The science and technology board welcomes a hundred yuan shares: Yiquan Technology Three Capital IPO R & D expenses Eight becomes employees' salary

Author:Cover news Time:2022.09.12

Cover Journalist Xiong Yingying

A shares will usher in a new shares of 100 yuan! On September 13th, Yiquan Technology will land on the science and technology board, with a stock code of 688391, the total issuance of 14.44 million shares, and the issuance price of 115.00 yuan.

Data show that before the sprint science and technology board was launched, Junquan Technology was listed on the New Third Board and delisted in April 2018. In addition, the company also sprinted A shares twice. For the first time, it was planned to log in to the GEM in 2011, and the company withdrew the application documents at the end of 2012; in 2016, it submitted the prospectus to the main board of the Shanghai City, but in November 2017 Whether it will be.

Main smart meter chip design

In the R & D expenses, 80 % of employees' salary accounts for employees

Xuanquan Technology was established in 2005. Its main business is the research and development, design and sales of smart grid terminal equipment chips. The main products include electrical metering chips, smart meter MCU chips, and carrier communication chips.

It is understood that the smart meter is the basic device of the data collection of the power grid. It undertakes the task of measuring, collection and transmission of electricity data. It is an important part of the smart grid. Important components of function.

In recent years, with the continuous advancement of my country's smart grid construction, the company's performance has also shown a year -on -year growth trend. The prospectus shows that from January to June this year, its operating income was 301 million yuan, and net profit attributable to the mother was 87.217 million yuan, an increase of 49.37%and 152.31%year-on-year. The company is expected to achieve a net profit of 138 million yuan to 150 million yuan in the first three quarters of this year, a year -on -year increase of 108.69%to 125.90%.

As a smart meter chip research and development design enterprise, the company is also continuously increasing R & D investment. From 2019 to 2021, the company's cumulative investment in R & D is 203 million yuan, accounting for 17.27%of operating income. As of the end of 2021, the company had a total of 136 R & D personnel, accounting for 71.96%of the total number of employees.

It is worth mentioning that from the perspective of the composition of R & D expenses, most of them are spent on employees' salary. The prospectus shows that from 2019 to 2021, the company's employee compensation was 41.6323 million yuan, 48.4568 million yuan, and 72.788 million yuan, respectively, accounting for 79.38%, 81.42%, and 79.42%of the R & D expenses, respectively.

13 -dollar stocks were listed in the year

Semiconductor companies account for 5

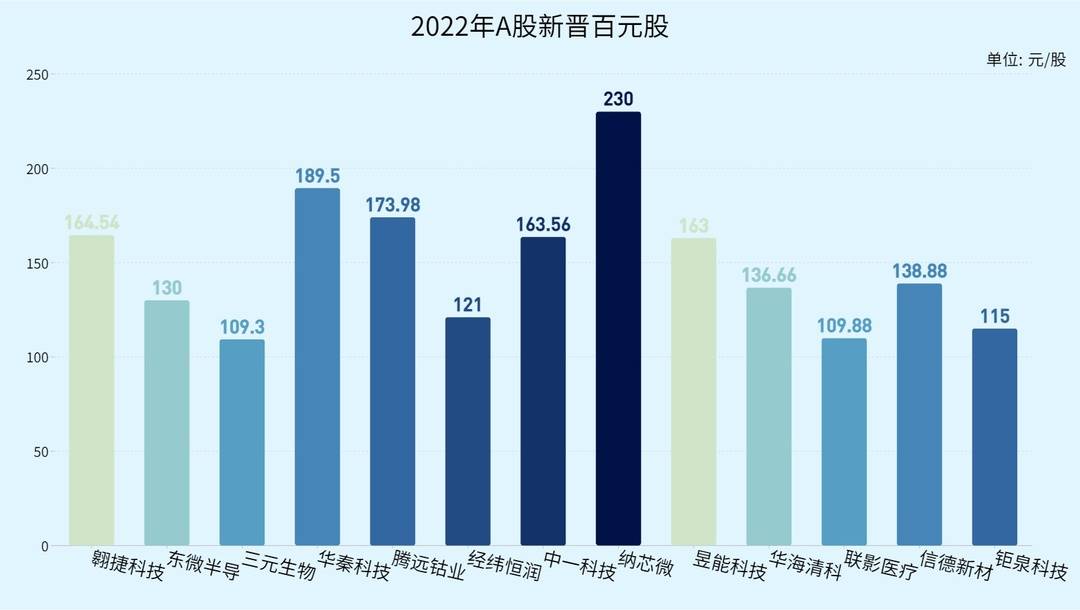

With the listing of Yiquan Technology, the number of A -share 100 yuan shares will increase to 13 during the year, 9 of which are new shares of science and technology board, and semiconductor companies account for 5.

From the perspective of market performance, 9 of the 12 hundred yuan shares that have been listed have increased on the first day. Yuneng Technology, which focuses on the new energy field of photovoltaic power generation, has increased by up to 77.98%. Among the three companies that broke on the first day, Cijie Technology fell more than 33%.

On April 22, Na core micro -landing science and technology board, with the issue price of 230 yuan/share, became the highest issue price of this year, the closing price increased by 12.86%on the first day. The company has always focused on the research and development of high -performance and high -reliability simulation integrated circuits. In the first half of the year, net profit attributable to mothers was 195 million yuan, an increase of 116.5%year -on -year, and its performance was bright.

There are also counterattacks relying on excellent performance after the first day of the company. On April 19, Jingwei Hengrun landed on the science and technology board, a decrease of 17.35%on the first day. However, with the high gross profit margin R & D service and solution business Q2 revenue increased significantly, the company achieved net profit of 100 million yuan in net profit at the first half of the year, an increase of 266.3%year -on -year.

After the semi -annual report was disclosed, Jingwei Hengrun blocked the 20%daily limit board on August 29. Many institutions also gave the "buy" and "increase holdings" rating, and the company's stock price also rose. As of the latest closing, 220.4 yuan/share, a cumulative increase of over 120%.

- END -

4 days of live room GMV more than 70 million!Behind the selection of Dongfang, the customer unit price and selection are waiting to be tested

Although the live broadcast room of the Oriental Selection of New Oriental Online ...

New Oriental's online stock price plummeted, and it was reduced by Tencent.

Radar finance produce | Li Yihui edited | Deep SeaOn June 20, the decline in the e...