks first, and aerospace ranks first in the industry with an average R & D expenses.

The trend of changes in the strength of R & D investment and R & D intensity of Chinese enterprises

The average R & D investment amount of Chinese enterprises (units: 100 million yuan)

The internationalization of Chinese enterprises continues to advance

The average multinational index is significantly improved

Among the 2022 Chinese companies, 254 companies have overseas income, overseas assets, and overseas personnel. The overseas income of these 254 companies accounts for 14.45%of the entire company's income, overseas assets account for 12.34%of all assets, and overseas personnel account for 7.05%of all personnel; of which, overseas income and overseas personnel account for 0.72 percentage points, respectively. 0.55 percentage points, but the proportion of overseas assets fell by 0.18 percentage points.

In accordance with the method of calculating the cross -border index of the United Nations Trade Organization, the multinational indexes of 254 companies were 11.28%. This average multinational index has increased by 0.36 percentage points compared with the cross -border business enterprises in the previous Fortune 500, and also increased by 0.08 percentage points from the 10.20%of the top 500 Chinese companies; After the recovery, accelerate the advancement.

However, the profitability of international enterprises has continued to be lower than non -nationalized enterprises, and this situation has continued for many years. 2022 The international business enterprises in the top 500 Chinese enterprises have lower income profit margins and net asset profit margins lower than non -nationalized business enterprises, and their per capita net profit and average net profit of enterprises are also lower than non -nationalized enterprises. Among the 2022 Chinese enterprises, the income profit margin of 254 international business enterprises was 3.47%, which was 2.45 percentage points lower than non -nationalized business enterprises; the profit margin of net assets was 8.70%, which was 0.70 percentage points lower than non -nationalized business enterprises. ; Per capita net profit is 11.30 million yuan, which is 64,300 yuan lower than non -international operating enterprises; the average net profit of enterprises is 8.926 billion yuan, which is 27 million yuan lower than non -international operating enterprises.

2022 Chinese Enterprise Fortune 500 internationalization and non -nationalized enterprises comparison

Chinese companies' Top 500 mergers and acquisitions and reorganizations remain active

State -owned enterprises become key forces to participate in mergers and acquisitions

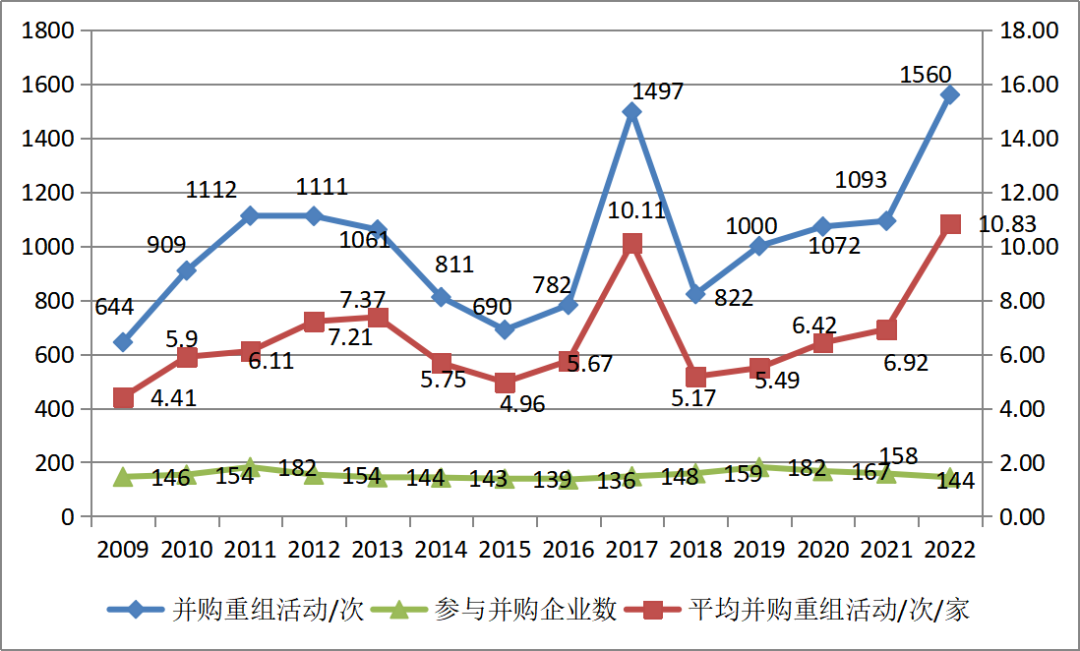

Among the 2022 Chinese companies, 144 companies have implemented mergers and acquisitions and reorganizations. This number has decreased by 14 from the previous Fortune 500. This is also the third consecutive year that the number of M & A main entities has decreased.

However, from the actual number of mergers and acquisitions reorganizations, 144 companies have implemented a total of 1560 M & A restructuring, which has increased by 467 times compared with the Fortune 500 last year, significantly increased by 42.73%. On average, each M & A subject implemented 10.83 mergers and acquisitions, an increase of 3.91 times over the last year. For four consecutive years, the number of Chinese companies' Fortune 500 mergers and acquisitions and reorganizations has increased.

State -owned enterprises are the key forces to implement mergers and acquisitions and reorganizations. Among the 2022 Chinese enterprises, 89 state -owned enterprises participated in the mergers and acquisitions and reorganization, accounting for 34.50%of all state -owned enterprises. The proportion of state -owned enterprises participated in the mergers and acquisitions and reorganizations was 11.77 percentage points. 37.22%, 14.49 percentage points higher than private enterprises.

From the perspective of the number of mergers and acquisitions, state -owned enterprises have implemented a total of 1281 mergers and acquisitions, accounting for 82.12%of the number of mergers and acquisitions. From the perspective of the average number of mergers and acquisitions of enterprises, state -owned enterprises are 14.39, which is higher than 5.07 private enterprises. Among them, the average number of non -financial central enterprises is as many as 25.14 times.

Top 500 Chinese Enterprises' Top 500 M & A and M & A Reorganization Trends

The number of shortlisted companies in the eastern region decreases

The number of shortlisted companies in the central and western regions increased from decrease to increase

The number of shortlisted enterprises (districts and cities) in the top 500 Chinese enterprises has continued to adjust, and the number of shortlisted companies in Hubei increased the largest, and Beijing decreased the most. The 2022 Chinese enterprises are distributed in 29 provinces (autonomous regions), and Hainan and Tibet still do not have the finals of the top 500 Chinese enterprises. A total of 13 companies in Hubei were shortlisted for the Fortune 500 Chinese enterprises, an increase of 5 nets from the previous year, which were the provincial -level regions with the largest number of shortlisted enterprises. Shanxi and Guangdong each increased each. Each increases by 1. Beijing's shortlisted enterprises decreased the most, and the net decreased by 5, which became the province (district and city), which reduced the largest number in the second consecutive year; followed by Liaoning, which was reduced by 4; again in Shanghai, a reduction of 2.

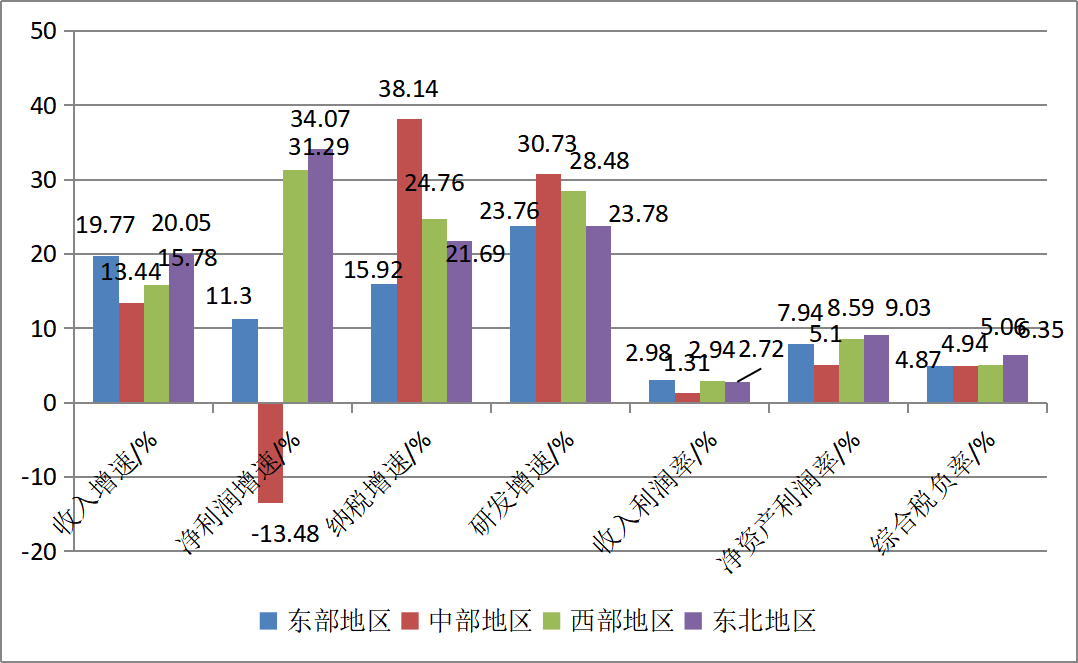

The number of shortlisted enterprises in the central and western regions increased from decrease, and the number of shortlisted enterprises in the eastern and northeast regions decreased from increasing to decrease. Among the top 500 Chinese enterprises, there were 366 companies from the Eastern region, from 6 increases from the previous year to a decrease of 5; 55 shortlisted enterprises in the central region, from 4 to the last year to 6 increases; There are 73 shortlisted companies in the western region, which has been reduced from 2 decrease last year to 3 increases; 6 shortlisted enterprises in the Northeast region have been reduced from the same year to 4. Generally speaking, the number of shortlisted enterprises in the central and western regions has increased, and the number of shortlisted companies in the east and northeast has decreased accordingly. The profitability of enterprises in central regions has declined significantly, and the operating income and net profit of enterprises in Northeast China ushered in rapid growth. Among the top 500 Chinese enterprises in 2022, due to the sharp decline in the net profit of Jiangxi and Shanxi enterprises in the central region, the overall profit decreased by 13.48%. The profitability deteriorated significantly. Level. The income profit margin of enterprises in the eastern region is 2.98%, which is higher than other regions; the profit margin of net assets in the western region is 9.03%, ranking first among the four regions. Enterprises in Northeast China ushered in rapid recovery, operating income increased by 20.05%, and net profit increased by 34.07%, all of which were leading in other three regions.

The number of shortlisted companies in the Fortune 500 of Chinese companies changes

Comparison of main indicators for finalists in the four major areas

State -owned enterprises focus on the world's first -class

Enter the stage of accelerating and high -quality development

This year is an important year for entering the new journey of building a socialist modernization country and entering the second century -old goal. The 20th National Congress of the Party will be held in October. It is a major event that affects economic development.

In the first half of 2022, the "Guiding Opinions on Accelerating the Construction of World -class Enterprises" was reviewed and approved. The introduction of the "Guiding Opinions on Accelerating the Construction of World -Class Enterprises" indicates the development direction of the major Chinese enterprises in the next few years, and it will undoubtedly substantially accelerate the construction of a world -class enterprise. The opinion pointed out that the current world -class enterprise competition and development pattern is facing new changes, requiring to increase cultivation, accelerate the construction of a number of world -class enterprises with excellent products, outstanding brands, innovation leadership, and modern governance, and proposed to build world -class enterprises in world -class enterprises Work requirements, implementation paths, specific tasks and security measures.

This opinion indicates the direction of the world -class enterprise, put forward requirements, and clarify the task. This will not only promote government departments at all levels to focus on the construction of world -class enterprises and do a good job of construction services; it will also inspire more large Chinese enterprises Entering the world -class enterprise construction camp, accelerate the pace of construction, and promote the construction of world -class enterprises with global competitiveness into a new stage.

State -owned enterprises are the key subjects of large Chinese enterprises. Since the 18th National Congress of the Communist Party of China, the Party Central Committee has continued to deepen the reform of state -owned enterprises. The three -year operation of state -owned enterprise reform is the specific construction map of the "1+N" policy system and top -level design of the reform of state -owned enterprise reform. It is also the re -deepening of major measures to reform various state -owned enterprises since the 18th National Congress of the Communist Party of China. Over the past three years, under the correct deployment and strong leadership of the Party Central Committee and the State Council, through the efforts of the state -owned assets commissions, central enterprises and local state -owned enterprises at all levels, we have become stronger and better, and have greatly enhanced the state -owned economic competition. Power, innovation, control, influence, anti -risk ability. On July 16, 2022, Hao Peng, Secretary of the Party Committee of the State -owned Assets Supervision and Administration Commission of the State Council, stated at the seminars of the central enterprise that as of the end of June, the main task of the three -year operation of state -owned enterprise reform was basically completed.

The "2022 Chinese Enterprise Fortune 500 Enterprise Development Report" pointed out that with the comprehensive implementation of the three -year action plan of state -owned enterprise reform, the development environment of state -owned enterprises will be significantly optimized, the development foundation will further consolidate, the development vitality will be fully stimulated, and the competitiveness and efficiency of enterprises will be stimulated. The benefits will be significantly improved, and state -owned enterprises will enter the stage of accelerating and high -quality development. (State -owned Assets Report Reporter Yuan Shimeng, Deputy Researcher Gao Rui, Association of Chinese Enterprise Federation)

Let's look at the 2022 Chinese Enterprise 500 list-

- END -

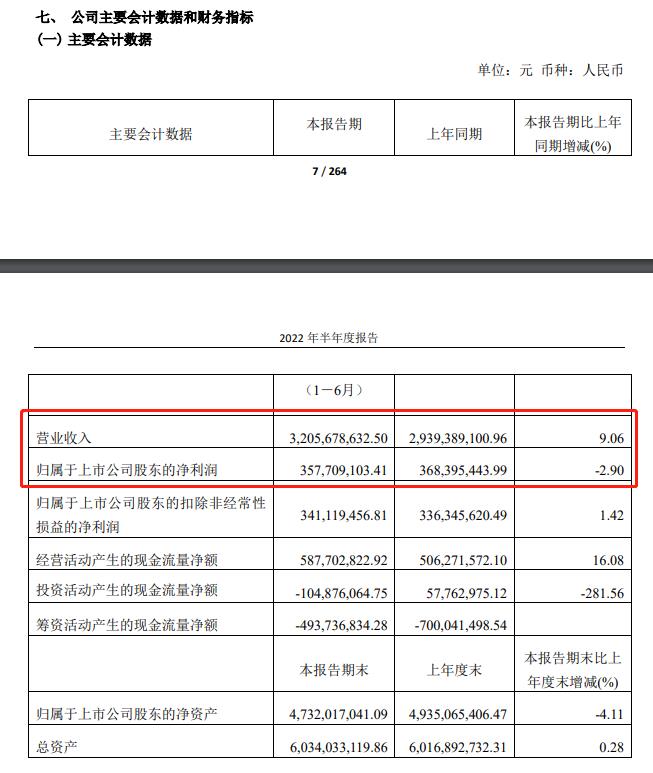

V viewing financial report | The price of raw materials rises, the cost increases the increase in Tao Li bread, "increasing increasing increasing income"

Zhongxin Jingwei, August 10th. On the afternoon of the 10th, Tao Li Bread released...

The number of uniforms and trade associations integrates high -quality development forums: Divine integration urges the new future of the cultural tourism industry

In order to better conform to the rapid development trend of the digital economy a...