No sleep tonight!Suddenly sharp, global crash!US stocks collapsed 900 points!Biden just spoke

Author:China Fund News Time:2022.09.14

China Fund News Taylor

Brothers and sisters, big things are not good, there is a black swan again tonight, and the peripheral market has collapsed. I hope that A -shares can stand up on Wednesday, and if you walk independence, you will be praised. Essence Essence

Let's take a look at what happened.

American inflation data exceeds expected

US stocks collapsed

On the 13th local time, the latest data released by the US Department of Labor showed that the August consumer price index (CPI) in the United States rose 0.1%month -on -month and 8.3%year -on -year. In the month, after excluding large fluctuations and energy prices, the core CPI rose 0.6%month -on -month and 6.3%year -on -year.

The US August CPI increased by 8.3%year-on-year, higher than the market expectations of 8.1%, and the previous value of 8.5%; August CPI rose 0.1%month-on-month, higher than the market expectations -0.1%

After eliminating the price of food and energy that fluctuated, the core CPI in August rose 6.3%year -on -year, higher than the market expectations of 6.1%, and 5.9%higher than the previous value.

And 0.3%of the previous value.

What does this data mean? The analysis believes that the high -rise CPI growth rate has once again strengthened the expectations of the Fed violent interest rate hike.

Mike Lovitter, the person in charge of Morgan Stanley Global Investment Office Model Investment Group, said: "Today's CPI data clearly reminds us that we still have a long way to go before inflation returns to reality." We are in a downward track and the Fed will stop refueling.

According to the data of Zhishang Institute, after the release of the CPI, the probability of the Federal Reserve ’s interest rate hike in September rose to nearly 90%, and the market even began to expect. The possibility of the Fed’ s interest rate hike 100 base points next week reached 18%.

The Federal Reserve Chairman Georom Powell reiterated last week that he "firmly committed" to reduce inflation, although he was worried that the continuous rate hikes could cause the economy to fall into a decline.

After the US CPI data came out, the global market was bloody and collapsed. Take a look.

Dow dives in front of the futures.

After the official opening, the U.S. stock index fell nearly 900 points, the Naqi index fell 4%, and the European stock market dived in a straight line.

The closing of European stocks fell across the board. The German DAX index fell 1.59%at 13188.95 points, the French CAC40 index fell 1.39%to 6245.69 points, and the British FTSE 100 index fell 1.17%to 7385.86 points.

The Turkish stock index plummeted 5%, triggering the market fusion mechanism

The US dollar index rose more than 100 points in a short term, and now reported to 109.388.

The dollar rose nearly 200 points against the yen and reported to 144.

The offshore RMB also suddenly fell.

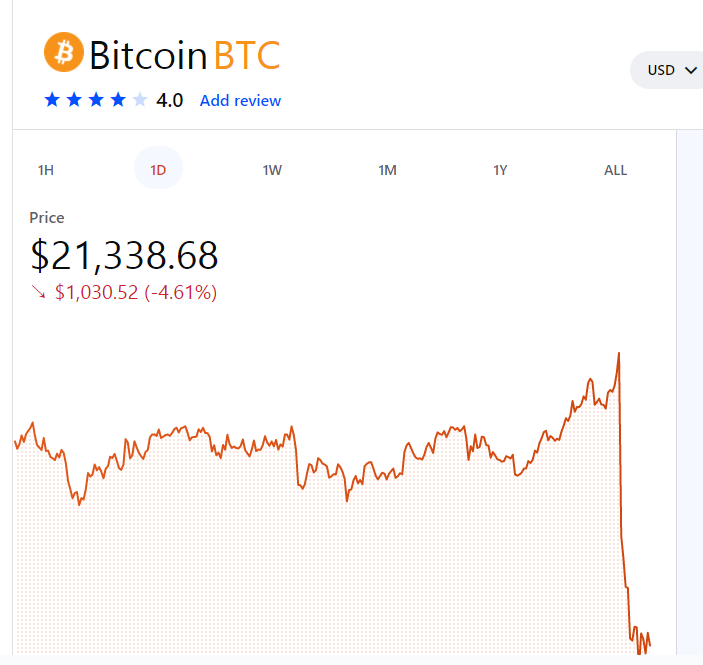

Bitcoin also plummeted, a decline of more than $ 1,000 (currently falling nearly 5%), and returned to less than $ 22,000.

Crude oil and gold are falling.

In terms of overall stocks, the new energy Weixi and Netease were held up. Previously, the National Press and Publication Agency released the domestic online game approval information

A50 fell nearly 1%.

Ava Trade chief market analyst Naeem Aslam said: "The American inflation data has confirmed that the inflation in the United States is still hot, which has made the Fed that has been trying to suppress inflation to face greater difficulties. The data confirms that the Federal Reserve's bullets have not stifled inflation, and the bullets of the Fed have not stifled inflation. This will worry many traders. "

Soochow macro analysis states that we believe that the September interest rate hike 75bp basic board is nailed, and it is difficult for the core CPI to fall within 5%and the still strong U.S. economy. Using an ultra -normal rate of interest rate hikes, the final value of policy interest rates in 2022 rose to 4%.

"The CPI report is undoubtedly negative to the stock market. Janus Henderson Investors Research Matt Peron said that this higher than expected report means that we will obtain the continuous pressure of the Federal Reserve policy through interest rate hikes." Any 'Federal Reserve fulcrum'. As we warned in the past few months, we have not yet got out of trouble and we will maintain a defensive situation in stock and industry allocation. "

Biden: It takes more time to reduce inflation in the United States

On the 13th local time, US President Biden delivered a speech on the latest inflation situation.

Biden said that in general, the price of the United States in the past two months is basically the same, which is good news for American families. However, the United States requires more time and determination to reduce inflation.

According to the latest data released by the US Department of Labor on the day, the US Consumer Price Index (CPI) rose 0.1%month -on -month and 8.3%year -on -year. The analysis believes that the high -rise CPI growth rate has once again strengthened the Fed's expected expected continuous rate hike.

That's what the stock market says. Blessing on Wednesday's A shares

The central bank is heavy! The trillion giants' institutions "planted": nearly 12 million were fined, and they were involved in "17 sins"! The general manager also eats a ticket

- END -

"Starlight" of brand strong farmers and rural areas

This summer, as hot as the weather, it belongs to Yanling Huang Peach.Relying on t...

Xinjiang holds wheat machine collection damage reduction skills great competition activities

Tianshan News (Reporter Liu Yi reported) On July 6, sponsored by the Agricultural ...