The United States brewing the biological manufacturing bill, Singapore becomes a "shelter" in the sea?Who is the next after Kingsrui, Koxing, Fosun, and Yao Ming?

Author:Pharmaceutical economy Time:2022.09.12

The latest media reports show that after the "chip bill" of US President Biden, the US President Biden is preparing to sign a new administrative order. It is reported that the draft administrative order draft has formulated a strategy of "supporting American manufacturing" and encouraged the use of biological systems to develop a series of products and materials, covering new drugs, human tissues, biofuels to food and other fields.

With the gradual refinement of the global industrial chain, the drug manufacturing includes the treatment of drugs and antibiotics that treat hypertension, diabetes, etc., and have been transferred from the United States, Europe and Japan to China in the past few decades. This situation obviously aroused the "key concern" of the American Biden government, and the new administrative order was also considered "targeting China" again.

Faced with the intricate international economic situation, Chinese pharmaceutical companies have begun to act in uncertainty.

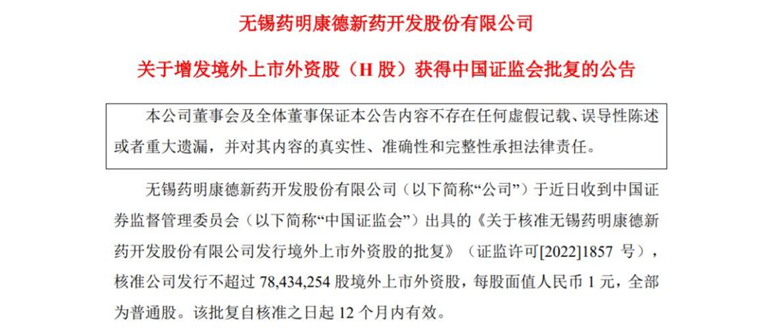

Yaoming Kangde recently issued an announcement that the issue of the issue of overseas listed stocks (H shares) was officially approved by the China Securities Regulatory Commission. According to the issuance plan, 70% of the funds raised will be used to expand the group's overseas business, of which 35% will be 35% (HK $ 2 billion) will be used in overseas business in Asia and other regions.

In July of this year, Yao Ming Kant publicly announced that it is expected to invest S $ 2 billion (about 9.73 billion yuan) in Singapore in the next ten years. The "9.73 billion yuan" amount far exceeds the overseas business funds issued by H shares.

Coincidentally, since this year, many domestic pharmaceutical companies have listed Singapore as the choice of "going to the sea":

In February, Kings Rui Biological officially announced that the company's Singapore production research and development base in the Asia -Pacific region was officially put into operation. The base has more than 30,000 square feet of highly automated protein production and genetic synthetic service equipment;

In March, Xinge Yuan Biotechnology Co., Ltd. announced the acquisition of Singapore's precision medical company Proteona Pte. LTD.

In June, Kexing Group currently plans to invest more than S $ 2 billion (10 billion yuan) to set up scientific research facilities and international commercial headquarters in Singapore;

In June, Fosun Pharmaceutical issued an announcement that the holding subsidiary FOSUNPHARMAPTE. It is planned to contribute no more than 218 million yuan (equivalent to RMB 1.054 billion) to include onCocare, one of Singapore's largest private oncology specialty centers.

China's open door will not be closed, it will only open and bigger. There are still more uncertainty in the US stock market, and more and more Chinese companies have begun to plan for -the case of "second listing" or "double listing" in Hong Kong and Singapore, China. This is not uncommon. It seems that this also provides path selection outside the U.S. stocks with "high -tech" attributes.

Is Singapore's international "bridgehead" or "refuge" for capital seeking retreats?

Does the Southeast Asian market have enough space to get rid of "inner rolls" in Chinese companies?

Singapore "Search"

ASEAN market prospects?

In recent years, domestic pharmaceutical companies have shifted their attention overseas to Southeast Asia, entered ASEAN, and used Singapore as an important destination for the "Asian market" sector. Pharmaceutical companies are actively "going to sea" on the industrial side and capital.

Affected by the global epidemic, although the international political and economic situation has severe and developed, the trade between China and ASEAN countries is still deepening. According to statistics recently released by the General Administration of Customs, the total value of my country's import and export in the first eight months of this year was 27.3 trillion yuan, an increase of 10.1%year -on -year; ASEAN is still the largest trading partner in my country. In the first 8 months, my country and ASEAN and ASEAN The total trade value was 4.09 trillion yuan, a year -on -year increase of 14%, maintaining a rapid growth rate.

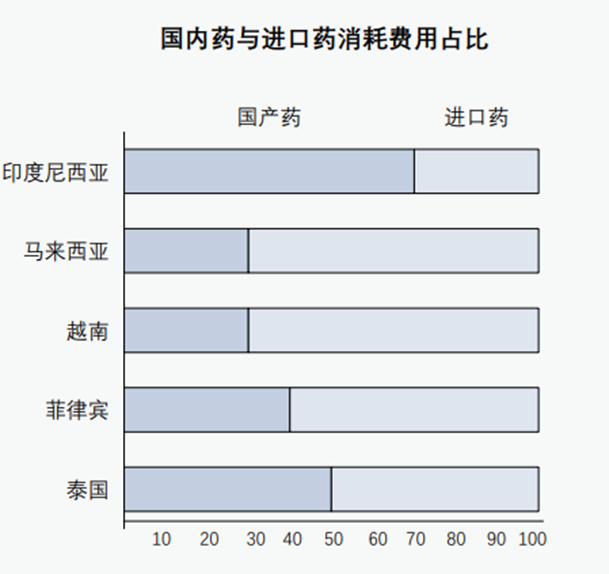

Some industry experts predict that by the end of 2022, only Indonesia, Malaysia, Singapore, Thailand and Vietnam will enter the middle class. The disposable income of the middle class in the region is expected to reach 300 billion US dollars; The problem of medium aging and non -infectious diseases, and the continuous rise in medical expenditures, also allowed drug consumption in most ASEAN countries to rely on imports.

Data show that domestic drugs of Chinese companies are one of the important import sources of countries in ASEAN countries.

Source: Pacific Bridge Medical "Aiming at the Asian Market", World Bank Group "Southeast Asian Drug Supervision System and Regulatory Coordination Scope"

Industry insiders pointed out that local pharmaceutical companies choose to use Singapore as a fulcrum to go out to sea, quickly establish internationalization capabilities, and then radiate to other countries in ASEAN, and then lay out in Europe and the United States. In License-in commercial cooperation, companies often choose the commercialization of commercialization of the Chinese market with the commercial rights and interests of Singapore, South Korea, Indonesia, the Philippines and other countries, which will help to strive for more BD negotiation chips.

In fact, since the beginning of this century, transnational pharmaceutical companies, Singapore has been regarded by multinational pharmaceutical companies (MNC) and BIOTECH as an important market area that opens the Asian market. Giants and other giants have set up regional headquarters or manufacturing centers in Singapore. MRNA emerging BionTech and Moderna also clearly clearly regarded Singapore as an important base for entering the Asian market. This choice is not unprecedented. Singapore is adjacent to Malaysia and Indonesia. It is in the more central position of 10 ASEAN countries. Since Singapore is located in the Malacca Strait, there are more than 20 newly established bases in the world's 25 major shipping companies, of which about 10 can provide specialized medical logistics services. This is undoubtedly undoubtedly. Bring the convenience of logistics transportation.

In addition, it takes about 6 hours to take off from China ’s domestic airport to Singapore Changi Airport; and because the Chinese population accounts for more than 70%, Mandarin is one of the important official languages in Singapore. Communication and management of personnel of the two places.

In recent years, from traditional Chinese medicine, chemical drugs to cell treatment, more and more Chinese drugs have entered the Singapore market or launched clinical trials, and continuously accelerate the internationalization process:

In May 2020, the Singapore Health Science Bureau (HSA) approved the issuance of the "Chinese Academy" registration approval, approved the registered registration of Singapore's Chinese medicine standards;

In November 2020, the Core Stone Pharmaceuticals announced that the company had submitted the new drug listing application (NDA) of the Singapore Health Science Bureau (HAS);

In February 2022, Genting New Yao announced that the Sanyin breast cancer indication of TRODELVY (Goshazuzab) was approved by the Singapore Health Science Bureau;

In March 2022, Deqi Pharmaceutical announced that Xpovio (Selinoso) has obtained a listing of the Singapore Health Science Bureau (HSA);

In May 2022, Sano Medical announced that the company's new generation of HT Supreme Drug Requesting and Tytrak semi -centered balloon pocket catheter obtained Singapore's "Medical Device Registration Certificate".

Obviously, from the perspective of the needs of the internationalization of drug supervision, whether it is approved by the European and American markets and radiated to emerging markets such as Southeast Asia, or through the accumulation of experience in emerging markets to extend the European and American markets, the strategy choice of Chinese pharmaceutical companies has begun to tend Diversification.

Opportunities and risks coexist. From a market perspective, although ASEAN countries are working hard to promote the comprehensive health coverage plan advocated by the World Health Organization ("UHC"), considering the different economic levels of various countries, the proportion of individual self -payment is also different.

Source: World Health Organization Data

Source: Southeast Asia Southern Asia Hygiene Finance Report

According to data from the World Health Organization, medical expenditures in Southeast Asia from 2000-2018 accounted for GDP percentage levels at a low level of GDP. In addition to Singapore, the per capita public health expenditure (CHE) in the ASEAN region reached 2619 US dollars, the rest of the rest are less than $ 400 Essence

Therefore, experts suggest that for Chinese local enterprises, the additional expenditures that may increase "going to sea" and the profit cycle of product profit may have a long -term impact on the overall profit of the enterprise itself. China thinks more about long -term strategy.

Chinese stock market return to Asia

How to choose a "shelter"?

Since the second half of last year, the environment for Chinese companies to go public in the United States has fallen to freezing. On August 12, 2022, the listing of five US stocks listed announced that it would delist from the New York Stock Exchange. In order to diversify the risks, there may be more Chinese stocks return to Asia in the future.

In fact, since the 1990s, the Brilliance Automobile (NYSE: CBA) as the first Chinese enterprise listed abroad to land on the NYSE, China stocks have gone through thirty years, and now there are nearly 300 companies. Chinese companies are listed in the United States.

However, since the "Didi incident" at the end of June 2021, 38 of the 41 stocks listed in 2021 were completed the IPO in the first half of the "Didi incident". Only 3 Chinese companies were in the second half of the year. Beauty listing. In 2022, this situation has not been improved. As of the end of July, only 7 Chinese companies successfully knocked on the bell in the United States.

As early as March of this year, the US Securities and Exchange Commission (SEC) issued an announcement, which included 5 companies such as the "Foreign Companies' Accountability Act" to include Baiji Shenzhou, Yumsheng China, Zai Ding Medicine, Shengmei Semiconductor, and Hehuang Medicine. List. In the first half of this year, the SEC has listed more than 140 Chinese stock companies on the list, which will undoubtedly exacerbate the return of China stocks.

Financial institutions who are familiar with the US stock listing rules said that the SEC's "Foreign Companies Accountability Act" clarifies that listed companies in the United States need to disclose the audit draft, otherwise they will face the risk of delisting; A large number of issues on the influence of VIE architecture and industry policies have further exacerbated the difficulty of overseas listing. The biopharmaceutical sector, as a concentration of US stocks "Chinese stocks", has also received the key "care" of SEC.

Facing the intricate global economic situation, "gentleman not stands under the wall", Chinese stocks must find a shelter to accelerate the conversion of listing locations. According to the data released by the Hong Kong Stock Exchange, dozens of Chinese stocks have returned to Hong Kong stocks in different forms. In addition to the privatization of enterprises such as Yaoming Kangde and San Life Pharmaceutical, they will be listed through privatization. "Listing" and other methods have also been widely selected by listed companies. It is worth noting that the selection of the return listing of China Stocks is not a single choice. As one of the overseas listing destinations of Chinese pharmaceutical companies, the New Stock Exchange also provides a choice for Chinese biomedical companies. Weilai Automobile was listed in the Hong Kong Stock Exchange and the New Stock Exchange in May 2022 and May 2022, respectively, and carried out a globalized capital market layout.

At present, the New Stock Exchange has set up "motherboards" and "Kelly board". From the perspective of its announcement, Kelly Board is suitable for science and technology innovation enterprises in the rapid growth stage. In terms of analogy, the target is the 18A and A -share science boards of the Hong Kong Stock Exchange. The difference is that the New Stock Exchange does not set the threshold for quantitative entry, but is decided by the sponsor to decide whether the applicant is suitable for listing on the New Stock Exchange. In addition, Singapore's REITS and foreign exchange -related products are richer and more active in transaction. These are more active. These are more active. These Factors may attract China's unprofitable BIOTECH company to go public in Singapore.

However, the New Stock Exchange is not "perfect". Data show that at the end of 2021, there were 2,572 listed companies in the Hong Kong Stock Exchange with a market value of more than 5 trillion US dollars. The market value ranked 4th among 23 exchanges in the APAC area, second only to the Shanghai Stock Exchange, the Japanese Stock Exchange and the Shenzhen Stock Exchange; There are 673 listed companies with a market value of over 600 billion US dollars. The market value ranks 9th in the APAC area. The Hong Kong Stock Exchange's stock market transactions are more active. In 2021, the average daily turnover of the Hong Kong Stock Exchange exceeded US $ 16 billion, while the average daily turnover of the New Stock Exchange was only 960 million US dollars.

Biomedical companies need the most needed financing. "Lack of liquidity" is obviously the biggest shortcoming. For the Singapore capital market, it is possible to improve the mechanism and improve liquidity. Really retain the core elements of listed companies.

If the timeline is stretched, the Chinese pharmaceutical company is delisted after the Singapore Stock Exchange is listed first. In 2004, Green Leaf Pharmaceutical went public to Singapore, but due to insufficient liquidity, Green Leaf Pharmaceuticals delisted from Singapore after completing privatization in 2012 and landed on the Hong Kong Stock Exchange in 2014. After the Hong Kong stock market was listed, the performance of Green Leaf Pharmaceuticals has always been It is growing steadily.

Financial market experts said that in the context of the current market environment is not stable, companies seeking dual major listing are in line with market expectations. "At present, among the companies listed on the New Stock Exchange, companies from China accounted for 15%of all listed companies. In addition to Hong Kong stocks, Singapore may become a new destination for Chinese pharmaceutical companies' overseas capital markets."

Edit: Chen Zesheng

- END -

Treasury market Fengyun | Moody's adjustment of Geely Automobile Rating Outlook is the first single guarantee bond of private housing enterprises in private housing companies to land

Zhongxin Jingwei, August 24th (Lei Zongrun) On August 24, Shibor's short -end varieties rose and down. Overnight varieties were reported 1.3bp 1.122%, 7 -day downward settlement 5.4bp reported 1.445%,...

Practice the responsibility of the organizer to help the development of the light industry industry chain

Practice the responsibility of the organizer to help the development of the light industry industry chainThe industrial chain and supply chain are the lifeblood of the economy. The stable supply chain