600759 out of the circle!The first A -share "talk show concept stock" was born, and the net profit in the first quarter increased by 96 times but was wearing a hat ... The shareholders are waiting for the opening

Author:Beijing Commercial Daily Time:2022.09.12

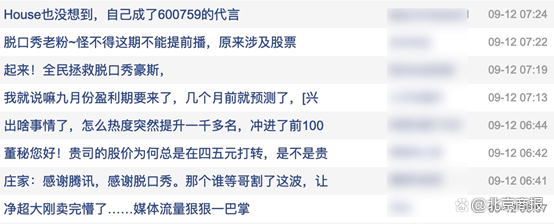

Screenshot of the Performance of the Fifth Season of the talk show: Screenshot of Tencent Video

"I didn't eat or drink in those days, but I looked out the window quietly. I didn't dare to tell my parents that my stock trading. My mother thought I had an unforgettable love."

In the "Talking Show Conference" broadcast during the Mid -Autumn Festival holiday, the talk show actor House tells his experience of investing in blood loss. During the performance, House also disclosed the stock code that made him loses huge- "600759".

After the show was broadcast, the stock of "600759" was boiling. What kind of stock is this?

The first "talk show concept stock" was born in A shares

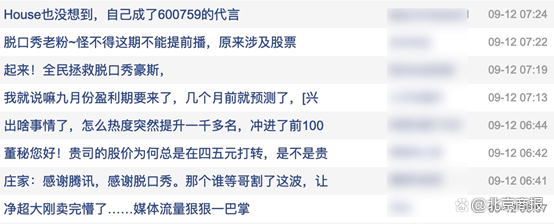

On September 12, the "600759" stock bar has become a commemorative place for shareholders and witnessed the birth of the first "talk show concept stock" in A shares.

The reason was in the latest issue of the "Fifth Season of the talk show conference". The talk show actor House described his investment experience and accurately told the retail mentality and successfully realized the "bombing".

Photo source: public account of Xiaoguo Factory

House said that the first stock he bought was 8,000 yuan two days ago, and his mentality was bursting. However, on the third day, it lost 4,000 yuan and lost 6,000 yuan on the fourth day until "120,000 left." In the later description, House directly disclosed the stock code that made him losing hugely- "600759".

On the evening of the 11th, in the contents of the public account of the laughing fruit factory, House told his creative process of the above content, and directly stated that the performance of comedy processing was "not so much loss."

However, he did not mention the relevant content about "600759". Some media commented that he didn't seem to realize that his performance has successfully set off the enthusiasm of A shares of A shares of the stock.

On the evening of September 12, ST Intercontinental issued a clarification announcement, saying that the company noticed that the Internet entitled "A talk show" 600759 "! What happened to the shareholders waiting for the opening? "The report caused market attention. As of now, the company's production and operation has not changed significantly. Investors are requested to invest rationally and pay attention to risks.

What kind of company is "600759"?

"600759", stock code of ST, intercontinental (intercontinental oil and gas).

In the past year, the overall trend of ST continent in the secondary market has fallen. Oriental Fortune shows that from September 9, 2021 to September 9, 2022, the cumulative decline of ST Intercontinental range was 17.22%. As of the closing of September 9th, STCAM reported 2.5 yuan/share, with a total market value of 5.659 billion yuan.

Public information shows that STCAC was established in 1984 and was formerly known as Hainan Zhenghe Industrial Group Co., Ltd. In 2014, the company transformed into the oil and gas industry. The main business has now transformed from real estate, leasing services and trade to oil exploration and development and investment in petrochemical projects and technology development, consultation, and services of related engineering.

It is reported that from last year to this year, the performance of intercontinental oil and gas has experienced a sharp rise. On the evening of April 24, intercontinental oil and gas disclosed the 2021 annual report. During the reporting period, the company realized operating income of 2.453 billion yuan, an increase of 51.22%year-on-year; "The net profit of home was 700,000 yuan, an increase of 100.24%year -on -year.

As of December 31, 2021, the current liabilities of intercontinental oil and gas were higher than the mobile assets of 4.622 billion yuan.

The audit results of the Dahua Accounting Firm (special common partnership) believe that "there is a large amount of overdue borrowing and expected liabilities with a large amount of intercontinental oil and gas, and the liquidity is temporarily difficult, indicating that there is a major failure to cause doubts about the continued doubts of intercontinental oil and gas operation capabilities. OK. "

More importantly, because intercontinental oil and gas have touched "the recent three consecutive fiscal year deducting non -recurring profit or loss before and after the low net profit is negative, and the recent audit report of a financial accounting report for the recent accounting year shows that the company's continuous operating capacity exists In the case of uncertainty, the company's shares were suspended on April 25, 2022 for one day. From April 26th, the trading was resumed and other risk alerts were implemented. The abbreviation of A -share stocks was also changed from "Intercontinental Oil and Gas" to "ST ICC".

Interestingly, the performance of the first quarterly report disclosed at the same time on the evening of April 24, which was disclosed at the same time on the evening of April 24, increased significantly, and the net profit attributable to mothers increased by 9664%year -on -year. Regarding the growth of performance, intercontinental oil and gas mainly due to "the international average international oil price increased during the reporting period compared with the same period last year, and the performance of the subsidiary Ma Teng's performance significantly increased compared with last year."

According to the latest semi -annual report of ST Intercontinental, ST Intercontinental revenue was approximately 1.335 billion yuan, an increase of 15.48%year -on -year; net profit attributable to mothers was about 124 million yuan, an increase of 117.75%year -on -year.

Just disclosed a sharp news this month

Because of a performance of HOUSE, many investors said that they would buy something on Tuesday (the first trading day after the festival) to help the House back.

However, it is worth noting that on September 9, ST Intercontinental just disclosed a sharp news.

According to the ST continental announcement, due to the dispute between the borrowing agreement, the Rural Credit Cooperative Cooperative (hereinafter referred to as "Liuzhou Agricultural Credit Society") will be Referred to as "Liuzhou Huagui"), the company, and the business management to the people court of the city of Liuzhou City. The civil judgment issued by the People's Court of Liuzhou City on October 14, 2021, the judgment was as follows: The defendant Liuzhou Huagui repaid the principal of approximately 17.894 million yuan to the plaintiff Liuzhou Agricultural Credit Society, with a penalty of about 11.223 million yuan; Liuzhou Agricultural Agricultural The Lixian has the right to pay priority for the mortgage provided by intercontinental oil and gas within the scope of the mortgage guarantee to be discounted or based on the auction or sale of the prices of the mortgage. Clear liability. The guarantor had the right to recover from the defendant Liuzhou Huagui after the guarantee of the guarantee; rejected the plaintiff Liuzhou Agricultural Credit Society other litigation requests.

The Liuzhou Central District People's Court issued the "Executive Notice" to Liuzhou Huagui, Intercontinental Oil and Gas, Zhenghe Commercial Management on August 15, 2022, pointing out that there was a dispute with the Liuzhou Agricultural Credit Society in the Liuzhou Agricultural Credit Society. Civil judgment has been legal effect. The applied executive Liuzhou Agricultural Credit Society applied for compulsory implementation from our court, and the court filed a case according to law. The following obligations were ordered to fulfill the following obligations: fulfilling the payment or behavior obligations determined by the above -mentioned effective legal documents; doubled the payment of interest or delayed performers in accordance with the law;

As of September 9, 2022, ST Intercontinental responded to the principal and interest of Liuzhou Agricultural Credit Society of RMB 21,928,800.

Edit 丨 Wang Naixin Comprehensive Zhongxinwei, Beijing Commercial Daily (Reporter Dong Liang Ding Ning), 21st Century Business Herald, China Securities Journal

Picture 丨 Smile Factory WeChat public account screenshot, Tencent video screenshot, Oriental Fortune Network

- END -

Luohe City Yuanhui District: Accelerate high -quality promotion of key projects

Dahe Daily · Yu Video Reporter Liu Guangchao Correspondent Huifeng Yongjie SunshineEngineering vehicles come and go, workers are intense construction, and high -rise buildings have risen ... On Augus

Dragon and Guangdong cooperation in depth: when creative design+tourism strategic cooperation is carried out

Text/Yangcheng Evening News all -media reporter Jiang YanPhoto/school providedOn A...