Nomura took the lead in calling for 100 basis points in September: To achieve 2%inflation targets, the United States will need a recession

Author:Daily Economic News Time:2022.09.14

On September 13th (Tuesday), Eastern Time, the August CPI data released by the US Department of Labor completely shattered the market's "fantasy" of the Fed's non -violent interest rate hike.

After the data was released, the rest of the risk assets except the dollar was spared. In addition, the Fed's dropping transaction has completely priced the 75 basis points in the United States in September, which shocked the market that the market expects that the Fed's 100 -basis point of interest rate hikes will reach 50%next week.

In addition, Nomura became the first trip to Wall Street that the Fed will raise 100 basis points at the meeting next week.

According to the report written by the managing director and senior economist Aichi Amemiya team by the reporter of the "Daily Economic News" reporter, in addition to the expected to raise interest rates from the Fed next week, Nomura believes that with the salary- The trend of rising prices is becoming increasingly obvious. At this stage, the Fed only can return inflation to its 2%target by pushing the unemployment rate.

However, Rick Roberts, who was the Federal Reserve Risk Credit Director during the financial crisis in 2008, did not agree with this. He pointed out to the reporter of "Daily Economic News" through WeChat that if the University of Michigan's University of Michigan announced on Friday this Friday time, the University of Michigan's will have long -term inflation expectations for a long time If it is not too bad, he expects the Fed's interest rate hike next week will still be 75 basis points.

Nomura: The United States will need a decline to push the unemployment rate to allow the inflation to return to the target of 2%

Nomura believes that the CPI report in August shows that the monthly inflation of core products and core services is generally strengthened, indicating that a series of upward inflation risks may be a reality.

For a period of time, Nomura has been emphasizing the rise of wages-prices, and increasingly unstable inflation expectations. These factors may continue to rise in a longer period of time (in such inflation environment) Make a stronger response.

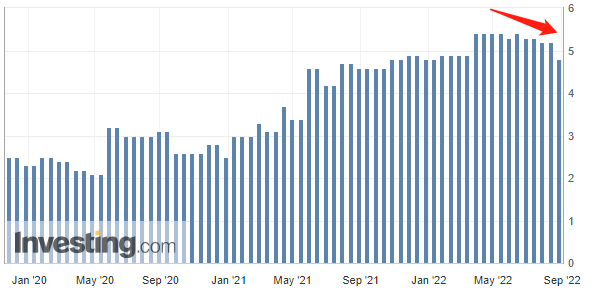

Picture source: Nomura

Aichi AMemiya's team pointed out that although their predictions were not always consistent with the Fed's policy actions, the historical history of increasing interest rate hikes afterwards shows that the Fed may underestimate the risk of high inflation and become ingrained.

Aichi AMemiya's team still believes that although the Federal Reserve did not raise interest rates at 100 basis points at the July meeting and did not meet Nomura's expectations, they believed that recent data will encourage Federal Reserve policy makers to re -consider whether to speed up interest rate hikes to speed up interest rates. pace.

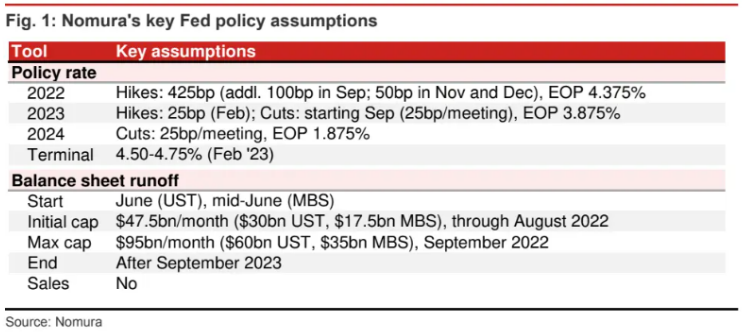

"Therefore, we think that these uplink inflation risks will promote the Fed's 100 basis points at the FOMC conference this month, which is higher than the 75 basis points we previously predicted. 50 basis points. But now, we are also expected to raise interest rates at 50 basis points at the December meeting (previously expected to be 25 basis points). "Aichi AMemiya's team wrote in the report.

In addition, Aichi AMemiya's team also said, "For the February 2023 meeting, we still maintain a rate hike of 25 basis points. Generally speaking, we are now the forecast of the federal fund interest rate forecast for the final rate hike cycle. It is 4.15%to 4.5%, 50 basis points higher than our previous forecast. "

Picture source: Nomura

AICHI AMemiya's team pointed out in the report that "the CPI report in August strengthened our point of view, that is, inflation is increasingly fascinated, and eventually a decline was needed to weaken the labor market, thereby restoring the stability of prices. Although the United States in 2022, the most in history in history in history The fast speed turned to the eagle and carried out a series of unusual interest rate hikes, but the prospects of American inflation have hardly shown signs of continuous improvement. "

"Therefore, we are still expected to further tighten the financial environment, which will cause obvious resistance to economic growth, promote the US economy to fall into a recession later this year, and push the unemployment rate near 6%in 2024." Aichi AMemiya The team wrote.

Before the interest rate hike next week, the market is still paying attention to this important inflation data

The data released by the US Labor Statistics on September 13 shows that after eliminating large fluctuations and energy prices, the core CPI in August rose 6.3%year -on -year 5.9%; the core CPI in August rose 0.6%month -on -month, which was twice the market expectations and the previous value (0.3%).

"Daily Economic News" reporter noticed that the overall inflation fall in August was mainly due to the continued decline in gasoline prices. At the same time, housing, food and medical prices continued to rise.

The decline in oil prices is mainly due to the release of oil reserves in the United States. According to CCTV News, data released by the US Department of Energy on September 12 showed that the US strategic oil reserve decreased by more than 8 million barrels to 434 million barrels last week, the lowest level since October 1984. The US strategic oil reserves hit the largest weekly decline since the week of September 9. The reduction of crude oil includes 6.3 million barrels of low sulfur crude oil and about 2 million barrels of high sulfur crude oil.

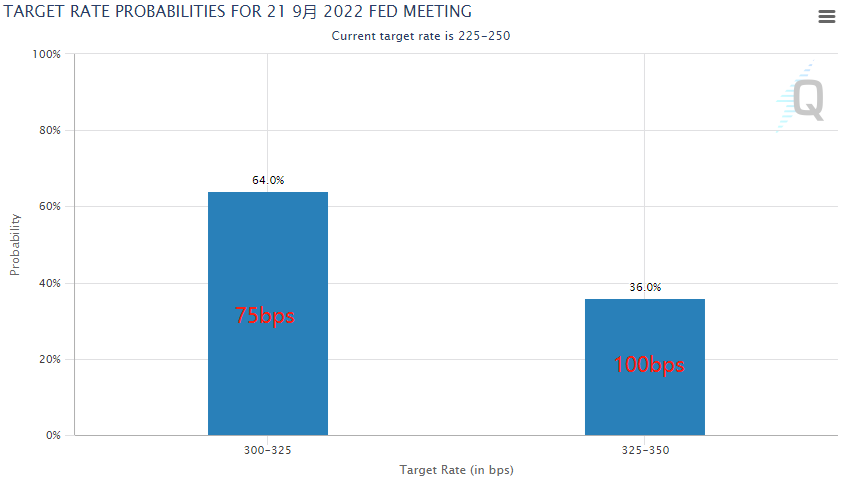

Inflation data in August, which caused risk assets over the overnight to plummet, and market risk aversion was heating up. The sharp decline in risk assets also originated from the market's heating up to the Fed's next interest rate hike. According to the "Fed Observation" of the Zhishang Institute, as of press time, the futures market believes that the probability of the Federal Reserve ’s interest rate hike will be 64%next week, and the range of 100 basis points in interest rate hikes has reached 36%. Picture source: Zhishang Institute

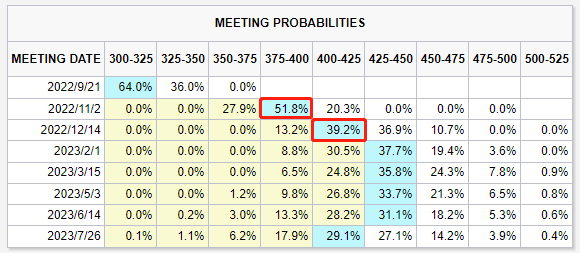

For the meeting after September, the current market expects that the Fed in November has a 51.8%probability of 75 basis points in the fourth consecutive interest rate hikes, and 39.2%of the possibility of rating is 25 basis points in December. This means that the market is expected to rise to more than 4%at the end of this year.

Picture source: Zhishang Institute

However, during the 2008 financial crisis, Rick Roberts, who was the Federal Reserve Risk Credit Director, pointed out that he did not agree with the Federal Reserve's expectations of 100 basis points to raise interest rates next week, unless it was announced on Friday this Friday announced on Friday this Friday. The expected data of the University of Michigan's consumption inflation is very bad.

He also pointed out that on Thursday, the "horror data" of the US Department of Commerce -core retail sales will also be closely concerned.

The 5 -year inflation expectation trend of the University of Michigan in the United States (Picture Source: British Caiqing)

At 22:00 on Friday, September 16th, Beijing time, the University of Michigan will announce the one -year inflation expectation of the market closely, and the data expected data expected data in 5-10 years. Rick Roberts believes that this will be another inflation that the Fed will pay close attention to index.

"When monitoring inflation, the Fed is very closely paying close attention to whether long -term inflation expectations have been 'anchored'. That is to say, if the real -time data reported in this direction (such as rising), but long -term inflation expectations remain unchanged, then then We say that long -term inflation expectations are 'anchoring'. So far, although the actual inflation data has been high, long -term inflation expectations have not changed, that is, long -term inflation expectations are 'anchoring' that is anchoring ' . The Fed hopes that this is the same as the expected data of the University of Michigan. The worst case is that the Fed's long -term inflation expectations of the Federal Reserve are rising. If this is true, the Fed will definitely tighten the monetary policy. "Rick Roberts said to a reporter.

"Of course, in addition to the inflation expectations of the University of Michigan, the Fed will also refer to more other inflation models, but the survey data of the University of Michigan is obviously the highest. Therefore, I think it is not too bad if the long -term inflation expectations of the University of Michigan announced on Friday are not too bad Then the Fed's interest rate hike will still be 75 basis points next week, "Rick Roberts added to reporters.

Daily Economic News

- END -

4894 billion yuan!The market value of restricted shares in July was hit for the year.

According to Wind data statistics, in July, a total of 29.67 billion shares were l...

Haiyu Finance Comment 丨 Shandong's new and old kinetic energy conversion: use strategic fixed force to go out of high -quality development new roads

2022 is a breakthrough in the conversion of new and old kinetic energy in Shandong...