Global Financial connection | A -share CRO sector has plummeted, Hong Kong stocks set off a "repurchase wave", and the US dollar index fell significantly

Author:21st Century Economic report Time:2022.09.13

21st Century Business Herald reporter Shi Shi Shi Shi Shanghai report

A -share closure of the CRO sector severely frustrated

CRO concept stocks fell today, and Kai Lai Ying and Yaoming Kangde both daily limit. For the analysis of A -share love, we came to connect Yang Delong, the chief economist of Qianhai Open source.

The news of the short -term pressure for the pharmaceutical sector

"Global Finance and Economics": Please review today A -share surface. What are the main factors that are mainly affected by the significant adjustment of the pharmaceutical sector?

Yang Delong: Today is the first trading day after the Mid -Autumn Festival. The A -share market shows a repeated trend. The consumption sector has performed strongly, while pharmaceutical stocks have fallen sharply. Then, in terms of news, US President Biden stated that it will increase the production of domestic biomedicine in the United States and reduce dependence on imported products in China, which may have a short -term impact on the market.

In fact, the pharmaceutical sector has experienced a large decline in the past two years, and it is mainly due to some pharmaceutical products into the collection list. Then the profit of the enterprise has fallen a large decline, which has changed the investment logic of many pharmaceutical stocks. Therefore, although many pharmaceutical stocks are at the lowest valuation of history, they are still at the bottom of the bottom, and it is difficult to have a significant (rising) performance.

The consumption sector performed relatively strong today. From a historical point of view, the consumer sector belongs to the sector that can cross the economic cycle. Some adjustment of white horse stocks, Chinese medicine, food and beverage, tourism, tax -free and other consumer white horse stocks.

Then after the early adjustment of new energy, many new energy stocks have re -configured value and vigorously developing clean energy is the only way to achieve dual carbon targets, and new energy replace traditional energy is also a general trend. Since the beginning of this year, the new energy sector has played a role in leading the market many times, and new energy in the fourth quarter is expected to continue to lead the two cities.

The market turning point in the second half of the year may appear in September

"Global Finance and Economics": Is it possible to stage the "Golden Nine Silver Ten" market this year?

Yang Delong: The inflection point of the market in the first half of the year appeared at the end of April. At that time, the market rebounded after the market plummeted. The market turning point in the second half of the year may appear in September, so the "Golden Nine Silver Ten" market may gradually appear.

Although the market has been adjusted for a long time, the bottom should be an arc bottom, which may not be as strong as the rebound in the first half of the year, but the probability of the market bottoming back is still relatively high.

The layout of the fourth quarter is now a good time. Although the marginal factor factors that affect the market have not been completely eliminated, the marginal improvement is improved. In September, the Federal Reserve interest rate conference may announce that it will raise interest rates 50 basis or 75 basis points to cope with high inflation, but this has been fully expected by the market, so the impact on the market is not great.

In terms of economic growth, it is expected to rise in the fourth quarter. In particular, the State Council's policy of promoting the stability of the economy has gradually landed, and the probability of economic recovery is relatively high.

Financial data released before the Mid -Autumn Festival shows that the central bank is taking more measures to support economic recovery, and the total social financing and corporate loans have performed well. Residents' medium and long -term loans declined a lot, mainly due to the sluggish real estate transactions, and the small mortgage loan of residents.

On the whole, the probability of economic recovery in the fourth quarter is higher. When the economic recovery, the stock market often has relatively good performance. Therefore, it is recommended that you maintain confidence and patience to the market outlook.

The Hong Kong stock market set off a "repurchase wave"

As of September 12, 178 Hong Kong stock listed companies had implemented repurchase shares during the year, an increase of 32%year -on -year; the total repurchase was HK $ 52.3 billion, a year -on -year increase of 136%, an increase of 13%over last year. The number and scale of Hong Kong stock companies repurchased this year far exceeded the same period last year. What are the reasons? What are the characteristics of the Hong Kong stock repurchase market this year? Let's listen to the interpretation of Wen Tianna, CEO of Boga Capital.

The stock price of some listed companies is in a low -lying position

Wen Tianna: Hong Kong stocks have recently presented the ups and downs of the ups and downs, but the recent market atmosphere has improved, mainly because the global market expects future economic growth and inflation may be mild. However, we always need to pay attention to the continuous rise in interest rates, which has a certain pressure on risk assets, enterprises and investors, so this has also led to the market presence of the upper collateral and not particularly clear direction.

It is obvious that the epidemic has begun to ease globally, and the market has good expectations for the concepts of domestic demand and tourism. This is also the market expectations of the market after 19,000 points. Especially the time nodes of the Mid -Autumn Festival and National Day, the overall improvement of the market atmosphere.

In addition, we saw that the Hong Kong stocks had been falling at a high position before, and once fell below 19,000 points. Many listed companies' stock prices were basically in a low -lying position. As a result, many companies started repurchase. Stocks listed on the market, then cancel.

This has a certain supporting role in the market. It releases a strong signal, that is, the listed company believes that its company's valuation should be higher, so the cancellation of the repurchase process has released signals that have reached the low position to investors.

Buying or short -term boosting company stock price

Wen Tianna: In addition, after the cancellation of relevant shares, especially after the repurchase, it has a significant improvement of the profit or financial figures per share of the company, which is beneficial to the valuation of listed companies. Judging from the recent and previous data, for large and medium -sized enterprises, repurchase can boost the company's stock price in the medium and short -term. But in terms of long -term, it is necessary to improve the fundamental improvement of the enterprise itself, so that the stock price can increase, which is also what investors need to understand.

The US dollar index fell significantly on the 12th

On the 12th, a basket of currencies weakened against the yen on the 12th, and the US dollar index fell 0.62%on the day, closed at 108.3300 at the end of the foreign exchange market. What is the reason for the decline of the US dollar index? How will it affect non -US currency exchange rates? Let's connect with the senior researcher of the Bank of China Research Institute Wang Youxin.

The US dollar index in the fourth quarter will gradually fall

"Global Finance and Economics": Is the US dollar index fall short, or is it that the recent rise has been topped?

Wang Youxin: The US dollar index rose rapidly in the early stage. After reaching the high level above 110, it has gradually fallen from a high point in the near future. Judging from the current trend and influencing factors, we judge that the current U.S. dollar index is basically close to the top.

Recently, the US dollar index has risen rapidly, mainly due to the Federal Reserve Chairman's speeches at the expected eagle at the global central bank conference, stating that he must continue to continue to raise interest rates sharply, so that the US dollar index rises rapidly. We expect that the US dollar index will continue to fluctuate at a high level before the September interest rate meeting, and will gradually fall after entering the fourth quarter.

The main reason for this trend is: on the one hand, after rapid interest rate hikes in the early stage, the current pressure on economic growth in the United States is increasing. Recent employment data shows that the unemployment rate has risen, reflecting the pressure of the US economic fundamentals. On the other hand, we see that with the current price of energy and commodities falling, it is expected that American inflation is expected to gradually topped, and as the economic growth pressure increases and demand is weak, inflation will continue to fall, and the necessity of continuing to raise interest rates in the fourth quarter will continue to raise interest rates in the fourth quarter. decline.

The rebound strength of the yen and the euro is relatively limited

"Global Finance Link": How will the exchange rate of non -US currencies such as the euro and the yen be affected?

Wang Youxin: Recently, the European Central Bank has accelerated the intensity of currency tightening under the pressure of inflation. The exchange rate of the euro to the US dollar has also returned to the parity level again, so it has also led to a certain number of callbacks in the US dollar. We predict that the European Central Bank will continue to maintain a significant interest rate hike rhythm under inflation pressure, and the interest rate hikes of the United States may gradually return to normal level. Under this time, it is expected that the euro exchange rate is expected to be boosted.

At present, the pressure of economic growth or decline is greater than the United States, so it may enter the state of comprehensive decline in the United States. Driven by risk aversion, the US dollar index may be supported.

Overall, the US dollar index is expected to gradually fall in the fourth quarter. Of course, driven by risk aversion may be relatively limited. Under the current situation of economic growth and the relatively weak economic recovery, it is expected that even if the US dollar indexes have recovered, the rebound of euro and yen will be limited. Even if the euro zone adopts a more tightened monetary policy, the boost of the euro will be limited, and there will be no significant changes.

(The market is risky, and investment needs to be cautious. The opinions of the guests on this show only represent their own opinions.)

Planning: Yu Xiaona

Produced: Shi Shi

Editor -in -chief: Du Hongyu and Jia Zhao Yue Li Yinong

Production: Li Qun

Shooting: Zhang Yuxiao

Trainer: Hao Jiaqi Zhang Yuxiao

New media overall planning: Ding Qingyun Zeng Tingfang Lai Xixun

Overseas operation producer: Huang Yanshu

Overseas Operation Editor: Zhang Ran Tang Shuangyan Wu Wanjie

Overseas Business Cooperation: Huang Zihao

Produced: Southern Finance All Media Group

- END -

Comparison map of Hong Kong today: This is what Hong Kong should be in Hong Kong.

Every drop of tear seems to say your dignity ...

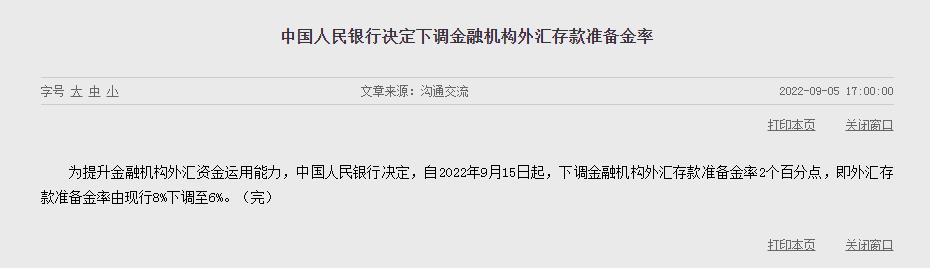

The foreign exchange deposit reserve rate has been reduced again within the year, which affects the market?Institutional interpretation

Zhongxin Jingwei, September 5th. In the afternoon of the 5th, the Central Bank ann...