Distressed!The CRO sector has plummeted, and these heavy warehouse holding funds have also fallen significantly today.

Author:Daily Economic News Time:2022.09.13

On September 13, the A -share CRO index fell sharply, and multiple stocks fell, and many public funds of many public funds such as Yaoming Kangde, Kailei, and Midicean were in the second quarter. Today, the decline is obvious. British daily limit.

Affected by this, the valuation of the funds related to heavy stocks has declined today. According to the statistics of Choice, among the 83 CRO concept funds, today's valuation closing price has decreased compared with the previous day's net value, and 7 funds have fallen by more than 4%.

Some analysts have stated that the depth adjustment of today's sector is related to overseas policy factors, but in view of that domestic companies have accelerated overseas production capacity, the impact on domestic enterprises has a relatively small impact on overseas orders.

Kang Longcheng, Kailei, and Yaoming Kant fell more than 10%

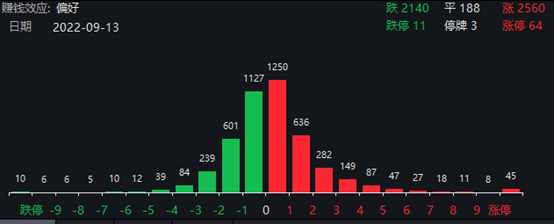

On September 13, the three major stock indexes of A -shares rose, and the overall money -making effect preferences, but there are still 11 stocks that fall, most of which come from the CRO and medical service sector. Wind statistics show that the CRO index and medical service selection index today fell 5.24%and 3.01%, respectively.

A -share rising and down distribution Source: Wind screenshot

Wind concept sector market statistics source: Wind screenshot

Specifically, in the relevant concept sector, more than 10%of the declines include Kang Longcheng, Yaoshi Technology, Yaoming Kangde, and Kailei. From the perspective of the stock price, the above -mentioned stocks have fallen by more than 30%, part of the part, part of exceeding more than more than more than 30%, part of the part, part of the part, part of the part, part of the part, part of the part, part of the part, part of the part, part of the part, part of the part, part of the part, part of the part, part of the part, part of the part, part of the part, part of the part, part of the part, part of the part, part of the part, part of the part, part of the part, part of the part, part of the part, part of the part. 50%, but today the stock price of the stock price also lowered the minimum historical PE of the relevant index again.

Taking the CRO index as an example, Wind statistics show that by September 13, the current dynamic PE level reached 32.15 times, which is the lowest value of history; the medical service selection index dynamic PE reached 44.20 times, close to the minimum value of 37.13 times. Judging from the median level of the relevant index, the current PE level is mostly hovering under half of it.

CRO, as the research and development link in the pharmaceutical outsourcing (CXO), is a key area in pharmaceutical investment. The depth of the market has also attaches importance to the cause behind it. Some analysts pointed out that it is related to overseas policy factors, mainly due to news to face the blow of investment emotions.

Runa, manager of Hang Seng Consumption Upgrading Fund, publicly stated that on September 12, US time, US President Biden signed an administrative order on biotechnology and biological manufacturing, mainly to encourage the return of the biological manufacturing industry in the United States and increase its efforts to increase its strength R & D. In the past, the American biological manufacturing industry highly relied on the global industrial chain, and many countries including Europe, India and China have undertaken a large number of orders from American biological manufacturing.

Rona analyzes that the domestic CXO industry is particularly dependent on American customers. Because more than 75%of domestic CXO companies have more than 75%from overseas and have high sensitivity to geopolitics, this administrative order has caused the market Further affects the valuation evaluation of relevant companies, so the market chooses to sell related targets in a relatively panic and pessimistic emotion to avoid risks.

Return to individual stocks may affect the level of net value of heavy warehouse funds

Under the depth of the sector, the killing efforts of key stocks cannot be underestimated. From the market performance on September 13, the performance of the relevant stocks in the CRO and medical service selection index fell more. Among them, including Yaoming Kangde, Midi, and Kailaiying, are also heavy positions of some public funds in the second quarter. At least from the fund's valuation performance today, it has indeed declined significantly compared with the previous day's net value level.

According to CHOICE data statistics, among the 83 CRO concept funds (statistical initial share), today's valuation closing price has decreased compared with the previous day, and 7 funds have fallen by more than 4%. Among them, the valuation of the China -Europe Medical Innovation Stock Fund fell the largest as the previous day's net value level, reaching 4.90%; ICBC Xingrui and Favoritic Medicine growth followed.

From the second quarter of the second quarter of China -Europe Medical Innovation Stock Fund, CRO concept stocks including Yaooming Kangde, Kailei, Jiuzhou Pharmaceutical, and Kang Longcheng are involved. Kang Long turned into 13.95%. According to Kailaiying's previous announcement, as of August 26, the fund's position holding the stock was further increased to 40.592 million shares, which is the eighth largest shareholder of the company.

ICBC Xingrui also has a large number of CRO concept stocks in heavy positions in the first quarter of the year. Yaoming Kangde, Kailei, and Yaoming Bio are the top three heavy positions. Wind statistics show that the first two stocks are compared to the end of the first quarter of this year. The number of positions has increased, of which Kailey's warehouse is as high as 45.85%.

However, although the CRO market today has external factors, from the perspective of the industry's fundamentals, the impact is limited. Runa, manager of Hang Seng Consumption Upgrade Hybrid Fund, analyzed that first of all, my country's CXO industry mainly gathered in the links of drug development and improvement. The demand for high -quality talents is extremely high. Essence In addition, the biological manufacturing industry not only has a large investment and a long investment cycle. At present, domestic enterprises have accelerated overseas production capacity layout, which has a relatively small impact on domestic enterprises to obtain overseas orders. Therefore, the administrative command has a limited impact on the industry in the short term.

Looking forward to the future, Rena believes that my country's CXO industry has more beautiful performance in the first half of the year, with sufficient orders for enterprises, and fixed assets and construction projects still maintain high -speed growth. From the side, the industry's high prosperity cycle continues, and its performance is expected to continue to increase.After nearly two years of valuation digestion, the overall valuation has returned to a more reasonable interval, and the value of the low -level configuration has been prominent in the long run.Daily Economic News

- END -

Grain production in Jingdong County welcomes bumper harvest

There is food in my hand, and I don't panic. For a long time, Jingdong County has ...

Hualin Securities: The financing balance increased by 0.37%compared with the previous day, and the securities margin balance decreased by 3.52%from the previous day.

002945 Huarin Securities As of August 16, 2022, the financing balance was 143.98 million yuan, an increase of 0.37%over the previous day, and the financing balance ranked 1632 among the two bids.Stock