Yongan Property & Casualty Insurance's equity changes: "Fosun" retreats, Shaanxi state -owned assets increase

Author:Daily Economic News Time:2022.09.13

A few days ago, a number of shareholders of Yongan Property Insurance Co., Ltd. (hereinafter referred to as "Yongan Property & Casualty Insurance") had brought up the equity recently, which attracted the attention of Fanxiang Finance.

Judging from the public information disclosure of its official website, on September 6th and September 8th, Yongan Property & Casualty Insurance issued three information disclosure announcements on shareholders' change. Among them, Shaanxi Qinlong Electric Power Co., Ltd., Yadongshan Control Entrepreneurship Investment Co., Ltd., and Yadongyi Hang Entrepreneurship Investment Co., Ltd. intends to transfer all or part of the equity of Yongan Property & Casualty Insurance.

In these announcements, Fanxiang Finance found that companies, including many "Fosun", transferred equity, and it was State -owned Assets that received its equity. As the only national insurance enterprise in Shaanxi Province, can Yongan Property and Casualty Insurance go on track under the operation of local state -owned assets?

"Futu" retreat?

Fanxiang Finance learned through Qixinbao that Yongan's financial and insurance actual controllers were the Shaanxi Provincial SASAC. At present, there are 18 shareholders, and the state -owned share capital accounts for 52.49%, of which Shaanxi state -owned assets directly hold 51.74%of the shares; Among them, four subsidiaries of Fosun held 40.68%, which was not much different from the shareholding ratio of Shaanxi state -owned assets.

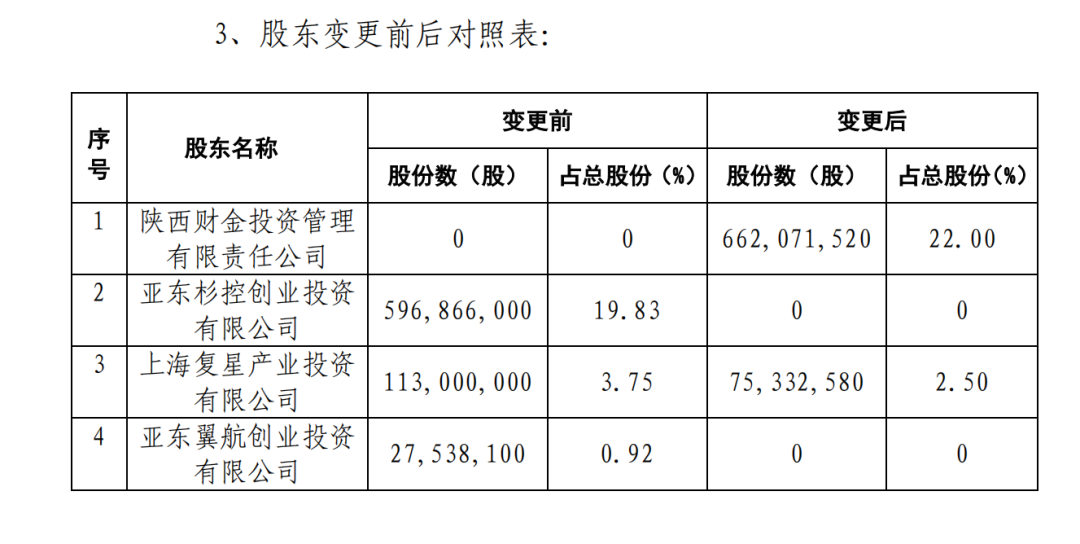

Judging from the equity transfer announcement, Yadong Shankong Entrepreneurship Investment Co., Ltd., Yadongyi Hang Entrepreneurship Investment Co., Ltd., and Shanghai Fosun Industrial Investment Co., Ltd., a subsidiary of "Fosun System", intends to hold Yongan Property & Casualty Insurance 19.83%, 0.92 %And 1.25%of the equity transfer to Shaanxi Caijin Investment Management Co., Ltd. (hereinafter referred to as "Shaanxi Cai Investment").

Image source: Screenshot of Yong'an Property Insurance Announcement

The Shanghai Fosun Industrial Investment Co., Ltd. and Shanghai Fosun Industrial Technology Development Co., Ltd. intend to transfer the equity of 2.5%and 1.5%of Yongan Property & Casualty Insurance to Shaanxi Credit Promotion Co., Ltd. (hereinafter referred to as "Shaanxi Credit Promotion").

At present, the above two equity transfer is yet to be approved by supervision. Once the transfer is completed, the shareholding ratio of Shaanxi Cai Investment and Shaanxi Credit Promotions is 22%and 4%, respectively. Shaanxi Caitou and Shaanxi Credit Promotions are both State -owned Assets Control in Shaanxi.

At the same time, Yadongshan Control Entrepreneurship Investment Co., Ltd., Yadong Wing Airlines Entrepreneurship Investment Co., Ltd., and Shanghai Fosun Industrial Investment Co., Ltd. will also withdraw from the ranks of Yongan Property & Casualty Insurance shareholders. Shanghai Fosun Industrial Technology Development Co., Ltd. To 14.68%.

Picture source: Fosun Group official website

It is worth mentioning that since this year, in addition to the transfer of Yongan Property & Casualty Insurance, the Fosun has continuously repaid the funds through the stock market, and the cash -out action is frequent. Among them, Hainan Mining, Zhongshan Public, Taihe Technology, and Tsingtao Beer are all on the reduction list of the Fosuna. In addition, Fosun Pharmaceutical and Golden Emblem wine, Fosuna has set more than 10 billion yuan this year.

The market generally believes that Fosun is now facing a large pressure on debt repayment. The 2022 interim report showed that Fosun International's total assets were 849.685 billion yuan, of which total liabilities reached 6511.57 billion yuan, and the debt ratio was as high as 76.64%. In addition, on August 23 To B1.

Shaanxi State -owned Assets

Fanxiang Finance believes that through a series of reduction of holdings of "Fosun", whether it is debt repayment or "weight loss fitness", it has its own considerations, but from the change of the change of the equity of Yongan Property & Casualty Insurance, it is also behind it. Yongan's shareholders' right to speak, corporate management and long -term development layout, etc. to make a "knot".

It is reported that the right to speak of the major shareholders of Yongan Property & Casualty Insurance is no longer a new thing. It has led to many problems such as incomplete corporate governance structure, insufficient solvency, complicated equity disputes, extensive management methods, and serious losses.

The entry of the enhancement of Shaanxi Cai Investment and Shaanxi Credit, which means that the control of Yongan Property and Casualty Insurance has further moved closer to Shaanxi state -owned assets.

It is worth noting that the first two days before the equity of the Refractory transfer, Shaanxi Qinlong Electric Power Co., Ltd. intends to transfer 0.23%of Yongan Property & Casualty Insurance to Shaanxi Investment Group Co., Ltd. (hereinafter referred to as "Shaanxi Investment," Shaanxi Investment Group Group "), after the transfer is completed, Shaanxi Investment Group's shareholding will reach 3.72%.

From the perspective of extended time, social capital has continued to withdraw, and the equity of Yongan Property & Casualty Insurance has moved closer to state -owned assets.

Photo source: Photo Network_500470299

Specifically, on August 12, 2016, the shareholders of Yongan Property & Casualty Insurance completed the capital increase. After changing the registered capital, Shaanxi State -owned Assets directly and indirectly held 48.47%of Yongan Property & Casualty Insurance.

In May 2020, Ping An Bank Co., Ltd. transferred the equity of 2.52%of Yongan Property & Casualty Insurance to Shaanxi International Trust Co., Ltd., and Ping An Bank shares withdrew from Yongan Property & Casualty Insurance; The subsidiary Shaanxi Provincial Huaqin Investment Group Co., Ltd. and Shaanxi Provincial Electric Power Construction Investment Development Corporation totaling 3.49%of the equity of Yongan Property & Casualty Insurance was transferred to Shaanxi Investment Group.

In November 2020, Caesar Tongsheng Development Co., Ltd. transferred its equity of 0.75%of Yongan Property & Casualty Insurance to Shaanxi International Trust Co., Ltd. in February 2021, Shaanxi Provincial Industrial Investment Co., Ltd. The equity of 1.16%of the property insurance was transferred to Shaanxi Financial Holding Group Co., Ltd.

On September 5, 2022, the Beijing Stock Exchange's "physical asset network auction" application platform North Communication interconnection showed that Xi'an Aircraft Industry (Group) Co., Ltd. will hold 0.38%of Yongan Property & Casualty Insurance. The listing transfer is still looking for the transferee. It is clearly seen that Shaanxi State -owned Assets Equity Control is a long -term layout. Once the recent three equity transfers will be approved, then Shaanxi State -owned Assets shall reach 77.97%of Yongan Property & Casualty Insurance, which will have the right to speak; The quantity has also fallen to 16, and the equity is further concentrated.

"Advanced" local industry?

Judging from the actions of central enterprises, local state -owned assets, and head private enterprises, and a series of enhanced controlling stakes in Shaanxi in recent years, Yongan Property and Casualty Insurance is undoubtedly a high -quality target. However, as the only national insurance company in Shaanxi Province, it affects its own business development due to issues such as scattered equity and inadequate discourse.

According to statistics from the solvency report, Yongan Insurance achieved a net profit of 210 million yuan in 2021, a year -on -year decrease of 27.2%, and the decline was obvious. In addition, Yongan Property Insurance received a ticket from the Banking Insurance Regulatory Commission due to internal problems.

It is worth noting that in 2021, after Tao Guangqiang, the former chairman of Yongan Property and Casualty, left office, Chang Lei, a state -owned assets from Shaanxi, served as the new chairman. Chairman of the Credit Co., Ltd..

It can be seen that operators with the background of the state -owned assets and the further concentration of Shaanxi state -owned equity, which means that Yongan's financial insurance will "do one game" in the next step. The attention of Fanxiang Finance is how to play a leading person in Shaanxi and promote the "advanced" of local industries?

Photo source: Photo Network_402186762

Taking Shaanxi State -owned Assets Students as an example, Changan Huitong, as a state -owned operation platform for the State -owned Assets Supervision and Administration Commission of Shaanxi Province. Since its two years of operation, it has long participated in the capital operation of local state -owned enterprises and local listed companies. The performance of the state -owned capital layout structure is prominent.

Increasing state -owned assets to increase the equity of local insurance companies will help insurance institutions to become bigger and stronger. The leading role played through financial institutions can also bring convenience to financing and capital increases to small and medium -sized insurance companies, bring more small and medium -sized insurance enterprises more than small and medium -sized insurance enterprises. More insurance business resources.

Specifically, Yongan Property Insurance may start a new round of capital increase and share expansion.

In this regard, Yongan Property & Casualty Insurance stated that with the completion of the company's equity reorganization and optimization work, the start of the new round of capital increase and share expansion work, the clarity of the company's strategic positioning and the change of development models, the issue of the overall efficiency of the company will continue to improve.

People in the industry also told Fanxiang Finance that in general, for some insurance companies or enterprises affected by some operations, the local governments must also bear the corresponding territorial responsibilities, credit endorsements, and some subject responsibilities. It is good for enterprises. In the long run, it depends on the specific operation.

Daily Economic News

- END -

Hebei: Make sure that the stable supply of vegetable production is sufficient

On August 29, the Hebei Provincial Department of Agricultural and Rural Affairs issued the Notice on Effectively Grasping Vegetables and Preservation of Vegetables to coordinate the prevention and c

Shanghai comprehensively strengthen the construction of drug supervision capabilities: carry out the

Content source: China Traditional Chinese Medicine Reporter: Li NaA few days ago, the General Office of the Shanghai Municipal People's Government issued the Implementation Opinions on Comprehensivel...