Black Tuesday, US stocks fell miserable

Author:Straight news Time:2022.09.14

On September 13, local time, the three major US stock indexes plummeted across the board. As of the closing, the Dow Jones Industrial Average has fallen by 1276 points, a decrease of 3.94%, the Standards 500 Index fell 4.33%, and the Nasdaq Composite Index fell 5.16%. Among them, the S & P 500 index hit the largest single -day decline since June 11, 2020.

On the 13th, a trader was watching the screen of the Dow Jones Industry Average Index on the 13th of the New York Stock Exchange (NYSE) trading hall. (Reuters)

According to data released by the US Department of Labor on the day, the US Consumer Price Index (CPI) increased by 8.3%year -on -year in August this year. The analysis believes that the year -on -year growth rate of CPIs that remain high has once again exacerbated the market's concerns about the Fed's continued radical interest rate hikes, and investors continue to press down on the same day.

In this regard, the US President Biden said that the stock market that fell sharply due to inflation that day did not necessarily reflect the overall situation of the economy. He said he was not worried about the inflation data released that day.

Ironically, just when Wall Street was filled with a "sad cloud" atmosphere due to continuous inflation, the US president Biden, who was in the White House, held a celebration for the White House signed the "Inflation Act" last month. However, the reality is that inflation has not been effectively relieved. People on social networks such as Twitter immediately responded to these ridiculous scenes presented by the United States that day. According to reports, on the 13th, the two media of CNN and MSNBC noticed that Bayeng's speech on the White House touted the "Inflation Act" in the White House "the time is wrong", and then cut off the picture of Biden's speech, MSNBC turned to turn to steering. Broadcasting news related to Trump.

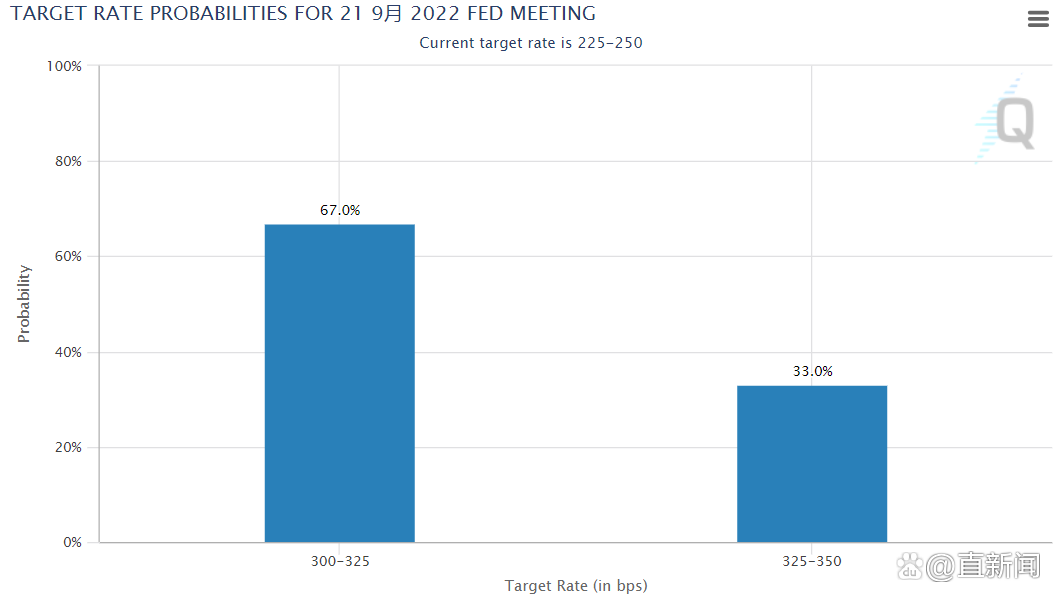

Another reason for the panic felling of the stock index is the further deterioration of interest rate hike expectations. As of the closing, the CME "Fed Observation" tool shows the probability of the Fed's 100 basis points next week, from 0%yesterday to 33%. Nick Timiraos, a well -known reporter known as the "New Federal Reserve News Agency", wrote on Tuesday that inflation data laid the foundation for the Federal Reserve's next week "at least 75 basis points" and raised the possibility of continuing to raise interest rates in the next few months.

(Source: CME)

Multi -problems have caused the "high fever" in the United States to inflation

Since March of this year, in order to cope with the general surge in oil prices, food prices and other living costs, the Fed has raised interest rates four times, and the rate hike has reached 225 basis points, but the level of inflation in the United States has not declined significantly. Many economists have pointed out that high inflation is the consequences of the US government's internal and external policies.

First, the U.S. government regards the warning of experts and seals a lot. After the outbreak of the new coronary pneumonia, regardless of public opinion's concerns about inflation, the US government introduced a large -scale economic stimulus bill to increase a large number of dollars. From March 2020 to March 2021, the Fed issued nearly $ 5 trillion. Many experts, including former US Treasury Secretary of Treasury Secretary Smems at the time, issued a warning saying that excessive stimulus may cause economic overheating. However, the U.S. government ignored it. Extremely loose monetary policy has led to a large amount of currency entry. The expectations of the Fed's shrinkage have caused a large number of US dollars to return, superimposed US currency easing policies, and further promoting inflation in the United States.

Secondly, the U.S. government has continued to pour fuel, which led to the outbreak of the Russian -Ukraine conflict. The United States and its allies also impacted Russia to impact the global energy market and food market, which led to the global energy, food and other global commodities prices. In the end, it will help the United States inflation in the end.

Third, since the last US government, the United States has launched a trade war on China. However, China is the largest commodity supply country in the United States, and the lives of the American people have a great demand for imported goods from China. Many think tanks and research institutions in the United States have made calculations. If the United States cancels all tariffs on China, it will reduce US inflation rate by about one percentage point. In this sense, tariffs on China's export goods are also an important reason for the overall level of inflation in the United States.

Affected by multiple factors such as high prices and financial environment, the US economy continued to decline in the first and second quarters of this year, and it has fallen into a technical decline. Inflation has become one of the most concerned economic issues that American people are paying attention to. U.S. President Biden signed the "Inflation Act" on August 16 this year. Although the bill was named in the name of anti -inflation, the actual role was questioned by many parties. Analysts believe that the treatment of the bill is not the root cause of the Democratic Party for the midterm election, and it is difficult to truly alleviate the current high inflation difficulties in the United States.

Source 丨 CCTV News, Finance Association, First Finance

- END -

Banking Insurance Regulatory Commission: At the end of the first quarter, 180 insurance companies' average comprehensive settlement capacity adequacy ratio was 224.2%

Zhongxin Jingwei, July 6th. According to the website of the Banking Insurance Regulatory Commission, a few days ago, the China Banking Regulatory Commission held the 15th working meeting of the Capita

China China Eastern Airlines: Buy 100 A320neo series aircraft from Airbus

On July 4, Capital State learned that China China China China Eastern Airlines (600115.SH) announced that the company and Airbus signed the Buy 100 A320NEO Series Aircraft Agreement in Shanghai, Chi