Well -known giants, large -scale layoffs!

Author:Harbin Daily Time:2022.09.14

According to CNBC, the United States Goldman Sachs Group is starting to carry out the largest layoffs since the outbreak of the new crown epidemic. Some analysts believe that this means that as the Fed promotes radical interest rate hikes, the tide of layoffs has spread from the scientific and technological giants of Silicon Valley to large financial institutions in Wall Street.

Goldman Sachs Group plans to lay off hundreds of people on this month, which makes Goldman Sachs the first large financial institution on Wall Street to start layoffs to control expenses.

In fact, there have always been the last elimination mechanism in Wall Street Bank, which will lay off 1%to 5%of employees with poor performance each year. However, since the outbreak of the new crown epidemic, the financial market was very active, and at the same time faced a wave of recruitment. Therefore, such an elimination mechanism is not only suspended, but major banks have also been radical.

For example, at the beginning of this round of layoffs, Morgan Chase Investment Banking Department has recruited 13%of employees, Goldman Sachs recruited 17%of employees, while Morgan Stanley increased the position of 26%.

Earlier this year, the financial market began to be severely frustrated, which caused various businesses between banks to slow down. As of the first half of this year, the number of IPOs of Wall Street for the first time has decreased by 90%, the business of high -yield bond issuance has decreased by 75%, and the acquisition and mergers and acquisitions business have decreased by 30%, which directly led to the rapid decline in banks' income.

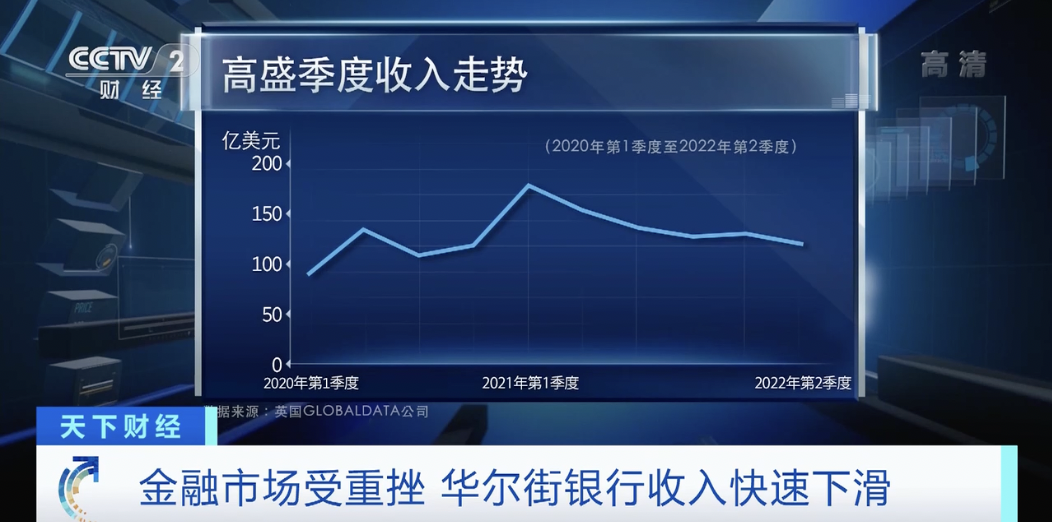

Goldman Sachs Group's quarterly revenue continued to decline in the first quarter of 2021. In the second quarter of 2022, revenue decreased by more than 20%year -on -year, and net profit fell close to 47%year -on -year.

Therefore, Goldman Sachs has restored the last elimination mechanism. As for whether a larger layoff plan will be adopted, David Solomon, CEO of Goldman Sachs Group, said in an interview with CNBC that it depends on the next Fed's trend and inflation trend.

Goldman Sachs's stock price has fallen by more than 13%since this year. Not only Goldman Sachs, the bank sector in the entire S & P 500 has fallen, and the overall decline in the sector has been close to 12%since this year. This makes the market full of concerns about the next trend of the US financial industry. If the economic recession continues and financial activities continue to be sluggish, more banks will join the ranks of layoffs.

David Solomon, CEO of Goldman Sachs Group: Goldman Sachs Economist said that in the next 12 months, there will be a 30%probability of economic recession, and the probability within 24 months is 50%. High probability.

From a more macroeconomic perspective, US layoffs have spread from the technology sector and manufacturing to the banking sector. If the inflation is high, the interest rate hike is more radical and the economic recession is more lasting, and there will be more large -scale layoffs in more industries.

Source: CCTV Finance

PSAs

- END -

Caramay City: Take the "cloud" up to the "number"

Tianshan.com reporter Gazira Nike Correspondent AoyamaPart of the rendering servic...

The Beijing Stock Exchange accepted a total of 115 companies' listing declaration in the first half of this year

The reporter learned from the Beijing Stock Exchange on July 1 that in the first h...