Market decoding 丨 June LPR remains unchanged, will it be reduced in the future?

Author:Chuanguan News Time:2022.06.20

Chuanguan News reporter Tian Yan

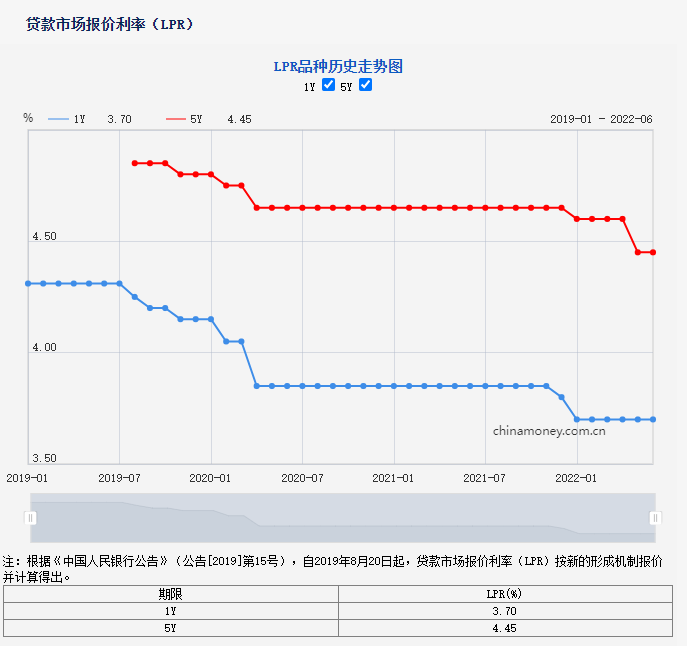

After the "loan market quotation interest rate" (hereinafter referred to as LPR) below a single maximum decrease in more than 5 years, the LPR failed to reduce continuously in June. On June 20, 2022, the People's Bank of China authorized the National Bank of China Interbank Borrowing Center to announce that the one -year LPR was 3.7%and the LPR of more than 5 years was 4.45%. This also means that the 1 -year LPR and more than 5 -year LPR are the same as last month.

For the June LPR quotation remains unchanged, many experts said that there is still room for decomposition in the future. Although the LPR quotation fails to continuously reduce, it does not affect the continuous reduction of the actual loan interest rate of the enterprise.

June LPR offer

Why remain unchanged?

LPR is formed by two parts: operating interest rates and banks in the open market. In terms of public market operating interest rates, it mainly refers to "interim borrowing convenience" (hereinafter referred to as MLF). Under normal circumstances, if the MLF interest rate remains unchanged, the possibility of the LPR adjustment of the month is relatively small. Earlier, the People's Bank of China had continued to do MLF in June, and the operating interest rate has not changed.

In terms of bank plus points, Wang Qing, chief macro analyst of Dongfang Jincheng, said that the reduction was not implemented in May, and credit investment accelerated significantly. Add some motivation.

In addition, the price of LPR above May 5th was reduced by 15 basis points, which is large, which will also affect the decline in bank liability costs such as the decline in bank liabilities to a certain extent. Zhang Xu, chief fixed income analyst of China Everbright Securities, analyzed that LPRs of more than 5 years in May have just declined 15 basis points. It has a obvious effect and continuity for the effect of loan volume and price. Essence

At the same time, the performance of financial data in May is also one of the reasons why LPR is not changing. Zhou Maohua, a macro researcher at the Everbright Bank Financial Market Department, said that the domestic economy has shown the momentum of stabilizing recovery, and the demand and structure of the domestic real economy in May have improved. At the same time, the domestic stable growth policy has gone forward, and the policy effects have appeared.

Although the quotation of the two varieties of LPR this month is unchanged, from the perspective of many experts, it does not affect the continuous reduction of the actual loan interest rate of the enterprise. Wang Qing believes that the current economy is in the early stages of restoration, and the policy surface is focusing on guiding banks to increase credit to allow the real economy. From this, focusing on stimulating the credit needs of enterprises and residents, banks have the motivation to continue to reduce the actual loan interest rate in the short term. In addition, the recent structural policies such as small WeChat credit support have been fully developed. While driving the incremental expansion of bank loans, this will also form a certain "reduction price" effect.

Will it be reduced in the future?

Regarding the direction of LPR quotations in the future, many experts said that there is still room for further reduction.

From the perspective of CITIC Securities' Mingming Bond Research Team, under the "policy of the city", the real estate policy is loosen in many places. There is still room for low -level LPR quotation in the next five years. "In May, MLF did not cut interest rates, and the 5 -year LPR downgraded 15 basis points. In conjunction with the lower limit of the interest rate of the first house's commercial personal housing loan, guided the interest rate of the housing loan rate, and supported the first need to just have a reasonable housing demand."

"We still have some room for adjustment." Wang Qing analyzed that in the next few months, in the next few months, the Fed will continue to greatly tighten the prospects of monetary policy, while the domestic monetary policy will pay more attention to the "mastering me as the main" tone, it will pay more attention to Internal and external balance, the possibility of MLF interest rate is less likely. However, considering that the possibility of continuing export growth in the second half of the year is greater, real estate will also run at a low level. In addition, domestic consumption restoration may be slow, and the policy surface needs to be moderate in the direction of steady growth.

It is worth mentioning that since the reform of the LPR quotation formation mechanism, in May this year, the first -year LPR did not drop and the 5 -year LPR decline, and the 5 -year LPR set the largest decline. From the perspective of the industry, the LPRs of the 1 -year and 5 -year period in June are consistent with May, indicating that my country continues to implement structural interest rate cuts, which also reflects the critical period of the current steady growth. my country's financial industry Strengthen the efforts to bailout the real economy, boost effective demand, and stabilize economic growth.

In the future, if the MLF interest rate remains unchanged, will LPR still have room to reduce? Zhang Xu believes that because more banks have recently lowered the interest rate of more than one period of time and large deposit deposit, even if the MLF interest rate does not decrease in the future, LPR quotes may still be reduced through the pressure of bank points. Wang Qing also said that while the MLF interest rate remains unchanged in the second half of the year, the regulatory level can promote the decline of bank funds by guiding bank funds to promote LPR quotation, thereby reducing the interest rate of corporate and residential loan.

- END -

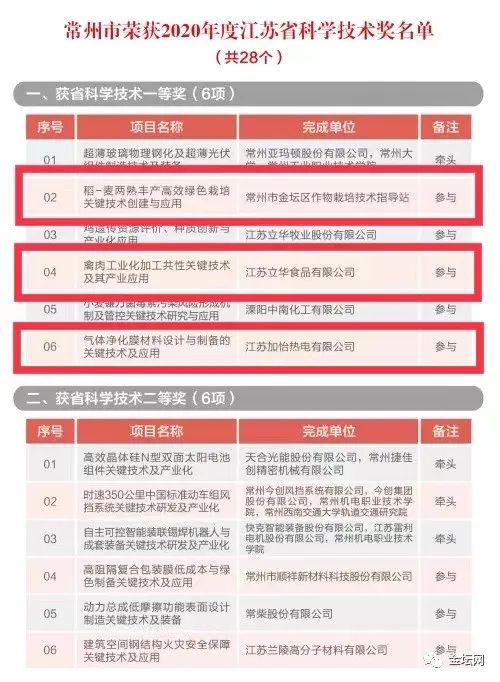

The province commended!Four Golden Altar!

Be happyrecentlyProvincial Science and Technology Reward ConferenceAnnounced 2020 ...

Suizhou High -tech Zone held a coordination and supervision meeting for the construction of a special railway line of thermal power plants

On the afternoon of June 14, Suizhou High -tech Zone held a coordination and super...