Lift the ban over 100 billion yuan!The market value of nearly 44 billion yuan this week has decreased by 35% month -on -month.

Author:Cover news Time:2022.09.12

Cover reporter Liu Xuqiang

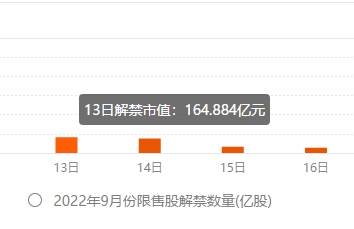

This week, the market value of tens of billions of yuan is about to attack. According to Wind data statistics, a total of 62 companies involved in the release of restricted shares this week (9.13-9.16), and the total number of lifting ban was about 1.846 billion shares. Based on the latest closing price, the total market value of the lifting of the ban was 43.686 billion yuan, a year -on -week decrease of 35.35%year -on -week.

Data show that the market value of 43.686 billion yuan this week was lifted.

From the perspective of the scale of lifting the ban, after statistics, the single -crystal ternary lithium electrical material leader Zhenhua New Material has the largest market value. The shared shareholders include the third largest shareholder of Zhoushan Xintianyu, the growth equity investment partnership and strategic matching shareholder Ningde Times. The reporter noticed that as of the close of September 9, Zhenhua New Materials's stock price was reported at 53.90 yuan/share, with a market value of 23.9 billion yuan. It is worth mentioning that since the listing, Zhenhua New Materials's stock price has increased by 360.93%from the issue price. The proportion of floating profits of strategic distribution shareholders such as Ningde Times has exceeded 3 times.

The second largest stock of the ban on the ban is Anjing Food, and shareholders including many investment companies and fund management companies. The reporter noticed that the company's lifting shares came from Aoi Food in March 2022 to complete the fixed increase, when the fixed increase price was 116.08 yuan/share. As of the closing of September 9, Anjing Food's stock price was 140.92 yuan/share, with a market value of 41.3 billion yuan. It means that after half a year, the proportion of shareholders participating in the above -mentioned fixed increase reached 21.91%, and the total floating profit amount exceeded 1.2 billion yuan.

In addition to lift the market value, the scale of lifting the ban has even more impact on individual stocks. According to Wind data, the number of shares of 4 shares of the shares of the banned shares will account for more than 40%of the total shares next week. , 45.43%, 43.45%, 41.35%. After lifting the ban, the first three stocks will increase by more than 200%.

Does a large lifting of the ban mean a significant fluctuation in the secondary market price? In this regard, industry experts stated that restrictions on sale stocks are a choice of choice, not the right to execute, and the scale of lifting the ban does not mean the actual reduction of holdings. From the perspective of past experience, the impact of restricted stocks has an uncertainty on the stock price. Compared with the cost of restricted shareholders, there is a large discount space compared to the secondary market price. Whether there is a lifting power depends on whether the stock market value is overestimated and whether its shareholders have cash demand. If the shareholders are confident in the future development of the company or the company's stock price is not ideal, the power of lifting the ban is insufficient.

- END -

Top Ten Innovation Liaocheng | Jiangbei Water City's trendy, "The world dare not make a small Liaocheng"

Liaocheng is agile and timeless because of water. The Millennium Beijing -Hangzhou...

Qiannan Prefecture organizes high -quality enterprises to exhibit China Lanzhou Investment and Trade Fair

Recently, the reporter learned from the State Commerce Bureau that the 28th China Lanzhou Investment and Trade Fair was held in Lanzhou, Gansu from July 7th to 10th. Guizhou Duyun Winery Co., Ltd., Gu