Tianyancha help financial investment institutions to deepen three steps to achieve one -stop risk monitoring

Author:Zhongxin Jingwei Time:2022.09.13

Zhongxin Jingwei, September 13th. The Careful Management Regulations of the Bank of the People's Republic of China on the Supervision and Administration Law of the People's Republic of China include: risk management, internal control, capital adequacy ratio, asset quality, loss reserve, centralized risk, association Trading, asset liquidity and other content. It can be seen that the due diligence of the banking and financial investment institutions and the standards of investment operations have extremely high requirements.

When an enterprise conducts financing plans, issues shares and lists, or reorganizes the acquisition of consolidated assets, financial investment institutions need to conduct comprehensive due diligence investigations on enterprises. So, which link of due diligence investigation? Generally speaking, after the investment institution sends an investment intention to the entrepreneurs, it is signed before signing the formal investment agreement. There are three purpose of due diligence: confirming and verifying the information obtained during the transaction; identifying the potential defects of the transaction to avoid risks; ensure that the transaction meets the relevant policies and regulations of internal and external related policies and regulations.

Among them, in order to evaluate and judge the real business of the enterprise, judge whether the enterprise has the prospects of development, it can be disassembled into three dimensions: the first is the market situation of the industry; ability. These require the support of compliance and massive commercial data.

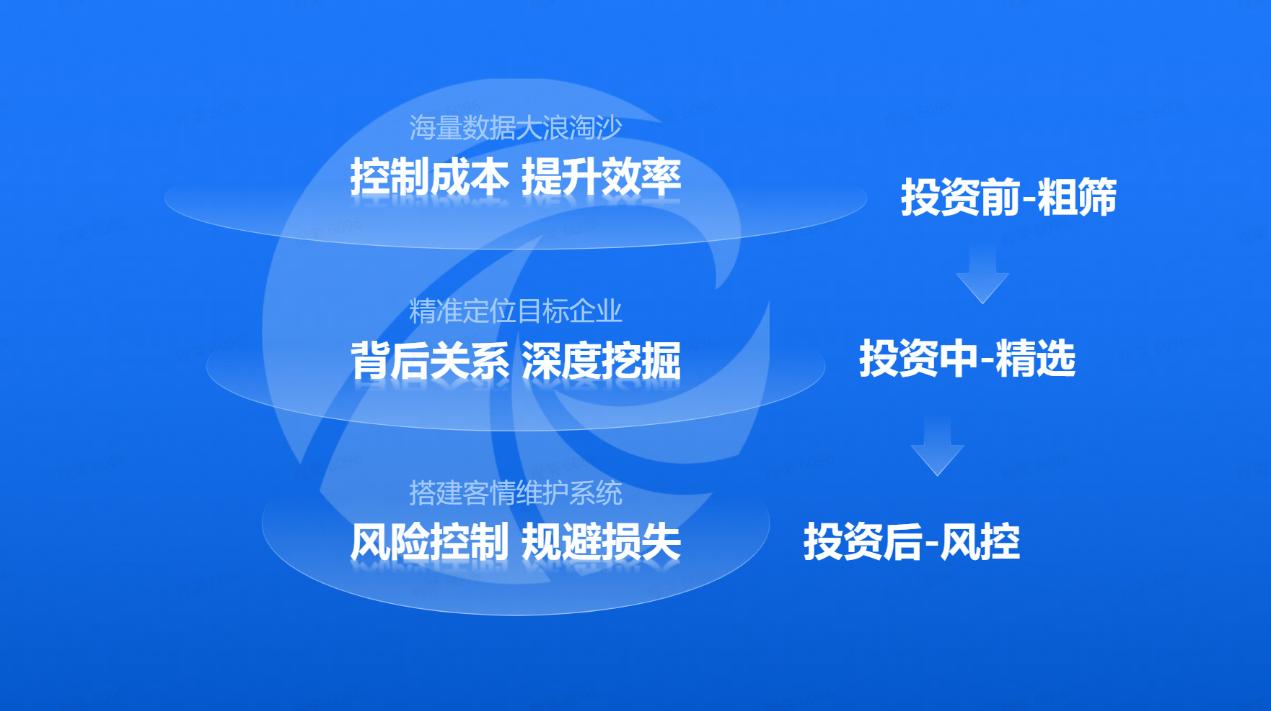

Massive data Big waves Tao sand control cost improvement efficiency

With the expansion of the business, many financial investment institutions have gradually appeared in the internal corporate library update, low accuracy, poor data quality; at the same time, due diligence, due diligence, also waste a lot of time costs, resulting in costs, which has caused costs, which has caused costs, which has caused costs, which has caused costs, which has caused costs, which has caused costs, which has caused costs, which has caused costs, which has caused costs, which has caused costs, which has caused costs, which has caused costs, which has caused costs, which has caused costs, which has caused costs and costs. High, low -efficiency dilemma.

To this end, financial investment institutions use Tianyan API interface and database products to export the full data information of enterprises before investing, and to sieve massive databases. Tianyancha contains more than 300 dimensions of social entities of more than 300 social entities, which solves the inadequate screening dimensions and insufficient data. As a result, the screening results are not accurate; the corporate library is too large, waste of labor costs and time costs. At the same time, following the changes in the market environment, the screening conditions can also be updated through the sky eye check API interface at any time.

Tianyancha insists on adopting public data information. The data comes from the national enterprise credit information disclosure system, China Executive Information Disclosure Network, the State Intellectual Property Office, China Customs Credit Information Publicity Platform, and the China Court Network. In addition, accuracy, effectiveness, sustainability, and compliance, fully meet the scenarios such as compliance review, risk assessment and monitoring.

Precise positioning target Enterprise Relations in depth excavation

What core information can we promote the occurrence of investment decisions? After the information is screened, high -quality investment companies are accurately positioned into the flow pool and entered the refined screening stage. In the progress of investment, basic corporate information can no longer meet the requirements of financial investment institutions, and it is necessary to make a deeper excavation of target companies.

Deep due diligence involves core information such as corporate capital composition, actual controllers, judicial and business risks, and behind -the -scenes relations. With the help of "related data visual interaction" technology, Tianyan investigations can find nearly 10 floors of related relationships. The enterprise conducts a detailed display of the case, assists financial investment institutions to accurately judge its comprehensive situation, helps risk assessment, and minimize investment risks.

Build a customer situation to maintain system risk control to avoid losses

After the investment is ongoing, the financial investment institution will always pay attention to the business of the enterprise, and use the advantages of big data to assist financial investment companies to create a digital system and select the dimension of monitoring according to the screening conditions, including industrial and commercial information, enterprise development, business risks, knowledge, knowledge Property rights, news public opinion and other information, real -time risk surveillance. Once the enterprise has negative information and operating risks of public opinion, Tianyan check data monitoring will push risk early warning information to financial investment institutions as soon as possible. According to the needs of investment institutions Timing push mode, WeChat service number push mode, effectively prevent and stop risk hidden dangers.

In recent years, Tianyancha has continuously improved the financial information big data platform. Data export, API data interface, database and other products have met the compliance data needs of financial investment. After the determination of investment decisions, Tianyancha has also become a due diligence for financial investment institutions to escort each investment. (Zhongxin Jingwei APP)

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

The cumulative transaction value of the "832 platform" reached 25.37 billion yuan to promote nearly 3 million farmers to consolidate the results of poverty alleviation

Xinhua News Agency, Beijing, September 2 (Reporter Hou Xuejing) The reporter learn...

The average daily payment reduction exceeds 530,000 yuan!Qingdao's comprehensive implementation of payment reduction policies allows market entities

Qingdao Daily/Guanhai News June 29th. Guanhai reporters learned from the Qingdao C...