Every time a reporter lasted for two months, the "Black Mouth Sitting Village" industrial chain: "The first -level market darling floating 1.4 million a day!"

Author:Daily Economic News Time:2022.09.13

The daily limit board grab the village and run the next day; below the issuance price, 100%subscribe for new shares will be listed soon!

Will investors who lack experiences be stunned?

Yes, this can be described as the most luxurious and comprehensive black -mouthed industry chain! From "Famous Settlement of Head Secretary", to "Famous Economist at the Head Secretary", to "Ten billion private equity"; from the flickering of the front desk, to the official seal of the brokerage firms, to the imitation head brokerage APP, This has formed a "perfect closed loop"!

Through this "closed loop", the reporter of "Daily Economic News" noticed that some investors could not stand the temptation and fell into a trap. In late August this year, investors reported that they had encountered difficulty in withdrawal, and today the investor's large amount of funds still cannot withdraw.

How did investors who did not know the truth be invited to the king and how did they be harvested?

"Daily Economic News" reporter (hereinafter referred to as a reporter) lasted two months, and exclusively revealed the "Black Mouth Sitting Village" industry chain!

Investors should pay attention to preventing various routines of "Black Mouth Sitting Village" IC Photo, Yang Jing's picture

● "General Manager of the Head Secretary" and "Chief Economist" appear on the QQ group of stock friends

The story starts with a public account called "Little Seven Talks".

On July 6 this year, the reporter found that the WeChat public account "Little Seven Talk Investment" issued a notice inviting fans into the group. The notice stated: "There is no charge for entering the group, no threshold, no routine. There is only one purpose, teach everyone the technology of stock trading, the direction of investment, etc., to build an investment system for everyone, and bring everyone to make some tobacco and alcohol money."

The "Xiaoqi Talk Investment", the group of WeChat publicly invited fans to enter, was later controlled by the "Black Top" gang by each reporter's investigation. Who is operating the public name of "Little Seven Talk Investment"?

According to the "Investment of Little Seven Talks" "Instructions on Fan Migration to the Public Account", the public account "Xiaoqi Snowball" that fans have paid attention to before have shifted all business and functions to this public account.

Earlier, the "Little Seven Snowballs" of Finance and Economics V "Little Seven Snowballs" sold the penguin account, which once made a lot of trouble among fans, causing fans to discuss. For details, please refer to the "100,000 investment advisory advertisements" every time with ox eyes! How hot is the fan economy in the financial circle? Effective fans are 200, and 100,000 fans are sold for 2 million.

At present, the WeChat public account named "Little Seven Snowballs" also stated that the original public account has also been transferred, and any speech has nothing to do with me. The authentication of the public account "Little Seven Talk Investment" is displayed as the Jinbeli Advertising Studio of Kowloon Po District, and the IP territory is displayed as the Philippines.

The group of "Xiaoqi Talking Investment" public invitations to join, before entering the group, need to contact the public service customer service. The customer service is named "Snowball Xiaoqi", which is similar to the name of "Little Seven Snowball".

A prompt message sent to reporters "Xiaoqi Talking Investment" public service said, "In order to improve the level and profitability of national trading, I will hold a ten -day retail special training camp, which will be held. Successfully set up an Oriental retail alliance ... "

After entering the group, the reporter asked the group assistant, "Which company are you from?" The other party replied, "a certain broker."

It is worth mentioning that the gang will establish a number of recommendation groups, and some groups publish content in the name of CITIC Securities, and some groups publish content in the name of a certain securities. The group "teacher" published in the name of CITIC Securities shows that it is "Yang Minghui, general manager of CITIC Securities", and the "teacher" of the group who published the content in the name of a certain securities shows that it is "the chief economics of a certain securities. Hai Haifeng ".

Although "He Haifeng" and "Yang Minghui" often try to hide their true identities in the group, they still show a lot of flaws. For example, on the evening of July 12, the team organized a training in multiple investors. The reporter noticed that the two "big coffee" training content of "Yang Minghui" and "He Haifeng" was basically the same.

Interestingly, on the evening of July 24, the assistant issued a notice in the group that to celebrate the 23rd anniversary of the establishment of a certain securities on August 18, the private financial summit of the "He Haifeng" system students will be held in Beijing. The location is "Beijing Haifeng Teacher Private Winery". In fact, this year is the 30th anniversary of the establishment of a certain securities.

Another road reporter also added QQ group number as an investor, and was added to an investment group signed by CITIC Securities. The reporter found that some people in the group released their views in the name of "CITIC Securities Yang Minghui" (QQ: 503408559) (Yang Minghui as general manager of CITIC Securities).

To this end, the reporter added the QQ number of "Yang Minghui". The so -called "Yang Minghui" told reporters that because there are many consulting students, there are any contact assistants who need help or add bubbles to answer them uniformly.

What is doubtful is that the so -called "Yang Minghui" has constantly stated in the group in the group, "There are two special invitations in the stock market, one is specially invited by securities firms, and the other is a special invitation. Divided into two types: one is a special invitation of the first -level market brokerage trading, and the second is the general invitation of the secondary market used by our retail friends. And the agency's special invitation is fixed, which is a first -level market transaction. Market transactions have a preferred transaction permissions and are not limited by any sector. There are no more than 10 securities firms and large fund companies invited by institutions in the market, and our CITIC Securities is one of them. A threshold for operation is mainly used to help institutions to subscribe for new shares (can be signed 100%) and grabbing (buy stocks that have blocked the daily limit). "So, how is the first -level market daily limit board raising?

The so -called "Yang Minghui" said: Regarding the daily limit of the first -level market, our institutions specifically cooperated with the main owner to operate the low -level stock stocks, grasped the single -stock agency to buy orders, and for the purpose of expanding the main benefits. Of course, our main force cannot swallow too much at one time, otherwise the Securities and Futures Commission will investigate, so we will release some chips for retail investors to buy, and then the retail investors will leave the site the next day to let the remaining main funds enter the market and keep up with the friends who have the layout of the layout. You can also use the income of a board for return.

He further emphasized: (the first -level market daily limit board grabbing) rules are buying today for sale today! It is never allowed to hold a profit without permission, and avoid triggering big data by relevant departments. So everyone must abide by our rules.

● Many tens of billions of private equity heads are converted

With each reporter's in -depth investigation, the gang can be described as a full set of acting. In addition to pretending to be a certain securities chief economist to do training, Yang Minghui, general manager of CITIC Securities, to teach and guide Participate in the illusion of marketing.

For example, in the QQ group, the head of the private equity of 10 billion yuan appeared. In the group, a group of friends signed "Shanghai Fusheng Assets-Land Airlines" (QQ: 3228284277) attracted the attention of the reporter. QQ information showed that "land Airlines" entered the group on August 9, 2022. According to data from the Fund Industry Association, Luhang is the actual controller of Shanghai Fu Shengsheng Assets, and the scale of Shanghai Fu Shengsheng Asset Management exceeds 10 billion yuan.

Also pretended to be Huaxi Fund Wang Yaning. QQ shows that "Wang Yaning" entered the group on August 7, 2022. It is worth noting that in the QQ group dialogue, investors who signed "Huaxi Fund Wang Yaning" said, "Our company now cooperates with the teacher's layout operation. At present, the only regret is that the share is less."

In addition, there is a private equity that signed "Boyuan Fund Qin Xiao" that has declared in the group that "the stock market will always be a place where a money person has obtained experience, and experienced persons get money, keeping up with the pace of a certain securities."

It is worth mentioning that in the QQ group, the figure signed by the well -known private equity institution "He Juan Investment Li Zegang" (QQ: 2496468270). Regarding the investment of Li Zegang, he is a private equity fund manager who is familiar with the reporter. In response, the reporter made verification and verification for the first time. He Jian Investment Related person revealed to reporters that this QQ was not owned by Li Zegang, and it was a liar.

According to the reporter's observation, investors who participated in the "daily limit board grabbing Zhuang" in the group can be described as "big guys". People who "invest in Lu Jun calmly" and "Dong Chengfei" and other people are also posing as in the group.

According to reporters, these so -called "private equity" are often played in the group. Through the investment actions that they are difficult to discern, they attract investors who do not know the truth.

● The so -called "first -level market" is really so profitable?

At around 10:50 on July 7 this year, "He Haifeng" called on the Qi groups established in another QQ group in the name of a certain securities. Lao He builds a position with everyone. "

However, within a month after the recommendation, Sichuan Jinding's stock price has never performed much.

In the afternoon of the same day, the group assistant issued a notice of the so -called "daily limit board" in the group, calling on the group members to buy Ruikang Pharmaceutical for a limited price.

At this time, Ruikang Pharmaceutical is in a state of daily limit, and there are more seals, and the possibility of successful buying is very small. Another group, after 2 pm on July 7, recommended Ruikang Medicine in the group.

However, many members in the group still responded to the call and "bought" Ruikang Medicine. Shortly after the above notice was issued, many people in the group will post screenshots to buy Ruikang Pharmaceuticals, but the backgrounds of these screenshots are the same, and they seem to use the same software. According to customer service, the software used by these investors is so -called "first -level market -specific software".

Every afternoon, the group assistant will release a stock that has already dailyly in the group, allowing investors to buy, and there are always many investors who will post screenshots that have been successfully bought in the group in the group soon.

Some investors have questioned the operation of the operation of the stock stocks that always successfully buy the daily limit board stock, "Can you buy the daily limit board? Which software is this used?"

According to a member of the group, he used a daily limit board stock called "Special Software of the first -level market" named "Junhong Professional Edition". Although the logo of the "Junhong Professional Edition" is very similar to a certain securities Junhong APP, the reporter did not find the so -called "Junhong Professional Edition" APP in the app store. In this regard, the group assistant told reporters, "Because the first -level market terminal is not open to the outside world, it cannot be searched in the application mall."

After closing on July 7, "He Haifeng" explained the "condition" behind the "daily limit board grabbing Zhuang buying operation" in the group. He claims that "the most important weapon of financial institutions is the dedicated code authorized by the organization. It is not only a license, but also a pass to enter the market. Not only can it be used in the secondary market institution to use the authorized special code to conduct large transactions. More importantly, it is more important. The institution can obtain priority to participate in the first -level market through the dedicated code ... and currently there are only 3 institutions authorized by the organization's authorization. The so -called "Special Code for Institutional Privileges" can also be directly involved in the underwriting and distribution of new shares.

According to "He Haifeng", after opening the above -mentioned so -called first -level market transaction terminal, investors can get two "permissions", including: ensure that investors can buy stocks that have daily limit based on account funds, that is, the "daily limit board grab the Zhuangzhuang Zhuangzhuang Zhuangzhuang Zhuangzhuang Zhuangzhuang Zhuangzhuang "; Ensure that investors can subscribe to new shares to the upcoming listing according to account funds at a ratio of 100%.

It is incredible to judge the common sense of securities investment, but the gang always uses these "tricks" that seem to make a stable earnings to stir the nerves of investors.

Regarding the so -called "daily limit board grabbing village", the information issued by the gang group shows that "the agency authorized the daily limit board to grab the village refers to the sales list in the first -level market transaction terminal." The village license (claims that there are only 3 licenses across the country) authorized, you can give priority to buying a single bargaining chip released by the daily limit board. "

In addition, the assistant told reporters that the income of the "daily limit board grab the village" is directly proportional to the amount of funds. "

In contrast, in the above two "permissions", the "profit" of "new" is more rich. For the gameplay of "new", the assistant said that the more account funds, the more new times the number of times, the "200,000 funds, only 2 new shares in a month, 7 times in 500,000 times, 1 million can play 10 times 10 times . "But all guarantees 100%signature.

In addition, he also said, "How many new shares can be distributed in accordance with our institution, and the new shares grabbed each time are different."

On July 12, the new share Tianxin Pharmaceutical was listed on the Shanghai Stock Exchange, an increase of 44%throughout the day. However, it is difficult to understand that from the screenshot of some investors released on the day, the cost price of the new shares of Tianxin Pharmaceuticals they hold is 29.5 yuan, which is more than 7 yuan lower than the issuance price of Tianxin Pharmaceutical. Judging from the screenshots released by investors, it was as high as 80%of the "floating profit ratio" of Tianxin Pharmaceutical's position on the same day.

In response, the assistant given by the assistant as a "because the price of new stocks in the first -level market is lower than the secondary market price. As long as everyone operates with our Cathay Pacific, the price of new shares will be lower than the secondary market."

The reporter noticed that recently, in the relevant new stock purchase operation notice issued in the group, the gang claimed that the purchase price of the new shares they received was significantly lower than the issuance price. It is worth mentioning that the gang will refer to the real issue price of new shares as the issuance price of the secondary market, to separate the issuance price of the so -called first -level market.

Similar to this, you can "every play", and each time you can get a miracle story of "risk -free profits" in a short time, it will be staged repeatedly in the group of the gang.

After Opi Mai launched on September 2 this year, some investors in "China -Sign" have exposed the "floating profit" situation in the group. Mai Mai's new shares, and the company's actual issuance price was 80.2 yuan. Under such a huge "discount", the investor's "floating profit" on the first day of listing reached an amazing 1.4 million yuan.

In order to show that this is not a "free service", "He Haifeng" claims that the so -called "agency authorized special code" is not awarded a free retail investor. During the use process, "a certain securities" needs to draw a 10%division from its profit. In addition, the assistant also pointed out in the group chat: "The total profit of 10%of the month's total profit was ended in January. If we could not be fulfilled, we will take legal measures and blacklists according to the contract requirements."

In addition, when a group friend questioned, the "teacher" often posted in the group to "brainwashes" the group friends on the so -called "first -level market transaction".

On July 12, the new shares and Xin Pharmaceuticals were listed, an increase of 44%throughout the day. However, from the screenshot released by the "investor" in the reporter's survey, the "floating profit ratio" of its position on that day was as high as 80%

● Doubtful "path of wealth"

In the eyes of some investors who lack understanding of basic securities common sense, the so -called "first -level market" transactions depicted by "He Haifeng" are the Kangzhuang Avenue that leads to "financial freedom". There are many doubts and flaws.

1. The doubts encountered during the account opening. According to the assistant introduction, if investors want to participate in the "first -level market" transaction, they need to take the following process: "First of all, you need to find me to receive and fill in the application form and sign a commercial confidentiality agreement to apply for the first -level market The dedicated code for authorization, wait for the dedicated code for the authorization, we will provide the exclusive download link to download the first -level market terminal APP.

In order to learn more about each other's gameplay, the reporter recently tried some "account opening experience".

First of all, the assistant first asked the reporter to fill in a form called the "Application Form for the Restaurant of a certain Securities". After the reporter filled in confirmation, the other party issued two more agreements, the so -called "Agreement of the Commercial Information Confidentiality Agreement of a certain Securities Co., Ltd." and the "Fund Security Guarantee Agreement" required the reporter to fill in and sign the painting. At the end of these two agreements, the official seal of a certain securities Co., Ltd. is attached.

It is worth mentioning that in the group chat opened in the name of CITIC Securities, at the end of these two agreements by the assistant to reporters, the official seal of CITIC Securities Co., Ltd.

After the reporter completed the signing of the above two agreements, the assistant began to teach reporters how to download the "terminal APP".

First of all, the other party first provided reporters with a webpage https://hgonbvl.cn/homes/#/login to open an account through the webpage.

However, the reporter could not open the link on the computer and mobile phone.

The assistant sent a link to the reporter to download a link to the so -called transaction terminal app https://xnwi.wjxxca.com/s/ybft and let the reporter download it according to the relevant steps. Before downloading the app, you need to exit the pure mode of the mobile phone system.

However, after repeated inquiries, the reporter confirmed that the so -called "JH professional version" APP in the link cannot be found in the regular application market. Later, under the guidance of the assistant, the reporter spent a lot of time to download and open this app.

During the registration process, the assistant provided reporters with the so -called "special code for institutional authorization". After completing the registration, real -name authentication and binding bank cards need to be performed.

Paradoxically, although the so -called "real -name authentication" is prompted in the software, in actual operation, each reporter uses fictional identity information to pass the certification.

In the "CITIC Securities Group", the relevant account opening process is basically similar. The group assistant first gave a link to each reporter (tongdaxin666.us/#/home). When the reporter copied the link, it was an unofficial website that was opened. It is worth noting that when the reporter entered the silver transfers of the "CITIC Securities to the Terminal of the CITIC to the Terminal", it was found that when the bank transfers were transferred, the so -called "silver transfer commissioner" was also needed in the silver syndrome triple custody channel. This is obviously different from the method of transfer of regular securities firms.

2. The doubts encountered during the transfer

After the reporter completed the registration procedure, the assistant began to prompt that the reporter transferred to the funds, saying that "if you did not participate in our grabbing within 3 trading days, your dedicated code will be canceled."

It is worth mentioning that the assistant introduced that the transfer time of the account funds is: the transfer time is from Monday to Friday from 9: 00 ~ 15: 00; 00, Saturday to Sunday are 13: 00-22: 00.

The reporter consulted a number of securities firms that the transfer time set by brokers for customers is usually 9: 00 ~ 16:00 on the trading day. For example, the customer transfer time of CITIC Securities is 9: 00 ~ 15:50 on the trading day, and the night and weekends on the day of working days cannot be transferred to funds.

After the reporter's opening customer service system according to the guideline, the so -called "a certain securities Junhong customer service" contacted the reporter on the remittance.

It is worth mentioning that, unlike the silver transfusion method commonly used in the securities industry, the customer service provides reporters with a bank account of a company, allowing reporters to enter the bank account. For example, every time a reporter applied for a transfer application, the customer service sent the bank account to the reporter's "Jiangxi Beiyuan Machinery Equipment Company".

In this regard, each reporter raised doubts to the group assistant. The group assistant said that the so -called Jiangxi Beiyuan Machinery Equipment Company is a cooperative merchant designated by Syndrome. "This company account is the cooperative company that reviews funds. There is no problem, the fund will directly enter your first -level account. "

In addition, it is doubtful that the reporter tried to transfer (deposit) many times within a few days, but the bank accounts provided by the other party's customer service all came from different companies, involving Changshu Yongyi Municipal Engineering Co., Ltd. and Jiangxi Beiyuan Machinery Equipment , Jiangsu De Nai Xin International Trade, Nantong Supreme Automobile Trade, Hebei Xingzhu Medical Equipment Co., Ltd. and other companies. Since then, the account of the transfer has also been changed to Nanchang Huanran Machinery Equipment Co., Ltd. and Lintong County Qingxu Department Store. And every time you issue an account, the customer service will remind: "Please complete the transfer within 10 minutes. If the timeout is not completed, please find the customer service card again."

In this regard, the assistant gave an explanation, "Because the card of each review of the funds is different. This is a review system set up by our institution and bank. The account is not used alone. It is necessary to use other users. "Some markets speculate," The reason why they changed a account after a few days may be to facilitate transfer of funds and for fear of using an account for a long time. "

After inquiries by reporters, although many companies designated by the above -mentioned receipt accounts, although they can find industrial and commercial information, the scope of business does not include securities business.

In addition to the above -mentioned abnormal receipt accounts, the gang will also fictional some regular institutions for them. For example, on September 4th, a screenshot of online banking was appeared in the group. Qixinbao showed that Hongta Asset Management Co., Ltd. was the holding Sun company of Hongta Securities.

3. The QQ group formed has been repeatedly blocked

It is worth mentioning that since July this year, the QQ group formed by the gang has been blocked many times. Every time they are blocked, they will quickly form a new group of "re -operating the old business" in a short time.

In addition, the reporter found that the news sent by the group will also be staged from time to time from time to time, which may make some investors confuse vision and difficult to distinguish authenticity.

For example, recently, a notice issued in the group stated that an assistant, suspected of using the stool of duties, with the help of other people's accounts to participate in the first -level market, conspiracy (Mou) to take huge profits, and has now been revoked by the Securities Regulatory Commission. The new assistant "Zeng Jin "'s securities dedication was nicknamed" S0880613010XXX ".

The reporter found on the website of the Securities Association that a practitioner named "Zeng Jin" could correspond to "S0880613010xxx".

● Many group friends have questioned

It is worth noting that in the number of groups formed by the gang, in addition to many members suspected of being "entrusting", some real investors have made some discrimination, and "Class market transaction" is difficult.

At about 3 pm on July 27, some friends questioned the so -called "first -level market" operation model in the group, but soon after, the assistant withdrew the information released by the group of friends.

In addition, the reporter noticed that shortly after issuing questioning information, the group of friends were kicked out of the group chat.

The group of friends told reporters that last year, the relatives of his friend also had a similar one, "The (daily limit) ticket he said, I could not buy it with regular stock software. Then you ca n’t buy it at all, so this is a scammer. Once your money is turned in, it may be able to turn out at the beginning, but the time is long, and the funds may not be transferred. In the past two years, I This is how the sister -in -law's sister -in -law was deceived. "

The gang often uses the so -called "first -level market to obtain high returns" in the group to lure investors.

The above -mentioned group friends further pointed out to reporters: "If my friend and his sister -in -law had not been like this before, I might believe it. When they said that when the first -level market was, I went to Baidu. After a while, I also asked the customer manager of a certain securities who opened an account. People said that they must not believe this. All of them are scammers. "

In addition, investors questioned in the group, why is the accounts transferred daily constantly changing?

In this regard, the group assistant was obedient for the reason of "filtering black money". It stated that "because each ticket cooperation is different, they must contact the Silver Certificate Commissioner to get real -time account information before each entry."

● Fortunately, group friends are difficult to withdraw money

Although there are a lot of information in the group show that through the "first -level market" transaction, investors can easily obtain "high profits", but in fact, from some investors who have already "entered" in their own experience, these Whether the so -called "profit" can be fulfilled to get a big question mark.

In late August this year, some friends reported in the group that they had encountered a withdrawal of withdrawal. "Everyone, how you transferred out the funds, I (attempts) have been reviewing it. I don't believe it, what's the matter? "

It is understood that in late August this year, the group of friends "purchased" new shares Tianli Lithium through the above -mentioned "first -level market" channels. Tianli Lithium was available on August 29 this year. It opened high and low on the first day of listing. After that, the stock price continued to be adjusted. On September 2, it fell below the issue price of 57 yuan.

However, the group of friends told reporters that despite the decline in the stock price after the listing of Tianli Lithium, the gang did not let him throw the stock, "say you need to wait for notification."

On the day of September 2nd, Tianli Lithium could fall below the issue price, and the group of friends have not been allowed to throw stocks.

"They, I also doubted at the time, and later I didn't know how to go in. I am afraid now, and I don’t know if I have been deceived. "

As we all know, investors open an account in the brokerage firm and can decide to buy and sell stocks independently. Secretariat cannot interfere with the independent decision -making of investors (the Guidelines for the Implementation of the Proper Management Implementation of Securities Business Institutional Institutional Institutional Institutional Institutional Institutional Institutions "clearly stipulates that Investment rights). The gang's approach obviously does not meet the basic criteria for the business of securities firms. It is understood that this group of friends are not new shareholders, and have two years of stock investment experience.

On the afternoon of September 2nd, the above -mentioned group friends could not issue a question in the group. Judging from the withdrawal screenshots he provided, he successfully transferred a 895 yuan on July 29 this year. On August 22, he tried to transfer a 9,000 yuan but failed. The reason for the failure turned out to be the "contact assistant assistant assistant assistant assistant "". At more than 1 pm on September 2nd, he tried to turn out a 1025.26 million yuan again, and did not turn it out as expected.

In this regard, he questioned the assistant: "I have been on the market that I bought the new shares and I will not be sold after listing. I will not reply to your question. Last time I wanted to transfer some money and I could n’t transfer it. You need to review it. If you do n’t give it to me After passing the review, then the money I voted could not be turned out. Are you really a scammer? The Public Security Bureau called me every day and asked me if I was deceived. "

However, such a question did not play a role. By the evening of September 2, the group of friends still failed to withdraw money from their accounts.

It is worth mentioning that after the above -mentioned cannot be withdrawn, after the exposure of the group, the gang kicked the group of friends out of the group chat. According to the group of friends, he has recently reported the gang's suspected fraud to the police. "The police said that this (scammers) may be overseas groups because there are many such overseas fraud groups. They are mature. There are not a few deceived people. "

After receiving a warning from the group friends, as of press time, the gang still did not show signs of help. The relevant QQ groups continued to fabricate the illusion of wealth about the "first -level market" every day.

In recent years, criminals have used the name of a fishing website and a fishing app to seduce investors and fraudulent cases. Many investors have suffered heavy losses, and many brokers have previously clarified these behaviors.

Recently, the reporter of "Daily Economic News" reported to the CSRC as investors as investors.

Daily Economic News

- END -

[Caizhi Headline] Let 37 financial institutions "step on the mine", what is the situation?

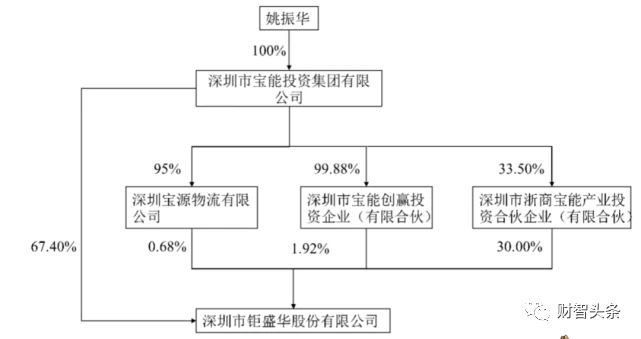

Real estate has continued to decline. Since the beginning of this year, Baoneng Gr...

GAC Group plans to set up electric drive technology companies with a total investment of 2.16 billion yuan

On August 11, 2022, the Hong Kong stock listed company GAC Group (02238.HK) announced that the 20th meeting of the 6th board of directors of the company was held on August 11, 2022 (Thursday) in commu