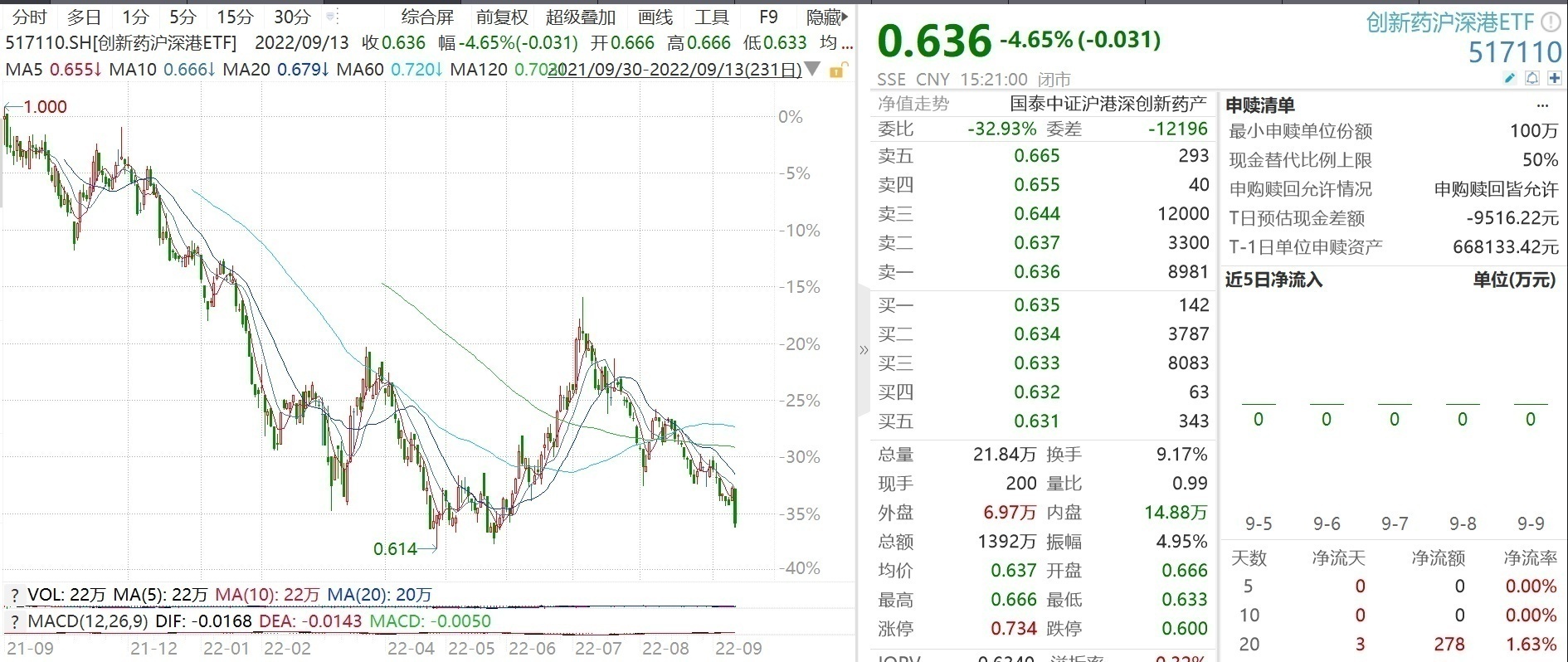

Innovation medicine CSI ETF (517110) fell 4.65%

Author:Capital state Time:2022.09.13

Innovation medicine CSI ETF (517110) fell 4.65%

Cause of the decline: emergency "Administrative Order of the American Biological Economy"

Urcented "Administrative Order of the American Biological Economy". The CXO sector has been adjusted more today, mainly due to market concerns caused by administrative orders on biotechnology, especially companies related to biotechnology or relatively high proportion of US business. At present, the tone of this policy is more to improve its biological economic competitiveness, and the specific impact of factors such as details and support are clear.

Uncertainty of innovative drug negotiations. Due to the extension of the collection policy, the increase in the intensity of innovative drug negotiations and the country's attention to clinical value -oriented, the pharmaceutical innovation sector has also changed from comprehensive development to high -quality development. At the end of this year, innovative drug negotiations are important observation indicators. Policy has changed marginal encouragement for innovative drugs. It is only that the positive impact of encouragement takes time to appear, change the space with time, and look forward to the future trend.

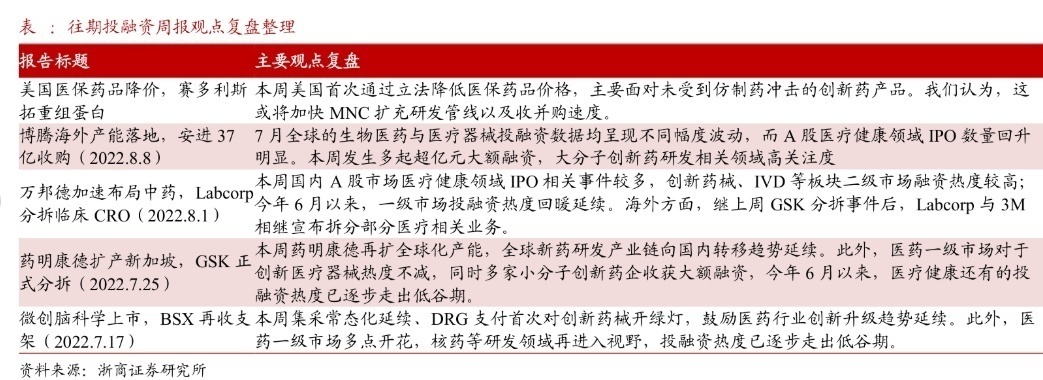

The popularity of investment and financing is still low. Biomedical and medical device's investment in financing in July showed a different degree of decline. In July 2022, 33 financing events accumulated in the domestic biomedical field, with a total financing of US $ 756 million, a decrease of about 10%month -on -month.

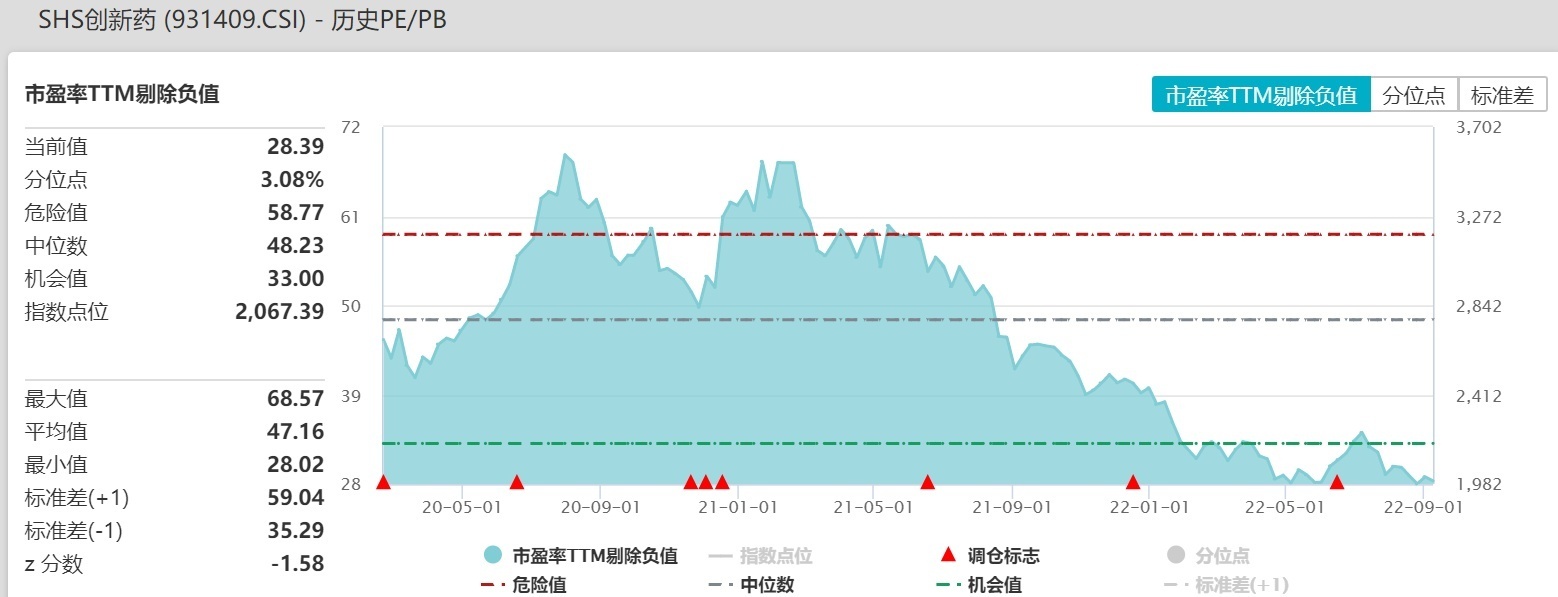

Low valuations have medium and long -term investment value. The innovative pharmaceutical sector has gone through a long and large callback since 2021, and many high -quality target valuations have been in the bottom range. At present, the P / E ratio of the Index Index (excluding negative value) of the Shanghai -Shenzhen -Hong Kong ETF subject is 28.39 times, which is within 5%of the history.

Preliminary suppression factors: (1) Some CXO companies are included in the American entity list and UVL list incident; (3) Continuous expansion of the scope of collection. (4) concerns about the growth of the growth rate of public health prevention and control beneficiaries. Through the early adjustment, the various concerns of the market have been fully reflected, and the market's early reflection is too pessimistic. If the growth rate of investment and financing has declined, it is a process of "de -pseudo -pseudo -savings". Innovation and upgrading brings the rise in the CXO requirements of pharmaceutical companies. Concentration will become a long -term trend.

In the fourth quarter, although there are still some internal and external factors, as the public health prevention and control policy has achieved a staged victory, the state's support for emerging industrial policies should gradually become optimistic. For example, if the CXO sector, the other two negative factors of the CXO section valuation are the high growth continuity of the year after the Ming Dynasty and the concerns of decoupled with China and the United States. It is planned to provide some forward-looking data for 2023-2024. It is expected that the new signing orders will be announced in the second half of the year may further alleviate the market's concerns about negative factors, and emotions will gradually become optimistic.

Data source: wind

Outlook of the market: The innovative drug sector has experienced repeated adjustments and grinding bottoms in the past six months. The valuation has entered a relatively historical low, and the rebound in May is also weaker than the large market. In the short term, the impact of public health prevention and control has been weakened. After unblocking, with the talent recruitment, clinical R & D, production and sales, authorization cooperation, and internationalization of pharmaceutical companies, the pharmaceutical companies will also resume normal operations in the future.

In the long run, under the drive of innovation, import alternatives and internationalization are still the long -term development trend of the domestic pharmaceutical industry. After that, the real product -capable product is landing overseas or the opportunity to increase valuations for innovation drugs. In addition, the long -term logic of population aging+consumption upgrade is still there. Investors can continue to pay attention to Innovation Pharmaceutical CSI ETF (517110).

- END -

Shanxi's first!Open

The reporter learned from the Shanxi Traffic Control Group that the first unmanned...

Xinyang special fiber in 2022 net profit of 15.1725 million yuan increased by 176.90% year -on -year

On August 1st, Xinyang special fiber (code: 836228.NQ) released the performance report of the 2022 half -year report.From January 1, 2022-June 30, 2022, the company realized operating income of 119 mi