The Beijing State -owned Assets Supervision and Administration Commission requires "research and judging relevant risks"?Fosun responded, Guo Guangchang also posted a Weibo: just returning home is isolated, China is always the most important base for Fosun

Author:Daily Economic News Time:2022.09.13

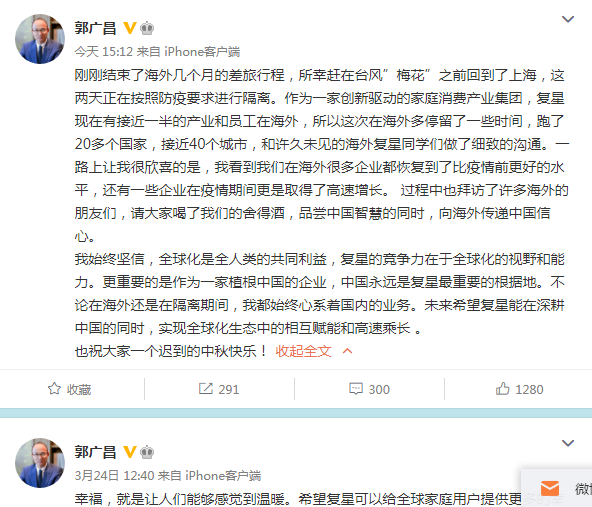

"Fosun now has nearly half of industries and employees overseas, so this time I stayed overseas for some more time." On the afternoon of September 13, Guo Guangchang, chairman of Fosun Group, posted on Weibo for nearly half a year. Various rumors.

Guo Guangchang said that he had just ended the travel trip of overseas several months back to Shanghai. These two days are being isolated in accordance with the requirements of epidemic prevention.

Guo Guangchang said on Weibo that this time I stayed more time overseas, ran more than 20 countries, nearly 40 cities, and had a detailed communication with the overseas Fosun students who had never seen them for a long time.

"What makes me happy along the way is that I have seen that many overseas companies have returned to a better level than before the epidemic, and some companies have achieved rapid growth during the epidemic. Friends, please drink our willingness and taste Chinese wisdom, and convey Chinese confidence to overseas. "Guo Guangchang said," I always believe that globalization is the common interest of all mankind, and Fosun's competitiveness lies in global The vision and ability of the transformation. More importantly, as a company rooted in China, China is always the most important base for Fosun. Whether overseas or during isolation, I always think about domestic business. In the future While deep cultivation of China, it can realize mutual empowerment and high -speed multiplication in the global ecology. "

It is worth noting that this is Guo Guangchang updated Weibo again since March 24 this year reposted Fosun official micro -Weibo.

According to the first report of the First Finance and Economics, recently, the Beijing Municipal Management Enterprise received a notice from the Beijing State -owned Assets Supervision and Administration Commission to sort out the cooperation with Fosun Group (not limited to holding stocks, equity investment, funds lending, engineering contracting, guarantee, trade and trade, trade and trade Cooperation and other matters), and judge the risk of cooperation to form a written report.

In response, Fosun Group responded: We noticed the "Notice of Beijing State -owned Assets Supervision and Administration Commission" on the Internet. After inquiring with the Beijing State -owned Assets Supervision and Administration Commission, it was learned that this survey was a daily information collection of the Beijing State -owned Assets Supervision and Administration Commission system. There was no targetedness. Previously, they also issued relevant investigations notice to relevant enterprises. Fosun has developed normally in Beijing's various businesses. On August 31st, the company just released the semi -annual report. In the context of the current complex and changing macro environment, it still maintained stable and toughness, and various businesses were running smoothly.

According to Yinguan Finance, on the afternoon of the 13th, Fosun Group plans to meet with the Beijing State -owned Assets Supervision and Administration Commission.

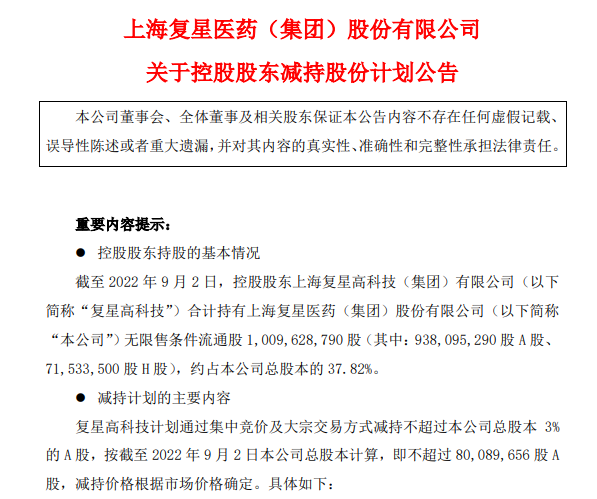

Prior to this, Guo Guangchang's helm has continued to reduce its holdings of the Fosuni listed company. According to Fosun Pharmaceutical's announcement on September 2, the controlling shareholder Shanghai Fosun High Technology (Group) Co., Ltd. intends to reduce its holdings of not more than 80.897 million shares, accounting for 3%of the total share capital ratio.

It is worth noting that Fosun Pharmaceutical is considered one of the core assets of Fosun. In the first half of 2022, the health business sector led by Fosun Pharmaceutical contributed 28%of Fosun International's operating income. This reduction is the first initiative to reduce its holdings as the controlling shareholder since Fosun Pharmaceutical was launched in 1998.

At the same time, Fosun also announced the control of Jinhui wine.

On September 2nd, the Yuyuan shares of Fosun issued an announcement that the company and wholly -owned subsidiaries intend to sell 65.9438 million shares of Jinhui wine through the agreement, accounting for 13%of the total shares of Jinhui wine. At the same time, the Yuyuan Co., Ltd. will continue to reduce its holdings of more than 5%in the next six months.

On the evening of September 9th, COFCO Industry issued an announcement that 16.39%of the shareholders of Shanghai Fosun Weishi Phase II equity investment fund partnership (limited partnership) due to its own business needs, it is planned to reducing the holding of listed companies by centralized bidding or community transaction method. The shares do not exceed 30.7365 million shares, which does not exceed 6%of the total share capital of the listed company. The listed company's half -annual report in 2022 shows that Fosun Weishi Fund is the second largest shareholder of the company.

On September 13, Fosun Pharmaceutical (600196.SH) fell 1.6%to close 34.44 yuan/share, with a market value of 69.3 billion yuan. Fosun International (0656.HK) fell 4.11%to close HK $ 4.9/share, with a market value of 40.88 billion Hong Kong dollars.

Edit | Lu Xiangyong Gai Yuanyuan

School pair | Sun Zhicheng

Cover Map Source: Guo Guangchang Weibo

Daily Economic News comprehensive announcement from First Financial, Guo Guangchang Weibo, Yinguan Finance, and listed companies

Daily Economic News

- END -

The total scale of the total revenue of the "Top 500 Chinese Enterprises" unveiled the list of the first one million yuan

The Chinese Enterprise Federation and the Chinese Entrepreneurs Association releas...

Can you buy 1 gram at a time, can you gain a sense of security?

For a while, he particularly liked to shake the glass tank of golden beans, and he...